HomeReady and Home Possible are both laudable initiatives aimed at making homeownership more achievable for low to moderate-income borrowers. HomeReady, a Fannie Mae program, is noted for its low down payment options and flexible underwriting standards. However, it does have income caps and requires the property to be the borrower's primary residence. On the other hand, Home Possible by Freddie Mac also offers flexible underwriting and low down payments. It sets a higher credit score requirement but can waive income limits in high-cost or underserved areas. Both programs require completion of a borrower education program. The choice between HomeReady and Home Possible depends on individual circumstances such as income, credit score, and location of the property. It's advised to seek professional counsel to make the best decision. The HomeReady program was launched by Fannie Mae as a route to homeownership for low to moderate-income borrowers. This initiative was designed to facilitate affordable home ownership and foster stability in diverse communities across the U.S. The program came into existence to help creditworthy borrowers with lower incomes gain access to mortgages. HomeReady recognizes that the traditional measure of creditworthiness – such as a high income or a large down payment – isn't achievable or realistic for everyone. This program broadens the scope, offering flexible underwriting standards to help deserving borrowers secure a home loan. Several criteria must be met to qualify for a HomeReady loan. Borrowers must be at or below a certain income limit, which varies by location but is generally set at the area median income (AMI). Additionally, a minimum credit score, typically around 620, is required. Borrowers must also complete an online homebuyer education course, further equipping them with the knowledge to sustain homeownership. The income limits for HomeReady loans are flexible, varying based on the area's median income. The aim is to target low to moderate-income individuals or families who may otherwise struggle to secure traditional financing. These flexible income limits make homeownership more accessible in underserved communities. HomeReady typically requires a minimum credit score of 620, although this can vary by lender. This criterion recognizes that lower-income individuals may have lower credit scores but are still capable of managing a mortgage responsibly. A distinctive feature of the HomeReady program is the requirement to complete an online homebuyer education course. This component ensures borrowers have a solid understanding of the responsibilities and intricacies of homeownership, reducing the likelihood of default. One of the main advantages of the HomeReady program is the ability to put down as little as 3% of the purchase price. This is significantly lower than the traditional 20% down payment, making homeownership more accessible to those with limited savings. The HomeReady program recognizes that a high credit score isn't achievable for everyone and allows for lower credit scores. A minimum score of 620 is typically required, which is lower than many conventional loans, offering more opportunities for those with less-than-perfect credit. Another advantage of the HomeReady program is the consideration of non-traditional sources of income in the loan approval process. This could include rental income from a basement apartment or the income of a boarder living in the home, further increasing affordability for homeowners. To equip borrowers with the knowledge needed to sustain homeownership, the HomeReady program requires the completion of an online homebuyer education course. This valuable learning tool helps borrowers understand their mortgage and the intricacies of homeownership. Borrowers using the HomeReady program may also benefit from reduced mortgage insurance costs compared to other low-down-payment loans. Lower mortgage insurance premiums can significantly reduce the total cost of the mortgage over time. One significant limitation of the HomeReady program is the income cap. While the program's intent is to help lower-income families, these restrictions can sometimes exclude individuals or families who earn more than the area's median income but still face affordability issues, especially in areas with high living costs. The limit is usually 80% of the area's median income, but this cap can be restrictive for those who fall slightly above it. The HomeReady program mandates that the property purchased must be the borrower's primary residence. This means that it cannot be used for investment properties or vacation homes. For those looking to break into the investment property market or acquire a second home, this stipulation could be a substantial drawback. The HomeReady loan program is subject to geographical limitations. While it seeks to help those in low-income neighborhoods, it may not provide the same level of assistance to those in higher-income neighborhoods. Borrowers may find that they are eligible in one area but not in another, adding a layer of complexity to the home-buying process. While HomeReady allows for lower down payments, it does require private mortgage insurance (PMI) if the down payment is less than 20%. PMI can add a significant amount to monthly payments, potentially straining the borrower's budget. Though PMI can be canceled once the borrower's equity reaches 20%, it is an additional cost to consider. Freddie Mac's answer to affordable homeownership is the Home Possible program. This initiative also targets low to moderate-income borrowers, striving to make homeownership accessible to a broader demographic. The Home Possible program was developed to help those who may not qualify for traditional mortgages due to lower incomes or lack of significant down payments. The initiative encourages stable homeownership in diverse communities, recognizing that the traditional route to homeownership may be out of reach for many. Like HomeReady, Home Possible has specific eligibility requirements. Borrowers' income must be at or below the area median income unless the property is located in a designated high-cost or underserved area. A minimum credit score, typically around 660, is required, and borrowers must also complete a borrower education program. The income limits for Home Possible loans are set relative to the area's median income. In high-cost or underserved areas, these income limits are waived, broadening the pool of potential borrowers. Home Possible requires a slightly higher minimum credit score than HomeReady, typically around 660. While this is still lower than many traditional loans, it may exclude some lower-income borrowers. As with HomeReady, a borrower education program is a necessary component of a Home Possible loan. This requirement ensures that borrowers are fully informed about the responsibilities and realities of homeownership. One of the most significant benefits of the Home Possible program is its low down payment requirement. Borrowers can secure a mortgage with a down payment as low as 3%. This reduced upfront cost makes homeownership accessible to those who may struggle to save a large sum for a traditional 20% down payment. Home Possible is also known for its more lenient credit score requirements. The program typically requires a minimum credit score of 660, which is lower than many traditional loan programs. This flexibility can open the door to homeownership for those with less-than-perfect credit histories. The Home Possible program offers versatility in terms of the types of properties you can purchase. Eligible properties include single-family homes, condos, and even multi-unit properties, provided the borrower occupies one of the units. This flexibility can make the program attractive to a variety of potential homeowners. Another advantage of the Home Possible program is the possibility of canceling the mortgage insurance. While private mortgage insurance (PMI) is required for down payments of less than 20%, it can be canceled once the borrower's equity in the home reaches 20%. This option can lead to significant long-term savings. Unlike some other programs, Home Possible does not have geographic restrictions. Borrowers can purchase a home in any area, whether it's classified as low-income or not. In certain high-cost or underserved areas, the program even waives the usual income limits. While Home Possible is aimed at facilitating affordable homeownership, it does have a fairly strict credit score requirement. Borrowers are typically required to have a minimum credit score of 660. This requirement might be more difficult for some potential homebuyers to meet, especially those who have had credit difficulties in the past. Similar to the HomeReady program, Home Possible loans require the property to be used as the borrower's primary residence. This condition excludes those wishing to buy investment properties or vacation homes. While this requirement makes sense in the context of the program's goals, it can be a limiting factor for those interested in different types of property ownership. The Home Possible program, while flexible in some areas, does enforce income restrictions. Although there are exceptions in high-cost and underserved areas, in general, a borrower's income cannot exceed the area median income. This cap can limit the program's accessibility for those with incomes slightly above the median but who may still struggle with housing affordability. A further limitation of the Home Possible program is the requirement for mortgage insurance if the down payment is less than 20%. While the program offers the potential for lower down payments, the addition of mortgage insurance premiums can inflate monthly payments, thereby putting additional financial strain on the borrower. Choosing between HomeReady and Home Possible depends on individual circumstances. Factors such as your income, credit score, location of the home, and future financial goals can all influence your decision. Additionally, professional advice can provide valuable insight. Individual financial circumstances play a significant role in deciding between these two programs. Your credit score and income level can determine which program's eligibility criteria you meet. Furthermore, the location of the home can influence your decision, particularly if it's in a high-cost or underserved area. Lastly, your future financial goals, such as whether you aim to invest in more properties, could also sway your choice. Given the complexity of mortgage loans and the individual nature of financial circumstances, seeking professional advice is crucial when choosing between these programs. A financial advisor or mortgage broker can help you navigate the intricacies and make the best choice for your situation. HomeReady and Home Possible are commendable initiatives by Fannie Mae and Freddie Mac, respectively, aiming to make homeownership more attainable for low to moderate-income borrowers. Both offer flexible underwriting and low-down payments, with unique benefits and limitations. HomeReady permits lower credit scores and considers non-traditional income sources but has strict income and property usage restrictions. Conversely, Home Possible mandates higher credit scores waives income limits in specific areas, and doesn't restrict purchase location. However, both require borrower education and carry income restrictions. Potential homebuyers must consider these factors along with their personal circumstances like income, credit score, and property location. Seeking professional advice is recommended to understand the nuances and select the most fitting program. Through these initiatives, the dream of homeownership becomes a viable reality for many underserved by conventional financing methods.Homeready vs Home Possible Overview

Understanding HomeReady

Background and Purpose

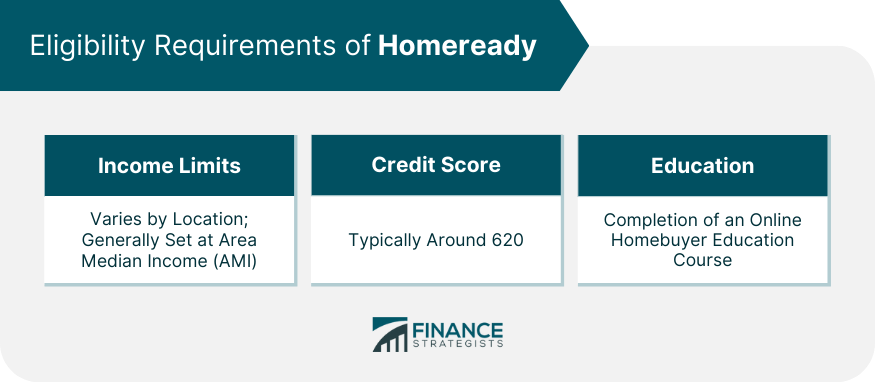

Eligibility Criteria Of HomeReady

Income Limits

Credit Score Requirements

Homebuyer Education

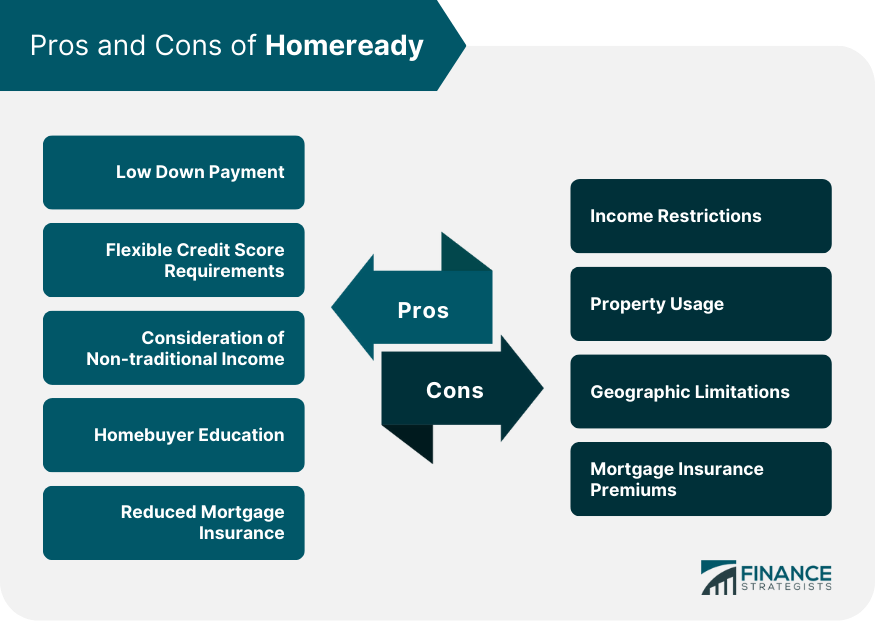

Pros of HomeReady

Low Down Payment

Flexible Credit Score Requirements

Consideration of Non-traditional Income

Homebuyer Education

Reduced Mortgage Insurance

Cons of HomeReady

Income Restrictions

Property Usage

Geographic Limitations

Mortgage Insurance Premiums

Understanding Home Possible

Background and Purpose

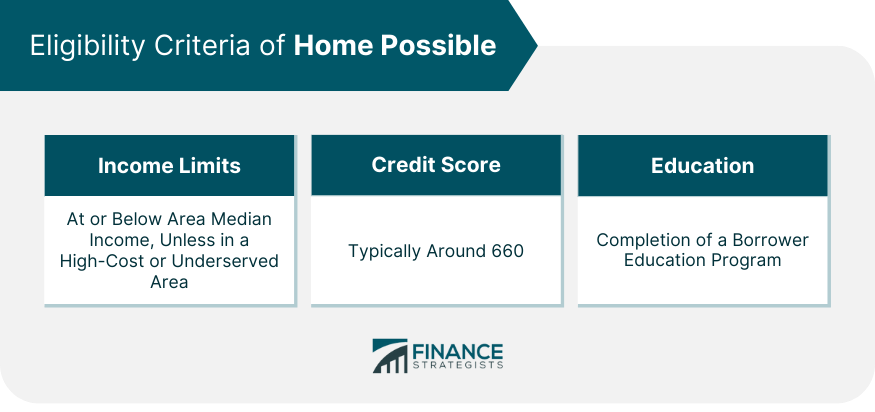

Eligibility Criteria of Home Possible

Income Limits

Credit Score Requirements

Homebuyer Education

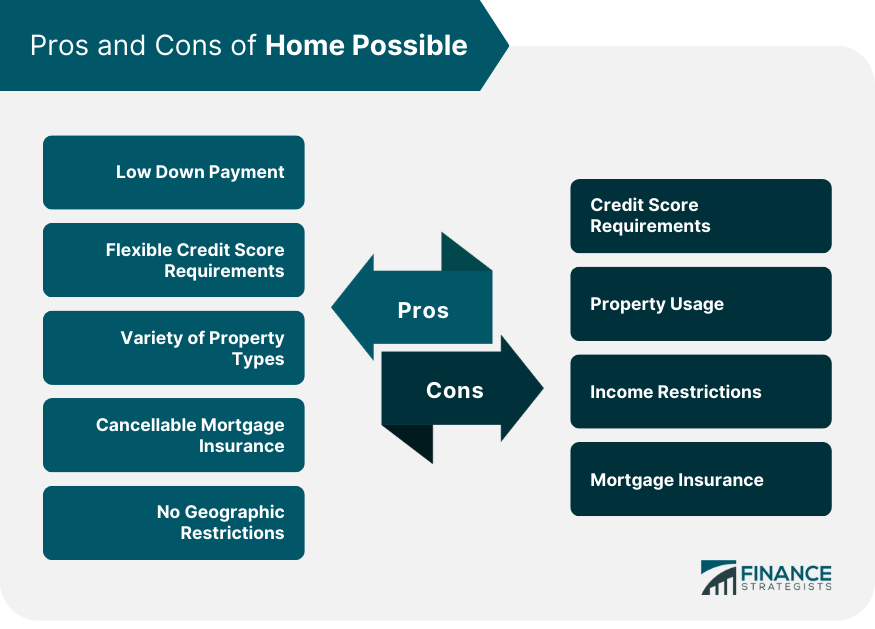

Pros of Home Possible

Low Down Payment

Flexible Credit Score Requirements

Variety of Property Types

Cancellable Mortgage Insurance

No Geographic Restrictions

Cons of Home Possible

Credit Score Requirements

Property Usage

Income Restrictions

Mortgage Insurance

How to Choose Between HomeReady and Home Possible

Factors to Consider

Importance of Seeking Professional Advice

Conclusion

Homeready vs Home Possible FAQs

The HomeReady program is a Fannie Mae initiative designed to help low to moderate-income borrowers access home loans. It offers flexible underwriting standards and low down payment options, broadening the pool of people who can become homeowners.

While both HomeReady and Home Possible aim to make homeownership more accessible for low to moderate income borrowers, there are notable differences. Home Possible, run by Freddie Mac, requires a slightly higher minimum credit score than HomeReady and can waive income limits in certain circumstances.

HomeReady's advantages include its low down payment options, flexible income, and credit score requirements. The required homebuyer education course is another benefit. Its limitations lie in its income caps, which could exclude higher earners, and the requirement for the property to be the borrower's primary residence.

Home Possible has specific eligibility requirements. Borrowers' income must be at or below the area median income unless the property is in a high-cost or underserved area. A minimum credit score, typically around 660, is required. Borrowers must also complete a borrower education program.

Choosing between HomeReady and Home Possible depends on your individual circumstances, including your income, credit score, and the location of the home. It's advisable to seek professional advice to help you understand the intricacies of each program and make the best choice for your situation.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.