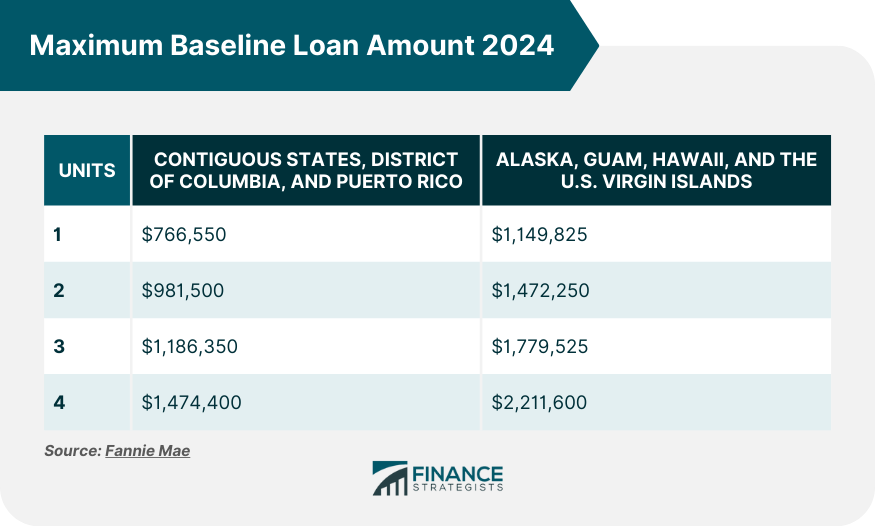

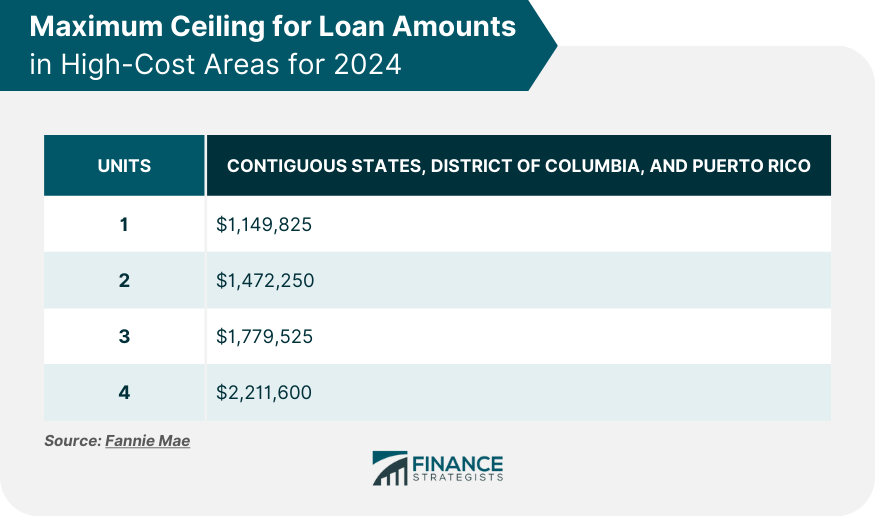

Fannie Mae, officially known as the Federal National Mortgage Association (FNMA), plays a pivotal role in the U.S. housing market. It's a government-sponsored entity that provides liquidity to mortgage lenders by purchasing and guaranteeing mortgages. By doing this, Fannie Mae ensures that lenders have the funds available to make more loans, ultimately aiding potential homeowners in obtaining mortgages. Mortgage loan limits dictate the maximum amount borrowers can take out for a mortgage while still enjoying government-backed securities. Setting these limits is essential as they strike a balance between assisting homebuyers and mitigating the risk to taxpayers. Furthermore, these limits ensure that home loans remain available and affordable, especially in high-cost areas. High balance loan limits refer to the maximum amount one can borrow in areas where average home prices surpass general conforming loan limits. The reason behind these limits is to assist homebuyers in regions where home prices are significantly higher than the national average, ensuring that residents in these areas have access to adequate financing. The housing crisis of 2008 prompted many changes in the mortgage industry, with the high balance loan limits being one significant adjustment. Since then, these limits have seen periodic revisions to reflect the fluctuating real estate market. Over the years, as housing prices increased, especially in specific high-cost areas, the need for adjusting the loan limits became apparent to accommodate these changes. The loan limits for Fannie Mae’s high-balance mortgages in 2024 are tiered based on the number of units in a property and the location of the home. The table below delineates the maximum baseline loan amounts for different regions: For these regions, the baseline loan limits range from $766,550 for single-unit properties to $1,474,400 for four-unit properties. This tiered structure ensures that larger properties, which typically come with a heftier price tag, have access to commensurate financing. Given the unique real estate markets in these territories, the loan limits are higher. A single-unit property has a ceiling of $1,149,825, whereas a four-unit property has an upper limit of $2,211,600. Such elevated limits recognize the distinct and often higher-priced housing landscapes in these areas. High-cost areas are regions where average home prices significantly surpass the general conforming loan limits. For 2024, Fannie Mae has set specific loan limits for such areas. However, it's essential to note that several states and territories, including Alaska, Hawaii, Guam, Puerto Rico, and the U.S. Virgin Islands, don't have designated high-cost areas this year. For Alaska, Hawaii, Guam, Puerto Rico, and the U.S. Virgin Islands, 2024 does not see any regions categorized as high-cost areas. It indicates uniformity in property prices or that the average home prices in these regions don't exceed the thresholds defined by Fannie Mae. For the remaining regions, which include the contiguous states and the District of Columbia, the loan limits in high-cost areas mirror the maximum baseline amounts set for places like Alaska and Hawaii. Starting at $1,149,825 for single-unit homes and maxing out at $2,211,600 for four-unit properties, these limits accommodate the increased property values found in the nation's priciest regions. Comparing 2024 to previous years, there's a notable increment in the loan limits. This rise is a testament to the growing housing market and the inflation that's impacting the economy. Such increases ensure that potential homeowners aren't priced out of the market. Multiple scenarios have necessitated these changes. Urban migration, increased demand for housing, and general economic growth in certain areas have driven up property prices. Recognizing these trends, Fannie Mae, in consultation with relevant stakeholders, adjusts loan limits to ensure they remain relevant. High-balance loans inherently allow borrowers to access larger loan amounts. This enhanced borrowing capacity is essential for properties in regions with steeper home prices, granting potential homeowners the necessary funds to secure their desired homes. For residents in high-cost areas, traditional loans may not suffice. High-balance loans come into play, offering the adaptability required to navigate such markets. They fill the gap between standard conforming loan limits and the actual home prices in these areas. Contrary to perception, high-balance loans might come with comparatively lower interest rates than jumbo loans. Since Fannie Mae backs these loans, lenders often feel more secure, which can lead to more competitive rates. With a more substantial loan at their disposal, borrowers can explore a broader range of property options. Whether it's a larger home or a property in a prime location, high-balance loans bring more choices to the table. While high-balance loans provide greater borrowing power, they also come with heftier monthly mortgage payments. Borrowers must ensure they have the financial capability to manage these larger amounts over the loan's tenure. Given the higher loan amounts, lenders may impose more stringent criteria for high balance loans. This could include a higher credit score requirement, more substantial down payments, or additional documentation. A larger loan implies a bigger financial commitment. If there's a market downturn, properties purchased with high balance loans might see a sharper depreciation, leaving borrowers in a tricky spot. Closing costs are often a percentage of the loan amount. Since high balance loans are larger, the absolute value of these costs might be higher, adding to the overall expense of procuring the loan. Start With Research: Before diving in, borrowers should become familiar with high balance loan limits and eligibility. Understanding these basics can streamline the subsequent steps. Familiarize Eligibility Criteria: A clear grasp of eligibility can prevent potential roadblocks down the line, ensuring a smoother application process. Assess Financial Standing: By evaluating one's own financial health and creditworthiness, borrowers can better position themselves for approval. Consult a Mortgage Advisor: Mortgage professionals can demystify complex elements of the loan process, guiding borrowers toward optimal decisions. Gather Necessary Documentation: Having all required documents ready can speed up the application and reduce wait times. Compare Loan Offers: By reviewing multiple offers, borrowers can secure the most favorable terms and interest rates. Understand Associated Fees: It's vital to recognize all costs, ensuring there are no unexpected surprises. Initiate the Application Process: With everything in place, borrowers can confidently begin their loan application. Stay Updated: Promptly addressing any lender queries can expedite approval and show the lender one's commitment. Provide Transparent Information: Clear communication regarding eligibility and loan terms can foster trust and prevent misunderstandings. Stay Updated With Fannie Mae Guidelines: Knowledge of current standards ensures regulatory compliance and enhances the borrower's confidence in the lender. Offer Clear Loan Terms: Simplifying loan terms can help borrowers make informed decisions without being overwhelmed by jargon. Conduct Rigorous Creditworthiness Evaluations: A comprehensive review of a borrower's creditworthiness can prevent potential issues and ensure loan repayment. Ensure an Efficient Application Process: Streamlining the application can improve the borrower's experience and lead to quicker loan disbursement. Educate Borrowers: Informing borrowers about the advantages and potential pitfalls empowers them to make knowledgeable choices. Provide Post-loan Support: Offering ongoing assistance and guidance strengthens the bond between the lender and borrower, leading to potential future collaborations. Fannie Mae's high balance loan limits for 2024 address the changing landscape of the U.S. housing market, especially in regions where home prices have surged beyond typical conforming loan boundaries. These limits are tailored to support potential homeowners in both the contiguous states and specific territories like Alaska and Hawaii, ensuring accessibility to adequate financing in diverse property markets. Born out of past crises, the ongoing adjustments to these limits reflect the dynamic real estate climate and economic conditions, with the aim of fostering homeownership while managing risks. For borrowers, understanding these limits and their implications is crucial. Meanwhile, lenders have a responsibility to uphold transparency and rigor in their practices, ensuring both compliance with Fannie Mae guidelines and a positive borrower experience. In essence, these loan limits are more than just numbers—they represent a balance between accessibility, financial prudence, and market realities.Fannie Mae Overview

Understanding Fannie Mae High Balance Loan Limits for 2024

Definition and Purpose

Historical Context and the Evolution of Loan Limits

Maximum Baseline Loan Amount 2024

For Contiguous States, District of Columbia, and Puerto Rico

For Alaska, Guam, Hawaii, and the U.S. Virgin Islands

Maximum Ceiling for Loan Amounts in High-Cost Areas 2024

States Without High-Cost Areas in 2024

For the Contiguous States, the District of Columbia, and Puerto Rico

Comparison With Previous Year's Loan Limits

Key Differences and Increases

Scenarios and Factors Leading to Changes

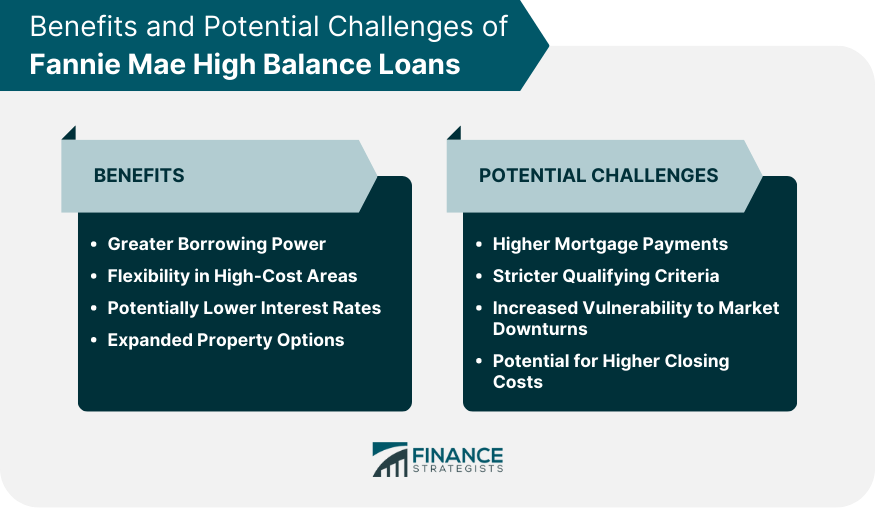

Benefits of Fannie Mae High Balance Loans

Greater Borrowing Power

Flexibility in High-Cost Areas

Potentially Lower Interest Rates

Expanded Property Options

Potential Challenges and Limitations

Higher Mortgage Payments

Stricter Qualifying Criteria

Increased Vulnerability to Market Downturns

Potential for Higher Closing Costs

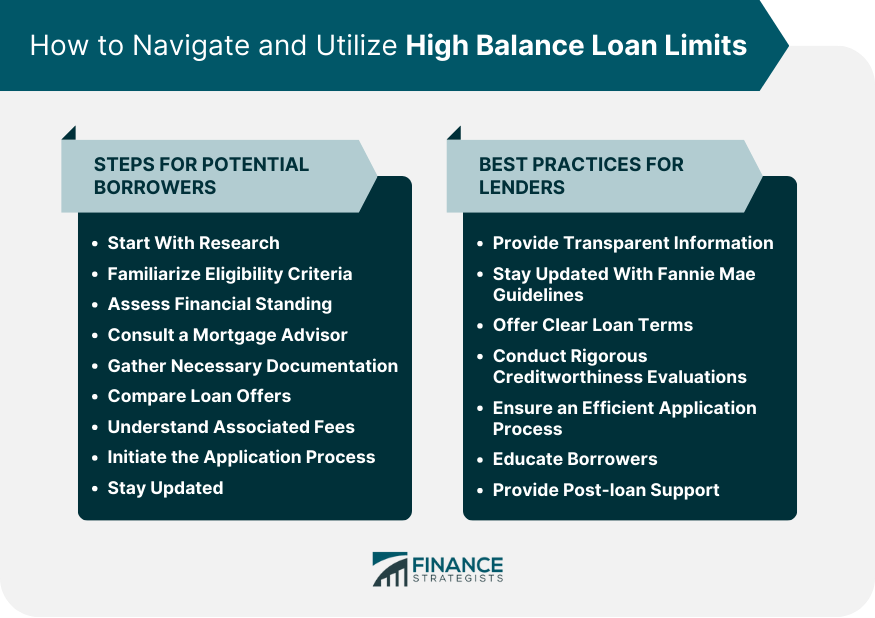

How to Navigate and Utilize High Balance Loan Limits

Steps for Potential Borrowers

Best Practices for Lenders

Bottom Line

Fannie Mae High Balance Loan Limits FAQs

The loan limits vary based on property units and location, ranging from $766,550 to $2,211,600.

These regions have distinct real estate markets, often with higher-priced housing landscapes.

They offer greater borrowing power, flexibility in high-cost areas, potentially lower interest rates, and expanded property options.

Some challenges include higher mortgage payments, stricter qualifying criteria, and potential vulnerability to market downturns.

Research eligibility, assess financial standing, consult a mortgage advisor, gather documentation, and compare loan offers for the best results.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.