Fannie Mae, formally known as the Federal National Mortgage Association, acts as a pivotal linchpin within the United States housing market. Established during the throes of the Great Depression, this government-sponsored enterprise has been committed to fostering liquidity, stability, and affordability in the housing sector. Its primary objective is to ensure that mortgage lenders have a continuous stream of capital, enabling Americans from various walks of life to access home loans. By facilitating a secondary mortgage market, Fannie Mae bridges the gap between lenders and investors, ensuring fluidity in the housing finance ecosystem. Moreover, its operations have been instrumental in stabilizing turbulent market conditions, offering reassurance to both lenders and borrowers during uncertain economic times. Through its consistent efforts, Fannie Mae has made homeownership an achievable dream for countless individuals, playing a foundational role in shaping the housing landscape of the United States. At its core, the Certificate of Occupancy is an official statement. It's issued by local government agencies and confirms that a property adheres to local building codes, zoning laws, and other pertinent regulations. While its primary role is to signify a property's readiness for habitation, the document also ensures that prospective inhabitants are moving into a space that's safe and sound in structural terms. Furthermore, it provides legal validation, enabling potential legal recourses if there were any misrepresentations. A Temporary Certificate of Occupancy, often abbreviated as TCO, is typically granted when a property is considered habitable but may have certain pending tasks or minor work yet to be completed. This could include aspects like landscaping or some internal finishings that do not jeopardize the safety or liveability of the building. The TCO permits residents or businesses to occupy the space even as these finishing touches are being added. It's essential to note, however, that TCOs have a limited validity. After a specific duration or once the pending work is completed, the property owner must then seek a permanent certificate. The Permanent Certificate of Occupancy, often referred to as PCO, is a testament to a building's full compliance with local building codes, safety regulations, and other required criteria. It indicates that the property has undergone rigorous inspections and has met all the stipulated standards for habitation. This certificate is a must-have for property owners as it provides assurance to potential tenants or buyers regarding the property's adherence to safety and quality standards. Unlike the temporary version, the PCO doesn't expire, solidifying the property's readiness for long-term occupancy. This specifies the purpose for which the property is intended. For instance, a property might be designated as residential, commercial, industrial, or mixed-use. This classification ensures that the property is utilized for its approved purpose and meets the specific standards and codes set for that particular use. For example, a commercial building would have different safety and design requirements compared to a residential one. This component identifies the structural nature of the property. It could be a single-family home, a multi-family dwelling, a commercial structure, an industrial warehouse, and so on. This distinction is essential because each building type has its own set of codes and regulations. For instance, a multi-family residence might have additional fire escape routes or safety measures compared to a single-family home. This denotes the maximum number of occupants the building can safely accommodate. For residential buildings, it might refer to the number of households or individual tenants, while for commercial structures, it could refer to the number of employees or visitors. This component is crucial for safety reasons, ensuring that the property does not get overcrowded, which can pose hazards like impeding emergency exits. Some properties might come with particular conditions or stipulations attached to their use. For instance, a building in a historical district might have restrictions on external modifications, or a commercial property might have stipulated operating hours due to its location in a residential zone. Highlighting these conditions on the Certificate of Occupancy ensures that property owners, tenants, or buyers are aware of these unique specifications and abide by them. For properties that have seen construction or rehabilitation within the past year, Fannie Mae's directives are clear-cut. It's imperative to ensure that all units within these properties possess a Certificate of Occupancy. This isn't merely a suggestion but a stringent requirement, emphasizing the significance of safety and compliance. This proactive approach underscores Fannie Mae's commitment to ensuring housing quality and reliability for all its associated properties. The onus lies heavily on lenders and servicers to ascertain that every individual unit within the property has its corresponding Certificate of Occupancy. This exhaustive check ensures that no unit is overlooked, guaranteeing safety and compliance across the board. Notably, this diligence underscores the meticulous nature of the lending process and Fannie Mae's stringent standards. A mere verbal confirmation won't suffice. Lenders must obtain tangible copies of these certificates from the borrower and meticulously retain them within the servicing file. This organized approach not only ensures adherence to Fannie Mae's guidelines but also creates an auditable trail for any future reference. By maintaining this repository, lenders reinforce their commitment to transparency and legal compliance. Before anything else, property owners should familiarize themselves with local regulations and requirements pertaining to Certificates of Occupancy. These regulations might vary based on the city, county, or state. Understanding these rules will offer clarity about what is expected and the benchmarks a property needs to meet. Prior to applying, owners must ascertain the prerequisites for the Certificate of Occupancy. This could range from specific documentation, such as blueprints, permits, or proof of ownership, to demonstrating compliance with local zoning laws. Being prepared with all required documents will expedite the application process. Certificates of Occupancy are only granted after meticulous inspections to ensure the property adheres to local building codes, safety standards, and any other pertinent regulations. Owners should schedule these inspections with the relevant municipal or county agencies. Inspections may encompass structural integrity, fire safety, electrical systems, plumbing, and more. Once all prerequisites are met and inspections are completed, property owners can formally submit their application for the Certificate of Occupancy. This often requires submitting the application form along with any supporting documents and proof of successful inspections. If the inspection identifies any areas of non-compliance, the property owner will need to address these issues promptly. Once rectifications are made, a re-inspection might be required. Keeping a proactive approach ensures that any feedback is promptly addressed, moving closer to obtaining the certificate. Beyond the 12-month threshold, Fannie Mae adopts a slightly different stance. For such properties, while it's essential to determine if each unit ever had a certificate, there's a bit more leeway in the protocols that follow. This nuanced approach recognizes the diverse challenges and variables associated with older properties. A dive into history is warranted. Lenders must undertake a systematic review to ascertain whether a Certificate of Occupancy was ever issued for each unit within the property, tracing back to its origins. This historical insight is pivotal, ensuring that past compliance standards were met and maintained. While obtaining these certificates is the gold standard, sometimes, due to various reasons, procuring them might be a challenge. However, every effort should be made to get copies. If successful, these copies, like their counterparts for newer properties, must find a home within the servicing file. This process, although occasionally challenging, is fundamental in maintaining a property's compliance and marketability. Sometimes, the paperwork submitted might not align with the official records, or essential documents might be missing from the application. Solution: Double-checking the document list against local regulations and keeping an organized file can ensure that all required paperwork is submitted. In case of discrepancies, liaising with local authorities or hiring a consultant can help in rectifying the errors. There might be small deviations or non-compliance issues in the building structure or systems that could hinder the approval process. Engaging a private inspector before the official inspection can help identify and rectify such issues. This pre-emptive measure ensures that by the time the official inspection rolls around, the property is in top shape. Given the volume of applications, there might be a backlog, leading to prolonged waiting periods for property inspections. Scheduling inspections well in advance, and during off-peak times if possible, can mitigate this hurdle. Regular follow-ups and establishing good communication with inspection agencies can also expedite the process. In some areas, the regulations concerning Certificates of Occupancy might be complex or not clearly defined, leading to confusion. Consulting with local real estate attorneys or experts who are familiar with regional requirements can provide clarity. They can guide property owners through the nuances and interpretations of these regulations. If a property undergoes changes or renovations after the application's submission but before the inspection, it could lead to discrepancies. Any major changes should either be held off until after the certification process or immediately reported to the relevant authorities to ensure the inspection is up to date. Even if a unit doesn't have its certificate, it doesn't absolve the owner from its upkeep. Maintenance cannot be sidestepped, and all expenses related to the sustenance and care of these units should be factored into the property's overall financial calculus. This commitment to upkeep, irrespective of a unit's certification status, is a testament to the overarching goal of ensuring property longevity and inhabitant safety. When traditional avenues close, alternative paths might emerge. If certificates are elusive, lenders should scout for other credible evidence suggesting that the certificates had, at some point, been issued. This could include older documents, municipal records, or attestations. Such alternative proofs, while not replacing the original, still offer a semblance of assurance regarding a property's historical compliance. In the realm of real estate, risk analysis is paramount. In the absence of a Certificate of Occupancy, a comprehensive risk evaluation becomes essential. This involves a multi-pronged approach, considering factors ranging from the property's physical state to its position within the broader market dynamics. The safety of inhabitants tops the priority list. Any property missing its certificate mandates a thorough physical inspection, ensuring no life safety hazards lurk within its confines. This inspection becomes the first line of defense against potential threats and underscores the non-negotiable emphasis on inhabitant safety. A unit's accessibility isn't just about ease; it's about legality. All units must be accessible through conventional routes. For instance, if a unit is accessed through a repurposed janitorial closet, it raises significant red flags. Such irregularities not only jeopardize inhabitant safety but also bring into question the property's structural integrity and compliance. Every property sits within the broader tapestry of market dynamics. Factors like local vacancy rates or barriers to property entry become vital when assessing a property without its certificate. A property located in a high-demand, low-vacancy market might still retain its allure despite certification challenges. Thus, the macroeconomic landscape becomes pivotal in shaping a property's valuation and desirability. For mortgage lenders, the Certificate of Occupancy isn't just another document; it's a beacon of assurance. It reinforces the belief that the property in question meets all safety and structural standards, thereby ensuring the lender's investment is well-shielded from undue risks. In the intricate world of lending, this certificate often plays the role of a lead dancer, guiding the pace and direction of the entire performance. A missing Certificate of Occupancy can spell tumult for mortgage applications. Without this certificate, lenders might perceive the loan as a high-risk proposition, leading to potential denials or less favorable loan terms. This ripple effect underscores the certificate's paramountcy. Moreover, the financial implications stretch beyond just loan terms; they can influence property valuations and, by extension, the broader housing market dynamics. For buyers and sellers navigating this tricky terrain, the watchword is caution. Buyers should be wary of properties lacking this certificate and, if still interested, should be prepared for potential mortgage hurdles. On the flip side, sellers should consider obtaining the certificate proactively to enhance the property's marketability and appeal. This dual-pronged approach ensures both parties are well-equipped to handle the intricacies of a transaction sans a Certificate of Occupancy. Fannie Mae, a cornerstone in the U.S. housing sector, plays a vital role in sustaining liquidity and stability in the market. An integral part of this infrastructure is the Certificate of Occupancy, confirming that properties adhere to local building and safety codes. There are two main types: Temporary and Permanent, each serving its purpose in validating a property's habitability. Fannie Mae mandates strict adherence to these certificates, especially for properties developed or rehabilitated within the last year. Any absence or discrepancy in these documents can pose significant challenges in mortgage lending. Lenders view this certificate as a guarantee of investment safety, and its absence can adversely affect loan terms and property valuation. It's crucial for property owners to understand and navigate the requirements, ensuring smoother transactions and fostering trust in the market. Overview of Fannie Mae

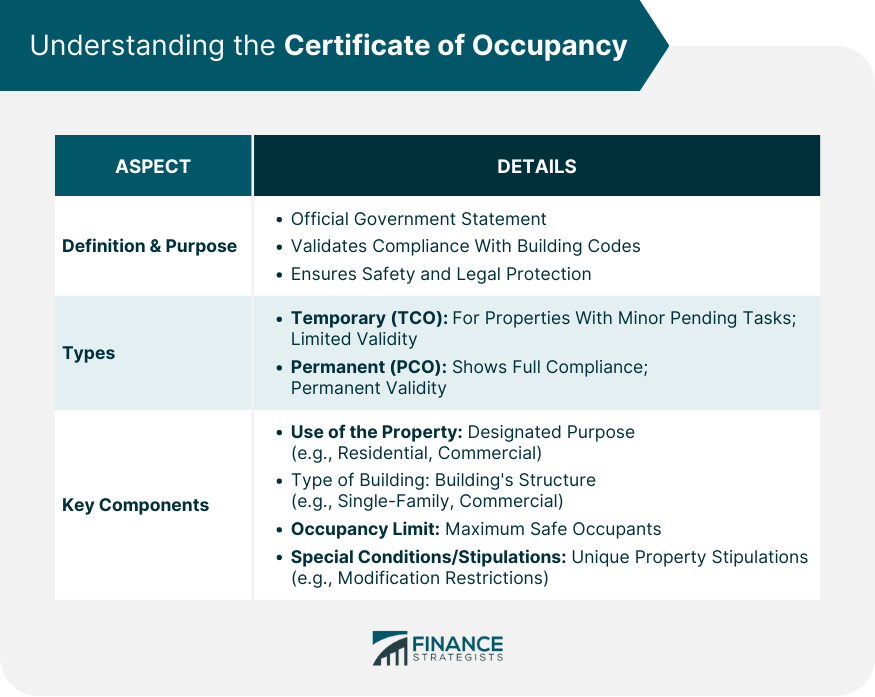

Understanding the Certificate of Occupancy

Definition and Purpose

Types: Temporary vs Permanent

Temporary Certificate of Occupancy (TCO)

Permanent Certificate of Occupancy (PCO)

Key Components of the Document

Use of the Property

Type of Building

Occupancy Limit

Special Conditions or Stipulations

Fannie Mae’s Stance on Certificates of Occupancy for Newly Constructed or Rehabilitated Properties

Criteria for Properties With Work Completed Within the Last 12 Months

Ensuring All Units Have a Certificate of Occupancy

Procuring and Retaining Copies in the Servicing File

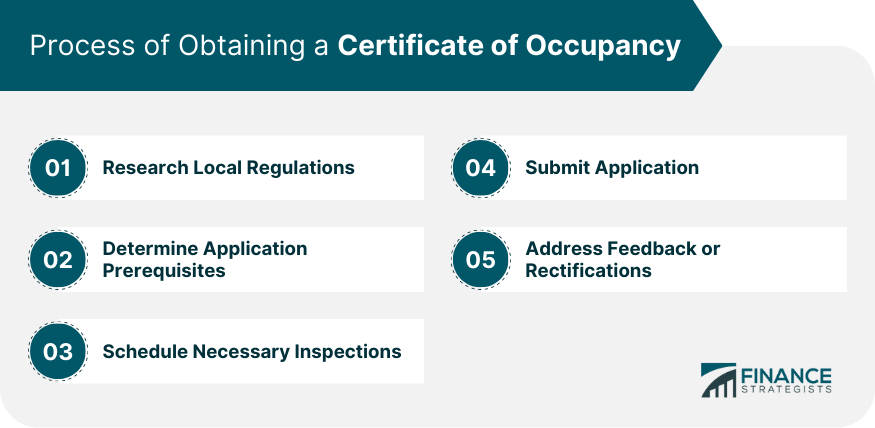

Process of Obtaining a Certificate of Occupancy

Research Local Regulations

Determine Application Prerequisites

Schedule Necessary Inspections

Submit Application

Address Feedback or Rectifications

Fannie Mae's Protocol for Other Properties

Certificates of Occupancy for Properties Outside the 12-Month Window

Determining Past Issuance of Certificates

Attempting to Procure and Retain Copies

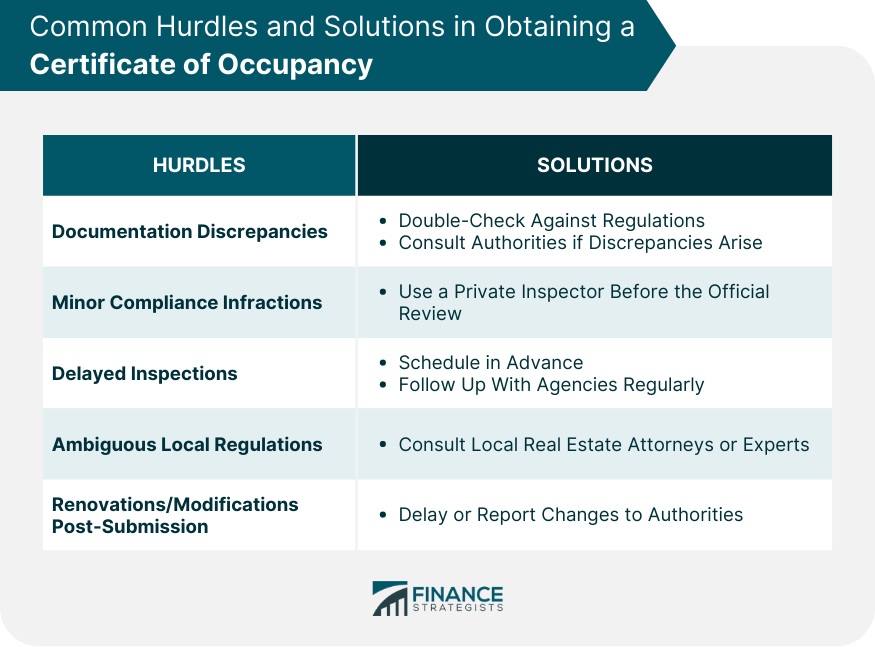

Common Hurdles in Obtaining a Certificate of Occupancy and Their Solutions

Documentation Discrepancies

Minor Compliance Infractions

Delayed Inspections

Ambiguous Local Regulations

Renovations or Modifications Post-Submission

Handling Absence of Certificate of Occupancy

Including All Maintenance Expenses

Seeking Alternative Evidence of Issuance

Analyzing the Risks Associated With Missing Certificates

Physical Inspection for Life Safety Issues

Assessing Unit Accessibility Concerns

Evaluating Property Market Conditions

Implications for Mortgage Lending

Lenders' Perspective on the Certificate of Occupancy

Repercussions for Mortgages Missing the Necessary Certificate

Recommendations for Buyers and Sellers in the Absence of a Certificate

Bottom Line

Fannie Mae Certificate of Occupancy FAQs

Fannie Mae emphasizes the importance of Certificates of Occupancy, ensuring properties are safe, compliant, and aligned with housing quality standards.

The Certificate of Occupancy ensures properties comply with local building codes, making it a critical document in real estate, protecting buyers.

Yes, there are primarily two types: temporary, for properties with some pending work but habitable, and permanent, indicating full compliance.

Absence of this certificate may result in high-risk perceptions, potential loan denials, or less favorable loan terms for mortgage applicants.

Fannie Mae seeks to ensure housing quality and reliability, so properties without the certificate may not align with their safety and compliance standards.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.