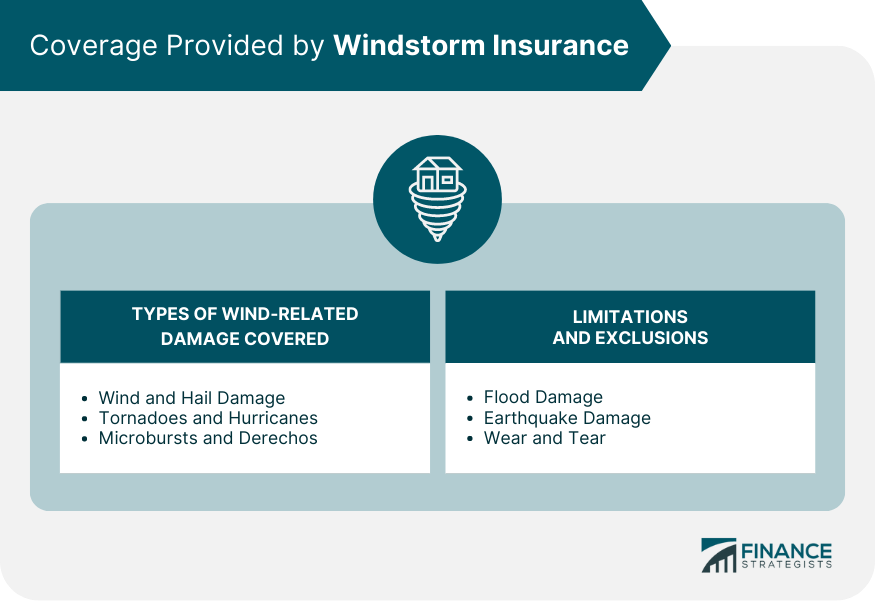

Windstorm insurance provides essential coverage for damages caused by windstorms, including hurricanes and tornadoes. Homeowners and business owners in wind-prone regions must offer financial protection against the devastating effects of these natural disasters. Severe wind events can lead to significant property damage and costly repairs. Standard property insurance often has limited coverage or excludes wind-related damages. Windstorm insurance fills this gap, providing property owners with the necessary financial resources to repair or rebuild after a windstorm. It is especially important for properties in high-risk areas like coastal regions and tornado-prone zones, including single-family homes, multi-unit buildings, commercial properties, and agricultural land with structures like barns. Wind and Hail Damage: Windstorm insurance typically covers damage caused by strong winds and hail, such as roof damage, broken windows, and damage to siding, fences, or outdoor equipment. Tornadoes and Hurricanes: These policies also cover damage resulting from tornadoes and hurricanes, including complete destruction of the property or damage to its structural integrity. Microbursts and Derechos: Lesser-known wind events, such as microbursts and derechos, can also cause significant damage. Windstorm insurance policies often include coverage for these types of events. Flood Damage: While windstorm insurance covers wind-related damage, it does not cover flood damage. Property owners in flood-prone areas should also consider purchasing separate flood insurance to protect against water damage. Earthquake Damage: Similarly, windstorm insurance policies do not cover earthquake damage. Property owners in earthquake-prone regions may need additional coverage for this type of natural disaster. Wear and Tear: Windstorm insurance does not cover damage caused by regular wear and tear or lack of maintenance. Property owners are responsible for keeping their property in good condition to minimize the risk of damage during a windstorm. Windstorm insurance policies may also include coverage for additional living expenses (ALE) incurred if the property becomes uninhabitable due to windstorm damage. ALE coverage can help pay for temporary housing, meals, and other necessary expenses while the property is being repaired or rebuilt. The location of the property plays a significant role in determining windstorm insurance premiums. Properties in high-risk areas, such as coastal regions and tornado-prone areas, typically have higher premiums due to the increased likelihood of windstorm damage. The type of property being insured also affects the cost of windstorm insurance. For example, commercial properties may have higher premiums than residential properties because they often have more extensive and expensive structures that require more extensive coverage. The materials and construction methods used in building the property can also influence windstorm insurance premiums. Properties built with wind-resistant materials and techniques may have lower premiums because they are less likely to sustain severe windstorm damage. The deductible and policy limits chosen by the property owner can also impact the cost of windstorm insurance. Higher deductibles can result in lower premiums but may require the property owner to pay more out-of-pocket for repairs after a windstorm. Policy limits should be set high enough to cover the cost of rebuilding or repairing the property in the event of a windstorm, but higher limits may also result in higher premiums. Property owners can take advantage of discounts and premium reduction strategies to lower their windstorm insurance costs. Some common strategies include: Installing wind-resistant features, such as storm shutters, impact-resistant windows, and reinforced roofs Bundling windstorm insurance with other insurance policies from the same provider Maintaining a good credit score Working with an insurance agent to identify additional discounts and coverage options Before purchasing windstorm insurance, property owners should assess their risk of windstorm damage. This includes considering the property's location, the local climate, and historical windstorm events in the area. Understanding the level of risk will help property owners make informed decisions about the coverage they need. It is essential to obtain quotes from multiple insurance companies to find the best windstorm insurance policy for the property. This will allow property owners to compare coverage options, premiums, and deductibles to find the most suitable policy for their needs. When choosing a windstorm insurance provider, property owners should also consider the financial strength and stability of the insurance company. A financially stable insurer is more likely to be able to pay claims promptly and fairly in the event of a windstorm. Financial ratings from organizations like A.M. Best, Standard & Poor's, and Moody's can help property owners evaluate an insurer's financial strength. Property owners should thoroughly review policy documents to ensure they understand the coverage provided by their windstorm insurance policy. This includes understanding the types of damage covered, any exclusions or limitations, and the claims process. An insurance broker or agent can help property owners navigate the process of purchasing windstorm insurance. These professionals can provide guidance on coverage options, answer questions about policy terms, and assist with comparing quotes from multiple insurers. After a windstorm, property owners should take the following steps: Take photos and videos of the damage to the property, making sure to capture both the exterior and interior. This documentation will be essential when filing a claim. Take reasonable steps to prevent additional damage, such as covering broken windows with plywood or placing tarps over damaged roofs. Keep receipts for any expenses incurred while taking these measures for reimbursement. Notify the insurance company of the damage as soon as possible. The insurer will provide guidance on the next steps in the claims process, including assigning a claims adjuster to assess the damage. Before the claims adjuster visits the property, property owners should: Gather documentation of the damage, including photos, videos, and any written descriptions Prepare a list of damaged items, including their approximate value and any receipts or other proof of purchase Keep records of any expenses related to temporary repairs or additional living expenses The insurance company will provide a settlement offer based on the claims adjuster's assessment of the damage. Property owners should review this offer carefully and consult with their insurance broker or agent if they have questions or concerns. If the property owner believes the settlement offer is insufficient, they may negotiate with the insurance company for a more favorable settlement. This may involve providing additional documentation or evidence to support the property owner's claim. If a windstorm insurance claim is denied, the property owner has the right to appeal the decision. This process typically involves submitting a written appeal to the insurance company, along with any additional documentation or evidence supporting the claim. Property owners may also seek assistance from their insurance broker, agent, or a public adjuster to help navigate the appeals process. A comprehensive home inventory is essential for ensuring that property owners have adequate windstorm insurance coverage and can efficiently file claims in the event of a windstorm. A home inventory should include a detailed list of all items in the property, along with their approximate value, purchase date, and any available receipts or proof of purchase. Digital tools, such as smartphone apps and online inventory management systems, can help property owners create and maintain their home inventory. A family disaster plan can help ensure that everyone in the household knows what to do during a windstorm or other emergency. This plan should include information on evacuation routes, emergency contacts, and a designated meeting place in case family members become separated. Regularly reviewing and practicing the disaster plan can help ensure that everyone is prepared in the event of a windstorm. Property owners can take several steps to make their property more resistant to windstorm damage, including: When building a new property or adding an extension, property owners should consider incorporating wind-resistant construction techniques. These may include using stronger framing materials, reinforcing the roof structure, and installing impact-resistant windows and doors. For existing properties, retrofitting can improve wind resistance and reduce the likelihood of significant damage during a windstorm. Some common retrofitting techniques include installing hurricane straps, reinforcing garage doors, and adding bracing to gable-end roofs. Proper landscaping can also help protect a property from windstorm damage. This includes selecting wind-resistant trees and shrubs, regularly trimming trees to remove dead or weak branches, and maintaining a safe distance between trees and the property to reduce the risk of falling limbs or trees. Windstorm insurance is a vital form of financial protection against wind-related damages, providing coverage for hurricanes, tornadoes, and other high-wind events. It is especially important for property owners in wind-prone regions, offering financial security against the devastating effects of these natural disasters. Understanding the coverage details and limitations of windstorm insurance is crucial, as it typically covers wind and hail damage, tornadoes, hurricanes, and other wind events, while excluding flood damage, earthquake damage, and regular wear and tear. Factors affecting windstorm insurance premiums include location and risk exposure, type of property, building materials, deductibles, and policy limits. To select the right policy, property owners should assess their risk, compare quotes from multiple insurers, evaluate financial strength, and read policy documents carefully. Additionally, creating a home inventory, developing a family disaster plan, and implementing wind-resistant construction techniques can enhance disaster preparedness and strengthen property against wind damage.What Is Windstorm Insurance?

Coverage Provided by Windstorm Insurance

Types of Wind-Related Damage Covered

Limitations and Exclusions

Additional Living Expenses (ALE) Coverage

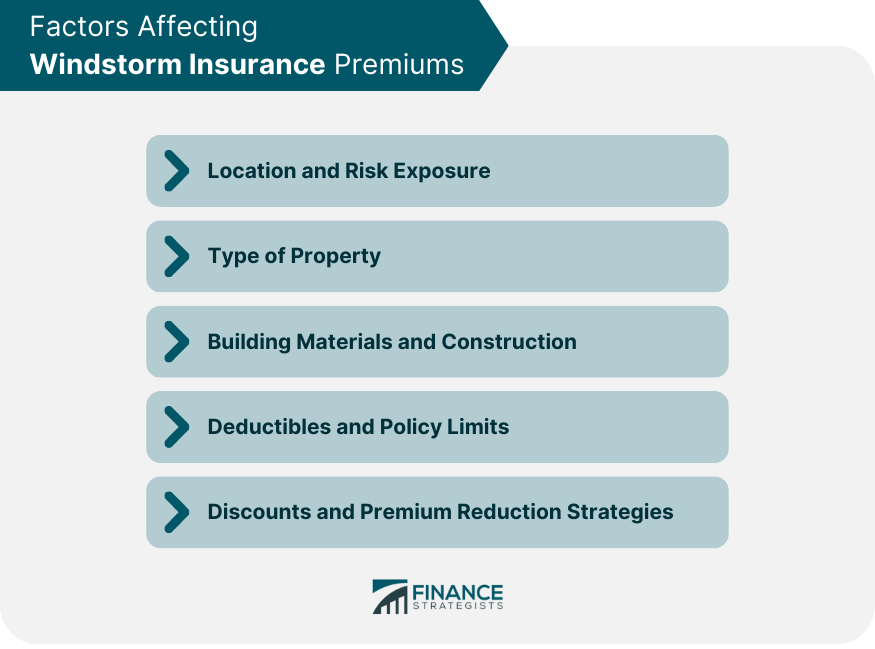

Factors Affecting Windstorm Insurance Premiums

Location and Risk Exposure

Type of Property

Building Materials and Construction

Deductibles and Policy Limits

Discounts and Premium Reduction Strategies

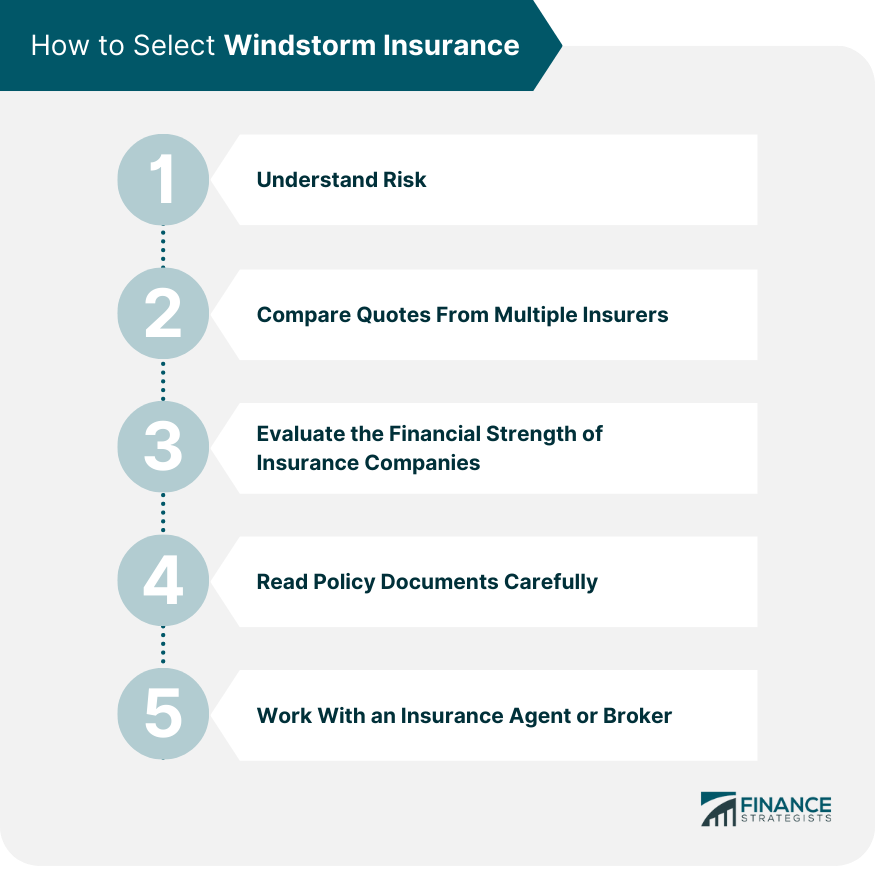

Selecting Your Windstorm Insurance

Understanding Your Risk

Comparing Quotes From Multiple Insurers

Evaluating the Financial Strength of Insurance Companies

Reading Policy Documents Carefully

Working With an Insurance Broker or Agent

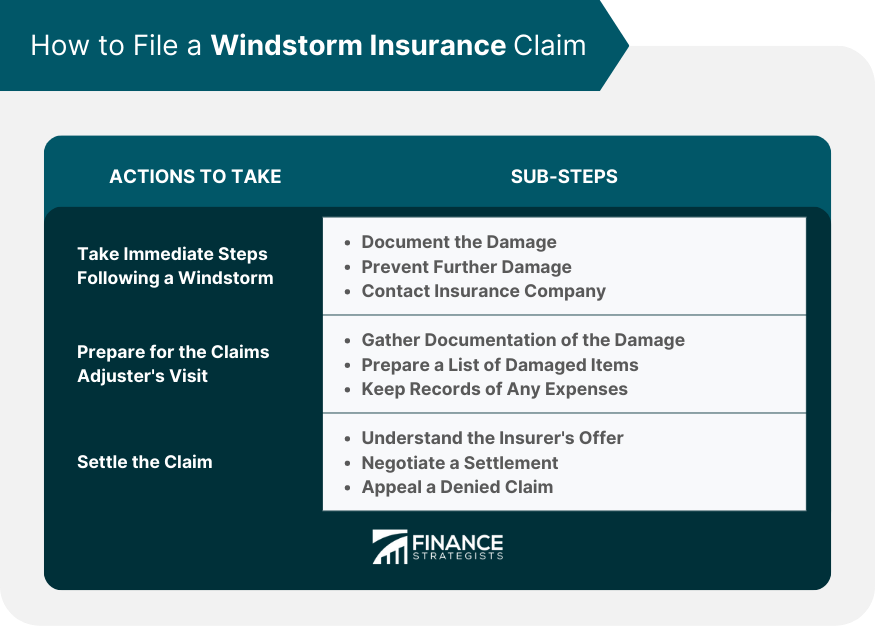

Filing a Windstorm Insurance Claim

Steps to Take Immediately Following a Windstorm

Document the Damage

Prevent Further Damage

Contact Your Insurance Company

Preparing for the Claims Adjuster's Visit

Settling the Claim

Understanding the Insurer's Offer

Negotiating a Settlement

Appealing a Denied Claim

Windstorm Insurance and Disaster Preparedness

Creating a Home Inventory

Developing a Family Disaster Plan

Strengthening Your Property Against Wind Damage

Wind-Resistant Construction Techniques

Retrofitting Existing Structures

Landscaping Considerations

Final Thoughts

Windstorm Insurance FAQs

Windstorm insurance is a specialized type of property insurance that covers damages caused by wind-related events, such as hurricanes, tornadoes, and derechos. It is important because standard property insurance policies often have limited coverage for wind-related damages, leaving property owners financially vulnerable in the aftermath of a windstorm.

Windstorm insurance generally covers damages caused by strong winds, such as roof damage, broken windows, and damage to siding, fences, or outdoor equipment. It also covers damages resulting from tornadoes, hurricanes, microbursts, and derechos.

The cost of windstorm insurance premiums is influenced by several factors, including the property's location and risk exposure, type of property, building materials and construction, policy deductibles and limits, and any available discounts or premium reduction strategies.

To file a windstorm insurance claim, document the damage with photos and videos, take reasonable steps to prevent further damage, and contact your insurance company as soon as possible. They will provide guidance on the next steps in the claims process, including assigning a claims adjuster to assess the damage.

Yes, you can often lower your windstorm insurance premiums by making improvements to your property that reduce the risk of windstorm damage. Some examples include installing wind-resistant features such as storm shutters, impact-resistant windows, and reinforced roofs, as well as retrofitting existing structures to improve their wind resistance.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.