Third-party insurance is a type of insurance that provides coverage for damages or injuries caused by the policyholder to someone else. This type of insurance is typically required by law in many jurisdictions, and is designed to protect both the policyholder and the injured party in the event of an accident. The purpose of third-party insurance is to protect individuals and businesses from the financial consequences of causing harm to another person or their property. Without this type of insurance, individuals and businesses would be responsible for paying for any damages or injuries they caused, which could be financially devastating. Third-party insurance is an important type of coverage that can provide protection and peace of mind to individuals and businesses. This type of insurance is particularly important for those who are at risk of causing damage or injury to others as a result of their activities, such as drivers, business owners, and professionals. Third-party insurance provides coverage for damages or injuries caused by the policyholder to someone else. This may include coverage for property damage, bodily injury, or both, depending on the specific policy and the jurisdiction in which it is issued. Like other types of insurance, third-party insurance typically has limits and deductibles that must be met before coverage kicks in. These limits and deductibles may vary depending on the policy and the jurisdiction in which it is issued. In the event of an accident or injury, the injured party may file a claim with the policyholder's insurance company to seek compensation for their damages or injuries. The claims process can be complex and may involve multiple parties, including the policyholder, the injured party, and their respective insurance companies. Once a claim has been filed, the insurance company will investigate the accident or injury and determine the appropriate amount of compensation to be paid to the injured party. This may involve negotiating a settlement with the injured party or their representative, and may also involve paying the injured party directly or through their legal representative. Property damage liability insurance provides coverage for damages caused by the policyholder to someone else's property, such as a vehicle or a building. This type of insurance is typically required by law in most jurisdictions. Bodily injury liability insurance provides coverage for injuries caused by the policyholder to someone else. This type of insurance is also typically required by law in most jurisdictions. Collision insurance provides coverage for damages to the policyholder's vehicle caused by a collision with another vehicle or object, regardless of who is at fault. This type of insurance is optional in many jurisdictions. Uninsured motorist insurance provides coverage for damages or injuries caused by an uninsured or underinsured motorist. This type of insurance is also optional in many jurisdictions. One of the primary benefits of third-party insurance is that it provides protection against legal liability in the event of an accident or injury. This can help individuals and businesses avoid costly legal fees and judgments. Third-party insurance also provides protection against financial losses caused by an accident or injury. Without this type of insurance, individuals and businesses could be responsible for paying for damages or injuries out of pocket, which could be financially devastating. Third-party insurance can also provide peace of mind to individuals and businesses, knowing that they are protected in the event of an accident or injury. This can help reduce stress and anxiety, and allow individuals and businesses to focus on other important matters. In many jurisdictions, third-party insurance is required by law. Having this type of insurance ensures that individuals and businesses are in compliance with these legal requirements and can avoid potential penalties or legal issues. One of the main drawbacks of third-party insurance is that it provides limited coverage for certain types of accidents or injuries. Depending on the policy, there may be exclusions or limitations on coverage that could leave individuals or businesses responsible for paying for damages or injuries out of pocket. Third-party insurance can also be expensive, particularly for individuals or businesses with a high risk of causing damage or injury to others. This can make it difficult for some individuals or businesses to afford the coverage they need. Like other types of insurance, third-party insurance typically has deductibles that must be met before coverage kicks in. Depending on the policy, these deductibles can be high, which can make it difficult for some individuals or businesses to afford the coverage they need. The claims process for third-party insurance can be complex and time-consuming, particularly if there are multiple parties involved. This can make it difficult for individuals or businesses to receive timely compensation for damages or injuries. The risk level of the policyholder is one of the main factors that can affect the rates for third-party insurance. Individuals or businesses with a higher risk of causing damage or injury to others are likely to pay higher premiums for this type of coverage. The coverage limits of the policy can also affect the rates for third-party insurance. Policies with higher limits of coverage are likely to be more expensive than policies with lower limits. The amount of the deductible can also affect the rates for third-party insurance. Policies with lower deductibles are likely to be more expensive than policies with higher deductibles. The jurisdiction in which the policy is issued can also affect the rates for third-party insurance. Different jurisdictions may have different requirements and regulations for this type of insurance, which can affect the cost of coverage. Third-party insurance is a type of insurance that provides coverage for damages or injuries caused by the policyholder to someone else. This type of insurance is important for individuals and businesses who may be at risk of causing harm to others, and can provide protection and peace of mind in the event of an accident or injury. Third-party insurance typically involves coverage for property damage liability, bodily injury liability, collision, and uninsured motorist insurance. The claims process can be complex, and coverage may be limited depending on the policy and jurisdiction. Some of the benefits of third-party insurance include protection against legal liability, financial losses, and compliance with legal requirements. However, there are also drawbacks to this type of insurance, such as limited coverage, high premiums, deductibles, and a complex claims process. The cost of third-party insurance can be affected by a variety of factors, including the risk level of the policyholder, coverage limits, deductibles, and jurisdiction. It's important for individuals and businesses to carefully consider these factors when choosing a third-party insurance policy.What Is Third-Party Insurance?

How Third-Party Insurance Works

Coverage for Damages and Injuries

Limits and Deductibles

Claims Process

Settlements and Payments

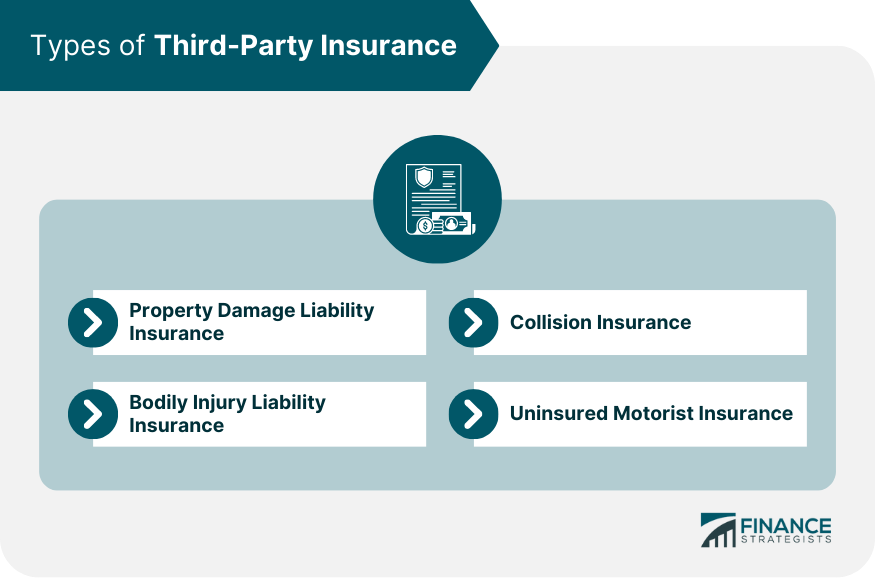

Types of Third-Party Insurance

Property Damage Liability Insurance

Bodily Injury Liability Insurance

Collision Insurance

Uninsured Motorist Insurance

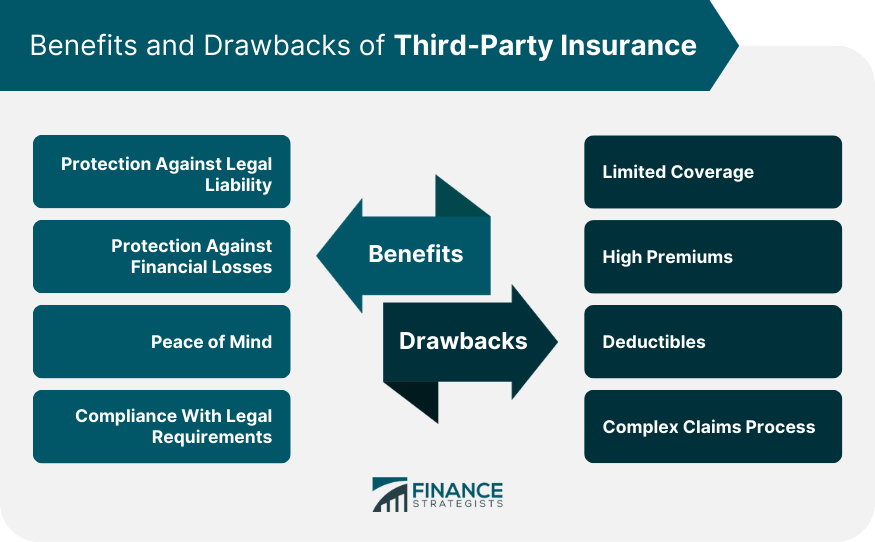

Benefits of Third-Party Insurance

Protection Against Legal Liability

Protection Against Financial Losses

Peace of Mind

Compliance With Legal Requirements

Drawbacks of Third-Party Insurance

Limited Coverage

High Premiums

Deductibles

Complex Claims Process

Factors Affecting Third-Party Insurance Rates

Risk Level

Coverage Limits

Deductibles

Jurisdiction

Conclusion

Third-Party Insurance FAQs

Third-party insurance is a type of insurance policy that protects the policyholder against liability claims made by a third party.

If a third party makes a claim against the policyholder, the insurance company will investigate the claim and, if it's valid, provide financial compensation to the third party.

The types of third-party insurance include liability insurance, comprehensive insurance, collision insurance, and uninsured motorist insurance.

Third-party insurance provides protection against legal liability, financial losses, and compliance with legal requirements, and gives peace of mind.

Drawbacks of third-party insurance include limited coverage, high premiums, deductibles, and complex claims processes.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.