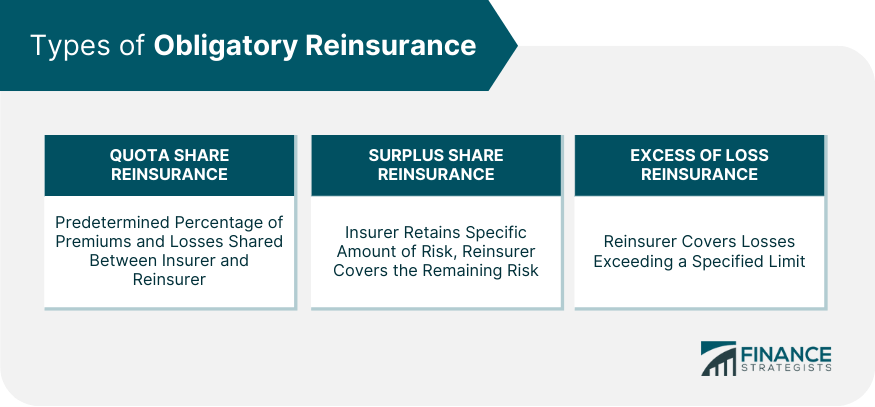

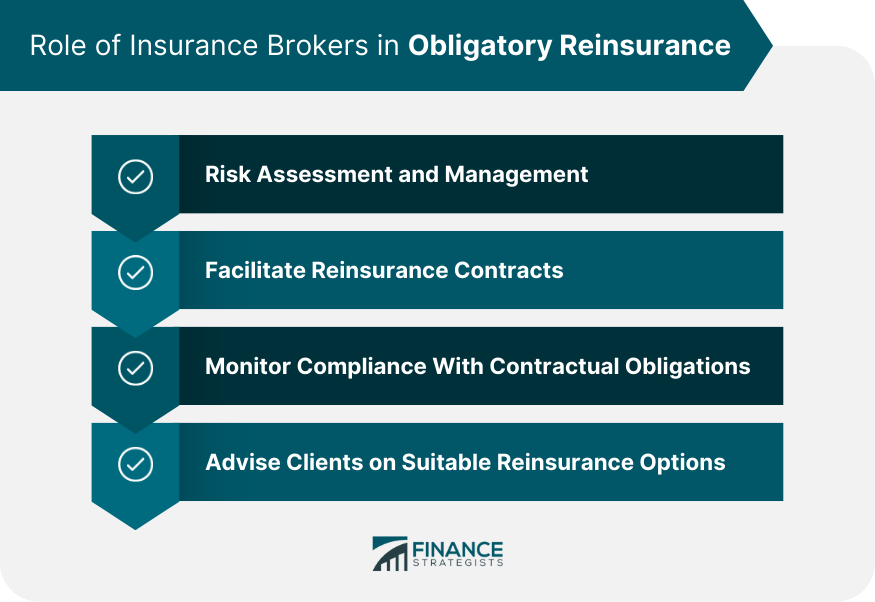

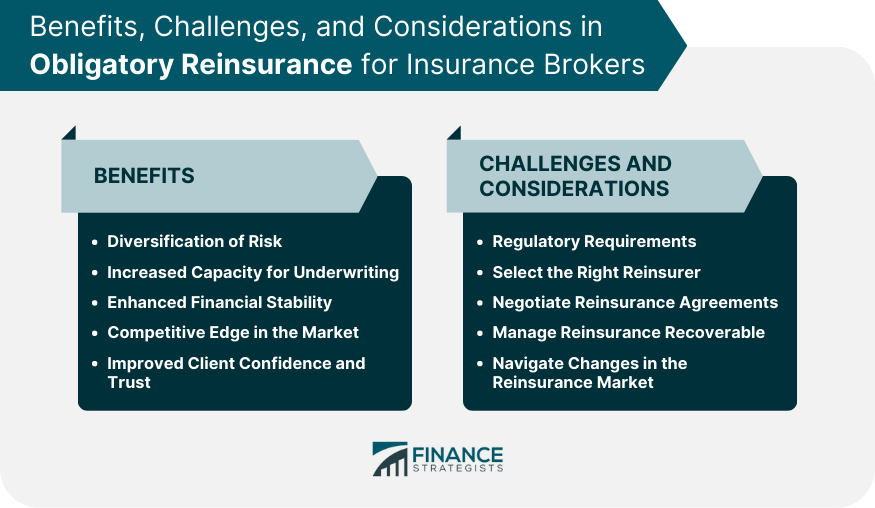

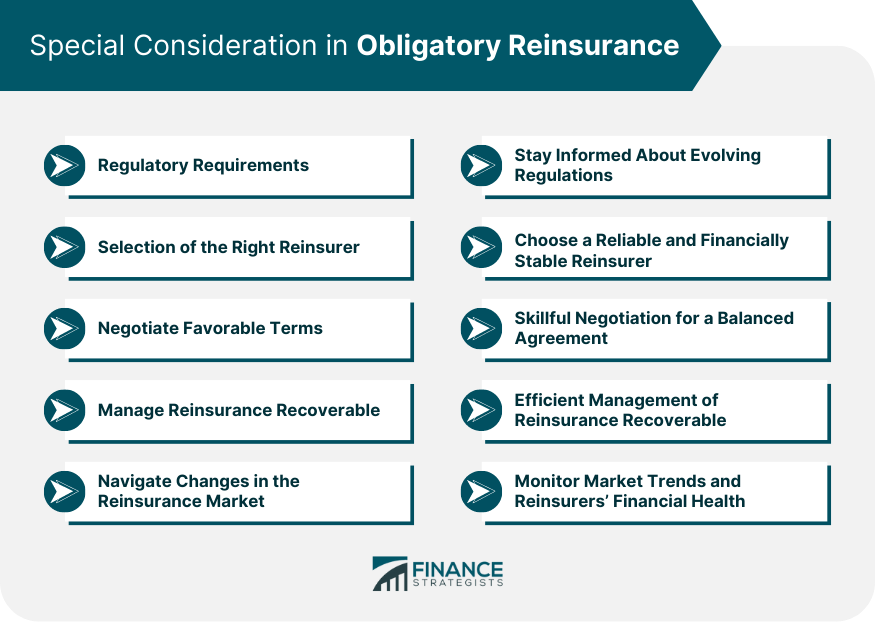

Obligatory reinsurance is a mandatory reinsurance agreement between an insurer and a reinsurer in which the reinsurer is required to accept a specific portion of the insurer's risks. This arrangement helps to distribute and manage risk exposures, enhance the insurer's underwriting capacity, and maintain financial stability within the insurance industry. Insurance brokers play a crucial role in facilitating these reinsurance agreements and providing expert advice to their clients. Quota share reinsurance is a type of proportional reinsurance where the insurer and the reinsurer share a predetermined percentage of premiums and losses. This type of reinsurance is often used by insurance brokers to help clients manage their risk exposure and enhance their underwriting capacity. Surplus share reinsurance is another form of proportional reinsurance, where the insurer retains a specific amount of risk, and the reinsurer covers the remaining risk. Insurance brokers often recommend this type of reinsurance to clients with larger or more volatile risk exposures. Excess of loss reinsurance is a non-proportional reinsurance arrangement where the reinsurer covers losses exceeding a specified limit. This type of reinsurance is commonly used by insurance brokers to protect their clients from catastrophic events or large losses. Insurance brokers play a critical role in assessing and managing their clients' risks. They analyze the potential exposure and recommend suitable reinsurance options to minimize potential losses. Insurance brokers facilitate the negotiation and placement of reinsurance contracts between their clients and reinsurers. They act as intermediaries, ensuring the terms of the agreement are fair and meet the needs of both parties. Insurance brokers are responsible for monitoring the compliance of their clients with the terms and conditions of the reinsurance contract. This includes ensuring timely payment of premiums and accurate reporting of claims. Insurance brokers provide their clients with expert advice on the most appropriate reinsurance options based on their risk profiles, financial objectives, and market conditions. Obligatory reinsurance allows insurance brokers to diversify their clients' risk portfolios, reducing the impact of a single event or loss on the insurer's balance sheet. Reinsurance agreements enable insurance brokers to increase their underwriting capacity, allowing them to take on more significant risks and generate additional revenue. Obligatory reinsurance contributes to the financial stability of insurance brokers and their clients by distributing risk and protecting against large losses. Offering a range of reinsurance options enables insurance brokers to differentiate themselves from competitors and attract new clients. By managing their clients' risks effectively through obligatory reinsurance, insurance brokers can build trust and confidence with their clients, leading to long-term business relationships. Insurance brokers must stay up-to-date with regulatory requirements related to reinsurance and ensure that their clients are in compliance with these regulations. Choosing a reliable and financially stable reinsurer is essential for insurance brokers to ensure the effectiveness of the reinsurance agreement and safeguard their clients' interests. Insurance brokers must negotiate favorable terms and conditions for their clients when entering into reinsurance agreements, balancing the needs of both the insurer and the reinsurer. Brokers need to manage reinsurance recoverable efficiently, ensuring that claims are settled promptly and accurately to maintain their client's financial stability. Insurance brokers must stay informed about developments in the reinsurance market, such as evolving regulations, market trends, and the financial health of reinsurers, to provide the best advice and solutions for their clients. Special considerations in obligatory reinsurance require careful attention from insurance brokers and industry professionals. These considerations include regulatory requirements, selection of the right reinsurer, negotiating favorable terms, managing reinsurance recoverable, and navigating changes in the reinsurance market. Insurance brokers must stay informed about evolving regulations to ensure compliance and protect their client's interests. Choosing a reliable and financially stable reinsurer is essential to ensure the effectiveness of the reinsurance agreement. Skillful negotiation is necessary to strike a balance between the needs of the insurer and the reinsurer. Managing reinsurance recoverable efficiently is crucial for maintaining financial stability, and staying informed about market trends and the financial health of reinsurers is vital for adapting to changes in the reinsurance landscape. By addressing these special considerations, insurance brokers can provide optimal risk management solutions and safeguard their clients' interests. Obligatory reinsurance is a crucial tool for insurers to manage and distribute risks, enhance underwriting capacity, and maintain financial stability. Insurance brokers play a pivotal role in facilitating reinsurance agreements, providing risk assessment, negotiating contracts, and advising clients on suitable options. Quota share, surplus share, and excess of loss are common types of obligatory reinsurance. Benefits for insurance brokers include risk diversification, increased underwriting capacity, enhanced financial stability, competitive advantage, and client trust. However, challenges such as regulatory compliance, selecting reliable reinsurers, negotiating favorable terms, managing reinsurance recoverable, and navigating market changes require careful attention. Insurance brokers must stay updated with regulations, market trends, and reinsurers' financial health to effectively meet client's needs and provide optimal risk management solutions.What Is Obligatory Reinsurance?

Types of Obligatory Reinsurance

Quota Share Reinsurance

Surplus Share Reinsurance

Excess of Loss Reinsurance

Role of Insurance Brokers in Obligatory Reinsurance

Risk Assessment and Management

Facilitating Reinsurance Contracts

Monitoring Compliance With Contractual Obligations

Advising Clients on Suitable Reinsurance Options

Benefits of Obligatory Reinsurance for Insurance Brokers

Diversification of Risk

Increased Capacity for Underwriting

Enhanced Financial Stability

Competitive Edge in the Market

Improved Client Confidence and Trust

Challenges and Considerations for Insurance Brokers

Regulatory Requirements

Selecting the Right Reinsurer

Negotiating Reinsurance Agreements

Managing Reinsurance Recoverable

Navigating Changes in the Reinsurance Market

Special Consideration in Obligatory Reinsurance

Bottom Line

Obligatory Reinsurance FAQs

Obligatory reinsurance is an essential aspect of the insurance industry that involves the sharing and distribution of risk between insurers and reinsurers. It is crucial for insurance brokers as it enables them to manage their clients' risk exposures effectively, enhance their underwriting capacity, maintain financial stability, and gain a competitive edge in the market.

Insurance brokers typically work with three main types of obligatory reinsurance: quota share reinsurance, surplus share reinsurance, and excess of loss reinsurance. These reinsurance arrangements help brokers to effectively manage and diversify their clients' risk exposures, protect against catastrophic events or large losses, and increase their underwriting capacity.

Insurance brokers play a pivotal role in obligatory reinsurance by assessing and managing their clients' risks, facilitating reinsurance contracts, monitoring compliance with contractual obligations, and advising clients on suitable reinsurance options based on their risk profiles and financial objectives.

Obligatory reinsurance offers several benefits for insurance brokers and their clients, including diversification of risk, increased capacity for underwriting, enhanced financial stability, a competitive edge in the market, and improved client confidence and trust.

Insurance brokers can stay informed about future trends and changes in the obligatory reinsurance market by keeping up-to-date with technological advancements, climate change impacts, evolving regulatory landscapes, and mergers and acquisitions in the reinsurance industry. This proactive approach enables brokers to adapt their practices and provide the best possible advice and solutions to their clients.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.