A noncancellable insurance policy, also known as a guaranteed renewable policy, is an insurance contract that guarantees the insured person's premium rates, benefits, and policy continuation as long as the policyholder pays their premiums on time. This type of insurance policy offers greater stability and protection for policyholders, making it an important product for insurance brokers to understand and offer their clients. Noncancellable health insurance policies provide policyholders with guaranteed coverage and stable premiums, ensuring that they have access to healthcare services regardless of changes in their health status or market conditions. Benefits of noncancellable health insurance: These policies offer a high level of protection for policyholders, ensuring that their coverage cannot be canceled or modified due to changes in their health or other factors. They also guarantee stable premium rates, providing long-term financial security. Common terms and conditions: Noncancellable health insurance policies typically have specific terms and conditions, such as a waiting period for pre-existing conditions, coverage limits, and exclusions for certain treatments or services. Noncancellable disability insurance policies provide policyholders with income protection in the event of a disabling injury or illness, guaranteeing stable premiums and benefits throughout the policy term. Benefits of noncancellable disability insurance: These policies offer financial security and protection for policyholders, ensuring that they will receive a stable income in the event of a disability. They also guarantee that their coverage cannot be canceled or modified due to changes in their health or other factors. Common terms and conditions: Noncancellable disability insurance policies typically have specific terms and conditions, such as elimination periods, benefit periods, and coverage limitations based on the insured's occupation or income. Noncancellable insurance policies guarantee that premium rates will remain stable throughout the policy term, providing long-term financial security for policyholders. These policies ensure that policy benefits, such as coverage limits and terms, cannot be changed or reduced, providing policyholders with reliable protection against unexpected life events. Noncancellable insurance policies cannot be canceled or modified by the insurer as long as the policyholder pays their premiums on time, offering a high level of protection and peace of mind. By offering guaranteed premiums and benefits, noncancellable insurance policies provide policyholders with a stable foundation for their long-term financial planning. Insurance brokers play a crucial role in helping clients understand their insurance needs and determining whether a noncancellable insurance policy is suitable for them. Brokers are responsible for comparing and evaluating different noncancellable insurance policies, ensuring that clients have access to the best possible coverage options for their needs. Insurance brokers must clearly explain the terms and conditions of noncancellable insurance policies to clients, ensuring that they fully understand the coverage, benefits, and limitations of their chosen policy. Brokers play a critical role in facilitating the purchase and renewal of noncancellable insurance policies, ensuring that clients maintain continuous coverage and protection. One challenge for insurance brokers is addressing pricing and affordability concerns related to noncancellable insurance policies, as these policies often come with higher premiums compared to other types of insurance. Insurance brokers must stay informed about changing market conditions and trends that may affect the availability or pricing of noncancellable insurance policies, ensuring that they can continue to offer competitive products to their clients. Brokers play a critical role in educating clients about the benefits and limitations of noncancellable insurance policies, ensuring that they make informed decisions about their coverage needs. Insurance brokers must stay informed about industry regulations and standards related to noncancellable insurance policies, ensuring that they offer compliant products and services to their clients. Brokers are responsible for adhering to compliance requirements set forth by regulatory bodies and industry standards when offering and managing noncancellable insurance policies. Regulatory bodies, such as state insurance departments and industry associations, play a vital role in overseeing the noncancellable insurance market and ensuring that brokers maintain compliance with relevant regulations and standards. Noncancellable insurance policies, also called guaranteed renewable policies, provide stable premium rates, benefits, and policy continuation as long as premiums are paid, offering crucial stability and protection for clients and making them vital for insurance brokers. There are two main types of noncancellable insurance policies: health and disability, each offering distinct advantages to policyholders. Insurance brokers play a crucial role in guiding clients through the process of selecting and managing noncancellable insurance policies while ensuring compliance with industry regulations and standards. Challenges such as pricing and affordability, changing market conditions, and client education require brokers to stay informed and adapt to market trends. Technological advancements and market growth present exciting opportunities for insurance brokers to expand their businesses and continue offering innovative and competitive noncancellable insurance products to their clients.What Is a Noncancellable Insurance Policy?

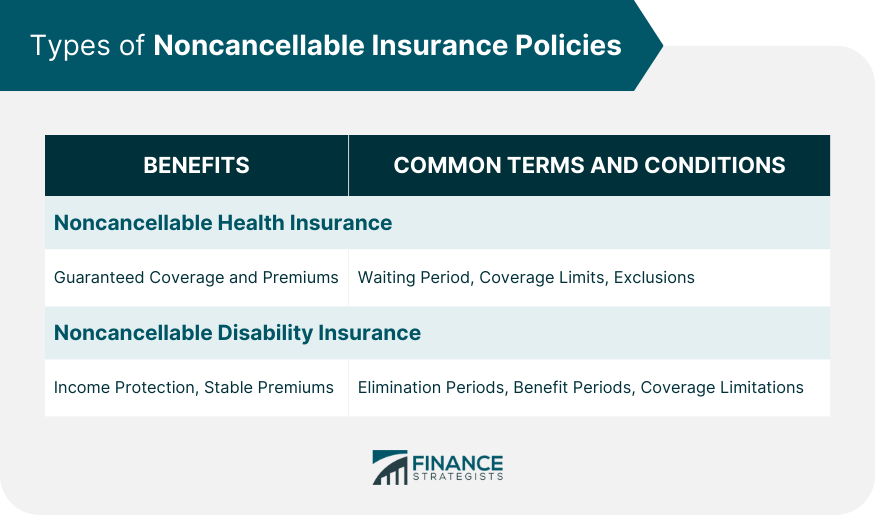

Types of Noncancellable Insurance Policies

Noncancellable Health Insurance

Noncancellable Disability Insurance

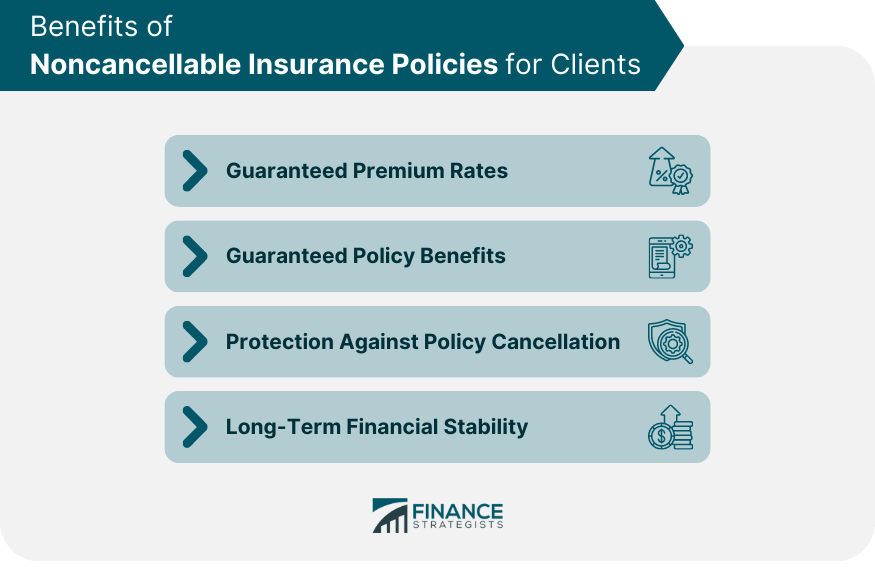

Benefits of Noncancellable Insurance Policies for Clients

Guaranteed Premium Rates

Guaranteed Policy Benefits

Protection Against Policy Cancellation

Long-Term Financial Stability

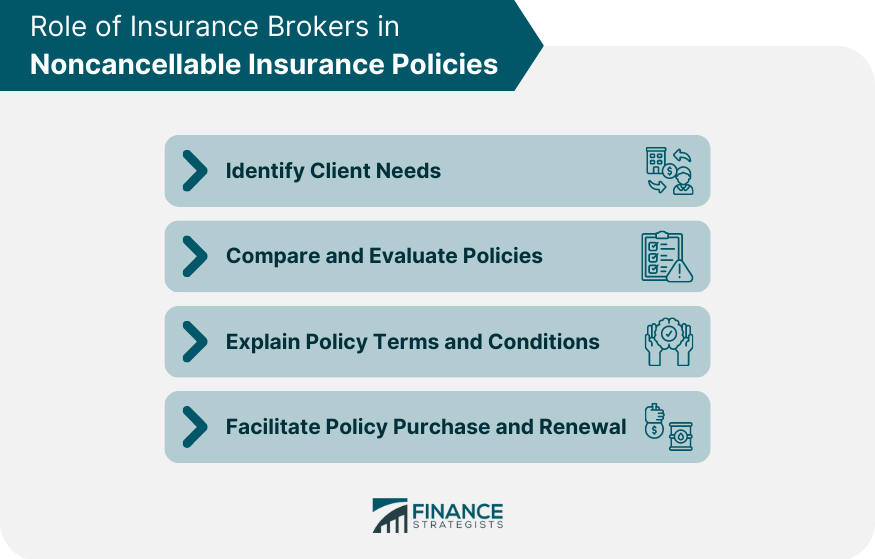

Role of Insurance Brokers in Noncancellable Insurance Policies

Identifying Client Needs

Comparing and Evaluating Policies

Explaining Policy Terms and Conditions

Facilitating Policy Purchase and Renewal

Challenges and Considerations for Insurance Brokers

Pricing and Affordability Concerns

Changing Market Conditions

Client Education and Awareness

Noncancellable Insurance Policy Regulations and Compliance

Industry Regulations and Standards

Compliance Requirements for Insurance Brokers

Role of Regulatory Bodies

Conclusion

Noncancellable Insurance Policy FAQs

A noncancellable insurance policy is a type of insurance contract that guarantees premium rates, benefits, and policy continuation as long as the policyholder pays their premiums on time. This provides policyholders with long-term financial stability, reliable protection against unexpected life events, and peace of mind knowing that their policy cannot be canceled or modified by the insurer.

There are two main types of noncancellable insurance policies: noncancellable health insurance and noncancellable disability insurance. Noncancellable health insurance provides policyholders with guaranteed coverage and stable premiums for healthcare services, while noncancellable disability insurance offers income protection in the event of a disabling injury or illness with guaranteed benefits and premiums.

Insurance brokers play a vital role in helping clients with noncancellable insurance policies by identifying their needs, comparing and evaluating policy options, explaining policy terms and conditions, and facilitating policy purchase and renewal. They also ensure compliance with industry regulations and standards related to noncancellable insurance policies.

Insurance brokers may face challenges such as pricing and affordability concerns, changing market conditions, and client education and awareness when offering noncancellable insurance policies. To address these challenges, brokers must stay informed about market trends, industry regulations, and focus on educating clients about the benefits and limitations of noncancellable insurance policies.

Future trends and opportunities in the noncancellable insurance policy market may include technological advancements, such as artificial intelligence and big data analytics, which can transform the industry and provide enhanced services and products for clients. Additionally, increased market growth and demand for noncancellable insurance policies offer opportunities for insurance brokers to expand their businesses and provide innovative and competitive products to their clients.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.