Mortgage insurance is a type of insurance policy that protects lenders in the event a borrower defaults on their mortgage. This insurance is essential for both homebuyers and lenders, as it enables individuals to purchase homes with lower down payments and provides lenders with protection against potential losses. There are different types of mortgage insurance, such as private mortgage insurance (PMI), mortgage insurance premium (MIP), and lender-paid mortgage insurance (LPMI). Private mortgage insurance (PMI) is a type of mortgage insurance policy provided by private insurance companies. PMI is typically required for conventional loans when the borrower is unable to make a down payment of at least 20% of the home's purchase price. By purchasing PMI, the borrower protects the lender from potential losses in case of default. PMI is generally required for conventional loans when the loan-to-value (LTV) ratio exceeds 80%. The LTV ratio is calculated by dividing the mortgage amount by the appraised value of the property. Borrowers with lower credit scores may also be required to obtain PMI, even if their LTV ratio is below 80%. The cost of PMI varies depending on factors such as the LTV ratio, credit score, and loan term. PMI premiums can be paid upfront as a one-time payment or incorporated into monthly mortgage payments. On average, PMI premiums range from 0.3% to 1.5% of the original loan amount per year. Borrowers can request the cancellation of PMI once their LTV ratio reaches 80% or lower, either through paying down the mortgage balance or an increase in the property's value. Additionally, the Homeowners Protection Act requires lenders to automatically cancel PMI when the LTV ratio reaches 78% for most loans. Mortgage insurance premium (MIP) is a type of mortgage insurance required for borrowers who obtain loans backed by the Federal Housing Administration (FHA). Similar to PMI, MIP protects lenders from losses in case the borrower defaults on the mortgage. MIP is required for all FHA loans, regardless of the down payment or LTV ratio. Borrowers must pay both an upfront mortgage insurance premium at closing and an annual premium incorporated into their monthly mortgage payments. The cost of MIP varies depending on factors such as the loan amount, LTV ratio, and loan term. Upfront MIP is typically 1.75% of the loan amount, while annual MIP premiums range from 0.45% to 1.05% of the outstanding mortgage balance. The duration of MIP depends on factors such as the loan term and LTV ratio. For loans with an original LTV ratio of 90% or less, MIP is required for 11 years. For loans with an LTV ratio greater than 90%, MIP is required for the entire loan term. Lender-paid mortgage insurance (LPMI) is a type of mortgage insurance in which the lender pays the mortgage insurance premiums instead of the borrower. LPMI is typically available for conventional loans and may be offered as an alternative to PMI. The primary advantage of LPMI is that it eliminates the need for borrowers to pay monthly mortgage insurance premiums. However, the lender typically charges a higher interest rate to compensate for the cost of LPMI. This may result in a higher overall cost for the borrower, depending on the length of time they hold the mortgage. When considering LPMI, borrowers should compare the total costs associated with LPMI and other types of mortgage insurance, such as PMI or MIP. It is essential to evaluate factors such as interest rates, monthly mortgage payments, and the duration of the mortgage insurance requirement. The LTV ratio is a significant factor in determining mortgage insurance premiums. A higher LTV ratio indicates a higher risk for the lender, resulting in higher mortgage insurance premiums. A borrower's credit score also impacts the cost of mortgage insurance premiums. Borrowers with lower credit scores are generally considered higher risk and may be charged higher premiums. The length of the loan term can also affect mortgage insurance premiums. Longer loan terms typically result in higher premiums, as the lender faces a more extended period of potential risk. The type of loan a borrower chooses will also impact the cost of mortgage insurance premiums. Government-backed loans, such as FHA loans, have specific mortgage insurance requirements and costs that differ from conventional loans. One of the most straightforward ways to avoid mortgage insurance is to make a down payment of at least 20% of the home's purchase price. This reduces the LTV ratio below 80%, eliminating the need for PMI on conventional loans. A piggyback loan, also known as an 80-10-10 loan, involves obtaining a second mortgage simultaneously with the primary mortgage. The primary mortgage covers 80% of the home's purchase price, while the second mortgage covers 10%. The borrower then provides a 10% down payment. This strategy allows borrowers to avoid mortgage insurance while still financing a portion of the home's purchase price. Some government-backed loan programs, such as VA loans and USDA loans, do not require mortgage insurance. Borrowers who are eligible for these programs can avoid mortgage insurance by utilizing these loan options. As mentioned earlier, LPMI can be an alternative to PMI for borrowers looking to avoid monthly mortgage insurance payments. However, borrowers should carefully weigh the pros and cons of LPMI and consider the long-term costs associated with the higher interest rate. Mortgage insurance plays a crucial role in protecting lenders from the risk of borrower default. By reducing the lender's potential losses, mortgage insurance allows lenders to offer loans with lower down payment requirements, thereby making homeownership more accessible. Mortgage insurance enables borrowers to purchase homes with lower down payments, making homeownership more attainable for many individuals. By offering protection to lenders, mortgage insurance allows borrowers to secure loans with LTV ratios above 80%. Mortgage insurance premiums are typically included in a borrower's monthly mortgage payment, along with principal, interest, taxes, and homeowners' insurance. Therefore, mortgage insurance can impact the total monthly cost of homeownership. Understanding the various mortgage insurance options and their respective costs is essential for homebuyers navigating the mortgage process. By evaluating factors that impact mortgage insurance premiums and exploring alternatives to avoid mortgage insurance, borrowers can make informed decisions that best suit their financial needs. Aside from that, mortgage insurance plays a vital role in the homebuying process by protecting lenders and enabling borrowers to purchase homes with lower down payments. By understanding the nuances of mortgage insurance and how it impacts monthly mortgage payments, borrowers can make well-informed choices to secure a mortgage that aligns with their financial goals and homeownership aspirations.What Is Mortgage Insurance?

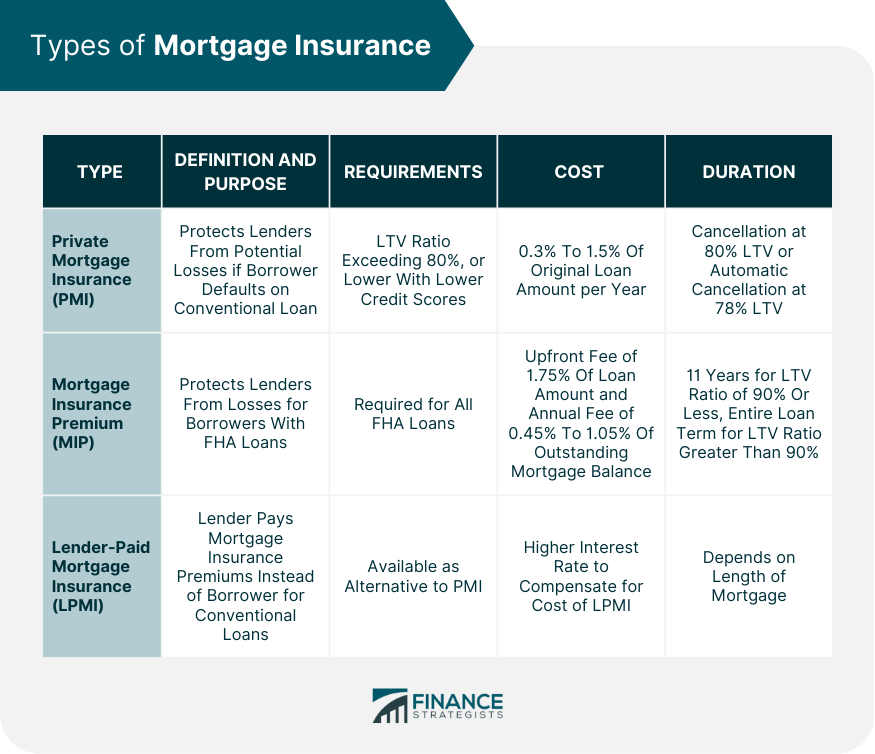

Types of Mortgage Insurance

Private Mortgage Insurance (PMI)

Definition and Purpose

Requirements for PMI

Cost of PMI

Cancellation of PMI

Mortgage Insurance Premium (MIP)

Definition and Purpose

Requirements for MIP

Cost of MIP

Duration of MIP

Lender-Paid Mortgage Insurance (LPMI)

Definition and Purpose

Advantages and Disadvantages

Comparing LPMI With Other Types of Mortgage Insurance

Factors Affecting Mortgage Insurance Premiums

Loan-To-Value (LTV) Ratio

Credit Score

Loan Term

Loan Type

How to Avoid Mortgage Insurance

Making a Larger Down Payment

Obtaining a Piggyback Loan

Utilizing Government-Backed Loan Programs

Considering Lender-Paid Mortgage Insurance

The Role of Mortgage Insurance in the Homebuying Process

Protecting Lenders From Default Risk

Enabling Homebuyers to Purchase Homes With Lower Down Payments

Affecting Monthly Mortgage Payments

Conclusion

Mortgage Insurance FAQs

Mortgage insurance, also known as mortgage protection insurance or private mortgage insurance (PMI), is a type of insurance that protects lenders against losses if a borrower defaults on a mortgage loan.

Mortgage insurance is typically required if you have a down payment of less than 20% of the home's purchase price. However, there are some loan programs that do not require mortgage insurance, such as VA and USDA loans.

The cost of mortgage insurance can vary depending on the size of the down payment, the loan amount, and the type of loan. On average, PMI can range from 0.3% to 1.5% of the original loan amount per year.

The length of time you need to pay mortgage insurance can vary depending on the loan program and the lender's requirements. For most conventional loans, mortgage insurance can be removed once the loan-to-value ratio (LTV) reaches 78%.

You can request to cancel your mortgage insurance once you have reached the required LTV ratio, or once you have built enough equity in your home. However, some loan programs require mortgage insurance for the life of the loan, so it's important to check with your lender.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.