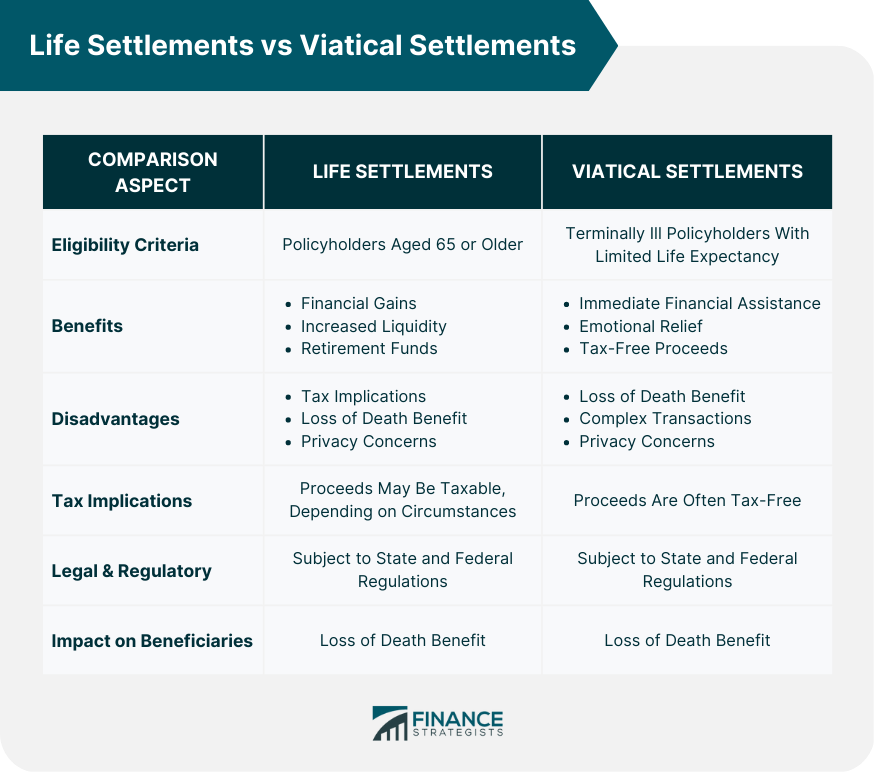

Life settlements and viatical settlements are two distinct options that provide policyholders with alternative ways to extract value from their life insurance policies. Though they share some similarities, they serve different purposes and are suited to different circumstances. A life settlement is a transaction in which a policyholder sells their life insurance policy to a third party for a lump sum payment that is greater than the cash surrender value but less than the policy's death benefit. Life settlements are primarily designed for seniors who no longer need or want their life insurance policies, and they can provide the policyholder with additional financial resources for retirement, medical expenses, or other needs. Typically, life settlements are available to policyholders who are 65 years of age or older. Life settlements can be made with various types of life insurance policies, including term, whole, and universal life. Life settlements usually require a policy to have a minimum face value, often ranging from $100,000 to $250,000. Life settlements can provide policyholders with a significant lump sum payment that may be used for various purposes, such as retirement planning, paying off debt, or funding long-term care. By selling their life insurance policies, policyholders can convert an illiquid asset into cash, providing increased financial flexibility. Life settlements can help policyholders adjust their financial strategies to better align with their changing needs and goals during retirement. The proceeds from a life settlement may be subject to taxes, depending on the policyholder's circumstances. When a policyholder sells their life insurance policy through a life settlement, their beneficiaries will no longer receive the policy's death benefit. Life settlements can require policyholders to disclose sensitive personal and medical information to third parties, which may raise privacy concerns. A viatical settlement is a transaction in which a policyholder with a terminal illness sells their life insurance policy to a third party for a lump sum payment that is typically a percentage of the policy's death benefit. Viatical settlements are designed to provide immediate financial assistance to terminally ill policyholders, helping them cover medical expenses and other costs associated with their illness. To qualify for a viatical settlement, policyholders typically must have a life expectancy of 24 months or less due to a terminal illness. Like life settlements, viatical settlements can involve various types of life insurance policies, including term, whole, and universal life. Viatical settlements may also require a policy to have a minimum face value, though this threshold can vary depending on the provider. Viatical settlements can provide critically needed funds for policyholders facing significant medical expenses related to their terminal illness. By providing financial support, viatical settlements can help alleviate some of the stress and anxiety experienced by policyholders and their families during a difficult time. In many cases, the proceeds from a viatical settlement are tax-free, providing policyholders with the full amount of the lump sum payment. As with life settlements, beneficiaries will no longer receive the policy's death benefit when a policyholder sells their life insurance policy through a viatical settlement. Viatical settlements can be complex, involving multiple parties and requiring policyholders to navigate various legal, financial, and medical considerations. As with life settlements, viatical settlements may require policyholders to disclose sensitive personal and medical information to third parties, which can raise privacy concerns. While both life and viatical settlements involve the sale of a life insurance policy, they cater to different segments of policyholders. Life settlements typically target seniors over 65 who no longer need or want their policies, whereas viatical settlements are designed for terminally ill policyholders with a limited life expectancy. Both life and viatical settlements provide policyholders with lump sum payments in exchange for their policies. However, viatical settlements tend to offer tax-free proceeds, while life settlements may have tax implications. Additionally, viatical settlements are primarily focused on providing financial relief for medical expenses, whereas life settlements offer greater flexibility in terms of how the funds can be used. Viatical settlements often provide tax-free proceeds to policyholders, while life settlements may be subject to taxes depending on the specific circumstances of the policyholder. Both life and viatical settlements are subject to state and federal regulations, which are designed to protect policyholders and ensure the legitimacy of the transactions. A key factor in determining whether a life or viatical settlement is more appropriate is the policyholder's health status. Those who are terminally ill and have a limited life expectancy may benefit more from a viatical settlement, while seniors in relatively good health may find a life settlement to be a better option. Policyholders should consider their financial needs and goals when deciding between a life and viatical settlement. A life settlement may be more appropriate for individuals looking to supplement their retirement income, while a viatical settlement may be more suitable for those facing significant medical expenses. When considering a life or viatical settlement, policyholders should take into account the potential impact on their beneficiaries, as selling a life insurance policy will result in the loss of the death benefit for those beneficiaries. Understanding the tax implications of each type of settlement is important for policyholders. Viatical settlements often offer tax-free proceeds, while life settlements may be subject to taxes depending on the policyholder's specific circumstances. Life and viatical settlements are two options for policyholders to sell their life insurance policies to a third party for a lump sum payment. Life settlements target seniors over 65 who no longer need or want their policies, while viatical settlements are designed for terminally ill policyholders with a limited life expectancy. Both options have benefits and drawbacks, and policyholders should consider factors such as their health status, financial needs and goals, impact on beneficiaries, and tax implications before deciding on a settlement. Viatical settlements often provide tax-free proceeds, while life settlements may have tax implications. Both types of settlements are subject to state and federal regulations. Policyholders should consult with a financial professional to determine which type of settlement is the most appropriate for their specific situation.Life Settlements vs Viatical Settlements Overview

Life Settlements

Overview

Definition

Purpose

Eligibility

Age Requirements

Policy Types

Policy Value

Benefits

Financial Gains for Policyholders

Increased Liquidity

Flexibility for Retirement Planning

Disadvantages

Tax Implications

Loss of Death Benefit for Beneficiaries

Privacy Concerns

Viatical Settlements

Overview

Definition

Purpose

Eligibility

Terminal Illness Requirements

Policy Types

Policy Value

Benefits

Immediate Financial Assistance for Medical Expenses

Emotional Relief for Policyholder and Family

Tax-Free Proceeds

Disadvantages

Loss of Death Benefit for Beneficiaries

Complexity of Transactions

Privacy Concerns

Comparing Life Settlements and Viatical Settlements

Eligibility Criteria

Benefits and Disadvantages

Tax Implications

Legal and Regulatory Aspects

Factors to Consider When Choosing Between Life and Viatical Settlements

Policyholder's Health Status

Financial Needs and Goals

Impact on Beneficiaries

Tax Implications

Conclusion

Life Settlements vs Viatical Settlements FAQs

Life settlements and viatical settlements both involve the sale of a life insurance policy, but they cater to different policyholders. Life settlements target seniors over 65 who no longer need or want their policies, while viatical settlements are designed for terminally ill policyholders with a limited life expectancy. Viatical settlements often provide tax-free proceeds, while life settlements may have tax implications.

Both life and viatical settlements result in the policyholder selling their life insurance policy, which means that the policy's death benefit will no longer be paid to the beneficiaries. Instead, the policyholder receives a lump sum payment that can be used for various purposes, such as retirement planning, medical expenses, or debt repayment.

The tax implications of life settlements and viatical settlements differ. Viatical settlement proceeds are often tax-free, providing policyholders with the full amount of the lump sum payment. In contrast, life settlement proceeds may be subject to taxes depending on the policyholder's specific circumstances.

Eligibility criteria for life settlements and viatical settlements are distinct. Life settlements are typically available to policyholders who are 65 years of age or older, while viatical settlements require the policyholder to have a terminal illness with a life expectancy of 24 months or less. Policyholders should consider their health status, financial needs, and the potential impact on beneficiaries when deciding between the two options.

Life settlements provide policyholders with financial gains, increased liquidity, and flexibility for retirement planning. However, they may have tax implications and result in the loss of death benefits for beneficiaries. Viatical settlements offer immediate financial assistance for medical expenses, emotional relief, and tax-free proceeds but also involve the loss of death benefits for beneficiaries and may require navigating complex transactions.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.