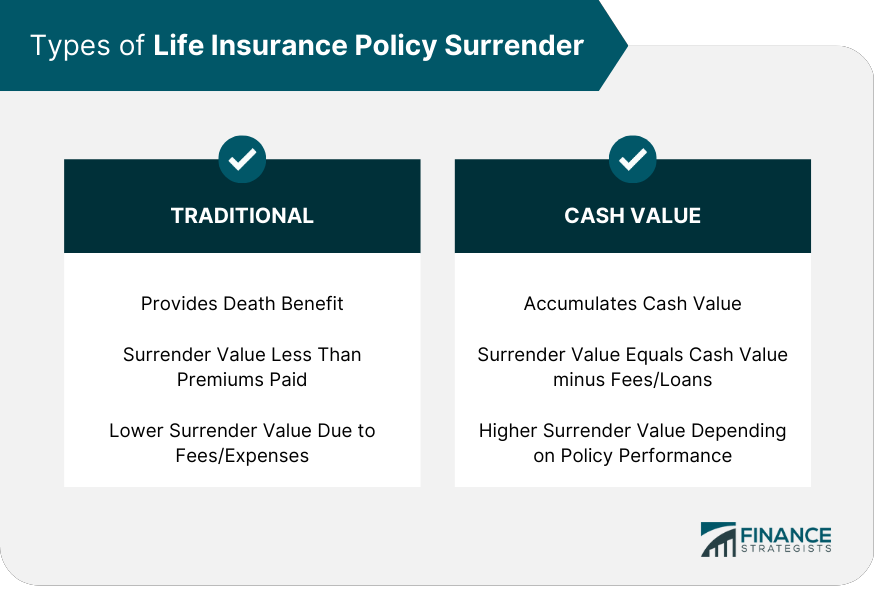

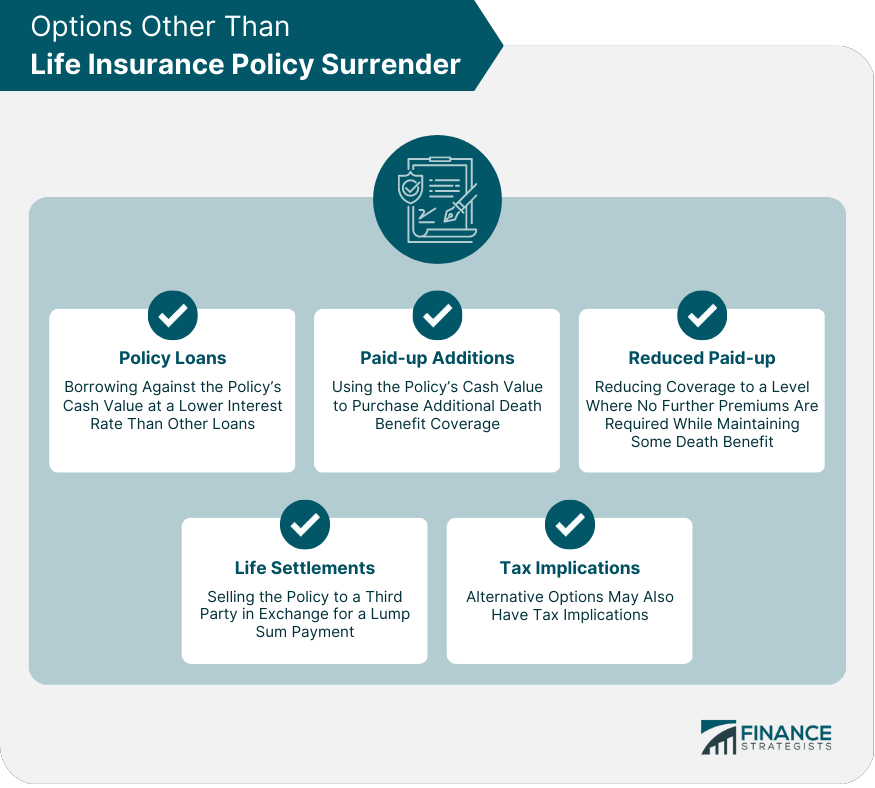

Life insurance policy surrenders refer to the process by which a policyholder terminates their life insurance policy and receives the surrender value from the insurer. When a policyholder surrenders their life insurance policy, they forfeit the death benefit that would have been paid out upon their death.” However, surrendering a policy may not always be the best option, as it may result in a loss of money and coverage. It is important for policyholders to carefully consider their options and consult with a financial professional before surrendering a life insurance policy. There are two main types of life insurance policy surrenders: traditional and cash value. Traditional life insurance policies provide a death benefit to the policyholder's beneficiaries upon their death. If the policyholder decides to surrender a traditional policy, they will receive a payout that is less than the total amount of premiums paid. The surrender value of a traditional policy is typically lower than the policy's face value, as insurers charge fees and expenses for administering the policy. Cash value life insurance policies accumulate a cash value over time. This cash value can be accessed by policyholders through policy loans or surrenders. If the policyholder decides to surrender a cash value policy, they will receive a payout that is equal to the policy's cash value minus any outstanding loans or fees. The surrender value of a cash value policy may be higher than the total amount of premiums paid, depending on the policy's performance. There are several reasons why a policyholder may choose to surrender their policy, including: 1. Policy No Longer Needed: The policyholder may no longer need life insurance coverage, such as if their financial circumstances have changed, or their beneficiaries no longer require financial support. 2. Financial Hardship: The policyholder may need to access the cash value of their policy to address a financial emergency or hardship. 3. Policy Underperformance: The policy may not be performing as expected, or the policyholder may have found a better alternative. Policyholders may be able to borrow against the cash value of their policy, typically at a lower interest rate than other loans. However, failure to repay the loan can lead to a reduction in the policy's death benefit or policy lapse. Paid-up additions use the policy's cash value to purchase additional death benefit coverage, allowing policyholders to increase their coverage without increasing premiums. Reduced paid-up insurance allows policyholders to reduce their coverage to a level where no further premiums are required, while maintaining some death benefit. Life settlements involve selling the policy to a third party in exchange for a lump sum payment. However, this option is typically only available to policyholders with larger policies. Alternative options to policy surrender may also have tax implications, and it is important to understand the impact of each option on your tax situation. The policyholder must contact their insurance company to initiate the policy surrender process. The insurance company will provide a surrender form, which must be completed by the policyholder. The surrender form requires the policyholder to provide personal and policy information, including the reason for surrendering the policy. The completed surrender form and policy documents must be submitted to the insurance company. Upon approval of the surrender request, the insurance company will pay out the surrender value of the policy, less any surrender charges and fees. Before surrendering a policy, it is important to consider the original purpose of the policy, such as providing financial support for dependents or covering end-of-life expenses. Policyholders should explore alternative options, such as policy loans or reduced paid-up insurance, before surrendering a policy. Surrendering a policy may impact the policyholder's beneficiaries, who may rely on the policy's death benefit for financial support. Surrendering a policy typically incurs charges and fees, which can reduce the payout received by the policyholder. Surrendering a policy may result in taxable income, and alternative options may also have tax implications. It is important to understand the tax implications of each option. Life insurance policy surrender involves terminating a policy and receiving its surrender value. Traditional policies provide a death benefit, while cash value policies accumulate cash over time. Reasons for surrendering a policy include no longer needing coverage, financial hardship, and policy underperformance. Options other than surrender include policy loans, paid-up additions, reduced paid-up insurance, and life settlements. Before surrendering a policy, consider its purpose, impact on beneficiaries, surrender charges and fees, and tax implications. To surrender a policy, contact the insurer, request a surrender form, fill it out, submit it with policy documents, and receive the surrender proceeds. Consult with a financial professional to explore options and understand the impact of surrender on your financial situation.What Is a Life Insurance Policy Surrender?

Surrendering a life insurance policy may be necessary if the policyholder can no longer afford to pay the premiums or if they no longer need the coverage provided by the policy. Types of Life Insurance Policy Surrender

Traditional Life Insurance Policies

Cash Value Life Insurance Policies

Reasons for Surrendering a Policy

Options Other Than Policy Surrender

Policy Loans

Paid-up Additions

Reduced Paid-up Insurance

Life Settlements

Tax Implications of Other Options

Steps in Policy Surrender

Contacting the Insurance Company

Requesting a Surrender Form

Filling Out the Form

Submitting the Form and Policy Documents

Receiving Surrender Proceeds

Considerations Before Surrendering a Policy

Purpose of the Policy

Alternative Options to Policy Surrender

Impact on Beneficiaries

Surrender Charges and Fees

Tax Implications

Conclusion

Life Insurance Policy Surrender FAQs

A life insurance policy surrender is a voluntary termination of a life insurance policy by the policyholder in exchange for a payout from the insurance company.

Policyholders may surrender a life insurance policy due to reasons such as the policy no longer being needed, financial hardship, or policy underperformance.

Yes, policy surrender typically incurs surrender charges and fees, which can reduce the payout received by the policyholder.

Alternative options to policy surrender include policy loans, paid-up additions, reduced paid-up insurance, and life settlements. These options can help policyholders avoid surrender charges and fees.

Policyholders should consider the original purpose of the policy, explore alternative options, understand the impact on beneficiaries, and consider the tax implications and surrender charges and fees involved. Consulting with a financial professional can help policyholders make informed decision.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.