The incontestability clause is a critical component in most life and health insurance policies. This provision safeguards the insured by preventing the insurer from denying claims due to inaccuracies or misrepresentations made by the policyholder after a specified period, typically two years. Its roots trace back to the 19th century when regulators introduced this clause to protect policyholders from insurers trying to evade claim payments. This clause fosters fairness in insurance contracts, reassures policyholders that their claims won't be arbitrarily denied, and also manages risk for insurers by limiting the window for contesting claims. As such, the incontestability clause plays an integral role in ensuring a balanced relationship between insurance companies and their clients, providing a sense of security and fostering trust in the world of insurance. One of the main purposes of the incontestability clause is to protect policyholders. It reassures the insured that the insurance company cannot renege on their contractual obligations after the policy has been in force for a certain time, typically two years. While the incontestability clause offers protection to policyholders, it also minimizes risk for insurers. It limits the timeframe during which they need to investigate and contest claims, making the process more efficient and manageable. The incontestability clause helps ensure a fair balance of power between insurers and policyholders. It restricts insurers from using information discovered after policy issuance to deny claims, fostering fairness in contractual relationships. The clause often includes provisions relating to misrepresentation. If a policyholder inaccurately described their health status at the policy's inception, insurers cannot use this against them after the incontestability period. Material facts are another key component of the incontestability clause. If an insured failed to disclose a significant health condition when applying for the policy, this would not be a ground for claim denial after the clause takes effect. Insurers often specify that pre-existing conditions not disclosed at the policy's start cannot be used as a basis for denying claims once the incontestability period is in place. While the incontestability clause protects policyholders from claim denial due to unintentional misrepresentations, fraudulent misrepresentation is often an exception. If an insured intentionally lied or withheld material facts, an insurer might contest the policy, even after the incontestability period. The incontestability clause does not safeguard against policy termination due to non-payment of premiums. If a policyholder fails to pay the required premiums, the insurer has the right to cancel the policy. If a claim arises from illegal activities, the incontestability clause does not protect the policyholder. Insurers are not obligated to pay claims originating from criminal acts, regardless of the incontestability period. The incontestability period often spans two years from the policy's effective date. However, this timeframe can vary depending on the jurisdiction and the type of policy. The incontestability period begins on the policy's effective date. Any material facts discovered by the insurer within this period could be grounds for contesting the policy or denying a claim. If a policy survives the incontestability period, the insurer is generally barred from contesting it later, even if they discover undisclosed material facts. This provision offers a sense of security and assurance for policyholders. In life insurance policies, the incontestability clause protects beneficiaries from claim denial due to misrepresentations on the part of the policyholder. The only exceptions are cases involving fraud, non-payment of premiums, or criminal activity. In health insurance policies, the clause prevents insurers from denying claims due to undisclosed pre-existing conditions or misstatements about the policyholder's health after a certain period. For long-term care insurance policies, the incontestability clause provides a similar layer of protection. It ensures that claims cannot be denied due to misrepresentations or non-disclosure of material facts after the clause is in effect. Incontestability clauses can vary significantly across jurisdictions. Some regions have a strict two-year clause, while others may extend the period or implement stricter rules around what can be considered incontestable. The enforcement of the incontestability clause can be affected by the jurisdiction's regulatory environment. Some jurisdictions enforce the clause rigorously, providing robust protection for policyholders, while others may lean more toward protecting insurers. Different jurisdictions can interpret the incontestability clause in varying ways. For instance, some may take a strict view of what constitutes fraud, while others may have a broader interpretation, providing insurers with more latitude to contest policies. The incontestability clause serves as an important pillar in the insurance sector, protecting policyholders while also managing risks for insurers. It ensures that claims can't be denied due to misrepresentations or undisclosed material facts after a specific period, usually two years. However, exceptions such as fraudulent activity, non-payment of premiums, and illegal activities may provide grounds for policy contestation. The interpretation and enforcement of this clause can vary across jurisdictions and types of policies, thereby impacting its application. Ultimately, the incontestability clause fosters a sense of fairness, trust, and balance in the contractual relationship between insurers and policyholders, offering assurance to both parties. Understanding its nuances empowers individuals to effectively navigate their insurance policies, providing a safety net against unexpected denials of their claims.Incontestability Clause Overview

Purpose of an Incontestability Clause

Protecting the Insured

Minimizing Risk for Insurance Companies

Ensuring Fairness in the Contract

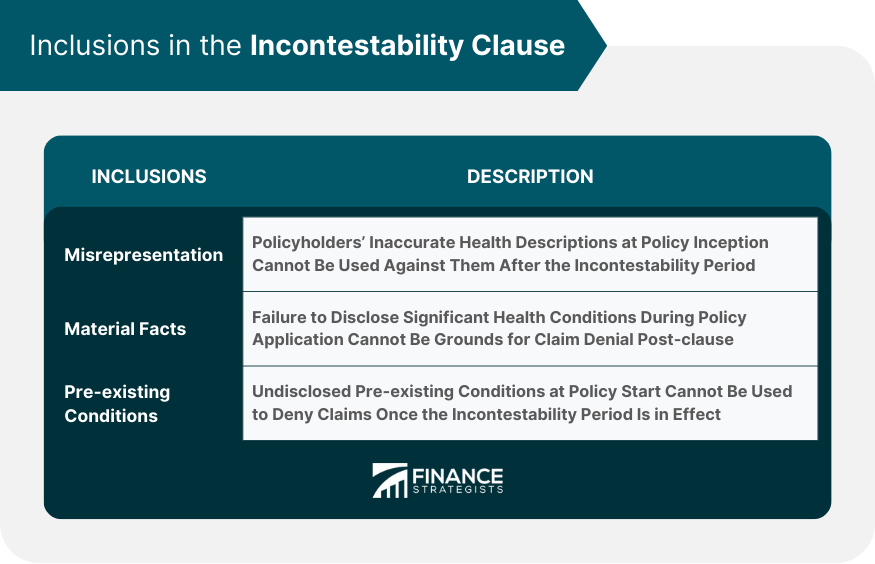

Inclusions in the Incontestability Clause

Misrepresentation

Material Facts

Pre-existing Conditions

Exceptions to the Incontestability Clause

Fraudulent Misrepresentation

Non-payment of Premiums

Illegal Activity

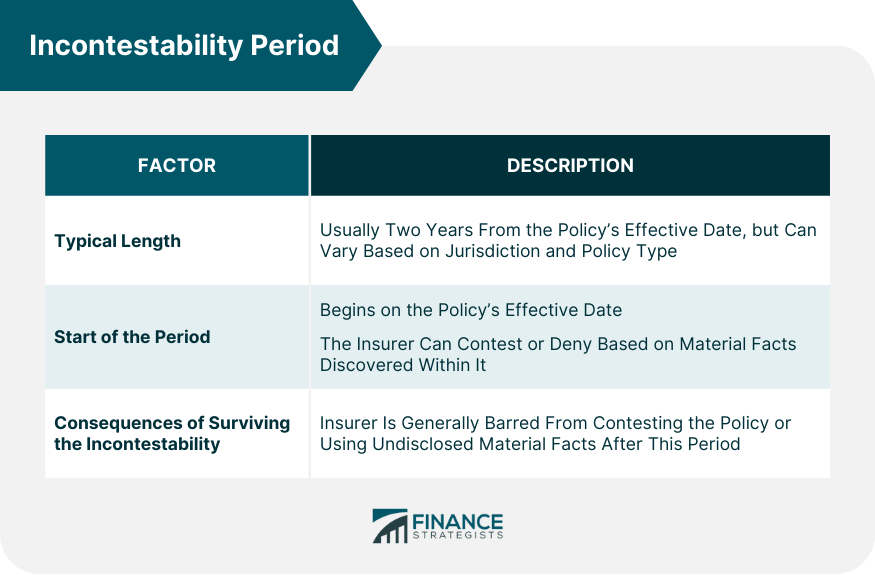

Incontestability Period

Typical Length of the Incontestability Period

Start of the Incontestability Period

Consequences of Surviving the Incontestability Period

Role of the Incontestability Clause in Different Types of Insurance Policies

Life Insurance Policies

Health Insurance Policies

Long-Term Care Insurance Policies

Comparison of Incontestability Clauses in Different Jurisdictions

Variation in the Incontestability Clauses

Effect of Jurisdiction on the Enforcement of the Clause

How Different Jurisdictions Interpret the Clause

Final Thoughts

Incontestability Clause FAQs

An incontestability clause is a provision in most life and health insurance contracts that prevents the insurer from denying a claim due to misstatements or misrepresentations made by the insured after a specific period, typically two years.

The primary purpose of the incontestability clause is to protect policyholders from arbitrary claim denials and to ensure fairness in the contract. It also limits the insurer's timeframe to investigate and contest claims, thereby minimizing risk for insurance companies.

An incontestability clause often includes provisions relating to misrepresentation, material facts, and pre-existing conditions. It means that if a policyholder inaccurately describes their health status or fails to disclose a significant condition at the policy's inception, insurers cannot use this against them after the incontestability period.

Yes, there are a few exceptions to the incontestability clause. These often include fraudulent misrepresentation, non-payment of premiums, and illegal activities. If an insured intentionally lied, failed to pay the required premiums, or if a claim arises from illegal activities, an insurer might contest the policy, even after the incontestability period.

The implementation and interpretation of the incontestability clause can vary depending on the type of insurance policy and jurisdiction. For instance, life, health, and long-term care insurance policies may have slight variations in their incontestability clauses. Moreover, some jurisdictions enforce a strict two-year clause, while others may extend the period or implement stricter rules around what can be considered incontestable.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.