Hole-In-One Insurance is a type of prize indemnification insurance that allows golf tournament organizers to offer large prizes for making a hole-in-one during the event. The insurance company assumes the risk of paying the prize if a participant successfully makes a hole-in-one. The primary purpose of Hole-In-One Insurance is to add excitement and attract participants to a golf tournament without the organizer bearing the financial risk of the prize. The insurance allows event organizers to offer substantial prizes, enhancing the appeal of the event, and increasing participation. Hole-In-One Insurance works by the event organizer paying a premium to an insurance company. In return, the insurance company agrees to pay the prize amount if a participant hits a hole-in-one during the event. The premium is calculated based on the prize value, the number of participants, and the difficulty of the hole. Individual Golfer Policies are Hole-In-One Insurance policies purchased by individual golfers. These policies cover the golfer for a specific period, usually a year, and payout if the golfer hits a hole-in-one during that period, regardless of the event or course. Golf Tournament Policies are purchased by tournament organizers to cover a specific event. These policies pay out if any participant in the tournament hits a hole-in-one on a designated hole during the event. Golf Course Policies are purchased by golf course owners or operators. These policies cover all hole-in-one events that occur on the course during a specified period, providing a promotional tool to attract golfers to the course. The value of the prize offered for a hole-in-one significantly affects the premium of the Hole-In-One Insurance policy. The higher the prize value, the higher the premium will be, as the insurance company assumes greater risk. The number of participants in the golf event also impacts the insurance premium. More participants increase the likelihood of a hole-in-one, leading to a higher premium. The distance of the hole designated for the hole-in-one contest affects the premium. Longer holes are more challenging, reducing the likelihood of a hole-in-one and, consequently, the premium. The overall difficulty of the golf course, particularly the designated hole, influences the premium. A more challenging course or hole decreases the chances of a hole-in-one, resulting in a lower premium. Prize indemnification is the primary feature of a Hole-In-One Insurance policy. The insurance company agrees to pay the prize amount if a hole-in-one is achieved during the covered event. Many Hole-In-One Insurance policies include signage and promotional materials for the event. These materials help advertise the hole-in-one contest and the prize, enhancing the event's appeal. Some Hole-In-One Insurance policies offer ancillary prizes for other holes during the event. These additional prizes provide extra excitement and opportunities for participants to win, even if they don't hit a hole-in-one. Bonus prize coverage is an additional feature that some Hole-In-One Insurance policies offer. This coverage provides prizes for participants who achieve other golfing feats during the event, such as the longest drive or closest to the pin. Choosing the right insurance provider is the first step in purchasing Hole-In-One Insurance. It's crucial to select a provider with a strong reputation, excellent customer service, and a history of prompt and fair claim settlements. Once an insurance provider is selected, the next step is to obtain a quote for the Hole-In-One Insurance policy. The quote will be based on several factors, including the prize value, the number of participants, the hole distance, and the difficulty of the golf course. After receiving a quote, policy features can be customized to fit the specific needs of the event. This could include adjusting the prize value, adding ancillary prizes, or including bonus prize coverage. Once the policy features are customized and agreed upon, the final step is to purchase the policy. The insurance provider will provide a policy document detailing the terms and conditions of the coverage, which should be reviewed carefully before finalizing the purchase. If a hole-in-one is achieved during the covered event, it must be reported to the insurance provider as soon as possible. The report should include details of the hole-in-one, including the participant's name, the hole number, and any witnesses. The insurance provider will require verification and documentation of the hole-in-one. This typically includes a signed witness statement and in some cases, video footage of the shot. The specific requirements will be outlined in the policy document. Once the hole-in-one is verified and all required documentation is submitted, the claim can be processed. If the claim is approved, the insurance provider will pay out the prize amount as per the terms of the policy. Effective advertising and promotion are key to attracting participants to a hole-in-one event. This could include social media promotion, local advertising, and leveraging the prize as a major draw. Choosing the right golf course and setting up the hole-in-one contest properly are crucial for a successful event. The selected hole should be challenging but achievable, and clear signage should be used to indicate the hole-in-one contest. Accurate yardage measurements are essential for a hole-in-one contest. The distance to the hole should be measured carefully and accurately, as this will affect the insurance premium and the validity of any hole-in-one claims. Volunteers and witnesses play a crucial role in a hole-in-one event. They help manage the event, witness the hole-in-one shots, and provide the necessary verification for any hole-in-one claims. Hole-In-One Insurance provides golf tournament organizers with a means to offer substantial prizes without bearing the financial risk themselves. It adds excitement to events and attracts participants. The insurance works by the organizer paying a premium, and the insurance company assumes the risk of paying the prize if a hole-in-one is achieved. There are different types of policies available, including individual golfer policies, golf tournament policies, and golf course policies. Factors such as the prize value, number of participants, hole distance, and golf course difficulty impact the insurance premiums. Common features of Hole-In-One Insurance include prize indemnification, signage and promotional materials, ancillary prizes, and bonus prize coverage. To purchase the insurance, one needs to select a reputable provider, obtain a quote, customize policy features, and finalize the purchase. In the event of a hole-in-one, the process involves reporting the achievement, providing verification and documentation, and submitting a claim for payout. Organizers can ensure a successful event by focusing on advertising and promotion, selecting the right course and setup, ensuring accurate yardage measurements, and engaging volunteers and witnesses.What Is Hole-In-One Insurance?

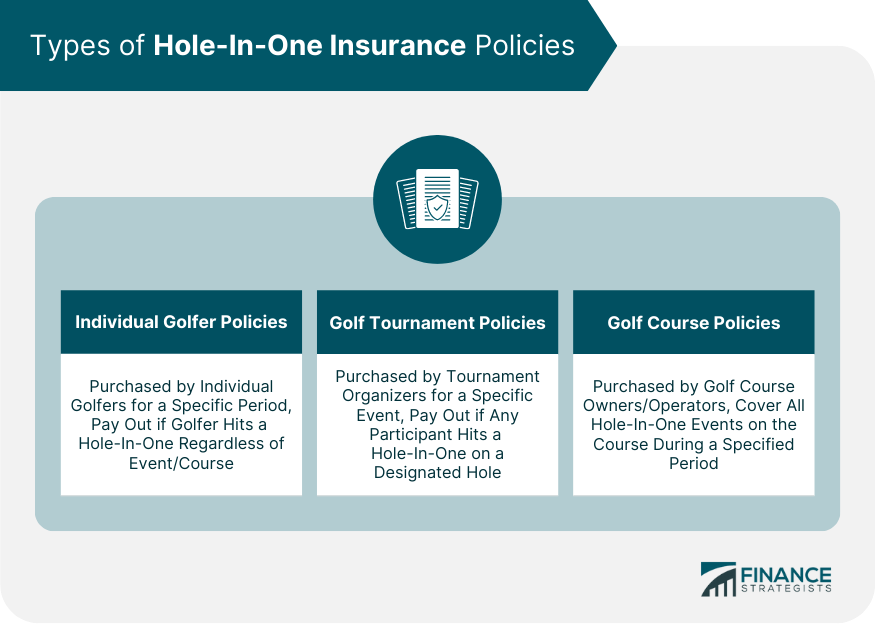

Types of Hole-In-One Insurance Policies

Individual Golfer Policies

Golf Tournament Policies

Golf Course Policies

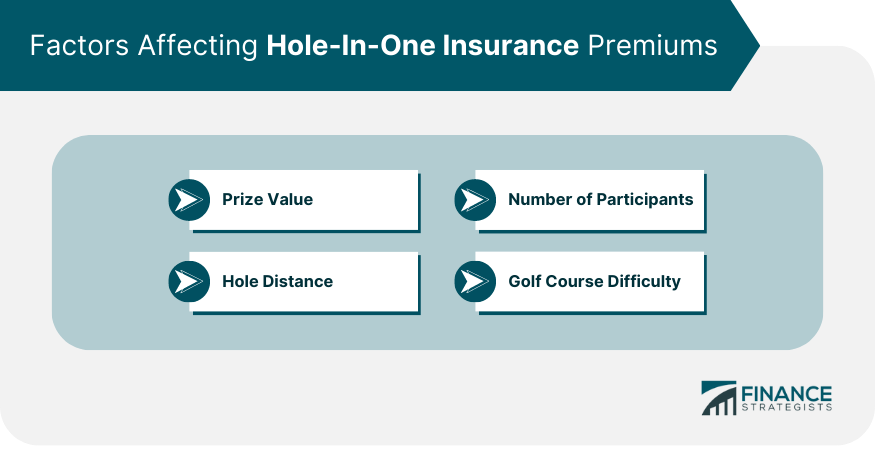

Factors Affecting Hole-In-One Insurance Premiums

Prize Value

Number of Participants

Hole Distance

Golf Course Difficulty

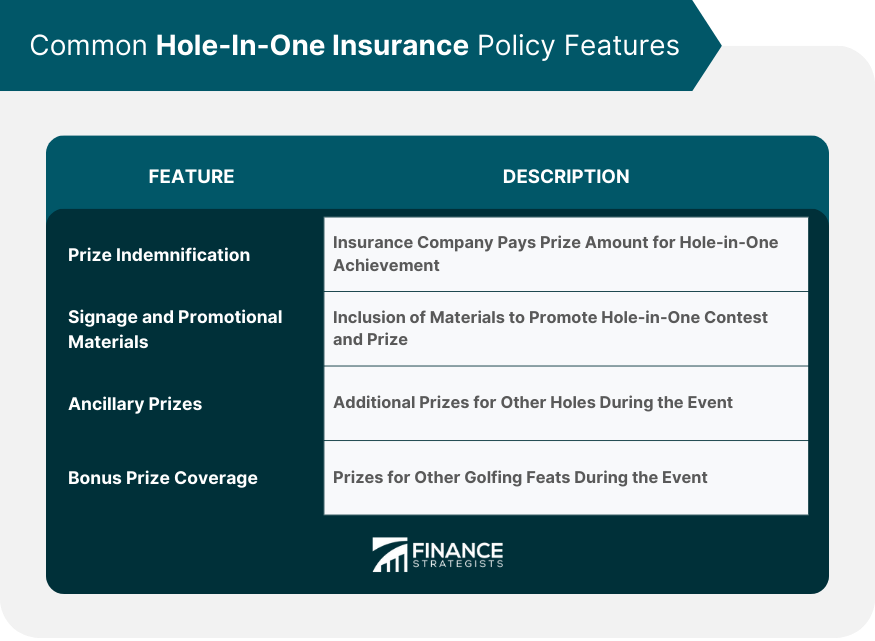

Common Hole-In-One Insurance Policy Features

Prize Indemnification

Signage and Promotional Materials

Ancillary Prizes

Bonus Prize Coverage

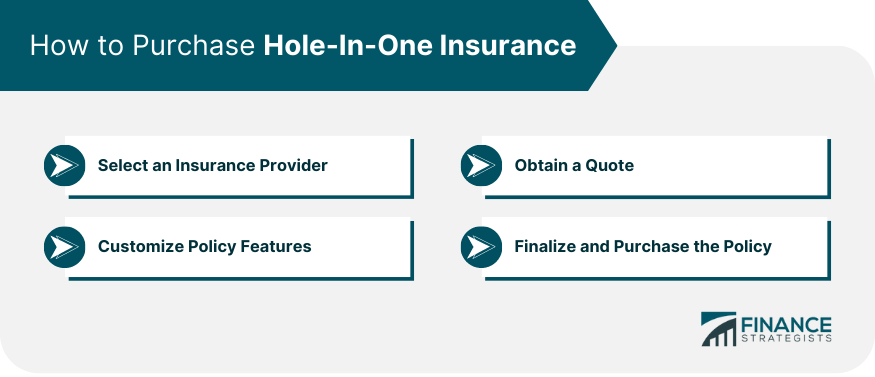

How to Purchase Hole-In-One Insurance

Selecting an Insurance Provider

Obtaining a Quote

Customizing Policy Features

Finalizing and Purchasing the Policy

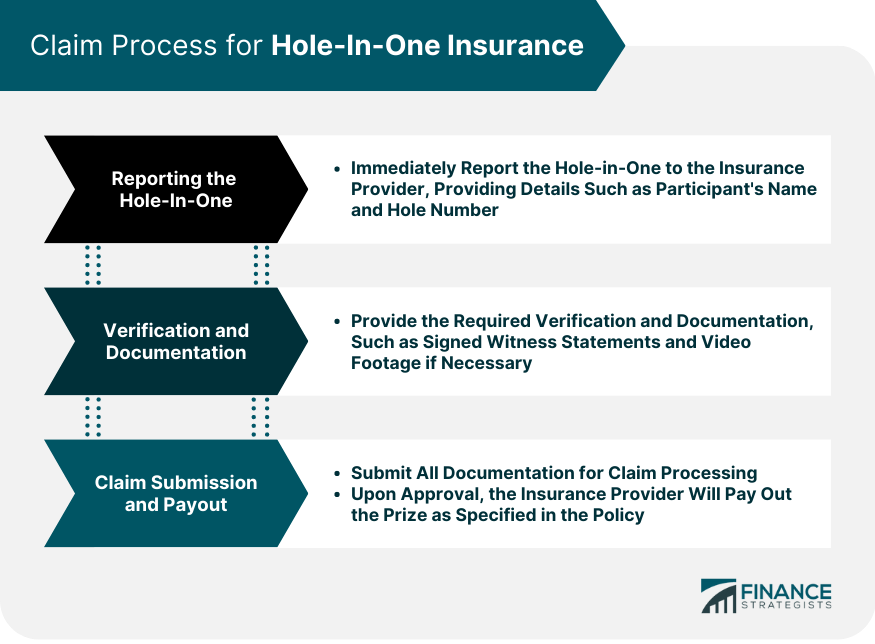

Claim Process for Hole-In-One Insurance

Reporting the Hole-In-One

Verification and Documentation Requirements

Claim Submission and Payout

Tips for Organizing a Successful Hole-In-One Event

Advertising and Promotion

Course Selection and Setup

Ensuring Accurate Yardage Measurements

Engaging Volunteers and Witnesses

Final Thoughts

Hole-In-One Insurance FAQs

Hole-In-One Insurance is a type of prize indemnification insurance that allows golf tournament organizers to offer large prizes for making a hole-in-one during the event. The insurance company assumes the risk of paying the prize if a participant successfully makes a hole-in-one. It adds excitement to the tournament and attracts more participants without the organizer bearing the financial risk of the prize.

There are three main types of Hole-In-One Insurance policies: Individual Golfer Policies, Golf Tournament Policies, and Golf Course Policies. Individual policies cover a golfer for a specific period, tournament policies cover a specific event, and course policies cover all hole-in-one events that occur on the course during a specified period.

Premiums for Hole-In-One Insurance are based on several factors, including the prize value, the number of participants, the hole distance, and the difficulty of the golf course. The higher the prize value and the number of participants, and the shorter the hole distance, the higher the premium will be.

Common features of Hole-In-One Insurance policies include prize indemnification, signage and promotional materials, ancillary prizes, and bonus prize coverage. These features can enhance the appeal of the event and provide additional opportunities for participants to win prizes.

If a hole-in-one is achieved during the covered event, it must be reported to the insurance provider as soon as possible. The provider will require verification and documentation of the hole-in-one, typically including a signed witness statement and possibly video footage. Once the hole-in-one is verified and all required documentation is submitted, the claim can be processed and, if approved, the insurance provider will pay out the prize amount.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.