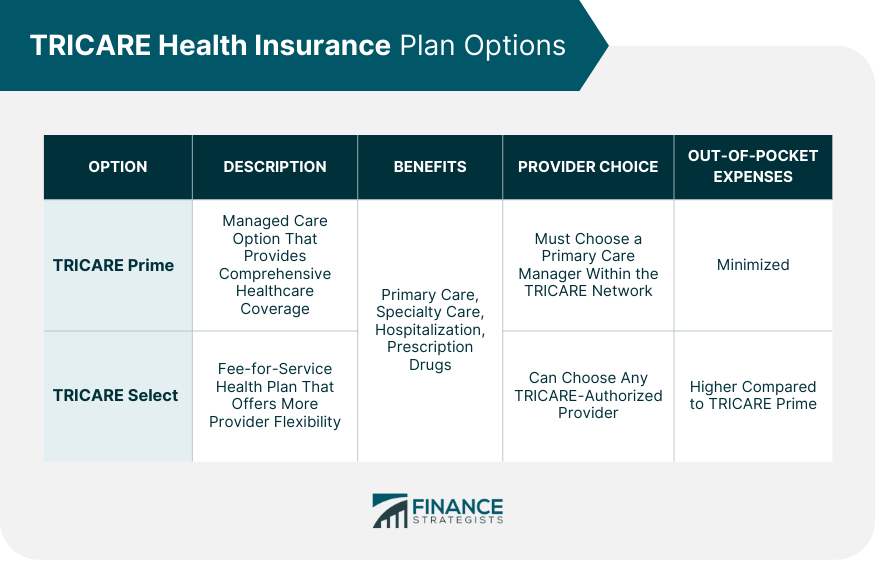

TRICARE is a healthcare program provided by the United States Department of Defense (DoD) to military personnel, retirees, and their dependents. TRICARE is a comprehensive healthcare program designed to provide medical and dental coverage to active-duty and retired military personnel, as well as their dependents. Established in 1993, TRICARE has evolved over the years, incorporating new health plan options and expanding coverage to meet the needs of its beneficiaries. The TRICARE program offers various health plan options, including TRICARE Prime, TRICARE Select, TRICARE For Life, and TRICARE Reserve Select. Each plan is tailored to meet the specific needs of different groups within the military community, ensuring access to quality healthcare services. The Department of Defense is responsible for administering the TRICARE program. The Defense Health Agency (DHA), a component of the DoD, manages TRICARE and ensures that beneficiaries receive the healthcare services they need. TRICARE works closely with the DoD to coordinate healthcare services for active-duty and retired military personnel, as well as their families. This collaboration allows the DoD to maintain a robust and efficient healthcare system that supports the well-being of its service members. TRICARE offers several health plan options to cater to the diverse needs of its beneficiaries. This section will cover the four main health plan options: TRICARE Prime, TRICARE Select, TRICARE For Life, and TRICARE Reserve Select. TRICARE Prime is a managed care option that offers comprehensive healthcare coverage to eligible beneficiaries. This plan is designed to minimize out-of-pocket expenses and provide access to a network of healthcare providers. TRICARE Prime offers a wide range of benefits, including primary care, specialty care, hospitalization, and prescription drugs. Beneficiaries enrolled in TRICARE Prime must choose a primary care manager (PCM) within the TRICARE network, who coordinates their healthcare services. TRICARE Select is a fee-for-service health plan that offers more flexibility for beneficiaries in choosing healthcare providers. This plan is designed for individuals who prefer greater freedom in managing their healthcare services. Beneficiaries enrolled in TRICARE Select can choose any TRICARE-authorized provider for their healthcare services. This plan covers a variety of services, including primary care, specialty care, hospitalization, and prescription drugs. However, TRICARE Select beneficiaries may have higher out-of-pocket expenses compared to those enrolled in TRICARE Prime. In addition to medical coverage, TRICARE offers dental and vision programs for eligible beneficiaries. This section will discuss the TRICARE Dental Program (TDP) and the TRICARE Vision Program. The TRICARE Dental Program is a voluntary dental insurance program that provides comprehensive dental coverage for eligible beneficiaries. TDP is designed to promote and maintain good oral health among military families. TDP covers a wide range of dental services, including diagnostic, preventive, restorative, and orthodontic care. Beneficiaries enrolled in TDP pay monthly premiums and may be required to share the cost of certain dental services through cost-sharing arrangements, such as copayments or deductibles. The TRICARE Vision Program offers vision coverage for eligible TRICARE beneficiaries. This program aims to ensure access to quality vision care and services for military families and retirees. The TRICARE Vision Program covers various vision services, including routine eye exams, prescription eyeglasses, and contact lenses. Beneficiaries enrolled in the program may be required to pay copayments or cost-shares for certain vision services, depending on their specific health plan and the type of service received. The TRICARE Pharmacy Program provides beneficiaries with access to prescription medications at affordable prices. This section will cover the overview of the TRICARE Pharmacy Program and the details of prescription drug coverage and pharmacy copayments. The TRICARE Pharmacy Program offers a comprehensive prescription drug benefit to eligible beneficiaries. The program is designed to ensure that military families and retirees have access to the medications they need to maintain their health and well-being. The TRICARE Pharmacy Program provides coverage for a wide range of prescription medications, including those prescribed for the treatment of chronic conditions, as well as medications for acute illnesses and injuries. Beneficiaries can obtain their prescriptions through various channels, such as military pharmacies, TRICARE network pharmacies, and the TRICARE Pharmacy Home Delivery service. TRICARE's prescription drug coverage includes a broad range of medications that are deemed medically necessary and appropriate for the treatment of various health conditions. The program utilizes a formulary, which is a list of covered medications that are reviewed and updated regularly to ensure that beneficiaries have access to safe and effective medications. In addition to the medications listed on the formulary, TRICARE may also cover non-formulary medications under certain circumstances, such as when a formulary medication is not effective or causes adverse side effects. Beneficiaries may be required to obtain prior authorization for certain medications to ensure their appropriateness and safety. TRICARE maintains a network of healthcare providers to ensure that beneficiaries have access to quality healthcare services. This section will discuss TRICARE-authorized providers, military treatment facilities (MTFs), and the civilian provider network. TRICARE-authorized providers are healthcare professionals and facilities that meet TRICARE's stringent standards for quality and safety. These providers agree to participate in the TRICARE network and accept TRICARE's established reimbursement rates for covered services. Authorized providers include primary care providers, specialists, hospitals, and other healthcare facilities. Beneficiaries can search for TRICARE-authorized providers through the TRICARE website or by contacting their regional contractor. Military treatment facilities are healthcare facilities operated by the Department of Defense to provide healthcare services to active-duty and retired military personnel and their families. MTFs offer a wide range of healthcare services, including primary care, specialty care, and inpatient care. MTFs serve as the primary source of healthcare for many TRICARE beneficiaries, particularly those enrolled in TRICARE Prime. In some cases, beneficiaries may be referred to civilian providers for specialty care or services not available at their local MTF. Enrollment in TRICARE is a crucial step in accessing healthcare services for eligible beneficiaries. This section will discuss the enrollment procedures, change of health plans, and the disenrollment process. TRICARE enrollment procedures vary depending on the beneficiary's specific health plan and eligibility status. In general, beneficiaries must complete an enrollment application and submit it to their regional contractor, along with any required documentation. Once enrolled, beneficiaries receive an enrollment card and other materials that provide information about their healthcare benefits and how to access services. It is important for beneficiaries to keep their enrollment information up-to-date and notify their regional contractor of any changes in their personal information, such as address or family status. Beneficiaries may need to change their TRICARE health plan due to various reasons, such as relocation, change in eligibility status, or personal preference. TRICARE offers an annual open enrollment season, during which beneficiaries can change their health plan or enroll in a new plan. Outside of the open enrollment season, beneficiaries may still change their health plan if they experience a qualifying life event (QLE), such as marriage, divorce, birth of a child, or retirement from active duty. It is essential for beneficiaries to report QLEs to their regional contractor to ensure their healthcare coverage remains accurate and up-to-date. Disenrollment from TRICARE may occur for various reasons, including loss of eligibility, voluntary disenrollment, or failure to pay enrollment fees. Beneficiaries who lose their TRICARE eligibility may be eligible for temporary healthcare coverage through the Continued Health Care Benefit Program (CHCBP) or may need to obtain alternative health insurance coverage. Voluntary disenrollment may occur if a beneficiary chooses to discontinue their TRICARE coverage. In some cases, beneficiaries may be required to wait until the next open enrollment season or experience a QLE to re-enroll in TRICARE. Many TRICARE beneficiaries may have other health insurance (OHI) in addition to their TRICARE coverage. This section will discuss the coordination of benefits between TRICARE and OHI and TRICARE's role as a secondary payer. When a TRICARE beneficiary has OHI, TRICARE coordinates benefits with the OHI to ensure that healthcare services are covered appropriately. In most cases, the OHI is considered the primary payer, meaning it is responsible for covering healthcare services before TRICARE contributes to the payment. Coordination of benefits helps to minimize out-of-pocket expenses for beneficiaries and ensures that healthcare providers receive appropriate reimbursement for their services. It is essential for beneficiaries with OHI to inform their healthcare providers and TRICARE about their OHI to facilitate proper coordination of benefits. When TRICARE acts as a secondary payer, it covers the remaining costs for healthcare services after the primary insurance has paid its share. In some cases, TRICARE may cover the entire remaining balance, resulting in no out-of-pocket expenses for the beneficiary. It is important to note that TRICARE's role as a secondary payer may vary depending on the beneficiary's specific health plan and the type of healthcare service received. Beneficiaries should consult their TRICARE handbook or contact their regional contractor for more information about how TRICARE coordinates benefits with their OHI. TRICARE health insurance plays a crucial role in ensuring the well-being of military families and retirees. By providing comprehensive healthcare coverage and access to quality healthcare services, TRICARE supports the health and well-being of the military community. The various health plans, dental and vision programs, pharmacy benefits, and extensive network of providers make TRICARE a valuable resource for military families and retirees. Understanding the TRICARE program, its offerings, and enrollment processes can help beneficiaries make informed decisions about their healthcare and ensure they receive the best possible care for their needs.What Is TRICARE Health Insurance?

Plan Options for TRICARE Health Insurance

TRICARE Prime

TRICARE Select

Dental and Vision Programs for TRICARE Health Insurance

TRICARE Dental Program

TRICARE Vision Program

Pharmacy Benefits for TRICARE Health Insurance

Overview of the TRICARE Pharmacy Program

Prescription Drug Coverage

TRICARE Health Insurance’s Network of Providers

TRICARE-Authorized Providers

Military Treatment Facilities

TRICARE Health Insurance Enrollment & Disenrollment Process

Enrollment Procedures

Change of Health Plans

Disenrollment

TRICARE and Other Health Insurance

Coordination of Benefits

TRICARE's Role as Secondary Payer

Conclusion

TRICARE Health Insurance FAQs

TRICARE is a health insurance program for active duty and retired military members and their families.

Eligibility for TRICARE varies depending on factors such as military status, location, and relationship to the service member. Generally, active duty members, retirees, and their families are eligible.

TRICARE offers several different plans, including TRICARE Prime, TRICARE Select, TRICARE Reserve Select, and TRICARE for Life.

TRICARE benefits vary depending on the plan selected, but may include coverage for doctor visits, hospital stays, prescription medications, and mental health services.

Enrollment in TRICARE can be done online, over the phone, or in person. Eligible individuals should visit the TRICARE website for more information and to enroll.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.