The 'free look period' is a customer-friendly policy applied in the finance and insurance industry, particularly in the life insurance and investment sectors. It offers a unique advantage to customers: the ability to reevaluate and potentially cancel a financial agreement without any financial penalty. The origins of the free look period can be traced back to the early years of insurance regulation when the need to protect consumers from rushed or ill-informed decisions became increasingly clear. The free look period primarily serves to enhance consumer protection and foster greater trust in the financial and insurance industries. Laws and regulations surrounding the free look period varies significantly across different jurisdictions. In the United States, state laws predominantly dictate the length and enforcement of the free look period. On the international front, similar regulatory practices exist with varied nuances. In the U.S., each state has its own stipulated free look period length, usually ranging from 10 to 30 days. During this time, a policyholder can cancel their insurance policy without penalties, receiving a full refund of any premiums paid. The free look period is a globally recognized consumer right. For instance, the Insurance Regulatory and Development Authority of India (IRDAI) mandates a free look period of 15 days for insurance policies. The free look period is a crucial component of various insurance policies. It allows policyholders to ensure that the purchased coverage aligns with their needs and expectations. In life insurance policies, the free look period provides consumers with an opportunity to comprehensively review their policy terms, conditions, and benefits. This reassessment period can be invaluable for understanding complex terms or realizing that the chosen coverage may not be the best fit. The free look period in health insurance allows individuals to scrutinize their policy's healthcare network, coverage limits, and exclusions. This ensures that the policy is comprehensive and meets the individual's unique health needs. Free look periods in disability insurance serve to allow consumers to confirm whether the policy covers their occupation and provides the necessary income replacement percentage. Annuity contracts, being a long-term commitment, benefit from a free look period. This period provides annuity buyers with a risk-free window to reassess their investment. Free look periods are not exclusive to insurance policies. They are also prevalent in mutual funds and other investment platforms, giving investors an opportunity to reconsider their investment decisions. Some jurisdictions allow a free look period for mutual funds, enabling investors to cancel their purchase and obtain a full refund. This provision aims to protect investors from impulsive buying decisions. Free look periods have also been implemented in other investment products. However, their prevalence and regulations differ significantly across countries and specific investment types. Consumer Protection: It serves as a safety net, providing a risk-free window to review and make informed decisions about a policy or investment. Informed Decisions: It gives individuals the time to understand complex terms and conditions, ensuring that the product suits their needs. Building Trust: For insurers and investment firms, offering a free look period demonstrates their commitment to transparency and consumer protection. Delay in Coverage Commencement: For insurance policies, coverage does not commence until the free look period is over, potentially leaving a gap in protection. Administrative Hassles: Cancelling a policy or investment during the free look period can sometimes involve administrative complications. Potential Loss of Business: For insurers and investment companies, the free look period could lead to potential loss of business due to cancellations. To optimize the benefits of the free look period, policyholders should conduct a thorough review of their policy. This includes understanding the coverage, limitations, exclusions, and charges involved. Policyholders should also be wary of missing the free look period deadline, as this would bind them to the policy terms. United States: In the U.S., the free look period for life insurance policies varies by state, typically ranging from 10 to 30 days. United Kingdom: In the UK, the Financial Conduct Authority mandates a 30-day free look period for life insurance and annuities. Australia: Australia's life insurance sector offers a 30-day cooling-off period, as regulated by the Australian Securities and Investments Commission. India: In India, a free look period of 15 days is required for life insurance policies, as mandated by the IRDAI. Technological advancements have the potential to redefine the free look period. Digital platforms could streamline the process, making it easier for consumers to access, review, and cancel policies during the free look period. Similarly, proposed changes in laws and regulations may extend the free look period or standardize its duration across different types of policies. Looking ahead, the evolution of the free look period will likely continue to be driven by the objective of enhancing consumer protection in the financial industry. The free look period, a pivotal element in the insurance and finance industry, embodies consumer protection by granting a risk-free assessment window for clients to make well-informed decisions. This policy, legally embedded in various jurisdictions globally, offers individuals the flexibility to reevaluate their financial agreements, potentially leading to cancellations without financial loss. Its application is evident in different insurance policies and investment platforms, helping align individuals' needs and expectations. While the free look period hosts multiple benefits, such as fostering transparency and facilitating informed decisions, it also has drawbacks, including potential administrative challenges and business loss. As the digital world continues to evolve, the future of the free-look period looks promising, with prospects for streamlined processes and potential regulatory changes. Despite variations across countries and products, its core principle remains consistent: augmenting consumer protection and freedom in financial decision-making.Definition of the Free Look Period

Legal Framework of the Free Look Period

US Laws and Regulations

International Laws and Regulations

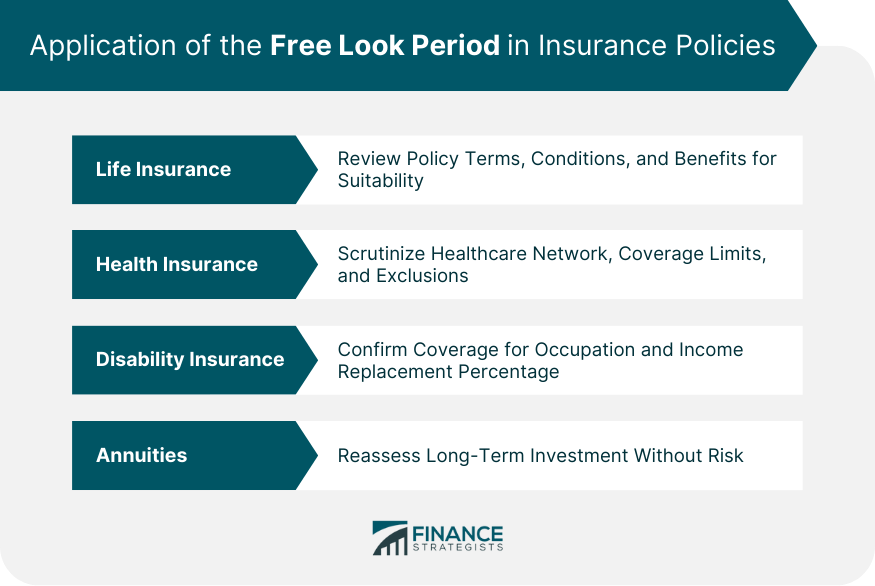

Application of the Free Look Period in Insurance Policies

Life Insurance

Health Insurance

Disability Insurance

Annuities

Role of the Free Look Period in Mutual Funds and Other Investments

Mutual Funds

Other Investments

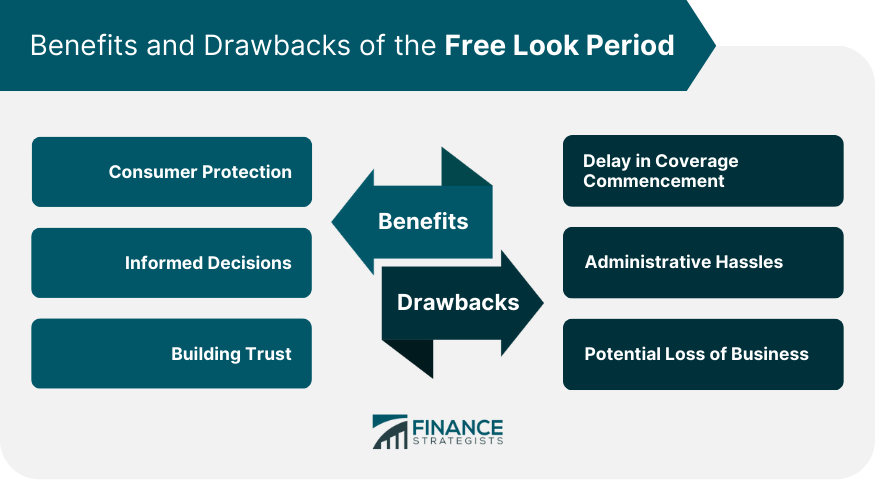

Benefits and Drawbacks of the Free Look Period

Benefits

Drawbacks

How to Take Advantage of the Free Look Period

Comparative Study of the Free Look Period Across Various Countries

Future of the Free Look Period

Final Thoughts

Free Look Period FAQs

The free look period is a customer-friendly policy in the finance and insurance industry that allows individuals to review and potentially cancel a financial agreement without any financial penalty.

The length of the free look period varies across jurisdictions and types of policies. In the United States, it typically ranges from 10 to 30 days, while in India, it is mandated as 15 days for insurance policies.

The free look period offers several benefits, including consumer protection, the ability to make informed decisions, and building trust in the financial industry by demonstrating transparency and commitment to consumer welfare.

Some drawbacks of the free look period include potential delays in coverage commencement, administrative complications when canceling policies or investments, and the possibility of a loss of business for insurers and investment firms due to cancellations.

To make the most of the free look period, individuals should carefully review their policy or investment, understand the terms and conditions, and be aware of the deadline for cancellation to avoid being bound by the policy terms.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.