Employers' liability insurance is a type of coverage that protects businesses against the financial consequences of employee injuries and illnesses that arise due to their employment. This insurance is crucial for businesses to safeguard themselves from potential lawsuits and financial losses that could result from workplace accidents, injuries, or occupational illnesses. By obtaining employers' liability insurance, businesses can protect their financial stability and maintain a positive reputation. It also ensures that employees receive the necessary compensation and medical care, fostering a safe and supportive work environment. In many countries, employers' liability insurance is legally required, and businesses must comply with specific regulations. Failure to adhere to these laws can lead to fines, legal actions, or even a shutdown of the business. Employers' liability insurance covers the medical expenses incurred by employees as a result of a work-related injury or illness. This coverage can include costs such as hospitalization, medication, and rehabilitation services. If an employee decides to take legal action against their employer, the insurance policy will cover the legal expenses associated with the case, such as attorney fees and court costs. The policy also provides compensation for an employee's lost wages during their recovery period, ensuring that they can maintain financial stability while recuperating from their injury or illness. Employers' liability insurance does not cover injuries or illnesses that are unrelated to the employee's job or workplace. For example, an employee injured during a weekend recreational activity would not be covered under this policy. Intentional acts of harm, such as an employer causing injury to an employee on purpose, are also excluded from coverage. Employers' liability insurance typically has a policy period, and any claims made outside this period will not be covered. It is essential to ensure that the coverage is up to date and active to avoid potential issues. Employers' liability insurance policies have a limit on the amount they will pay for each individual claim, known as the per-claim limit. This limit can vary depending on the policy and the specific needs of the business. The policy will also have an aggregate limit, which is the total amount the insurer will pay for all claims during the policy period. It is crucial for businesses to select appropriate limits that align with their risk exposure and financial capabilities. The type of industry a business operates in and its associated risks can significantly impact the cost of employers' liability insurance. High-risk industries, such as construction or mining, often have higher premiums due to the increased likelihood of employee injuries or illnesses. A higher number of employees generally equates to increased risk, leading to higher premiums for businesses. As a company grows, it is essential to reevaluate its insurance needs and adjust coverage accordingly. Businesses with a history of frequent claims may face higher insurance premiums, as they are considered riskier by insurance providers. Implementing safety measures and reducing workplace accidents can help improve a company's claims history and lower their premiums. The chosen coverage limits and deductibles will directly impact the cost of the policy. Higher limits and lower deductibles typically result in higher premiums, while lower limits and higher deductibles lead to lower premiums. When a workplace injury or illness occurs, it is crucial for the employer to promptly report the incident to their insurance provider. Timely reporting ensures that the claims process can begin as soon as possible and that the employee receives the necessary support and compensation. Following the report of an incident, the insurance company will investigate the circumstances surrounding the injury or illness. This investigation may involve reviewing the employee's medical records, inspecting the workplace, and interviewing witnesses. The insurer will then evaluate the claim to determine liability and the appropriate compensation amount. In some cases, the insurance company and the injured employee may agree on a settlement without going to court. This process typically involves negotiations between the insurer, the employer, and the employee (or their legal representative) to reach an agreement on the compensation amount. If a settlement cannot be reached, the case may proceed to court. In this situation, the insurance company will provide legal representation for the employer, and the court will ultimately determine the outcome of the case. While employers' liability insurance focuses on protecting businesses from financial losses resulting from employee injuries or illnesses, workers' compensation insurance provides coverage for employees' medical expenses, rehabilitation costs, and a portion of their lost wages. Workers' compensation insurance typically does not cover legal expenses or compensation claims resulting from lawsuits. In the United States, workers' compensation insurance is required by law in most states. However, employers' liability insurance is not mandated at the federal level, and requirements can vary depending on the state and the specific industry. It is essential for businesses to research their local regulations and ensure they have the appropriate coverage. To determine which type of insurance is best for a particular business, employers should assess their risk exposure, legal requirements, and financial capabilities. In many cases, businesses may benefit from having both employers' liability insurance and workers' compensation insurance to provide comprehensive coverage for various workplace scenarios. Small businesses often face unique challenges and risks when it comes to workplace accidents and injuries. Employers' liability insurance can provide vital financial protection and help maintain a positive reputation in the community. As businesses grow, so does their risk exposure. Medium-sized businesses should carefully evaluate their insurance needs and ensure they have adequate coverage to protect their expanding workforce. For large corporations, employers' liability insurance is crucial to protect their financial stability and maintain investor confidence. With a diverse workforce and multiple locations, these businesses need robust coverage to address various workplace risks. Non-profit organizations are not exempt from workplace accidents and injuries. Employers' liability insurance can help protect these organizations from financial strain, allowing them to continue their mission without disruption. By providing employees with proper training and education on workplace safety, businesses can significantly reduce the risk of accidents and injuries. These programs should be regularly updated and communicated to all staff members. Conducting routine risk assessments helps identify potential hazards and implement appropriate preventive measures. These assessments should be thorough and involve input from employees to ensure all potential risks are considered. Clear company policies on workplace safety and behavior can help reduce the likelihood of accidents and injuries. These policies should be well-communicated to employees and consistently enforced. Fostering a culture of safety within the workplace involves promoting open communication, recognizing and rewarding safe practices, and ensuring that all employees feel responsible for maintaining a safe work environment. When selecting an insurance provider, it is essential to compare the coverage options offered by different companies. This comparison should consider factors such as policy limits, exclusions, and any additional coverage options that may be available. The reputation and financial stability of an insurance provider are crucial factors to consider when selecting a policy. Businesses should research potential providers to ensure they have a positive track record and the financial resources to pay claims. Excellent customer service and claims support are essential when dealing with workplace accidents and injuries. Businesses should choose an insurance provider that is responsive, supportive, and efficient during the claims process. While the cost of the policy should not be the sole factor in selecting an insurance provider, businesses should compare rates from multiple providers to ensure they are receiving competitive pricing for their coverage. Employers' liability insurance plays a crucial role in protecting both employees and employers from the financial consequences of workplace injuries and illnesses. This coverage ensures that employees receive appropriate compensation and medical care, while businesses maintain their financial stability and reputation. Compliance with legal requirements for employers' liability insurance is essential to avoid fines, legal actions, or business closure. By researching local regulations and obtaining appropriate coverage, businesses can ensure they meet their legal obligations. Employers' liability insurance is a vital component of a comprehensive risk management strategy for businesses of all sizes and industries. By obtaining appropriate coverage, businesses can protect themselves from financial losses, maintain their reputation, and ensure business continuity in the face of workplace accidents and injuries.What Is Employers' Liability Insurance?

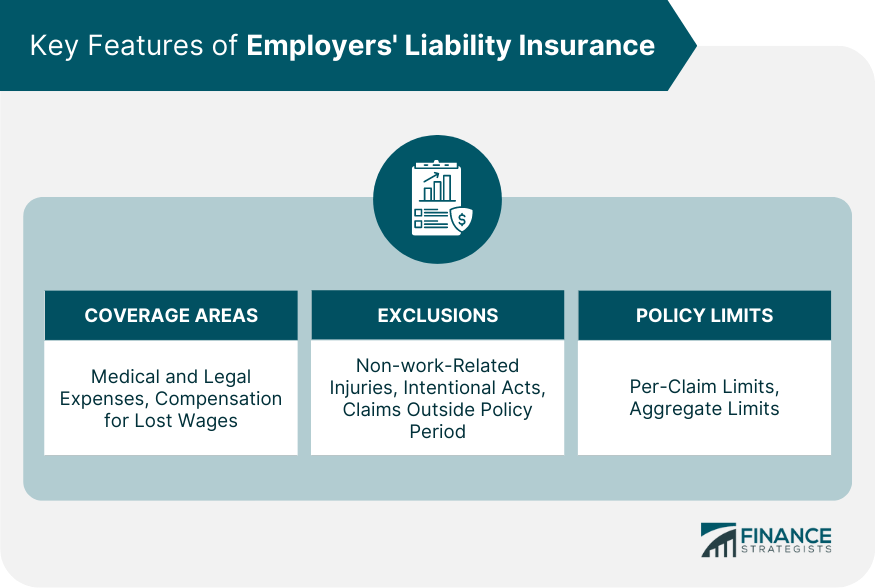

Key Features of Employers' Liability Insurance

Coverage Areas

Medical Expenses

Legal Expenses

Compensation for Lost Wages

Exclusions

Non-work-Related Injuries

Intentional Acts

Claims Outside Policy Period

Policy Limits

Per-Claim Limits

Aggregate Limits

Factors Affecting Employers' Liability Insurance Premiums

Industry Type and Associated Risks

Number of Employees

Claims History

Coverage Limits and Deductibles

The Claims Process for Employers' Liability Insurance

Reporting an Incident

Investigation and Evaluation

Negotiating Settlements

Legal Proceedings

Employers' Liability Insurance vs Workers' Compensation Insurance

Differences in Coverage

Legal Requirements and Variations by State

Choosing the Right Policy for Your Business

Employers' Liability Insurance for Different Business Types

Small Businesses

Medium-Sized Businesses

Large Corporations

Non-profit Organizations

Best Practices for Reducing Employers' Liability Insurance Claims

Implementing Safety and Training Programs

Regular Risk Assessments

Establishing Clear Company Policies

Encouraging a Culture of Safety

Choosing the Right Employers' Liability Insurance Provider

Comparing Coverage Options

Evaluating Reputation and Financial Stability

Assessing Customer Service and Claims Support

Shopping for Competitive Rates

Conclusion

Employers' Liability Insurance FAQs

Employers' liability insurance is a type of insurance that provides financial protection to businesses against employee claims of work-related injuries, illnesses, or damages caused by workplace conditions.

Employers' liability insurance is required by law in many countries, including the United States, for businesses that have employees. Any business with employees is at risk of facing lawsuits from workers who suffer workplace injuries or illnesses, and employers' liability insurance can help protect against these claims.

Employers' liability insurance typically covers legal expenses and compensation costs associated with work-related injuries or illnesses that employees suffer while on the job. This can include medical bills, lost wages, and other related expenses.

The amount of coverage needed for employers' liability insurance varies depending on the size and type of business. Many states have minimum requirements for coverage, and businesses may want to consider additional coverage depending on their risk factors.

Employers' liability insurance can be purchased through insurance companies or brokers that specialize in providing coverage for businesses. It's important to shop around and compare policies to ensure that you are getting the right coverage for your business at a competitive price.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.