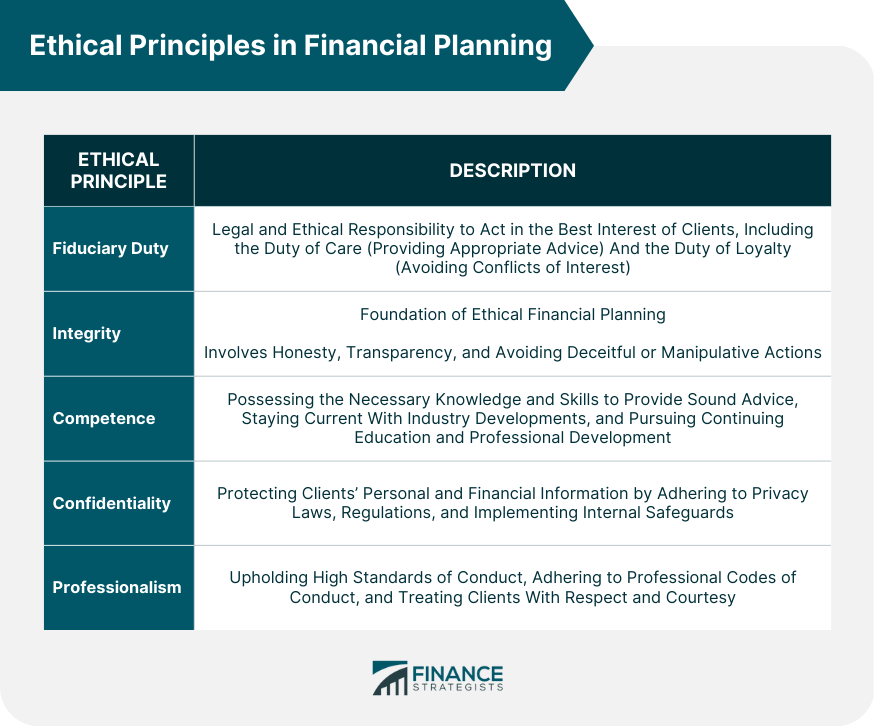

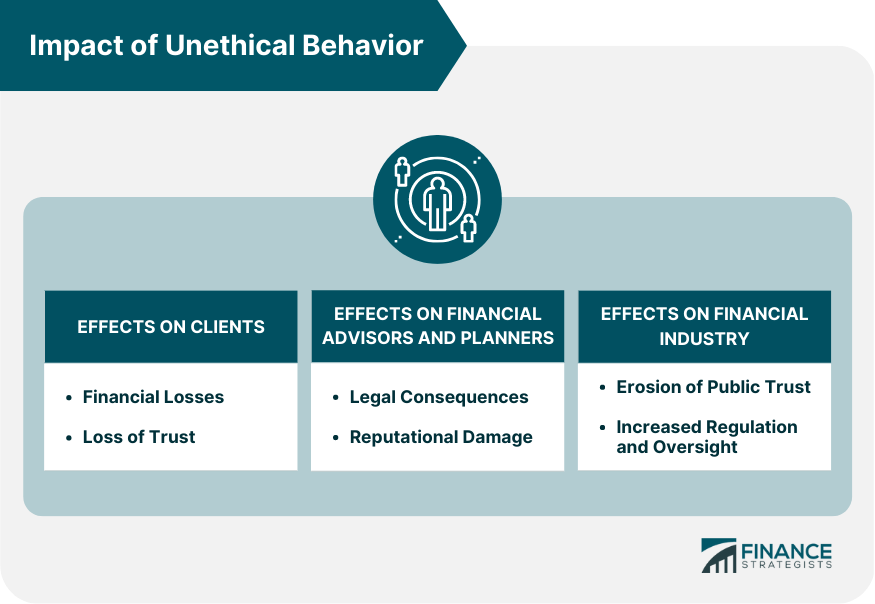

Ethical principles play a crucial role in financial planning. Financial planners are entrusted with managing their clients' finances, which can have a significant impact on their clients' lives. As such, financial planners must uphold ethical standards and ensure that they act in their clients' best interests. Ethical principles such as honesty, integrity, transparency, and confidentiality guide financial planners in their interactions with clients and help them to make decisions that are in their clients' best interests. By adhering to ethical principles, financial planners can establish trust with their clients and build long-term relationships based on mutual respect and understanding. In this way, ethical principles are essential for ensuring that financial planning is conducted with professionalism, accountability, and a commitment to the well-being of clients. A fiduciary duty is the legal and ethical responsibility of financial planners and advisors to act in the best interest of their clients. This duty involves two main components: the duty of care and the duty of loyalty. Financial planners must exercise the same level of care, skill, and diligence that a prudent professional would in similar circumstances. This includes gathering relevant information, analyzing data, and providing appropriate recommendations to clients. Financial planners must put their client's interests above their own and avoid any potential conflicts of interest that may compromise their ability to provide unbiased advice. Integrity is the foundation of ethical financial planning. Financial planners must be honest and transparent in their dealings with clients, disclosing all relevant information, and avoiding any actions that could be construed as deceitful or manipulative. Competent financial planners possess the necessary knowledge and skills to provide sound advice and make informed decisions on behalf of their clients. This includes staying current with industry developments, seeking continuing education, and pursuing professional development opportunities. Financial planners are responsible for protecting the privacy of their clients' personal and financial information. This involves adhering to applicable privacy laws and regulations, as well as implementing internal safeguards to prevent unauthorized access or disclosure of client data. Professionalism in financial planning involves upholding high standards of conduct and treating clients with respect and courtesy. Financial planners should adhere to professional codes of conduct and strive to maintain a positive reputation in the industry. In the United States, the Securities and Exchange Commission (SEC) and the Financial Industry Regulatory Authority (FINRA) are responsible for regulating financial planners and advisors. These agencies establish rules and guidelines to ensure that financial professionals act in the best interest of their clients. Certified Financial Planner (CFP) and Chartered Financial Consultant (ChFC) are two professional designations for financial planners. These certifications require candidates to complete a rigorous course of study, pass an examination, and meet ongoing continuing education requirements. Professional organizations, such as the CFP Board and the American College of Financial Services, establish codes of ethics and professional responsibility that outline the ethical principles and standards that financial planners must adhere to in their practice. Ethical dilemmas arise when financial planners face situations that involve conflicting ethical principles or values. These dilemmas may involve conflicts of interest, potential harm to clients, or challenges to professional integrity. To resolve ethical dilemmas, financial planners must consider the potential consequences of their actions and weigh the pros and cons of various alternatives. Financial planners can use ethical principles, consult with peers or professional organizations, and document their decision-making process to help resolve ethical dilemmas. Unethical behavior by financial planners can lead to financial losses for clients and damage their trust in the financial planning process. Clients may suffer financial losses due to inappropriate investment recommendations, mismanagement of funds, or fraudulent activities by unscrupulous financial planners. When clients lose trust in their financial planners, they may be less likely to seek professional financial advice in the future, which can negatively impact their long-term financial well-being. Unethical behavior can have severe consequences for financial planners and advisors, including legal repercussions and damage to their professional reputations. Financial planners who engage in unethical behavior may face legal penalties, such as fines, sanctions, or even criminal charges, depending on the nature and severity of their misconduct. A damaged professional reputation can lead to a loss of clients, diminished career prospects, and difficulty in finding new employment opportunities within the financial industry. Unethical behavior within the financial planning industry can lead to a loss of public trust and increased regulation and oversight. A lack of trust in the financial planning industry can discourage individuals from seeking professional financial advice and undermine the credibility of ethical financial planners. In response to unethical behavior, regulators may impose stricter rules and guidelines on financial planners and advisors, resulting in increased compliance costs and administrative burdens for professionals in the industry. Financial planning firms and professional organizations can promote ethical practices by offering training programs that focus on ethical principles, decision-making processes, and real-life case studies. Fostering a culture of ethical behavior within financial planning firms involves setting clear expectations for conduct, providing support and resources for ethical decision-making, and recognizing and rewarding ethical behavior. Financial planning firms and professional organizations must regularly monitor and enforce compliance with ethical standards to ensure that financial planners adhere to the highest levels of professional conduct. Ethics play a crucial role in financial planning, guiding financial planners in their interactions with clients and decision-making processes. Ethical principles such as honesty, integrity, transparency, confidentiality, competence, and professionalism establish trust and ensure the well-being of clients. Financial planners have a fiduciary duty to act in the best interest of their clients, encompassing the duty of care and duty of loyalty. Compliance with regulatory and industry standards, such as those established by financial industry regulators and professional organizations, is essential. Ethical dilemmas may arise, requiring analysis, consultation, and adherence to ethical principles. Unethical behavior can lead to financial losses for clients, damage trust, and have severe consequences for financial planners and the industry, including legal repercussions, reputational damage, and increased regulation. Promoting ethical practices involves implementing training programs, fostering a culture of ethical behavior, and monitoring compliance with ethical standards.Ethical Principles in Financial Planning

Fiduciary Duty

Duty of Care

Duty of Loyalty

Integrity

Competence

Confidentiality

Professionalism

Regulatory and Industry Standards

Financial Industry Regulators

Professional Organizations and Certifications

Codes of Ethics and Professional Responsibility

Ethical Dilemmas in Financial Planning

Identifying Ethical Dilemmas

Analyzing Potential Solutions and Consequences

Resolving Ethical Dilemmas

Impact of Unethical Behavior

Effects on Clients

Financial Losses

Loss of Trust

Effects on Financial Planners and Advisors

Legal Consequences

Reputational Damage

Effects on the Financial Industry

Erosion of Public Trust

Increased Regulation and Oversight

Promoting Ethical Practices in Financial Planning

Implementing Ethical Training Programs

Encouraging a Culture of Ethical Behavior

Monitoring and Enforcing Compliance with Ethical Standards

Conclusion

Ethics in Financial Planning FAQs

Ethics in financial planning revolve around five main principles: fiduciary duty, integrity, competence, confidentiality, and professionalism. These principles guide financial planners and advisors in making decisions that prioritize their client's best interests while upholding high standards of conduct.

Ethics in financial planning ensures that financial planners and advisors act in the best interest of their clients, which helps clients achieve their financial goals and maintain trust in the planning process. Upholding ethical standards also contributes to the overall integrity and credibility of the financial planning industry, encouraging individuals to seek professional advice and fostering a positive reputation for ethical financial planners.

Regulatory bodies like the SEC and FINRA establish rules and guidelines to ensure that financial professionals act in the best interest of their clients. Professional organizations and certifications, such as the CFP and ChFC, set additional ethical standards, codes of ethics, and professional responsibility guidelines that financial planners must adhere to in their practice.

Unethical behavior in financial planning can have significant negative consequences for clients, financial planners, and the industry as a whole. Clients may suffer financial losses and lose trust in the planning process, while financial planners may face legal repercussions and reputational damage. The financial planning industry could experience an erosion of public trust and increased regulation and oversight in response to unethical behavior.

Financial planning firms can promote ethics in financial planning by implementing ethical training programs, fostering a culture of ethical behavior, and monitoring and enforcing compliance with ethical standards. These actions can help ensure that financial planners and advisors consistently adhere to the highest levels of professional conduct and act in the best interest of their clients.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.