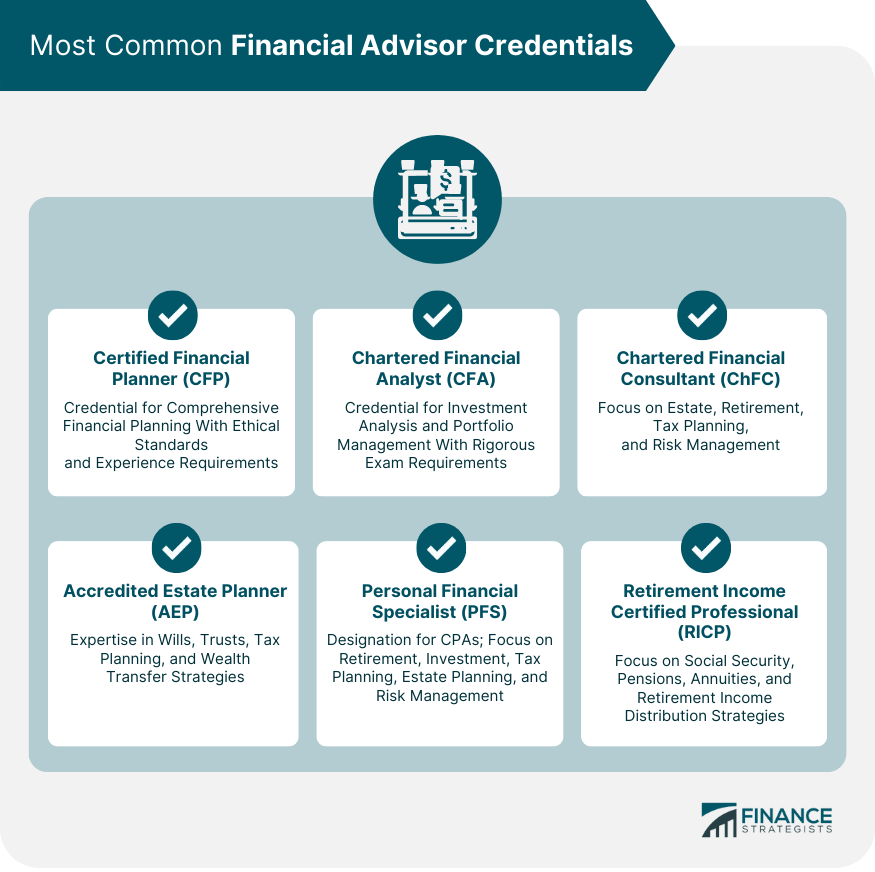

When seeking professional financial advice, it is essential to consider the credentials held by potential financial advisors. These credentials indicate the advisor's level of education, experience, and expertise in specific areas of financial planning and investment management. The most common financial advisor credentials include Certified Financial Planner, Chartered Financial Analyst, Chartered Financial Consultant, Accredited Estate Planner, Personal Financial Specialist, and Retirement Income Certified Professional. The Certified Financial Planner (CFP) certification is one of the most widely recognized credentials in the financial planning industry. Financial advisors who hold this designation have demonstrated their knowledge and competence in comprehensive financial planning. To obtain the CFP certification, candidates must complete a CFP Board-approved education program, pass a comprehensive exam, and fulfill a minimum of three years of relevant work experience. CFP professionals are required to adhere to a strict code of ethics and maintain a fiduciary duty to their clients, putting their clients' best interests ahead of their own. The Chartered Financial Analyst (CFA) designation is a globally recognized credential in the investment management industry. It is awarded by the CFA Institute to finance and investment professionals who have demonstrated their competence in investment analysis and portfolio management. To obtain the CFA designation, candidates must pass a series of three rigorous exams, demonstrate a minimum of four years of relevant work experience, and commit to the CFA Institute's Code of Ethics and Standards of Professional Conduct. The CFA designation is especially relevant for financial advisors who specialize in investment management and analysis, as it signifies a high level of expertise in these areas. The Chartered Financial Consultant (ChFC) designation is another well-regarded credential in the financial planning industry. It is awarded by The American College of Financial Services to financial advisors who have completed a comprehensive education program and demonstrated their knowledge in advanced financial planning topics. To obtain the ChFC designation, candidates must complete a series of required courses, pass a comprehensive exam, and fulfill a minimum of three years of relevant work experience. The ChFC designation focuses on advanced financial planning topics, including estate planning, retirement planning, tax planning, and risk management. The Accredited Estate Planner (AEP) designation is a credential awarded by the National Association of Estate Planners & Councils (NAEPC) to financial advisors who specialize in estate planning. AEP designation holders have demonstrated their expertise in various aspects of estate planning, including wills, trusts, tax planning, and wealth transfer strategies. To obtain the AEP designation, candidates must hold a professional designation in a related field, such as CFP or ChFC, complete a comprehensive estate planning education program, and fulfill a minimum of five years of relevant work experience. The Personal Financial Specialist (PFS) credential is a financial planning designation specifically for Certified Public Accountants (CPAs). It is awarded by the American Institute of Certified Public Accountants (AICPA) to CPAs who have demonstrated their expertise in personal financial planning. To obtain the PFS credential, candidates must be an active CPA in good standing, complete a series of required courses or demonstrate equivalent knowledge, pass a comprehensive exam, and fulfill a minimum of two years of relevant work experience in personal financial planning. The PFS credential focuses on various aspects of personal financial planning, including retirement planning, investment management, tax planning, estate planning, and risk management. It signifies that a CPA has additional expertise in financial planning beyond traditional accounting services. The Retirement Income Certified Professional (RICP) designation is a credential awarded by The American College of Financial Services to financial advisors who specialize in retirement income planning. RICP designation holders have demonstrated their expertise in various aspects of retirement income planning, including Social Security, pensions, annuities, and retirement income distribution strategies. To obtain the RICP designation, candidates must complete a series of required courses, pass a comprehensive exam, and fulfill a minimum of three years of relevant work experience in financial services. Financial advisor credentials are essential in ensuring that your advisor has the necessary knowledge, skills, and expertise to provide competent advice tailored to your unique financial needs and goals. Credentials also signify that the advisor adheres to a specific code of ethics and maintains a commitment to professional conduct, helping to ensure that you receive unbiased and trustworthy advice. By understanding the various financial advisor credentials, you can select an advisor with the appropriate expertise to address your specific financial concerns and objectives. Financial advisor credentials play a critical role in helping individuals select the right professional to assist them in achieving their financial goals. These credentials serve as an indicator of an advisor's education, experience, and expertise in specific areas of financial planning and investment management. By familiarizing yourself with the different types of credentials available and understanding their significance, you can make an informed decision when selecting a financial advisor, ensuring that the advice you receive is tailored to your unique needs and objectives. Moreover, credentials can help guarantee that your advisor adheres to a specific code of ethics and maintains a commitment to professional conduct, providing you with unbiased and trustworthy advice. As you embark on your financial journey, recognizing the importance of financial advisor credentials can be crucial in securing your financial future and working towards your financial goals with confidence.Financial Advisor Credentials: Overview

Certified Financial Planner (CFP)

Overview of CFP Certification

Education and Experience Requirements

Ethical Standards and Fiduciary Responsibility

Chartered Financial Analyst (CFA)

Overview of CFA Designation

Rigorous Exam Process and Requirements

Focus on Investment Management and Analysis

Chartered Financial Consultant (ChFC)

Overview of ChFC Designation

Education and Experience Requirements

Advanced Financial Planning Topics

Accredited Estate Planner (AEP)

Overview of AEP Designation

Focus on Estate Planning

Education and Experience Requirements

Personal Financial Specialist (PFS)

Overview of PFS Credential

Requirements for Certified Public Accountants (CPAs)

Focus on Personal Financial Planning

Retirement Income Certified Professional (RICP)

Overview of RICP Designation

Focus on Retirement Income Planning

Education and Experience Requirements

Understanding the Importance of Credentials

Ensuring Professional Competence

Compliance With Ethical Standards

Tailoring Financial Advice to Individual Needs

Conclusion

Financial Advisor Credentials FAQs

Some of the most common financial advisor credentials include Certified Financial Planner (CFP), Chartered Financial Analyst (CFA), Chartered Financial Consultant (ChFC), Accredited Estate Planner (AEP), Personal Financial Specialist (PFS), and Retirement Income Certified Professional (RICP). These credentials indicate the advisor's expertise in specific areas of financial planning and investment management.

You can verify a financial advisor's credentials by checking the issuing organization's website or contacting them directly. Many credential-granting organizations, such as the CFP Board, CFA Institute, or AICPA, maintain online databases where you can search for and verify a financial advisor's credentials.

No, not all financial advisors have credentials. However, a financial advisor with recognized credentials demonstrates their commitment to professional development and adherence to industry standards. When selecting a financial advisor, it is crucial to consider their credentials, education, experience, and overall expertise to ensure that they can effectively address your unique financial needs and objectives.

Many financial advisor credentials require adherence to a specific code of ethics and standards of professional conduct. Credential-granting organizations often enforce these standards through disciplinary processes and ongoing continuing education requirements. By selecting a financial advisor with recognized credentials, you can have greater confidence that they will provide unbiased and trustworthy advice while maintaining a commitment to professional conduct.

Financial advisor credentials can help you achieve your financial goals by ensuring that you receive advice tailored to your unique needs and objectives. Advisors with recognized credentials have demonstrated their education, experience, and expertise in specific areas of financial planning and investment management. By selecting an advisor with the appropriate credentials, you can ensure that they have the knowledge and skills necessary to help you navigate your financial journey and achieve your goals.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.