Financial advisors are highly sought-after professionals who enable individuals and businesses to make sound financial decisions. They provide helpful guidance on topics such as investing for the long term, saving for retirement, and managing debt responsibly. Becoming a financial advisor requires training in formal education - such as a degree in finance or accounting - or direct experience gained from the industry. Furthermore, only those advisors certified by appropriate organizations may offer advice on certain financial topics. This entails passing exams and obtaining relevant licenses. A good financial advisor can be invaluable when planning a secure financial future. They will take the initiative to understand your current situation and long-term goals and plans. Understanding these factors, a financial advisor can create an individualized plan that maximizes security while minimizing risks. They can use their expertise to help you decide how best to invest and save money, reduce or eliminate debt to create greater financial freedom going forward, and more. Have a financial question? Click here. Financial advisors are highly trained professionals who can advise and guide all aspects of personal finance. They can assist with comprehensive financial planning, tailored investment strategies, and risk management. One of the main benefits of working with a financial advisor is the level of expertise and experience that they offer. Financial advisors are highly trained professionals with years of experience in helping clients manage their money, investments, and financial plans. They have the knowledge and resources to guide all aspects of finances, from budgeting and saving to investing, taxation, and retirement planning. With a financial advisor, you can also get comprehensive financial advice on various other topics, such as estate planning, insurance coverage, debt management, or business planning. In addition, your advisor can help you create goals for long-term success, like saving for college or purchasing real estate. Your advisor will assess your current financial situation to ensure that all options are considered when deciding your future. Financial advisors understand how important it is to design tailored investment strategies to meet an individual’s needs and goals. They are knowledgeable about different types of investments, such as stocks, bonds, and mutual funds, as well as alternative investments like exchange-traded funds (ETFs), commodities, annuities, and derivatives. By utilizing your personal information, such as income level, risk tolerance, life goals, and the timeline for investing objectives, your financial advisor can make sure that any investment recommendations will suit your unique situation and maximize potential returns. Another huge benefit of hiring a financial advisor is risk management. While some level of risk may be associated with most investments, a skilled advisor can help you identify those risks and suitable strategies for mitigating them. Advisors stay up-to-date with changing economic conditions to adjust their clients' investment portfolios accordingly to minimize losses should market conditions take an unexpected turn. Managing your finances can be a complex and daunting task, which is why many people turn to financial advisors for help. Here are some of the most common reasons why people seek a financial advisor’s services: If your financial situation has changed significantly, such as through marriage, divorce, inheritance, or a career change, it can be beneficial to consult a financial advisor. A professional advisor can assist you in managing your money more efficiently and navigating complex decisions that may come with changes in your finances. If you are beginning to prepare for retirement, adding a certified financial planner to your team can be incredibly helpful. Financial advisors have expertise that can help guide your decision-making regarding the many options available for investing for retirement. Working with an advisor will also ensure that your planning is tailored to meet your needs. Estate planning is complicated and includes many legal considerations. Working with a qualified estate planner is essential to ensuring that all of the legal aspects of estate planning are taken care of and that taxes and other fees are minimized or eliminated completely. A financial advisor can provide comprehensive advice on how best to manage estates, both during life and after death. Taxes can be complex and intimidating, but they are unavoidable if you want to keep more earnings. A trained financial advisor will help evaluate the best based on your income level and goals. The right advice can help reduce the amount of tax due while taking advantage of all deductions possible. For those seeking guidance on business financing or expansion plans, working with a dedicated business planner provides invaluable insight into finding the right sources of capital and developing successful growth strategies. Business planners also assist entrepreneurs in creating budgets and sound cash flow management practices - critical pieces for any successful business venture. When looking for a financial advisor, it is essential to research and choose an individual or firm that can meet your specific needs. Here are some factors to consider when selecting a financial advisor: Check the credentials of any potential advisors. Financial advisors must be registered and licensed with the appropriate regulatory authorities to provide services, so verify these before making any decisions. It is also essential to consider an advisor’s experience level - having years of expertise in the field will be invaluable regarding sound advice. You must understand your advisor’s investment philosophy before signing on as a client, as this will form the basis for their strategy. Learn how they approach investing and assess whether their beliefs align with yours. Ask questions about what types of investments they focus on and what asset allocations they may use - this will give you an idea of how much risk you are comfortable taking. Communication between yourself and your financial advisor should be open and transparent. Feeling comfortable speaking with them and confident in their responses is essential. Ensure that both parties are on the same page when discussing goals, strategies, and expectations. Establishing an effective communication style early on will ease any future conversations regarding investments or changes to your plan. Find out if you will be charged a flat fee or by assets under management. Understanding up front exactly what fees you may pay can help avoid confusion or potential disappointment down the road, as well as provide greater certainty around budgeting for planning ahead of time. Remember that some advisors charge various fees, such as those associated with trade orders or advising services, so remember to ask about those, too. The accessibility of some advisors may be limited due to geographic location or workload. If convenient access is important for you, inquire about availability before committing yourself financially. If meeting face-to-face is only possible sometimes, look into advisors who offer virtual meetings via technology like Skype/FaceTime/Zoom so that you have easy access without needing to travel long distances every time. Financial advisors have a fiduciary responsibility – meaning they must always act in the best interests of their clients. Ensure that any potential advisors that you are considering have documents outlining their fiduciary responsibilities available upon request. Knowing up front whether or not your advisor follows this responsibility can help ensure a positive relationship where both parties trust one another's intentions entirely moving forward. Finding the right financial advisor can be daunting, but there are many ways to help ensure that you get the best advice possible. Here are some tips for locating an experienced and knowledgeable financial advisor: One of the most reliable sources for finding a great financial advisor is asking for recommendations from your family, friends, and colleagues who have had positive experiences with advisors. Gather referrals from people you trust and have used their services in the past. You can also find potential advisors through online searches - online sites allow users to filter according to areas of specialization, years of experience, and more. Hence, it is also worth exploring these options if you seek specific criteria from an advisor. It is also possible to find trusted professionals through associations such as Certified Financial Planners (CFPs) and Chartered Financial Analysts (CFAs). These organizations strive to uphold high industry standards for their members, including regular re-evaluation and certification processes. Professional associations are a great way to find a qualified financial advisor with specialized knowledge in certain areas, such as estate or retirement planning. A financial advisor is a professional who provides advice on investments and financial matters. They offer guidance and develop strategies to help people achieve their goals, such as saving for retirement, paying off debt, creating budgeting plans, or investing in stocks or real estate. Partnering with a financial advisor can be beneficial in many ways. Working with an experienced professional can give you sound advice and guidance on managing your investments, protecting your family’s assets, and growing your wealth. They can also help create personalized plans and strategies tailored to your needs. A financial advisor acts as an ally solely focused on helping you achieve your goals. Unlike banks or other institutions, advisors usually have no vested interest in the products that they recommend; they focus exclusively on helping you reach your objectives. A good advisor will also be available to answer questions or discuss changes that may be needed throughout the process. Ultimately, having a trusted financial advisor can bring significant value to any portfolio through their experience, knowledge, and customized services designed specifically around their owner's needs.Financial Advisor: Overview

Benefits of Partnering With a Financial Advisor

Professional Expertise and Experience

Comprehensive Financial Planning

Tailored Investment Strategies

Risk Management

When Do You Need a Financial Advisor?

Changes in Financial Situation

Retirement Planning

Estate Planning

Tax Planning

Business Planning

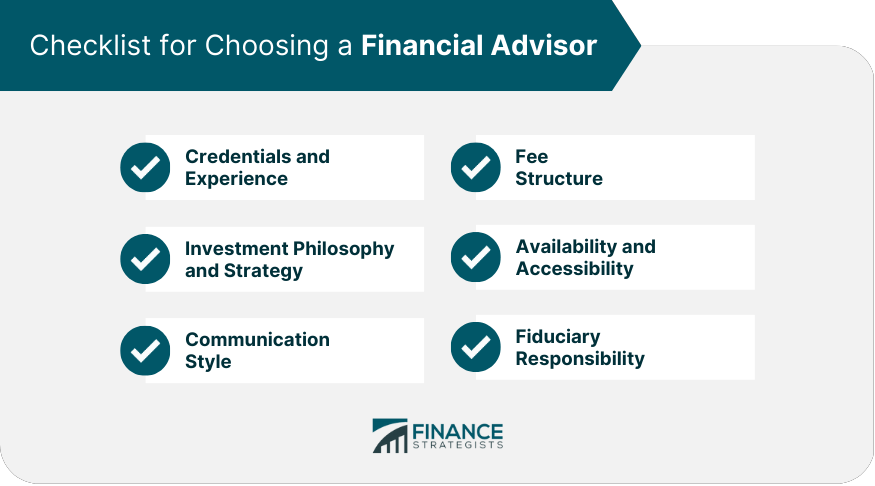

Factors to Consider When Choosing a Financial Advisor

Credentials and Experience

Investment Philosophy and Strategy

Communication Style

Fee Structure

Availability and Accessibility

Fiduciary Responsibility

How to Find a Financial Advisor

Referrals

Online Searches

Professional Associations

Final Thoughts

What Is the Value of Partnering With a Financial Advisor? FAQs

A financial advisor is a professional who provides advice on investments and financial matters. They offer guidance and develop strategies to help people achieve their goals, such as saving for retirement, paying off debt, creating budgeting plans, or investing in stocks or real estate.

A financial advisor can provide invaluable assistance in helping you to realize your financial goals. Through personalized advice and guidance, they can develop strategies to help reduce risk and maximize your return. They also have access to qualified services available only to individuals with professional advice.

Before selecting an advisor, it is essential to conduct research and due diligence. Factors to consider include expertise, experience level, service fees, and potential conflicts of interest. It is also important to review references from past clients or employers.

Financial advisors typically charge hourly rates or a flat fee depending on the services provided. Other costs may include investment management fees, usually based on percentages of assets under management (AUM). Investors should know all costs associated with working with an advisor before committing.

There is no single answer, as individuals may need advisors at different points in life depending on their circumstances and goals. Those who want more sophisticated strategies, such as investing in stocks or managing complicated tax requirements, would benefit from using the services of an experienced professional consultant.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.