Financial advisors stand at the crux of individual and corporate financial health, offering advice and strategic planning services that help clients achieve their financial goals. To best serve their clients, financial advisors must obtain the proper credentials that demonstrate their expertise and knowledge of the field. This certification process is integral to their professional development, as it not only equips them with the necessary skills to guide their clients but also provides them with the credibility required in the marketplace. Becoming a certified financial advisor is a journey that involves both academic education and professional training. This process begins with understanding the role of a financial advisor, followed by acquiring the necessary qualifications and training. Upon successful completion of these steps, an individual can then apply for the relevant certifications that set the foundation for a thriving career in finance. Starting the journey to become a financial advisor requires a deep and broad understanding of the role's many responsibilities. Investment Management: They are responsible for understanding a wide range of investment options and guiding clients toward decisions that align with their financial goals and risk tolerance. Financial Planning: Financial advisors help clients develop comprehensive financial plans that cover areas such as savings, investments, retirement, tax planning, and estate planning. Risk Assessment: They analyze the level of risk involved in different financial strategies and investment options, ensuring clients' decisions align with their risk tolerance levels. Insurance Advice: Financial advisors guide clients in understanding and choosing appropriate insurance policies to safeguard against potential risks. Retirement Planning: They assist clients in setting retirement goals and devising strategies to meet these objectives, such as determining optimal contributions to retirement accounts. Estate Planning: Financial advisors help clients plan the transfer of their assets in the event of their death, reducing potential estate taxes and ensuring their wishes are met. Regulatory Compliance: They need to stay updated on financial regulations and ethical standards, ensuring their advice complies with all relevant laws and guidelines. Subjects such as finance, economics, business administration, or mathematics are often chosen because they delve into key financial concepts and principles that financial advisors use daily. Finance or Economics Degree: These degrees provide a comprehensive understanding of financial markets, economic trends, and investment principles. Business Administration Degree: This subject includes learning about strategic planning, organizational behavior, and management principles, all of which are useful when advising business owners or clients with business investments. Mathematics Degree: A degree in mathematics strengthens the analytical skills needed for assessing financial data, predicting future trends, and creating financial strategies for clients. Aspiring financial advisors should consider augmenting their degrees with additional finance-related courses. Such courses can delve deeper into specific aspects of finance, thereby broadening one's knowledge and understanding. For instance, courses on investment analysis can enhance the ability to evaluate investment opportunities. Risk management courses can provide an understanding of how to identify and mitigate financial risks. Financial planning courses can arm individuals with the knowledge to help clients design their financial futures. These combined academic experiences not only serve to equip potential financial advisors with the essential knowledge and skills for their future roles but also prepare them for the more specialized learning that comes with professional certification. The journey to acquiring certification is a critical part of becoming a certified financial advisor. Here are the main steps: This is usually self-driven and depends largely on individual study habits. However, many find it beneficial to enroll in coaching or training programs that provide study materials, practice tests, and guidance on how to tackle the exam effectively. These resources can build your confidence and better your chances of passing the exam. Fill-Out the Application Form: This form often requests information about your academic background, professional experience, and personal details. It's essential to provide accurate and up-to-date information. Provide Proof of Eligibility: After completing the application form, you'll need to submit evidence of your educational qualifications and professional experience. Pay the Examination Fee: The amount varies depending on the certification. It's usually a good idea to double-check the fee amount and the payment method accepted by the certification body. Verification Process: After submission, your application goes through a verification process where the certification body checks the accuracy of the information you provided and the authenticity of your documents. Approval and Scheduling the Exam: Once your application is approved, you can proceed to schedule your exam. Exams are typically offered during specific windows throughout the year, and you can choose a date that works best for you. After successfully passing the certification exam, you're not quite done yet. There is a post-exam process that involves a final assessment of your qualifications. Confirmation of Exam Results: Once you pass the exam, the certification body will officially confirm your results. This confirmation usually comes in the form of a letter or an email notification. Final Application Review: During this review, they will re-verify the details you provided during registration, such as your educational background and professional experience. Exam Performance Integrity Check: This process is designed to ensure that the exam was completed honestly and in compliance with the examination policies. Any hint of malpractice could lead to disqualification and withdrawal of your certification. Completion of Experience Requirement: For some certifications, such as the CFP, you must also complete a specific number of hours of relevant professional experience after passing the exam before you can be officially certified. Once approved by the certification body, you'll be awarded your certification. This official recognition marks the start of your journey as a certified financial advisor. This certification can significantly enhance your credibility and open up more professional opportunities. Being a certified financial advisor is not just a job title; it's a launchpad for various opportunities in the finance industry. Here are some key aspects of career progression for a certified financial advisor: Achieving certification opens up an array of opportunities. It adds a significant advantage to a resume and increases the chances of securing better positions in renowned financial institutions or insurance companies. Some advisors also opt to start their own private practices. Certification not only enhances credibility but also gives financial advisors a competitive edge in the job market. Certified advisors are often positioned to command higher salaries due to their demonstrated expertise. The financial industry is dynamic, with new regulations, market trends, and financial products emerging regularly. It's vital for financial advisors to stay updated by attending seminars, workshops, or other continuous learning programs. These educational opportunities help advisors stay current and provide the best possible advice to their clients. Building professional relationships is an integral part of career advancement. Networking with other professionals can lead to new opportunities, the exchange of ideas, and greater visibility within the industry. As a certified financial advisor, your role is to provide valuable advice that helps clients navigate their financial journey. Your success in this role can lead to increased client trust, referrals, and ultimately, career growth. Financial advisors play a crucial role in guiding individuals and businesses toward their financial goals. To excel in this profession, advisors must undergo a rigorous certification process that ensures they possess the necessary expertise and credibility. The journey to becoming a financial advisor starts with understanding the diverse responsibilities of the role, building a strong academic foundation, and additional finance-related courses that can further enhance one's knowledge. Professional certification is a vital step in establishing credibility. CFP and CFA certifications are highly regarded in the industry, each focusing on different aspects of financial services. Obtaining certification opens up numerous opportunities for career advancement, including enhanced job prospects, a competitive edge in the job market, and the potential for higher salaries. Continuous professional development and networking are critical for staying updated on industry trends and building a successful career.What Is a Financial Advisor?

Initial Steps To Become a Financial Advisor

Understand the Role of a Financial Advisor

Build an Academic Base

Supplement Education With Additional Courses

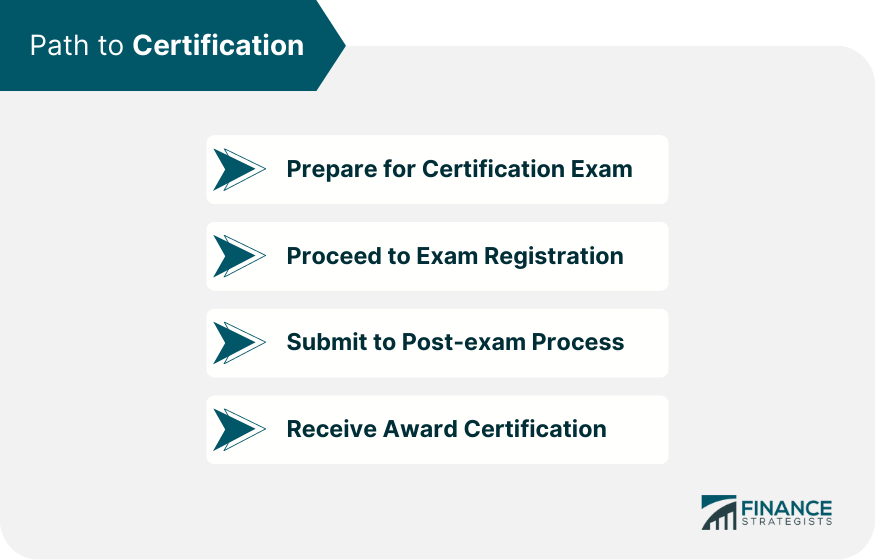

Path to Certification

Prepare for Certification Exam

Proceed to Exam Registration

For education, this typically means an official transcript or degree certificate. For professional experience, you might need to provide job descriptions, letters of reference, or other official documentation from your employer(s).Submit to the Post-exam Process

If you haven't completed this requirement by the time you pass your exam, you'll need to complete it during this post-exam phase.Receive Award Certification

Career Progression as a Certified Financial Advisor

Enhanced Job Prospects

Competitive Edge and Higher Salaries

Continuous Professional Development

Networking

Deliver Client Value

Conclusion

Certification Steps for a Financial Advisor FAQs

The certification steps for a financial advisor involve understanding the role, building an academic base in finance-related fields, pursuing additional courses, and obtaining a professional certification like CFP or CFA.

Certification is crucial for a financial advisor as it establishes credibility, enhances job prospects, provides a competitive edge, and opens up opportunities for career advancement.

To be eligible for the CFP certification, you need a bachelor's degree and at least three years of relevant professional experience in financial planning.

Preparation for the certification exams involves self-driven study and may benefit from enrolling in coaching or training programs that provide study materials, practice tests, and effective exam strategies.

After passing the exams and undergoing a final review, you will be awarded the certification, marking the beginning of your career as a certified financial advisor, with opportunities for career progression and continuous professional development.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.