A grantor retained income trust allows the grantor to transfer assets to a trust while retaining an income stream from the trust for a set number of years. Upon the conclusion of the trust term, the assets are usually transferred to the beneficiaries of the trust, who are typically the heirs of the grantor.

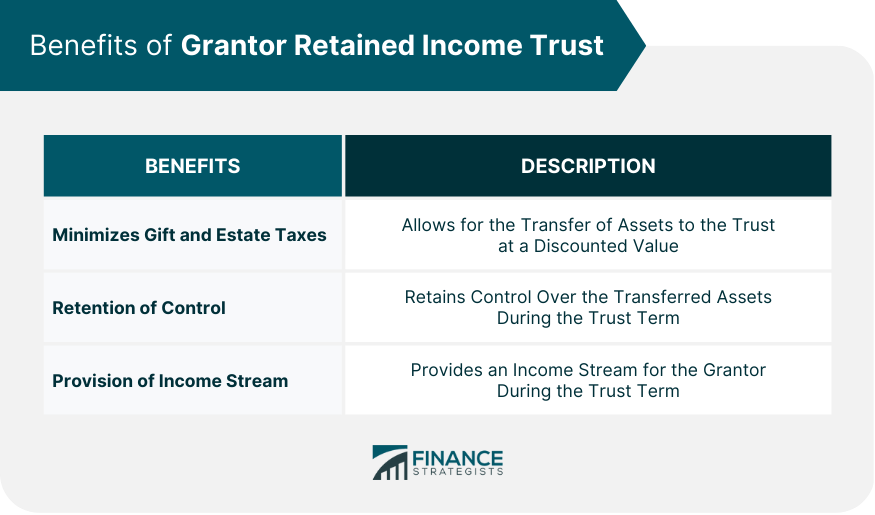

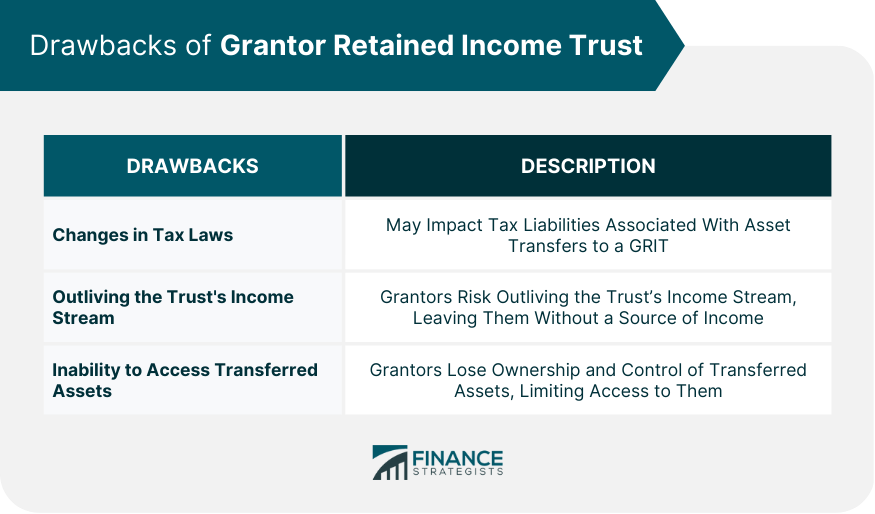

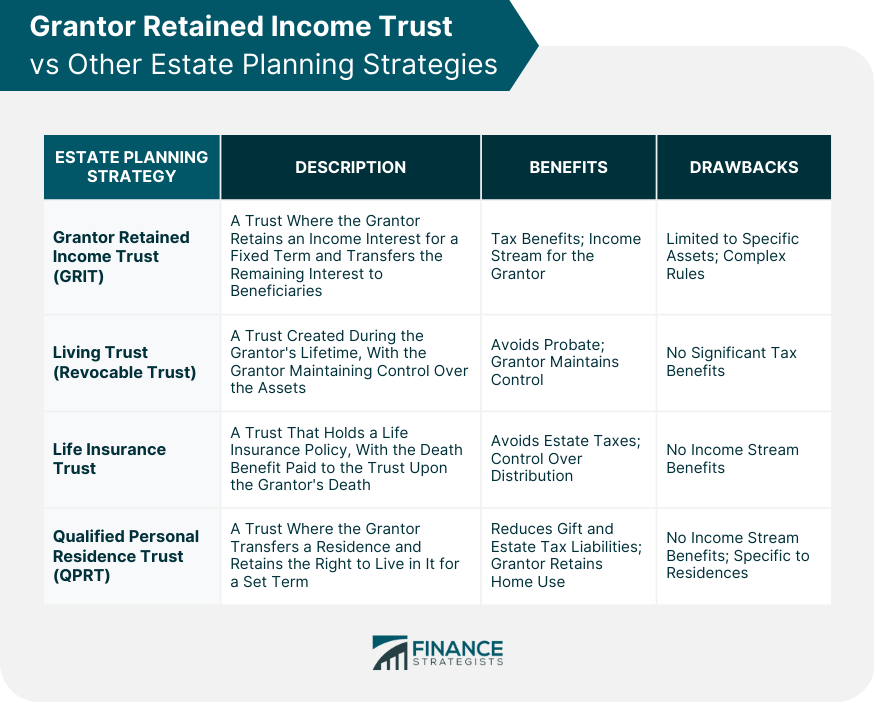

I'm Taylor Kovar, a Certified Financial Planner (CFP), specializing in helping business owners with strategic financial planning. In navigating the complexities of estate planning for a high-net-worth client, we explored leveraging a Grantor Retained Income Trust (GRIT) to minimize estate taxes while preserving wealth for the next generation. By transferring appreciating assets into the GRIT, the client was able to retain income for a set period, significantly reducing the taxable value of their estate. Let's see how a GRIT can work for you! Contact me at (936) 899 - 5629 or [email protected] to discuss how we can achieve your financial objectives. WHY WE RECOMMEND: IDEAL CLIENTS: Business Owners, Executives & Medical Professionals FOCUS: Strategic Planning, Alternative Investments, Stock Options & Wealth Preservation GRIT offers several benefits to the grantor, including minimizing gift tax and estate tax liabilities, maintaining control over the transferred assets, and providing an income stream for the grantor during the trust's term. One of the primary benefits of GRIT is the ability to minimize gift tax and estate tax liabilities. The grantor can transfer assets to the trust at a discounted value, reducing the tax liabilities associated with the transfer. The trust's income stream payments to the grantor can also be structured to minimize tax liabilities. Another benefit of GRIT is that the grantor retains control over the transferred assets during the trust term. This means that the grantor can continue to manage and control the assets, even though the grantor no longer owns them. This feature allows the grantor to maintain a certain level of control over the assets and ensure that they are being managed according to their wishes. GRIT provides an income stream for the grantor during the trust term. This income stream can be structured as a fixed or variable payment depending on the grantor's needs and preferences. The income stream can provide a source of income for the grantor while also allowing them to transfer assets to their heirs. While GRIT offers several benefits, there are also risks and drawbacks to consider before establishing a GRIT. Tax laws are subject to change, and a change in tax laws could significantly impact the tax liabilities associated with the transfer of assets to a GRIT. For example, if the estate tax exemption is lowered, the grantor may face significant tax liabilities when transferring assets to the trust. The grantor must structure the income stream to ensure they have enough income to support themselves during the trust term. However, if the grantor lives longer than expected, they may outlive the trust's income stream payments, leaving them without a source of income. Once the assets are transferred to the trust, the grantor no longer owns or controls them. While the grantor can still receive income stream payments from the trust, they cannot access the transferred assets. The following are the requirements for establishing a GRIT: Assets that have the potential for appreciation are the best candidates for transfer to a GRIT. These assets can include stocks, real estate, and other investment assets. The grantor must also establish a proper income stream for themselves during the trust term. The income stream can be either fixed or variable, depending on the grantor's preferences. The income stream must also comply with IRS regulations, including the minimum interest rate requirement set by the IRS. Failure to comply with the Internal Revenue Service (IRS) regulations can result in significant tax liabilities for the grantor. For example, if the trust's income stream payments are too low, the transfer could be deemed a gift rather than a sale, resulting in a significant tax liability. While GRIT is a popular estate planning strategy, it is not the only option available. Other estate planning strategies, such as living trusts, life insurance trusts, and qualified personal residence trusts, offer similar benefits and drawbacks. A living trust, also known as a revocable trust, is a trust that the grantor creates during their lifetime. The grantor can transfer assets to the trust and retain control over them during their lifetime. Upon the grantor's death, the assets are transferred to the trust's beneficiaries without going through probate. Living trusts offer several benefits, including avoiding probate and allowing the grantor to maintain control over the assets during their lifetime. However, they do not offer the same tax benefits as a GRIT. A life insurance trust is a trust that the grantor creates to hold a life insurance policy. The policy's death benefit is paid to the trust upon the grantor's death and distributed to the trust's beneficiaries according to the grantor's wishes. Life insurance trusts offer several benefits, including avoiding estate taxes on the death benefit and ensuring that the death benefit is distributed according to the grantor's wishes. However, they do not offer the same income stream benefits as a GRIT. A qualified personal residence trust is a trust that the grantor creates to transfer their primary residence or vacation home to the trust. The grantor retains the right to live in the home for a set number of years, after which the home is transferred to the trust's beneficiaries. QPRTs offer several benefits, including reducing gift and estate tax liabilities and allowing the grantor to retain the use of the home during the trust term. However, they do not offer the same income stream benefits as a GRIT. A grantor retained income trust is a valuable estate planning tool that can help high-net-worth individuals transfer assets while retaining control and receiving an income stream for a set term. GRITs offer several benefits, including minimizing gift and estate tax liabilities, providing an income stream, and maintaining control over the transferred assets. However, there are also risks to consider, including potential changes in tax laws and the risk of outliving the income stream. It is important to seek professional advice before establishing a GRIT to ensure compliance with IRS regulations and explore other estate planning strategies that may be more suitable for individual circumstances. Hiring an estate planning attorney can help individuals navigate the complexities of estate planning and make informed decisions about their financial future. What Is a Grantor Retained Income Trust (GRIT)?

Read Taylor's Story

Fee-Only Financial Advisor

Certified Financial Planner™

3x Investopedia Top 100 Advisor

Author of The 5 Money Personalities & Keynote Speaker

Benefits of Grantor Retained Income Trust

Minimizes Gift and Estate Taxes

Retention of Control

Provision of Income Stream

Drawbacks of Grantor Retained Income Trust

Potential for Changes in Tax Laws

Risk of Outliving the Trust’s Income Stream

Inability to Access Transferred Assets

Requirements for Establishing a Grantor Retained Income Trust

Select the Right Assets to Transfer

Establish a Proper Income Stream

Comply With IRS Regulations

Grantor Retained Income Trust vs Other Estate Planning Strategies

Living Trust

Life Insurance Trust

Qualified Personal Residence Trust (QPRT)

Conclusion

Grantor Retained Income Trust (GRIT) FAQs

A grantor retained income trust (GRIT) is a trust that allows the grantor to transfer assets to the trust while retaining an income stream for a set number of years. At the end of the trust term, the assets are transferred to the trust's beneficiaries.

GRIT offers several benefits, including minimizing gift and estate tax liabilities, maintaining control over the transferred assets, and providing an income stream for the grantor during the trust term.

To establish a GRIT, the grantor must select the right assets to transfer, establish a proper income stream for the grantor, and comply with IRS regulations.

While GRIT offers several benefits, there are also risks and drawbacks to consider before establishing a GRIT, including potential changes in tax laws, the risk of outliving the trust's income stream, and the inability to access the transferred assets.

While GRIT is a popular estate planning strategy, other estate planning strategies offer similar benefits and drawbacks, such as living trusts, life insurance trusts, and qualified personal residence trusts. It is important to consult a financial advisor to determine which strategy best suits individual circumstances.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.