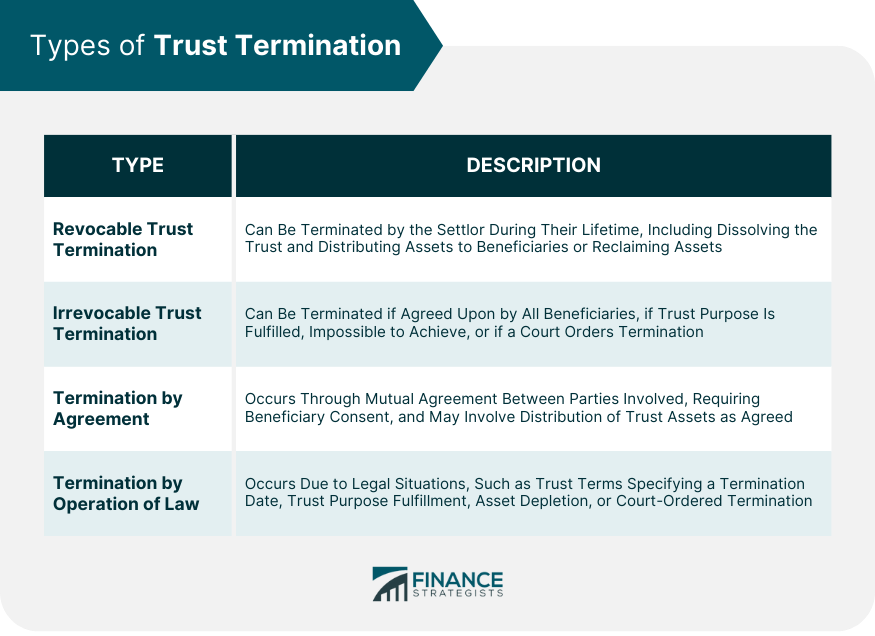

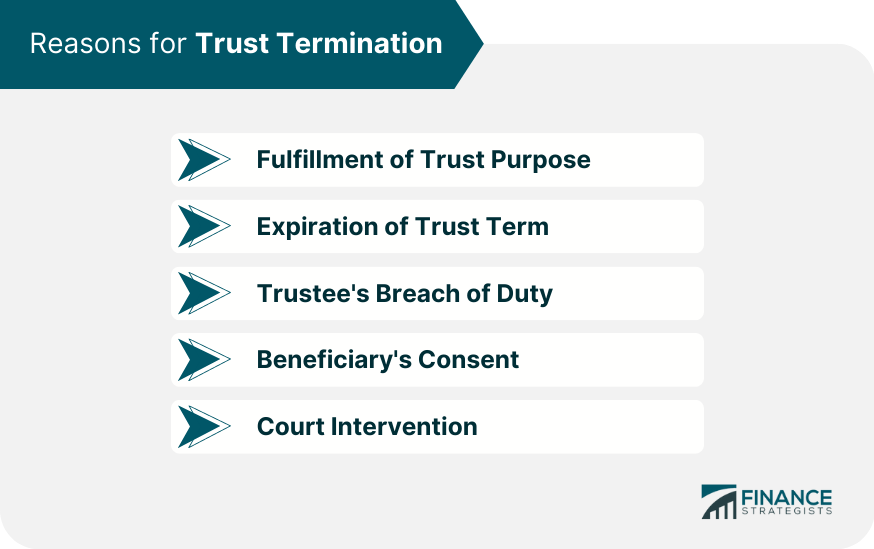

Trust termination refers to the process of ending a trust, which may occur for various reasons. The termination involves winding up the trust's affairs and distributing its remaining assets to the beneficiaries according to the terms of the trust or applicable law. Understanding trust termination is essential for both trustees and beneficiaries. It ensures that the trust's purpose is fulfilled, the assets are distributed appropriately, and any legal or tax implications are addressed. A revocable trust can be terminated by the settlor (the person who created the trust) at any time during their lifetime. The settlor has the authority to revoke or amend the trust provisions, including dissolving the trust entirely and distributing the assets to the beneficiaries or reclaiming the assets for themselves. An irrevocable trust, as the name suggests, generally cannot be terminated by the settlor. However, it may still be terminated under specific circumstances, such as if all the beneficiaries agree to the termination, if the trust's purpose has been fulfilled or becomes impossible to achieve, or if a court orders the termination. Trust termination may occur through a mutual agreement between the parties involved, such as the beneficiaries and the trustee. This type of termination usually requires the consent of all beneficiaries and may involve the distribution of the trust assets as agreed upon by the parties. Trust termination can also occur by operation of law. This may happen when the trust's terms specify a termination date or event, the trust's purpose has been fulfilled or becomes impossible to achieve, or the trust's assets are depleted. In some cases, a court may order the termination of a trust due to a legal issue or violation of public policy. A trust is a legal arrangement through which one party, known as the trustee, holds and manages assets for the benefit of another party, referred to as the beneficiary. Trusts are often established with specific goals or purposes in mind. Once these objectives have been met, the trust may no longer be necessary and could be terminated. For instance, a trust might have been created to fund a beneficiary's college education. If the beneficiary has graduated and no longer requires financial assistance from the trust, its purpose has been fulfilled, allowing for the termination of the trust. Trusts can also be established with an explicitly defined lifespan, after which the trust is planned to cease existence. This is often stipulated in the trust deed, the legal document that outlines the terms and conditions of the trust. Once the trust's term has reached its end, the remaining assets in the trust are then distributed among the beneficiaries as per the terms outlined in the trust document. This distribution process can include provisions such as equal division among beneficiaries or specific assets being allocated to particular individuals. A trustee is expected to manage the trust's assets responsibly and in the best interests of the beneficiaries, a responsibility known as a fiduciary duty. If a trustee does not uphold these responsibilities and breaches their duty, the beneficiaries can take legal action. They may petition the court to terminate the trust and distribute its assets. The court then decides whether the trustee has indeed acted improperly and if so, may order the dissolution of the trust. There are situations where the beneficiaries of a trust can agree to terminate it. This usually requires unanimous consent from all beneficiaries. However, the termination of the trust in this manner must not conflict with the trust's original intended purpose. For example, if the trust was set up to last until a beneficiary reached a certain age, it might not be permissible for the beneficiaries to prematurely terminate the trust. Courts have the power to intervene in the operation of a trust in certain circumstances. If the purpose of the trust is deemed to have become illegal, unfeasible, or contrary to public policy, a court may order the termination of the trust. For example, if a trust was set up to fund an activity that has since been outlawed, the court could rule that the trust's continuation is not lawful. Upon trust termination, the trust assets are distributed to the beneficiaries according to the terms outlined in the trust document or by court order. Proper distribution is crucial to avoid potential disputes among beneficiaries. The termination of a trust may have significant tax implications for both the trust and its beneficiaries. Trust income, capital gains, and estate taxes may apply, depending on the circumstances surrounding the trust termination. Trust termination may lead to litigation if there are disputes among the beneficiaries or disagreements regarding the trustee's actions. It is essential to have a clear understanding of the trust's terms and the applicable laws to minimize the risk of litigation. Trust termination is the process of ending a trust and distributing its assets to the designated beneficiaries. It can occur for various reasons and may have significant consequences for all parties involved. There are different types of trust termination, including revocable trust termination, irrevocable trust termination, termination by agreement, and termination by operation of law. Each type has unique requirements and implications. Trusts can be terminated for various reasons, such as the fulfillment of the trust's purpose, expiration of the trust's term, or a trustee's breach of duty. Consequences of trust termination include the distribution of trust property, tax implications, and potential litigation. Understanding trust termination is crucial for settlors, trustees, and beneficiaries to effectively manage the trust and its assets. It is essential to be aware of the types of trust termination, the reasons for termination, and the potential consequences. Consulting with an experienced estate planning attorney can provide valuable guidance and help ensure a smooth trust termination process.What Is Trust Termination?

Types of Trust Termination

Revocable Trust Termination

Irrevocable Trust Termination

Termination by Agreement

Termination by Operation of Law

Reasons for Trust Termination

Fulfillment of Trust Purpose

Expiration of Trust Term

Trustee's Breach of Duty

Beneficiary's Consent

Court Intervention

Consequences of Trust Termination

Distribution of Trust Property

Tax Implications

Potential Litigation

Bottom Line

Trust Termination FAQs

Trust termination is the legal process of bringing a trust to an end, either by fulfilling its purpose or due to specific circumstances.

There are four types of trust termination: revocable trust termination, irrevocable trust termination, termination by agreement, and termination by operation of law.

Trust termination can occur due to various reasons, such as the fulfillment of the trust purpose, expiration of the trust term, trustee's breach of duty, beneficiary's consent, or court intervention.

The consequences of trust termination may include the distribution of trust property, tax implications, and potential litigation.

Yes, a trust can be terminated early if certain circumstances arise, such as the fulfillment of the trust's purpose, expiration of the trust term, or the agreement of all involved parties. However, termination of an irrevocable trust may be more challenging and require court intervention.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.