Second-to-die life insurance, also known as survivorship or joint life insurance, is a type of life insurance policy that insures two individuals, typically spouses or business partners, and pays out the death benefit upon the death of the second insured person. This type of insurance is primarily designed for estate planning purposes, providing liquidity to cover estate taxes and other expenses, and ensuring that heirs and beneficiaries receive the intended financial support. With second-to-die life insurance, the death benefit is not paid out until the second insured person passes away. Premiums are typically lower than those for individual life insurance policies since the risk is spread across two lives, and the policy's payout is deferred until the death of the second insured. Second-to-die life insurance can be an effective tool for managing potential estate tax liabilities, as the death benefit can be used to pay estate taxes and other expenses, reducing the burden on heirs and beneficiaries. By providing a significant death benefit upon the death of the second insured, second-to-die life insurance ensures that heirs and beneficiaries receive the financial support they need to maintain their lifestyle, pay for educational expenses, or manage any outstanding debts. Since the policy covers two lives and the death benefit is paid out only upon the death of the second insured, the premiums for second-to-die life insurance are generally lower than those for individual life insurance policies. Second-to-die life insurance allows couples to obtain coverage even if one of the insured individuals has health issues that might make it difficult or costly to obtain individual life insurance. In some cases, second-to-die life insurance may be available even if both insured individuals have health issues, as the insurer takes into account the combined life expectancy of the two insured persons. Many second-to-die life insurance policies offer flexibility in terms of policy riders, premium payment options, and investment components, allowing policyholders to customize their coverage to suit their unique needs and financial goals. Since the death benefit is not paid out until the death of the second insured, the surviving insured may not receive any immediate financial benefits from the policy, which could create financial challenges in the event of the first insured's death. Estate tax laws may change over time, potentially reducing the need for second-to-die life insurance as an estate planning tool. If the relationship between the two insured individuals deteriorates or they divorce, the policy's death benefit may not serve the intended purpose of providing financial support to the intended beneficiaries. In the event of a divorce or separation, the policy may need to be restructured, which could result in additional costs or complications. Individual life insurance policies provide coverage for one person and pay out a death benefit upon the insured's death. While these policies can offer more immediate financial benefits to the surviving spouse or family members, they may have higher premiums compared to second-to-die life insurance. Joint life insurance policies cover two individuals and pay out a death benefit upon the death of either insured person. These policies may be more suitable for couples who require immediate financial support upon the death of either spouse Term life insurance provides coverage for a specified term, usually between 10 and 30 years. If the insured individual dies during the term, the policy pays out a death benefit. Term life insurance policies can be more affordable than permanent life insurance options, but they do not offer the same estate planning benefits as second-to-die life insurance. Consider your estate planning objectives and whether second-to-die life insurance aligns with those goals. This type of insurance is best suited for individuals with significant estate tax liabilities or those who want to provide financial support to heirs and beneficiaries upon the death of the second insured. Evaluate the financial needs of your intended beneficiaries, such as children or grandchildren, and determine whether a second-to-die life insurance policy will provide adequate financial support to meet those needs. If one or both insured individuals have health issues, second-to-die life insurance may be a more cost-effective option than individual life insurance policies. Compare the premium costs of second-to-die life insurance policies with those of individual or joint life insurance policies, taking into account your budget and financial goals. Research and compare various insurance providers to determine which company offers the best combination of coverage, pricing, and customer service. Consult with an insurance agent or financial planner who is knowledgeable about second-to-die life insurance policies and can provide guidance on selecting the right policy for your needs and objectives. Review the policy options, riders, and investment components available with second-to-die life insurance policies to customize your coverage and ensure that it aligns with your estate planning goals and financial objectives. Second-to-die life insurance can be a valuable estate planning tool, providing liquidity to cover estate taxes and other expenses, and ensuring that heirs and beneficiaries receive the intended financial support. When considering second-to-die life insurance, carefully assess your personal and family needs, taking into account your estate planning objectives, the financial needs of your beneficiaries, and the health conditions of the insured individuals. By doing so, you can select a policy that best aligns with your unique circumstances and financial goals.What Is Second-To-Die Life Insurance?

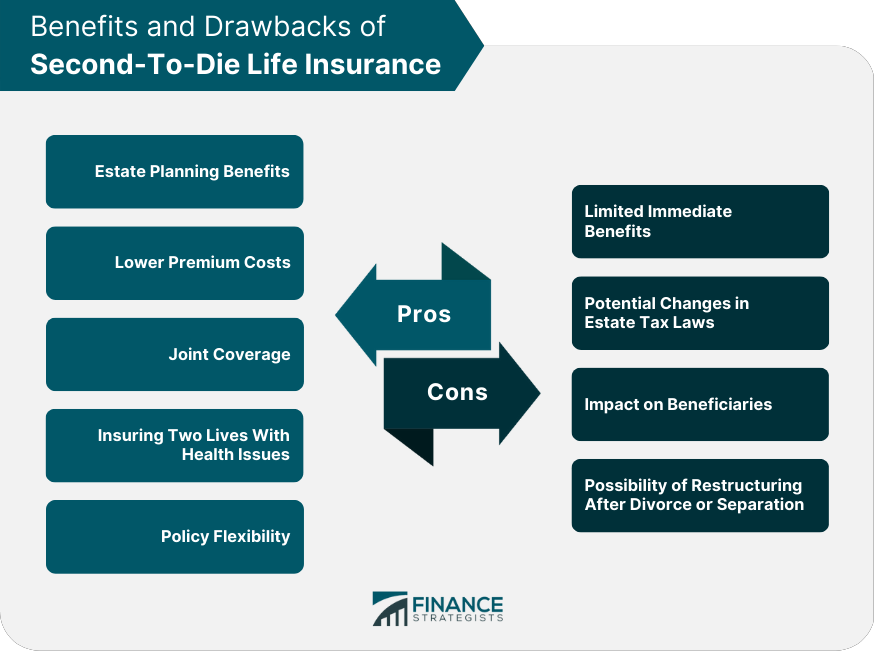

Advantages of Second-To-Die Life Insurance

Estate Planning Benefits

Estate Tax Protection

Providing for Heirs and Beneficiaries

Lower Premium Costs

Insurability

Joint Coverage

Insuring Two Lives With Health Issues

Policy Flexibility

Disadvantages of Second-To-Die Life Insurance

Limited Immediate Benefits

Potential Changes in Estate Tax Laws

Impact on Beneficiaries

Restructuring After Divorce or Separation

Comparing Second-To-Die Life Insurance to Other Insurance Options

Individual Life Insurance

Joint Life Insurance

Term Life Insurance

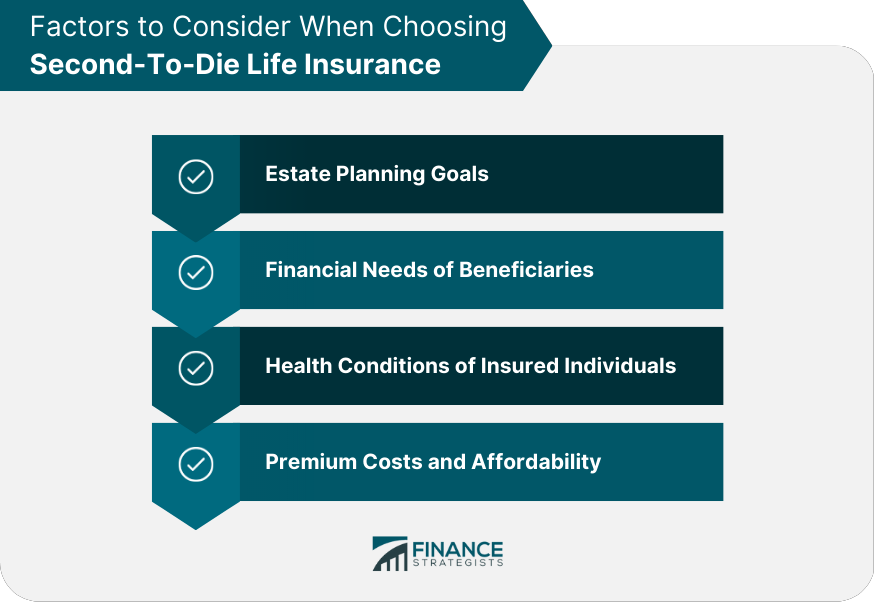

Factors to Consider When Choosing Second-To-Die Life Insurance

Estate Planning Goals

Financial Needs of Beneficiaries

Health Conditions of Insured Individuals

Premium Costs and Affordability

How to Purchase Second-To-Die Life Insurance

Selecting an Insurance Provider

Working With an Insurance Agent or Financial Planner

Evaluating Policy Options and Riders

Conclusion

Importance of Second-To-Die Life Insurance in Estate Planning

Assessing Personal and Family Needs for Insurance Coverage

Second-To-Die Life Insurance FAQs

Second-to-die life insurance is a type of life insurance policy that covers two people, typically a married couple. The policy pays out a death benefit after both individuals have passed away.

Unlike traditional life insurance policies that pay out a death benefit when the insured individual dies, second-to-die life insurance policies pay out a death benefit after both individuals have passed away. This type of policy is often used as an estate planning tool.

The primary benefit of second-to-die life insurance is that it can help preserve the wealth and assets of a married couple for their heirs. This type of policy can also be less expensive than two separate life insurance policies for each individual.

Second-to-die life insurance can be a good option for married couples who want to ensure that their heirs receive a significant inheritance. This type of policy can also be useful for couples who have estate tax concerns, as the policy can provide funds to pay estate taxes after both individuals have passed away.

Choosing the right second-to-die life insurance policy depends on your specific needs and financial situation. Consider factors such as the policy's death benefit, premium payments, and the financial strength and reputation of the insurance company when selecting a policy. A financial advisor can also provide guidance on selecting the right second-to-die life insurance policy for your needs.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.