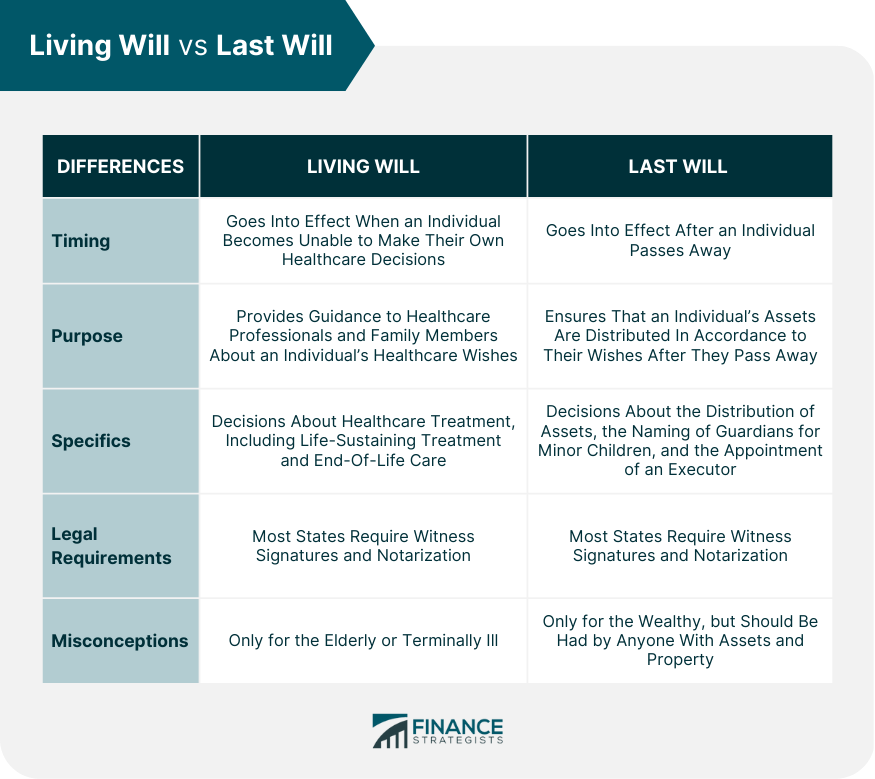

A living will and a last will are two separate legal documents that are important in estate planning. A living will outlines an individual's healthcare wishes when they become unable to make decisions for themselves. While a last will records an individual's preferred method of distributing their assets after they die. It is crucial to differentiate the two documents to guarantee that your desires are appropriately carried out. Without these documents, an individual's assets and healthcare decisions may be left to the court, which can cause unnecessary stress and conflict for their loved ones. A living will, also often called an advance healthcare directive, is a legally binding document that details an individual's healthcare preferences should they become incapacitated or unable to make decisions. The purpose of a living will is to provide guidance to healthcare professionals and family members about the individual's wishes for medical treatment. This includes decisions about life-sustaining treatment and end-of-life care. Living wills are important because they ensure that an individual's wishes are respected and carried out, even if they cannot communicate their wishes themselves. Legal requirements for a living will include witness signatures and notarization. At least two witnesses are required by most states to sign the document, and some states require that the document be notarized. The witnesses cannot be related to the individual, and they cannot be named as beneficiaries in the document. Living wills do not go into effect until the individual becomes unable to make decisions for themselves. Until that point, the individual has the right to make their own healthcare decisions. A misconception about living wills includes the idea that they are only for older individuals or individuals who are already ill. Anyone over the age of 18 can create a living will, and it's important for individuals of all ages and health statuses to have one. Living wills can apply to any situation where an individual is unable to make their own healthcare decisions, including situations where they are in a coma or have suffered a severe injury. In contrast, a last will is a legal paper that specifies how an individual's assets should be distributed after their death. It is to ensure that an individual's assets are distributed according to their wishes and that their loved ones are taken care of after they pass away. This includes decisions about who will inherit property and assets, who will take care of minor children, and who will be responsible for carrying out the individual's wishes. To make a last will legally binding, it needs to have witness signatures and notarization, which is required in most states. The document typically needs at least two witnesses who can sign it, and some states may require notarization to ensure its validity. A last will can be changed at any time as long as the individual is of sound mind and follows the proper legal procedures. People believe that they are only for wealthy individuals. However, anyone who has assets and property should have a last will. Another misconception is that a last will is all that is needed for estate planning. In reality, a last will is just one part of a comprehensive estate plan that should also include a living will, a power of attorney, and other legal documents. The key differences between a living will and a last will include the following: A living will goes into effect when an individual becomes unable to make their own healthcare decisions. This can include situations where the individual is in a coma, has suffered a severe injury, or is otherwise unable to communicate their healthcare wishes. In contrast, a last will goes into effect after an individual passes away. A living will provides guidance to healthcare professionals and family members about an individual's healthcare wishes in the event that they become unable to make decisions for themselves. A living will specifies healthcare decisions, including end-of-life care and life-sustaining treatment, while a last will ensures asset distribution per the individual's wishes upon death. The specifics of a living will include decisions about healthcare treatment, including life-sustaining treatment and end-of-life care. In contrast, the specifics of a last will include decisions about the distribution of assets, the naming of guardians for minor children, and the appointment of an executor. Legal requirements for both a living will and a last will vary by state. However, most states require witness signatures and notarization for both documents. At least two witnesses are typically required to sign the document, and the witnesses cannot be related to the individual or named as beneficiaries in the document. Some states also require that the documents be notarized to ensure their validity. Misconceptions about living wills include the belief that they are only for the elderly or terminally ill, but in reality, anyone over 18 can have one, and they can apply to any situation where a person can't make their own healthcare decisions. Misconceptions about last wills include the notion that they are only for the wealthy, but anyone with assets and property should have one. A last will is just one part of a comprehensive estate plan that should include other legal documents. A living will and a last will are two separate legal documents that are important in estate planning. A living will details a person's desired medical care if they cannot make decisions for themselves, while a last will specifies how a person's assets should be distributed upon their death. The primary contrast between a living will and a last will is determined by their timing, purpose, and specifics. If you are interested in creating a living will and/or a last will, it is important to consult with an estate planning attorney who can help you create a comprehensive estate plan that meets your individual needs. By taking the time to create a comprehensive estate plan that includes both a living will and a last will, an individual can have peace of mind knowing that their wishes will be respected and carried out according to their desires. Overview of Living Will vs Last Will

What Is a Living Will?

What Is a Last Will?

Living Will vs Last Will

Timing

Purpose

Specifics

Legal Requirements

Misconceptions

Final Thoughts

Living Will vs Last Will FAQs

Anyone over 18 should have a living will, and anyone with assets and property should have a last will.

The difference between the two is that a living will outlines healthcare wishes while a last will outlines asset distribution after death.

One of the most common legal requirements is that the document must be witnessed by at least two people who are not beneficiaries of the will or related to the individual.

No, they are two separate legal documents with different purposes and specific requirements.

A living will ensures healthcare wishes are respected while a last will ensures assets are distributed according to wishes after death.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.