The valuation date refers to a specific point in time at which the value of an asset, business, or investment is determined for various purposes, such as financial reporting, taxation, mergers and acquisitions, or estate planning. The valuation date is a crucial element in financial analysis and decision-making, as it affects the accuracy and relevance of the valuation process. Establishing a proper valuation date ensures that financial information is up-to-date and reflects the most recent market conditions, business performance, and economic factors. This information enables investors, financial managers, and other stakeholders to make informed decisions about investments, resource allocation, and risk management. Legal and regulatory requirements often dictate the valuation date for specific purposes, such as financial reporting or taxation. These requirements ensure consistency and comparability in financial analysis and decision-making across different entities and jurisdictions. Business events and transactions, such as mergers and acquisitions, buy-sell agreements, or divestitures, may require a specific valuation date to determine the fair market value of the assets involved in the transaction. Market conditions and economic factors, such as interest rates, inflation, and market volatility, can significantly impact the value of assets and investments. Therefore, the valuation date should consider these factors to ensure that the valuation reflects the most recent and relevant information. Industry trends and practices may also influence the choice of the valuation date. For instance, businesses in the same industry may follow a common valuation date for financial reporting or benchmarking purposes, ensuring comparability and consistency in financial analysis. In estate planning, the valuation date is typically the date of death of the decedent. However, an alternative valuation date (AVD) may be used in some cases, typically six months after the date of death, which could result in a lower estate tax liability if the value of the assets has decreased during that period. The valuation date is critical in estate planning, as it affects the value of the assets included in the decedent's estate and the resulting estate tax liability. Choosing the appropriate valuation date can help minimize the tax burden on the estate and its beneficiaries. In mergers and acquisitions, the valuation date is essential for determining the fair market value of the target company's assets and liabilities, which impacts the transaction price and the resulting financial performance of the combined entity. In buy-sell agreements between business owners, the valuation date is used to determine the value of the business interests being transferred. This information is crucial for establishing a fair transaction price and ensuring that the rights and obligations of the parties involved are adequately addressed. In investment analysis, the valuation date is used to measure the performance of an investment or portfolio over a specific period. Comparing the value of an investment at different valuation dates enables investors to assess the investment's return and risk characteristics and make informed decisions about their investment strategy. In portfolio management, the valuation date is used to rebalance the portfolio by adjusting the weights of the individual assets based on their current market value. This process helps maintain the desired risk-return profile of the portfolio and ensures that the investment objectives are met. The discounted cash flow analysis is a widely used valuation method that estimates the present value of a business or investment's future cash flows. The valuation date is crucial in this approach, as it serves as the starting point for projecting future cash flows and discounting them back to the present value. The capitalization of earnings method is another income-based valuation approach that involves estimating the value of a business or investment by dividing its expected future earnings by a capitalization rate. The valuation date plays a significant role in determining the expected earnings and the appropriate capitalization rate, which reflects the risk associated with the business or investment. The CCA method involves estimating the value of a business or investment by comparing it to similar businesses or investments in the market. The valuation date is essential for selecting the most recent and relevant market data, such as stock prices, trading multiples, and financial ratios, to ensure an accurate and reliable valuation. The PTA method estimates the value of a business or investment based on historical transactions involving similar businesses or investments. The valuation date is critical in this approach, as it helps identify the most recent and relevant transactions for comparison and adjust for any changes in market conditions, industry trends, or economic factors. The adjusted net asset method is an asset-based valuation approach that estimates the value of a business or investment by adjusting its net assets to their fair market value. The valuation date is essential in determining the appropriate market values for the assets and liabilities, which affect the overall value of the business or investment. The liquidation value method estimates the value of a business or investment based on the net proceeds it would generate if its assets were sold and liabilities settled. The valuation date is critical for this approach, as it determines the market conditions and asset values that would prevail during the liquidation process. Rapidly changing market conditions can make it challenging to select an appropriate valuation date, as asset values may fluctuate significantly over short periods. This uncertainty may result in valuation discrepancies and affect the reliability of the valuation process. Unforeseen events, such as natural disasters, geopolitical conflicts, or market disruptions, can significantly impact the value of assets and investments. These events may introduce uncertainty in determining the appropriate valuation date, as they may affect the underlying assumptions and projections used in the valuation process. There may be subjectivity involved in determining the appropriate valuation date, especially when there are no specific legal or regulatory requirements. This subjectivity may lead to inconsistencies and discrepancies in valuation, which can affect the comparability and reliability of financial analysis and decision-making. The valuation date plays a vital role in the financial analysis and decision-making processes. Serving as the foundation for determining the value of assets, businesses, and investments, the valuation date significantly impacts investment decisions, business transactions, and estate planning. A thorough understanding of the concept of valuation date allows stakeholders to make more informed decisions and ensures accurate and relevant financial analysis. However, it is crucial to acknowledge the challenges and uncertainties associated with determining the appropriate valuation date, such as rapidly changing market conditions, unforeseen events, and subjectivity in the selection process. By being aware of these factors, stakeholders can enhance the quality and reliability of their financial analysis and minimize inconsistencies and discrepancies that may arise due to the valuation date.What Is the Valuation Date?

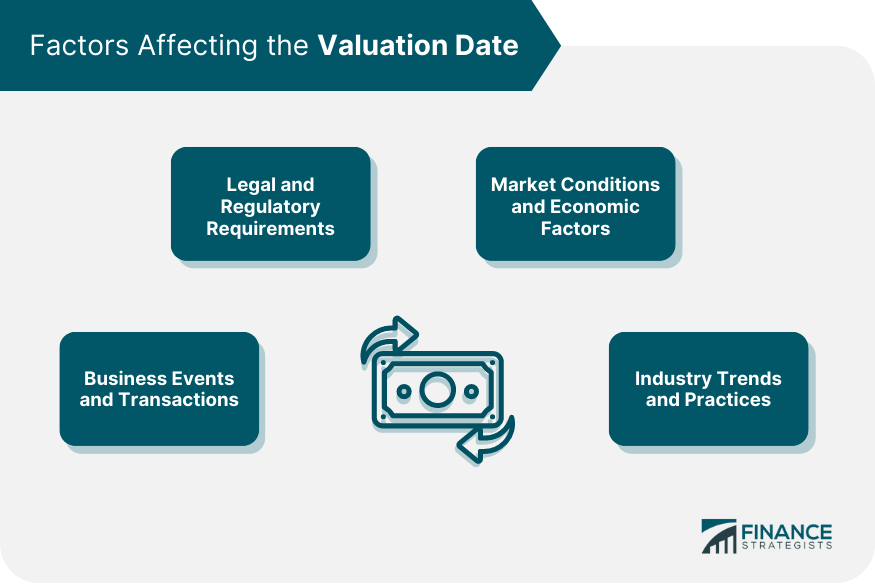

Factors Affecting the Valuation Date

Legal and Regulatory Requirements

Business Events and Transactions

Market Conditions and Economic Factors

Industry Trends and Practices

Valuation Date in Different Contexts

Valuation Date in Estate Planning

Alternative Valuation Date (AVD)

Impact on Estate Taxes

Valuation Date in Business Transactions

Mergers and Acquisitions

Buy-Sell Agreements

Valuation Date in Investment Analysis

Performance Measurement

Portfolio Management

Valuation Date and Valuation Methods

Income Approach

Discounted Cash Flow (DCF) Analysis

Capitalization of Earnings

Market Approach

Comparable Company Analysis (CCA)

Precedent Transaction Analysis (PTA)

Asset-Based Approach

Adjusted Net Asset Method

Liquidation Value

Challenges and Uncertainty in Determining Valuation Date

Rapidly Changing Market Conditions

Unforeseen Events and Their Impact on Valuation

Subjectivity in Determining the Appropriate Valuation Date

Conclusion

Valuation Date FAQs

The valuation date is the date on which an asset or liability is valued for financial reporting purposes. It is also known as the measurement date.

The valuation date is important because it is the point in time when the value of an asset or liability is determined. This value is used in financial statements, tax filings, and other financial reporting.

The valuation date is typically determined by accounting standards or regulations. For example, public companies must value their assets and liabilities as of the end of each fiscal quarter.

In some cases, the valuation date can be changed. This might happen if there is new information that becomes available after the initial valuation date that would significantly impact the value of the asset or liability.

The valuation date is important because it determines the value of an asset or liability for financial reporting purposes. The value of an asset or liability can change over time, so it is important to use an appropriate valuation date to ensure that the value accurately reflects the current market conditions.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.