A Negotiable Certificate of Deposit (NCD) is a type of fixed-deposit investment instrument offered by banks and other financial institutions. Unlike regular certificates of deposit, an NCD is negotiable, meaning it can be sold or transferred to another party in the secondary market before it reaches maturity. NCDs are typically issued in large denominations, often starting at $100,000 or more, making them a popular investment option for institutional investors. They carry a fixed interest rate and have a specified maturity date, typically ranging from a few weeks to one year. Due to their negotiability and relatively short maturity period, NCDs provide investors with a higher degree of liquidity compared to traditional certificates of deposit, while still offering a reliable and relatively low-risk return. NCDs are typically issued in large denominations, often exceeding $100,000, making them a favored instrument among institutional investors. The maturity of NCDs can range from a few weeks to up to one year, although most NCDs have a maturity of three to six months. The interest rate on an NCD is fixed and is usually higher than that of a regular savings account. The rate is dependent on the prevailing market conditions at the time of issuance. Unlike traditional CDs, NCDs are negotiable and can be traded in the secondary market. This attribute provides investors with a higher degree of liquidity. NCDs can be categorized into short-term and long-term NCDs based on their maturity. Short-term NCDs have a maturity of less than one year, while long-term NCDs have a maturity of more than one year. There are two types of NCDs based on interest rate: fixed-rate NCDs and floating-rate NCDs. Fixed-rate NCDs carry a fixed interest rate throughout their term, while the interest rate on floating-rate NCDs is reset periodically based on a benchmark rate. The process of creating an NCD involves a bank or financial institution deciding the amount to be raised, the interest rate to be offered, and the maturity date. The NCD is then issued through a process called underwriting. NCDs can be traded in the secondary market. The price at which an NCD trades in the secondary market depends on several factors, including the credit rating of the issuing institution, the time to maturity, and the prevailing interest rates. Safety: NCDs are considered a safe investment because they are backed by the issuing bank or financial institution. Liquidity: Because NCDs are negotiable, they offer higher liquidity than traditional CDs. Investors can sell their NCDs in the secondary market before maturity if they need to access their funds. Higher Interest Rates: NCDs usually offer higher interest rates compared to savings accounts and other similar short-term investment options. Flexibility: NCDs offer investors flexibility in terms of maturity and interest payment options. Investors can choose between short-term and long-term NCDs and between fixed-rate and floating-rate NCDs. Interest Rate Risk: The value of an NCD can fall if market interest rates rise. This is because the fixed interest payments of an NCD become less attractive compared to other investments offering higher rates. This risk is more pronounced for long-term NCDs. Credit Risk: While NCDs are generally considered safe, there is a risk that the issuing bank or institution could default on its obligations. This risk is typically low for well-rated institutions but can increase during times of financial stress. Reinvestment Risk: the risk that an investor will have to reinvest the principal or interest payments at a lower rate than the original NCD. This risk arises when an NCD matures in a low-interest-rate environment. While both NCDs and term deposits offer fixed returns and are considered safe, NCDs offer higher liquidity due to their negotiability. On the other hand, term deposits may offer slightly higher interest rates for individual investors. Treasury bills are short-term debt instruments issued by the government and are considered risk-free. While NCDs also offer low risk, they carry a higher risk than treasury bills due to the potential credit risk of the issuing institution. However, NCDs typically offer higher returns to compensate for this additional risk. Commercial paper is a short-term debt instrument issued by corporations. While NCDs and commercial paper are similar in many ways, the main difference lies in the credit risk. Commercial paper typically carries higher credit risk than NCDs, which are issued by banks and financial institutions. NCDs play a critical role in controlling the money supply in the economy. When banks issue NCDs, they increase the money supply by creating more short-term liquidity. Conversely, when NCDs are redeemed, the money supply decreases. The issuance of NCDs also influences interest rates. When demand for NCDs is high, banks can issue them at lower interest rates. Conversely, if demand is low, banks may have to offer higher interest rates to attract investors. In the U.S., NCDs are regulated by the Federal Reserve and the Office of the Comptroller of the Currency (OCC). They ensure that banks follow all necessary regulations when issuing NCDs and that investors are adequately protected. Banks and financial institutions must adhere to various compliance requirements when issuing NCDs. These include maintaining proper records, disclosing all necessary information to investors, and ensuring that the issuance of NCDs does not lead to an excessive risk concentration. Negotiable Certificates of Deposit (NCDs) are versatile investment instrument that offers several benefits to investors. They provide safety, higher interest rates, liquidity, and flexibility in terms of maturity and interest payment options. NCDs are favored by institutional investors due to their large denominations and negotiability in the secondary market. However, NCDs also come with certain risks. Interest rate risk, credit risk, and reinvestment risk should be considered when investing in NCDs, especially for long-term NCDs or during financial stress periods. When comparing NCDs with other financial instruments, they offer higher liquidity than term deposits and potentially higher returns than treasury bills. Additionally, NCDs carry lower credit risk compared to commercial paper. In the economy, NCDs play a vital role in controlling the money supply and influencing interest rates. Regulatory authorities, such as the Federal Reserve and the Office of the Comptroller of the Currency, ensure compliance and investor protection in the issuance of NCDs. Overall, NCDs serve as an important investment option for those seeking a balance between safety, liquidity, and higher returns.What Is a Negotiable Certificate of Deposit (NCD)?

Features of Negotiable Certificate of Deposit (NCD)

Denomination

Maturity

Interest Rate

Negotiability

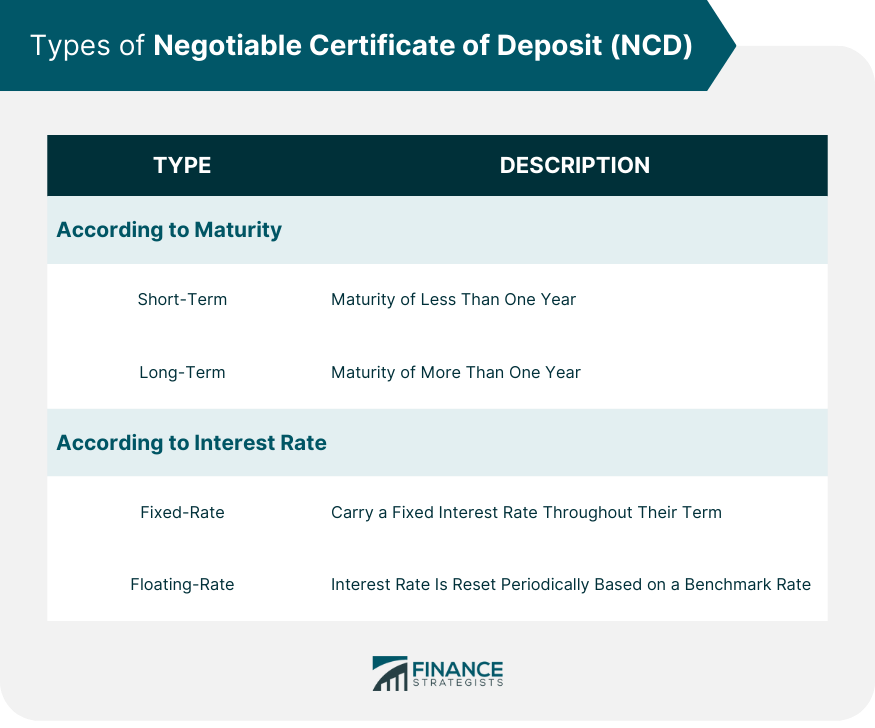

Types of Negotiable Certificate of Deposit (NCD)

With Respect to Maturity

With Respect to Interest Rate

Mechanism of Negotiable Certificate of Deposit (NCD)

Creation Process

Trading and Negotiation Process

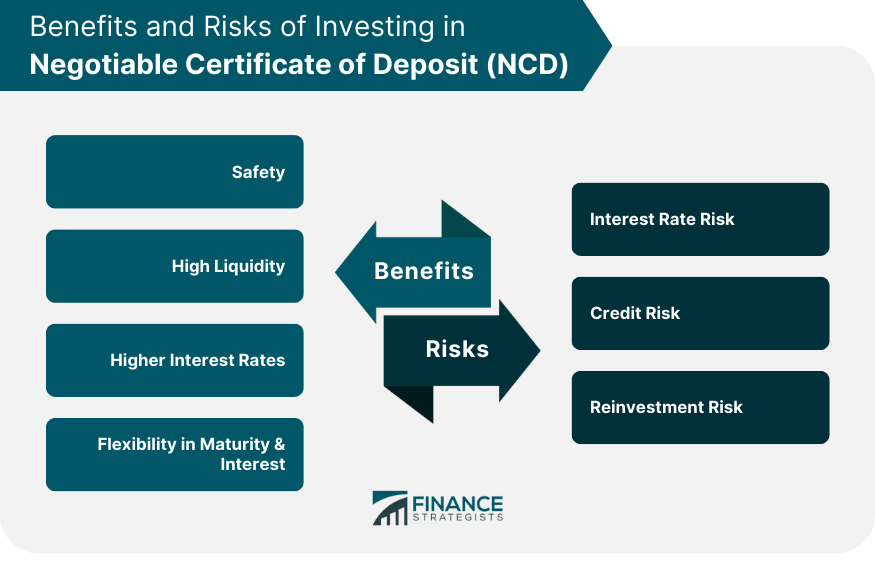

Benefits of Investing in a Negotiable Certificate of Deposit (NCD)

Risks Associated With Negotiable Certificate of Deposit (NCD)

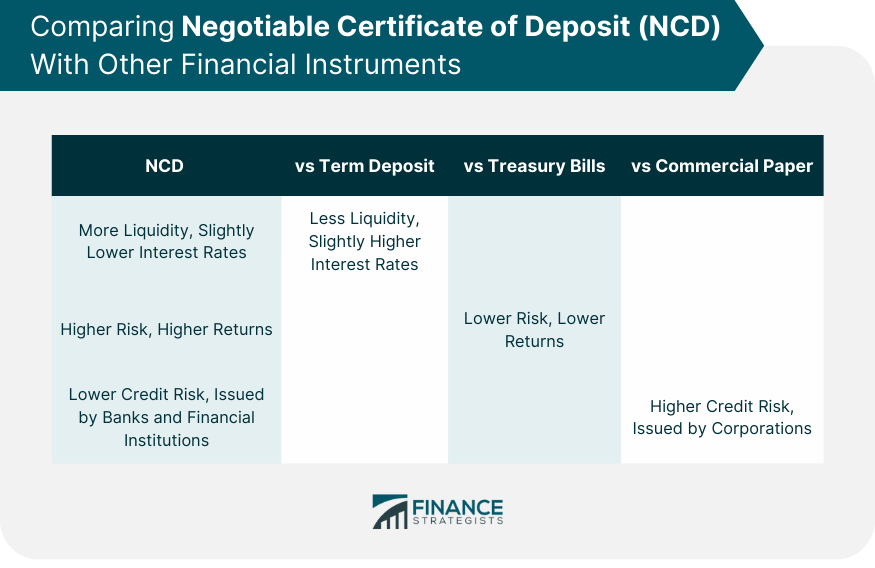

Comparing Negotiable Certificate of Deposit (NCD) With Other Financial Instruments

NCD vs Term Deposit

NCD vs Treasury Bills

NCD vs Commercial Paper

Role of Negotiable Certificate of Deposit (NCD) in the Economy

Impact on Money Supply

Influence on Interest Rates

Regulatory Framework for Negotiable Certificate of Deposit (NCD)

Regulatory Authorities

Compliance Requirements

Bottom Line

Negotiable Certificate of Deposit (NCD) FAQs

NCDs are short-term debt instruments issued by banks or financial institutions. They carry a fixed interest rate, have a specified maturity date, and are negotiable, meaning they can be bought or sold in the secondary market.

Key features of NCDs include their denomination (usually issued in large denominations), maturity (ranging from a few weeks to one year), fixed interest rate (typically higher than regular savings accounts), and negotiability (they can be traded in the secondary market).

Unlike term deposits, NCDs are negotiable and offer higher liquidity. Compared to treasury bills, they carry a slightly higher risk but offer higher returns. As compared to commercial paper, NCDs generally carry a lower credit risk since they are issued by banks and financial institutions.

While NCDs are generally considered a safe investment, they do carry certain risks. These include interest rate risk (the value of an NCD can fall if market interest rates rise), credit risk (the risk that the issuing bank could default on its obligations), and reinvestment risk (the risk of having to reinvest the principal or interest payments at a lower rate).

Technology, particularly fintech developments like blockchain and AI, can make the trading process of NCDs more efficient and transparent. This could potentially attract more investors to the NCD market and significantly influence its future dynamics.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.