The International Monetary Fund, colloquially known as the IMF, stands as a pillar of global economic cooperation. Founded in 1944 during the United Nations Monetary and Financial Conference, the IMF is an organization comprising 190 member countries. Its primary purpose is to foster global monetary cooperation, ensure financial stability, and facilitate international trade. Bridging divides and connecting countries, the IMF acts as a central hub where nations convene on international monetary issues. The organization's reach and influence have grown exponentially since its inception. The IMF isn't merely a forum for dialogue. It's a powerhouse that shapes economic policy, offers financial assistance, and provides guidance to nations navigating the labyrinth of the global economy. The International Monetary Fund, or IMF, is a multinational organization with the goal of fostering global trade, generating high employment and sustained economic growth, and reducing poverty. According to the IMFs website, its "primary purpose is to ensure the stability of the international monetary system—the system of exchange rates and international payments that enables countries (and their citizens) to transact with each other. The Fund's mandate was updated in 2012 to include all macroeconomic and financial sector issues that bear on global stability". Created in 1945 and based in Washington, D.C., the IMF consists of a board representing 189 countries. Their representation is based on the county's economic power, so more financially influential countries have greater voting power. The IMF's primary activities are surveilling economies, capacity building, and lending. Divergent economic policies can lead to monetary chaos. The IMF strives to harmonize these policies, fostering global monetary cooperation. This cooperation ensures a stable international monetary system—the system of exchange rates and international payments that enables countries to transact with each other. The objective isn’t just about stability; it’s about creating an environment where economies can flourish without the threat of monetary discord. By facilitating discussions, offering advice, and providing platforms for collaboration, the IMF aids nations in aligning their monetary policies. This alignment not only reduces the risk of economic crises but also paves the way for sustainable growth. Exchange rates can be volatile, with fluctuations leading to economic turbulence. The IMF champions exchange rate stability, emphasizing a system where countries can confidently engage in trade without fearing sudden and disruptive rate changes. By doing so, it supports international trade and investment. With regular consultations and surveillance, the IMF monitors exchange rate movements and advises countries on policies that can stabilize these rates. Through these actions, the organization aims to eliminate erratic behavior in exchange rates and promote confidence in the global economic system. Trade imbalances can lead to significant economic challenges, both for nations with massive trade surpluses and those with deficits. The IMF works diligently to ensure balanced growth of international trade, reducing the likelihood of trade disputes and fostering an equitable global trading environment. By offering policy advice and facilitating discussions, the IMF helps countries address imbalances and adopt practices promoting balanced trade. These measures not only boost economic growth but also mitigate the potential for trade-related disputes. Financial crises can cripple economies. In these times of dire need, the IMF extends a helping hand, providing financial assistance to member countries facing balance of payments problems. But this assistance isn't a mere handout. It comes attached with policy advice aimed at rectifying the root causes of the financial problems. By providing short-term capital and policy direction, the IMF ensures countries can stabilize, rebuild, and return to a path of sustainable growth. This lifeline not only aids the affected country but also shields the global economy from potential contagion. The IMF's primary activities are surveilling economies, capacity building, and lending. Surveillance: The IMF collects data on national economies, as well as international trade and the global economy. In addition, they provide regular economic forecasts which are published in the World Economic Outlook. Capacity Building: Through its capacity-building programs, the IMF provides assistance, training, and policy advice to its member countries. Part of the training consists of how to collect economic data, which the IMF also takes to publish in its reports. Lending: In order to mitigate financial crises, the IMF makes loans to countries experiencing financial distress. The funds total around $645 billion USD and are contributed by member countries based on a quota. The IMF measures its finances in SDR, or special drawing rights, which is a kind of pseudo-currency comprised of set proportions of the world's reserve currencies. In an interconnected global economy, the economic policies of one nation can ripple across borders, influencing economies worldwide. The IMF's surveillance machinery continually monitors these policies, ensuring they align with global economic stability. Through regular assessments, the organization keeps a pulse on global economic trends, offering policy advice tailored to each country's unique situation. Beyond individual countries, the IMF also delves into regional and global economic trends, ensuring its advice is both holistic and contextually relevant. This dual approach ensures nations have the guidance they need to foster growth while remaining aligned with global economic stability. Financial turbulence can hit any nation, regardless of its economic stature. During these trying times, the IMF's financial assistance programs act as a beacon of hope. Catering to a myriad of challenges, these programs range from those addressing balance of payments problems to structural issues affecting economic growth. Yet, these aren't just financial lifelines. Each program comes attached with policy advice, ensuring countries don't just recover from crises but also address the root causes, ensuring long-term stability. Beyond surveillance and financial aid, the IMF offers technical assistance to its member countries. This assistance targets specific challenges, offering expertise in areas like tax policy, exchange rate policy, and central banking. By doing so, the IMF ensures nations have the technical know-how to address their unique economic challenges. This hands-on approach not only fosters growth but also builds capacity. Through technical assistance, the IMF empowers countries, ensuring they have the tools and knowledge to navigate the global economic maze. Capacity development goes hand-in-hand with technical assistance. The IMF believes that for policies to be effective, countries need the institutional and human capacity to design, implement, and uphold them. To this end, the organization offers training, shares best practices, and provides expert advice, ensuring countries can stand tall in the global economic arena. By strengthening institutions and building human capacity, the IMF ensures nations are not just beneficiaries of aid but also active contributors to global economic growth. The IMF's contributions to the global economy are manifold, with its relentless pursuit of economic stability and growth standing at the forefront. Through its surveillance, policy advice, and financial assistance, the organization ensures the global economy remains on an even keel, resistant to shocks and geared for growth. Economic stability isn't just about avoiding crises. It's about creating an environment where businesses can thrive, investments can flourish, and nations can chart a course towards prosperity. Reforms are the lifeblood of economic evolution. The IMF actively supports its member countries in their reform journeys, offering guidance, financial assistance, and technical know-how. Whether it's transitioning to a market economy, implementing fiscal reforms, or restructuring the banking sector, the IMF stands by its members, ensuring they have the resources and knowledge to navigate these transformative paths. Reforms, while essential, can be challenging. With the IMF's support, countries can confidently embark on these journeys, secure in the knowledge that they aren't alone. The global economic landscape is vast, with multiple organizations playing crucial roles. The IMF doesn't operate in isolation. It actively collaborates with other international entities, whether it's the World Bank, the World Trade Organization, or regional development banks. This spirit of cooperation ensures that efforts to bolster the global economy are synergistic. By joining hands with other organizations, the IMF amplifies its impact, ensuring a cohesive approach to global economic challenges. The global economic landscape is in a constant state of flux, with uncertainties lurking around every corner. Whether it's geopolitical tensions, financial crises, or pandemics, the IMF faces the Herculean task of navigating these uncertainties while ensuring global economic stability. These challenges, while formidable, underscore the importance of the IMF. In an unpredictable world, the organization stands as a beacon of stability, guiding its member countries through turbulent times. Resources are the bedrock of any organization, and the IMF is no exception. While it has significant financial clout, the ever-evolving nature of global economic challenges means the IMF must continually assess its resource needs. Ensuring it has the financial muscle to support its member countries, especially during times of crises, remains a persistent challenge. Yet, this challenge also highlights the organization's resilience. Through periodic reviews and member contributions, the IMF ensures it remains well-equipped to fulfill its mandate. The global economy isn't a static entity. It's a dynamic, ever-evolving beast, with new challenges and opportunities emerging constantly. The IMF, in its quest to ensure global economic stability, must keep pace with these dynamics, anticipating shifts and adjusting its strategies accordingly. From the rise of digital currencies to shifting trade dynamics, the IMF faces the unenviable task of staying ahead of the curve. Yet, this challenge also offers opportunities. By adapting to these dynamics, the IMF not only addresses current challenges but also shapes the future of the global economy. The International Monetary Fund (IMF) serves as a vital pillar of global economic cooperation, fostering stability, growth, and international trade among its 190 member countries. As a powerful organization shaping economic policies and providing financial assistance, the IMF plays a central role in addressing economic challenges worldwide. The IMF's primary objectives of promoting global monetary cooperation, exchange rate stability, and balanced international trade underscore its significance in facilitating a resilient global economic system. Its surveillance, policy advice, financial aid, and technical assistance contribute to member countries' economic stability and growth, reinforcing the IMF's instrumental role in the global economy. Nevertheless, the IMF faces its share of challenges. Economic uncertainty, constantly evolving global economic dynamics, and ensuring adequate financial resources are key hurdles. Despite these obstacles, the IMF's adaptability, collaboration with other international organizations, and commitment to its mandate enable it to effectively navigate turbulent waters and continue shaping the path of the global economy.What Is the International Monetary Fund (IMF)?

Purpose of IMF

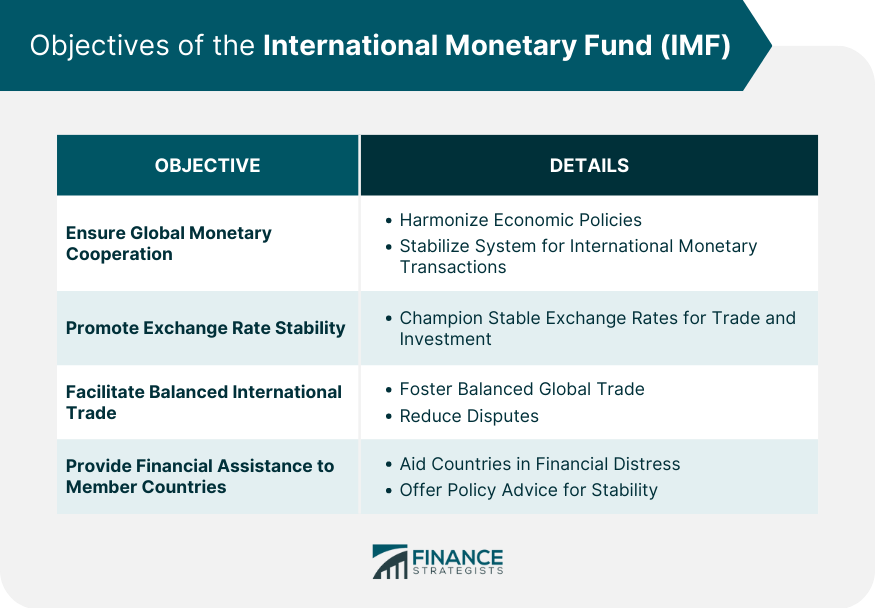

Objectives of the IMF

Ensure Global Monetary Cooperation

Promote Exchange Rate Stability

Facilitate Balanced International Trade

Provide Financial Assistance to Member Countries

Uses of IMF in Finance

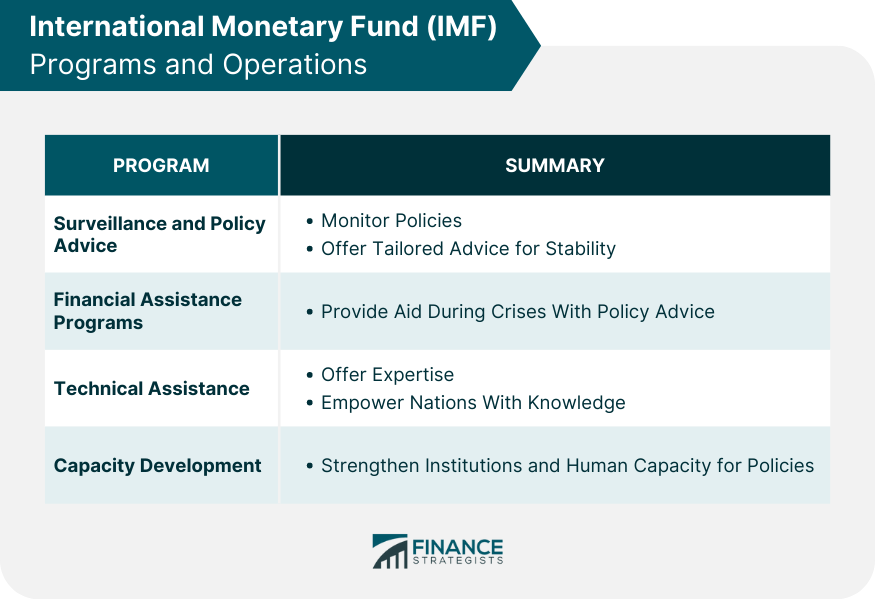

IMF Programs and Operations

Surveillance and Policy Advice

Financial Assistance Programs

Technical Assistance

Capacity Development

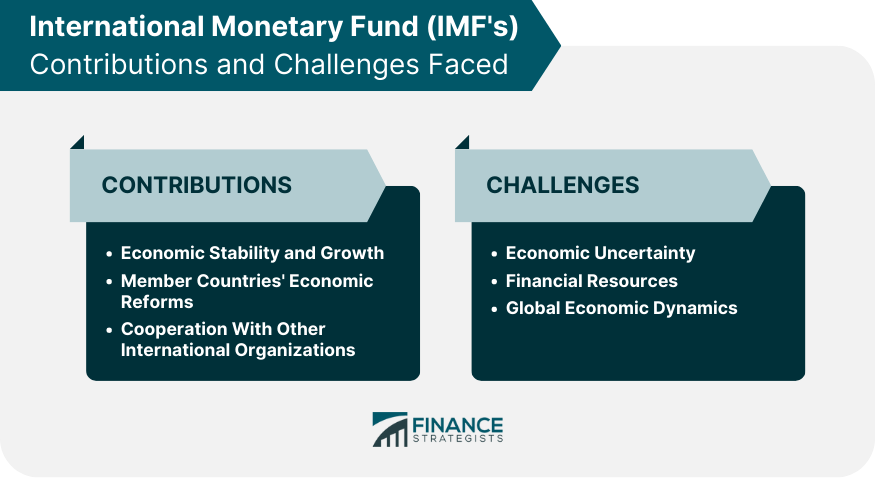

IMF's Contributions to Global Economy

Economic Stability and Growth

Member Countries' Economic Reforms

Cooperation With Other International Organizations

Challenges Faced by the IMF

Economic Uncertainty

Financial Resources

Global Economic Dynamics

Conclusion

International Monetary Fund (IMF) FAQs

IMF is an acronym for International Monetary Fund.

The International Monetary Fund, or IMF, is a multinational organization with the goal of fostering global trade, generating high employment and sustained economic growth, and reducing poverty.

According to the IMFs website, its “primary purpose is to ensure the stability of the international monetary system—the system of exchange rates and international payments that enables countries (and their citizens) to transact with each other.

Created in 1945 and based in Washington, D.C., the IMF consists of a board representing 189 countries. Their representation is based on the county’s economic power, so more financially influential countries have greater voting power.

The IMF’s primary activities are surveilling economies, capacity building, and lending.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.