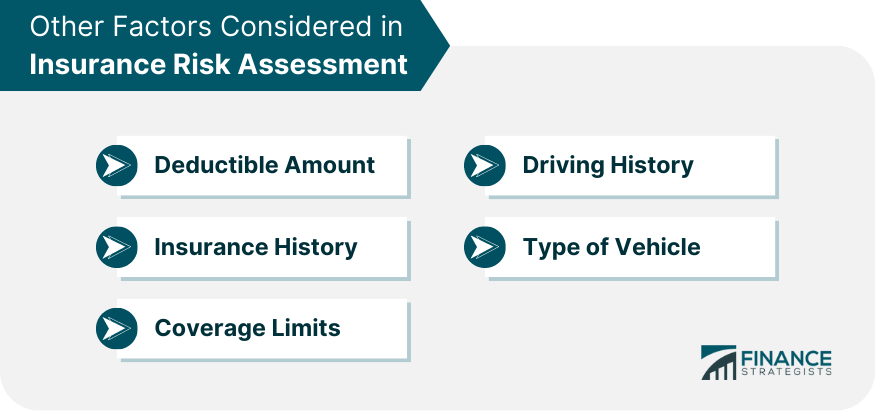

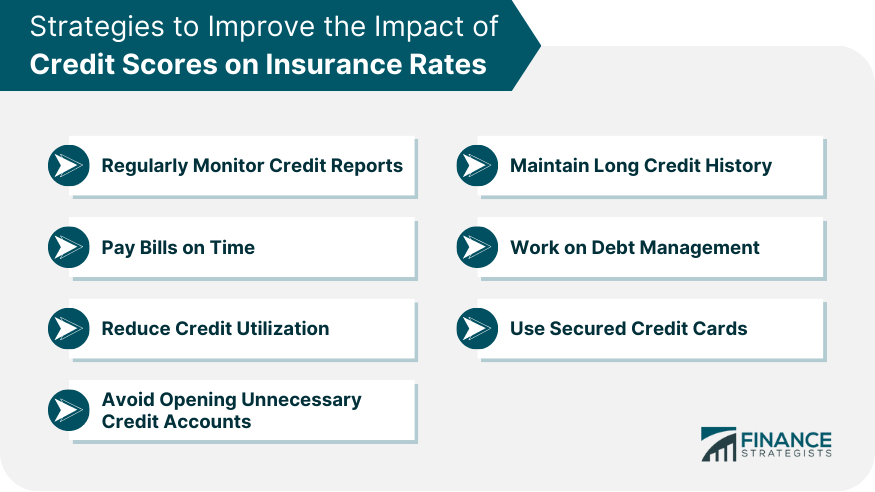

Credit scores have become a significant consideration for insurance companies when determining car insurance rates. Individuals with higher credit scores are deemed to be more financially responsible and are perceived as less likely to file insurance claims. Insurance companies interpret higher credit scores as an indicator of lower insurance risk, leading to potentially lower premiums for policyholders with good credit scores. On the other hand, those with lower credit scores may face higher premiums due to the perceived higher risk of filing claims. This link between credit scores and insurance risk has resulted in credit scores being used as a key metric in evaluating an applicant's risk profile for car insurance. Insurance companies rely on credit scores for various reasons, which help them assess risk and determine appropriate premiums for policyholders. Credit scores serve as an indicator of an individual's financial responsibility and management, giving insurers insights into how applicants handle their finances. This suggests that individuals with higher credit scores may be more likely to be responsible and cautious on the road, leading to a lower likelihood of filing claims. Credit scores provide a standardized metric that allows insurers to categorize applicants into different risk groups, making the risk assessment process more efficient by quickly identifying applicants who may pose higher or lower insurance risks. By considering credit scores along with other relevant factors, insurers can offer personalized insurance rates that align with the perceived risk level of each applicant, ensuring that premiums accurately reflect the individual's risk exposure. The use of credit scores streamlines the underwriting process, allowing insurers to quickly assess an applicant's financial responsibility and risk profile, which leads to faster underwriting decisions and a smoother customer experience. Incorporating credit scores into risk assessment helps insurers maintain consistency in their underwriting practices, ensuring that applicants with similar risk profiles are treated similarly, resulting in fair and transparent insurance pricing. Having a bad credit score can have a persistent and ongoing impact on your car insurance rates. As long as your credit remains poor, you may find yourself facing higher insurance rates compared to those with better credit scores. To mitigate this, the best approach is to work on improving your credit score. Once your credit score improves, you can compare car insurance quotes to find more favorable rates. If you wait until your policy renewal period to shop around, don't forget to ask your current insurance company to review your credit, as some insurers only check for changes every few years, especially for long-time customers. With a positive change in credit score, other insurance companies may offer you more affordable rates, and one of them may be a better fit for your specific needs. By comparing quotes and exploring your options, you can find the most competitive car insurance rates that align with your improved creditworthiness. The other key factors considered in insurance risk assessment include: Deductible Amount: The deductible amount chosen by the policyholder affects insurance risk. Higher deductibles result in lower premiums, as policyholders assume more of the financial risk in the event of a claim. Insurance History: A policyholder's insurance history, including any lapses in coverage or past claims, is considered in risk assessment. A history of frequent claims may lead to higher insurance risk and potentially higher premiums. Coverage Limits: The level of coverage chosen by the policyholder also impacts insurance risk assessment. Higher coverage limits increase the insurer's potential liability, leading to higher premiums. Driving History: Insurance companies analyze an applicant's driving history, including the number of accidents, traffic violations, and claims filed in the past. A clean driving record with no history of accidents or violations signifies a more cautious and responsible driver, leading to a lower insurance risk and potentially lower premiums. Type of Vehicle: The make, model, year, and safety features of the vehicle owned by the policyholder are assessed. Cars that are more expensive to repair or replace are considered higher risk. Stay proactive by checking your credit reports regularly from all three major credit bureaus – Equifax, Experian, and TransUnion. Reviewing your credit reports allows you to identify any errors, inaccuracies, or potential signs of identity theft. If you find any discrepancies, promptly dispute them with the respective credit bureau to rectify the information and ensure your credit score accurately reflects your financial behavior. Consistently paying your bills on time is one of the most critical factors in improving your credit score. Payment history makes up a significant portion of your credit score, and maintaining a record of on-time payments can positively impact your creditworthiness. By demonstrating responsible payment habits, you signal to insurance companies that you are a reliable and low-risk policyholder, which may lead to lower insurance premiums. Credit utilization refers to the percentage of your available credit that you are currently using. Aim to keep your credit card balances below 30% of the available credit to exhibit responsible credit management. High credit utilization can indicate financial strain and may negatively affect your credit score. By keeping your credit card balances low, you demonstrate that you can manage credit responsibly, potentially resulting in improved insurance rates. Opening multiple credit accounts within a short period can have a negative impact on your credit score. Each credit inquiry made by a lender during the application process can slightly lower your score. Moreover, having many new credit accounts may suggest that you are in financial distress or overextending yourself, which insurers may view as a higher insurance risk. Be strategic in applying for credit and avoid opening unnecessary accounts that could potentially harm your credit score and insurance rates. The length of your credit history also plays a role in your credit score. A longer credit history demonstrates stability and reliability in handling credit over time. If you have older credit accounts with a positive payment history, try to keep them open, as they contribute positively to your credit score. Closing old credit accounts can shorten your credit history and potentially lower your credit score, which may impact your insurance rates. Reducing overall debt can lead to an improvement in your credit score. Focus on responsibly managing your outstanding debts and work towards paying off high-interest debts first. By demonstrating a commitment to reducing debt, you can positively influence your creditworthiness and potentially secure more favorable insurance rates. If you are rebuilding your credit or have a limited credit history, consider using secured credit cards. Secured credit cards require a cash deposit as collateral and can help you build or improve your credit score when used responsibly. Credit scores play a significant role in the determination of car insurance rates for many insurance companies. Individuals with higher credit scores are perceived as financially responsible and are likely to exhibit safer driving habits, leading to lower insurance risk. As a result, policyholders with good credit scores may enjoy potentially lower premiums. To improve credit scores' impact on insurance rates, consumers should monitor credit reports, pay bills on time, reduce credit utilization, avoid credit accounts, maintain credit history, work on debt management, and use secured credit cards. These proactive steps can enhance creditworthiness and potentially lead to more favorable insurance premiums. By staying informed about these strategies, consumers can make more informed decisions and potentially secure more affordable car insurance coverage.Does Credit Score Affect Car Insurance Rates?

Why Do Insurance Companies Rely on Credit Scores?

Financial Responsibility

Risk Categorization

Personalized Premiums

Efficiency

Underwriting Consistency

How Long Can Bad Credit Affect Your Car Insurance Rates?

Other Factors Considered in Insurance Risk Assessment

Strategies to Improve the Impact of Credit Scores on Insurance Rates

Regularly Monitor Credit Reports

Pay Bills on Time

Reduce Credit Utilization

Avoid Opening Unnecessary Credit Accounts

Maintain Long Credit History

Work on Debt Management

Use Secured Credit Cards

Conclusion

Does Credit Score Affect Car Insurance Rates? FAQs

Credit scores can influence car insurance rates as many insurers consider them when assessing risk and determining premiums.

Individuals with higher credit scores are often perceived as financially responsible, leading insurers to view them as lower insurance risks, potentially resulting in lower premiums.

A lower credit score may lead to higher car insurance rates as insurers may consider it an indicator of higher insurance risk.

No, while credit score is an important factor, car insurance rates are influenced by various other factors, including insurance and driving history, vehicle type, deductible amount, and coverage limits.

Improving your credit score through responsible financial behavior may positively impact car insurance rates, potentially leading to more affordable premiums.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.