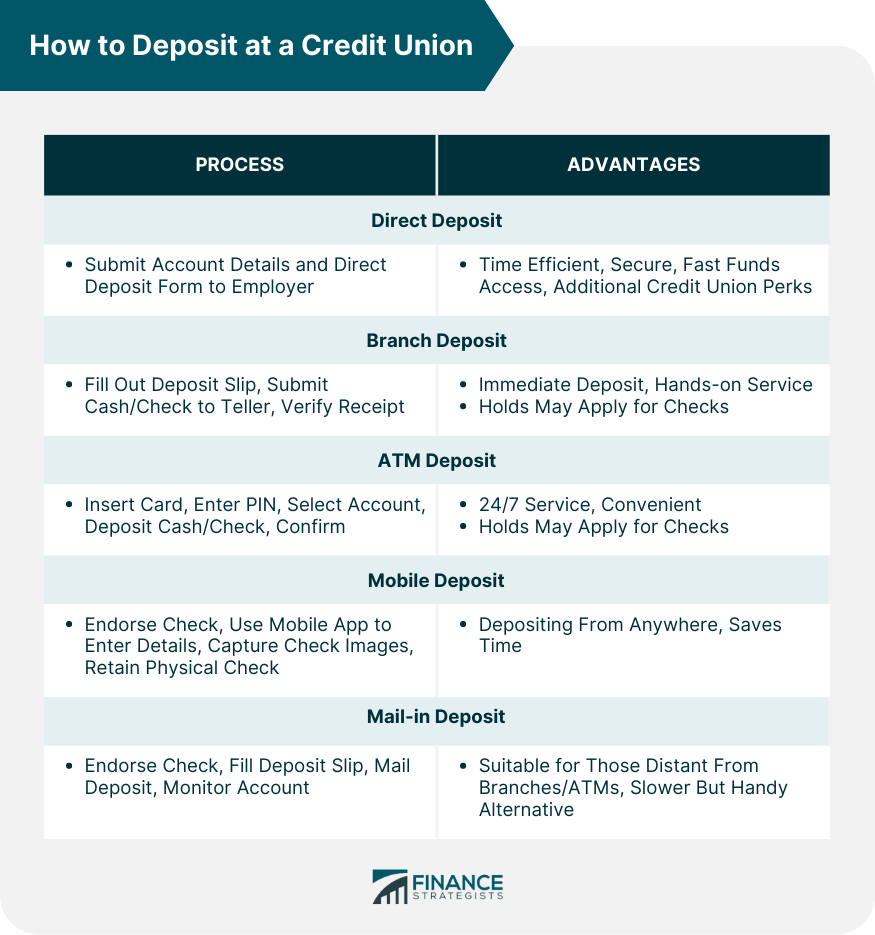

Deposits form the backbone of any banking operation, credit unions included. Despite differences in governance, credit unions employ similar procedures to banks for facilitating deposits. The key difference between banks and credit unions is that credit unions, being member-owned, prioritize delivering high-quality services to their customers. Also, since they operate on a non-profit basis, they typically offer higher interest rates on deposits than their for-profit banking counterparts. Your financial goals dictate your deposit type choice: checking accounts for routine transactions like bill payments and savings accounts for accumulating savings with higher interest rates. Money market accounts, on the other hand, offer higher yields and come with check-writing privileges. Lastly, certificates of deposit, while being less liquid, promise higher returns over the long term. Direct deposit is an efficient, secure method of depositing money electronically into your account. Instead of handling a physical check, the money is automatically transferred to your account on a pre-decided date. It eliminates the risk of checks getting lost or stolen and facilitates quicker access to funds. Setting up direct deposit involves these steps: 1. Gather Necessary Details: This includes your account number and your credit union's routing number, which can be found on your checks or account statements. 2. Obtain a Direct Deposit Form: This can typically be found on your credit union's website or at a local branch. 3. Submit the Form: Provide your employer with the filled out form and the necessary account details. Direct deposit offers several benefits: Time Efficiency: It negates the need to physically visit a branch or ATM to deposit checks, saving valuable time. Security: It lowers the risk of check loss or theft. Additionally, it eradicates the possibility of checks getting damaged or misplaced in transit. Fast Access: It ensures quicker access to your funds. Moreover, the direct deposit process eliminates any delays that might occur due to holidays or non-business days. Additional Perks: Many credit unions offer extras like waived fees or early pay for members using direct deposit. Prior to your branch visit, ensure that you have all necessary items, including the cash or checks you wish to deposit, a deposit slip, and your ID. It's also a good idea to confirm the branch hours and any special procedures in place. 1. Fill Out Deposit Slip: At the branch, fill in a deposit slip with necessary details like your account number, date, and deposit amount. 2. Handover to Teller: Give the deposit slip along with the cash or checks to the teller for processing. 3. Verify Receipt: After the deposit is processed, the teller will provide a receipt. Ensure to check the details for accuracy. 1. Endorse Check: Sign the back of the check. 2. Fill Out Deposit Slip: Complete a deposit slip, as with cash deposits. 3. Handover to Teller: Give the endorsed check and deposit slip to the teller. 4. Note on Hold Policy: Be aware that credit unions may put a hold on check deposits as per their policy, delaying immediate access to these funds. Most credit unions are part of a shared network, enabling members to use ATMs of other credit unions and certain banks without incurring additional charges. To find a convenient ATM location, you can use your credit union’s website or mobile app. Some credit unions also provide locator tools that can assist you in finding the nearest in-network ATM. 1. Card Insertion and PIN Entry: Insert your debit card into the ATM and enter your Personal Identification Number (PIN). 2. Choose Deposit Option: From the on-screen menu, select the "deposit" option. 3. Select Account and Deposit Cash: Choose the account to which you want to deposit, then insert your cash into the machine. 4. Confirm Deposit: Verify and confirm the deposit amount on the screen before concluding the transaction. 1. Card Insertion and PIN Entry: Same as a cash deposit. 2. Choose Deposit Option: Select the "deposit" option, then choose "check deposit." 3. Endorse and Insert Check: Sign the back of the check, and then insert it into the ATM as instructed. 4. Confirm Deposit: The machine will scan the check. Verify and confirm the deposit amount before completing the transaction. Mobile deposit is a feature that allows you to deposit checks from anywhere using your smartphone. This feature, available through your credit union’s mobile app, saves you the trouble of visiting a branch or ATM, making it a convenient choice for many. To use mobile deposit, you'll need a few things: a smartphone, your credit union's mobile app, and a stable internet connection. Some credit unions may require you to register for a mobile deposit before you can use the service. 1. Endorse the Check: Sign the back of the check and add "For mobile deposit only" under your signature. 2. Log Into Mobile App: Access your credit union's mobile app. 3. Select Deposit Option: Choose the deposit function within the app. 4. Enter Deposit Amount: Key in the amount written on the check. 5. Capture Check Images: Take clear, well-lit photos of both sides of the check to submit. 6. Retain the Check: It's advised to keep the physical check until the credit union confirms the deposit. For those who can't visit a branch or an ATM or are uncomfortable with digital banking, mailing in a check is a viable option. Though not as immediate as other methods, mail-in deposits can still be a useful tool in your banking toolbox. Mail-in deposits are especially useful for individuals who live a significant distance from a branch or ATM, are currently out of town, or prefer to avoid digital banking methods. It provides an alternative, albeit slower, method of deposit. 1. Endorse the Check: Sign the back of the check. 2. Complete a Deposit Slip: Fill out a deposit slip with the necessary account information. 3. Mail the Deposit: Put the endorsed check and the deposit slip in an envelope, and mail it to your credit union's specified mailing address. 4. Monitor Your Account: After mailing, regularly check your account to confirm the deposit has been received and processed by the credit union. Each credit union has its own rules regarding deposit limits and holds, particularly for check deposits. Understanding these policies is crucial to managing your account effectively and avoiding any unexpected surprises, such as a delay in fund availability. Credit unions typically have a daily cut-off time for deposits, beyond which deposits are considered as made on the next business day. Therefore, it's important to know your credit union's specific cut-off times to ensure timely deposit of funds. Upon deposit, particularly with a check, you may notice two different balances displayed for your account: your current balance and your available balance. While your current balance reflects the total amount of money in your account, your available balance indicates the funds you can spend or withdraw. Understanding these two balances is key to managing your spending and avoiding potential overdrafts. Digital wallets like Apple Pay, Google Pay, or Samsung Pay have become increasingly popular for their convenience and security. They allow you to store your debit card information securely and make payments directly from your phone. In some cases, you may also be able to make deposits directly into your credit union account using your digital wallet. Credit unions may also offer P2P payment options, such as Zelle or Venmo. These services allow you to send money directly to another person's account with just a few taps on your smartphone. Some credit unions also let you use these services to deposit money into your own account. While not yet mainstream, some progressive credit unions are starting to accept deposits in cryptocurrencies such as Bitcoin or Ethereum. It's essential, however, to understand the risks and potential regulatory issues associated with crypto deposits before using this method. Depositing funds at a credit union can be achieved through various methods, each providing unique advantages. Direct deposit offers an efficient, safe option for automated fund transfer, while physical deposits at branches afford immediate deposit and personal service. Depositing at ATMs provides round-the-clock service and convenience, and mobile deposits allow for any time, anywhere depositing. Mail-in deposits, although slower, are useful for individuals distant from branches or ATMs. Beyond these, credit unions have started offering innovative options like digital wallets, P2P payments, and even crypto deposits. Regardless of the method, it's crucial to understand the policies regarding deposit limits, holds, cut-off times, and account balances to effectively manage your account. The choice of deposit method depends on your needs, preference, and proximity to a branch or ATM, all with the aim of maximizing convenience and the benefits credit unions offer.Understanding Deposits in Credit Unions

How to Deposit at a Credit Union

Direct Deposit

Defining Direct Deposit

Steps to Set Up Direct Deposit

Advantages of Using Direct Deposit

Physical Deposit at Branch

Preparing for a Branch Visit

Steps for Depositing Cash or Checks at a Branch

Steps for Depositing Checks at a Branch

Deposit at ATM

Locating a Credit Union or Shared ATM

Steps for Cash Deposit at an ATM

Steps for Check Deposit at an ATM

Mobile Deposit

Understanding Mobile Deposit

Pre-requisites for Mobile Deposit

Process of Depositing Checks Using Mobile Deposit

Mail-in Deposit

Understanding Mail-in Deposit

Situations When Mail-in Deposit is Useful

Steps to Follow for Mail-in Deposit

Things to Keep In Mind When Depositing at a Credit Union

Deposit Limits and Holds

Cut-off Times and Deposit Availability

Account Balance

Alternative Deposit Methods at Credit Unions

Digital Wallets

Peer-to-Peer (P2P) Payments

Crypto Deposits

Bottom Line

How to Deposit at Any Credit Union FAQs

Provide your employer with your account number and the credit union's routing number. Some credit unions may require a direct deposit form.

Bring your cash or checks, a deposit slip, and your ID for a physical deposit at a credit union branch.

Use your debit card to access your account at the ATM, then select the deposit option and follow the prompts to deposit cash or checks.

The mobile deposit lets you deposit checks using your smartphone. Download your credit union's mobile app and follow the prompts to deposit your check.

Mail-in deposits are ideal when you can't visit a branch or ATM, are out of town or prefer not to use digital banking methods.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.