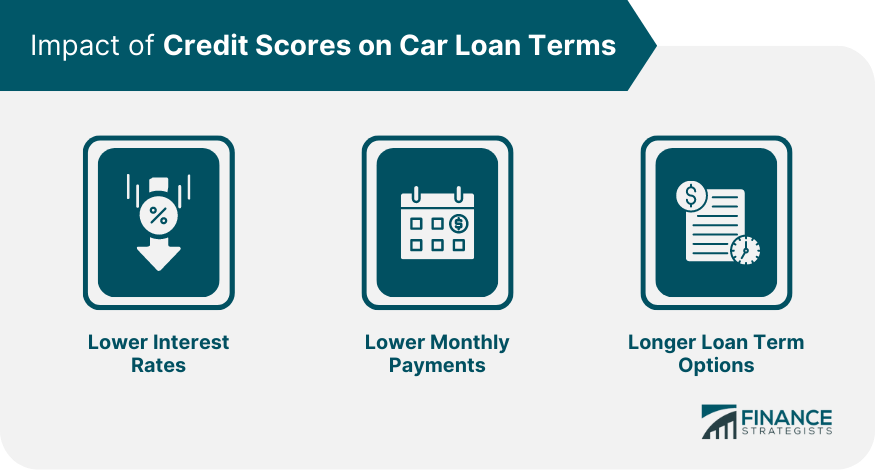

When purchasing a car, your credit score becomes a key determinant in the financing process. A credit score is a numerical representation of your creditworthiness, reflecting your past credit behavior and how likely you are to repay a loan. It ranges from 300 to 850, with higher scores indicating better creditworthiness and lower risk to lenders. In general, a credit score of at least 600 is considered the minimum requirement to qualify for a traditional auto loan. However, keep in mind that the specific credit score required may vary depending on the lender and the loan program. A credit score below 600 might place you in the subprime category, which means you may be considered a higher-risk borrower by lenders. In such cases, traditional auto financing options might be limited, and you may need to explore specialized bad credit car loans. These loans are designed to help individuals with lower credit scores obtain financing for a vehicle, but they often come with higher interest rates and less favorable terms compared to traditional loans. Credit scores have a significant impact on the terms of a car loan, shaping the overall cost and repayment experience. Understanding how credit scores influence car loan terms is essential for any prospective car buyer. Lower Interest Rates: A high credit score can lead to lower interest rates on your car loan. Lower interest rates mean you will pay less in interest over the life of the loan, saving you money in the long run. Lower Monthly Payments: With lower interest rates, your monthly car loan payments will be more affordable. Lower monthly payments can ease the strain on your budget, making it easier to manage your finances. Longer Loan Term Options: A strong credit score may grant you more flexibility in choosing the length of your loan term. Lenders might be willing to offer longer loan terms, such as 60 or 72 months if you have a high credit score. When it comes to car loan interest rates, credit scores are indeed crucial, but they are not the sole factors that lenders consider. Here are additional elements that influence car loan interest rates: Lenders assess your income to determine your ability to repay the car loan. A stable and sufficient income can instill confidence in lenders, even if your credit score is not perfect. A higher income can lead to more favorable interest rates as it demonstrates your capacity to handle the loan. The length of the loan you request can impact the interest rate offered. Generally, shorter loan terms come with lower interest rates because the lender is taking on less risk over a shorter repayment period. On the other hand, longer loan terms may have higher interest rates, as they involve more extended exposure to potential changes in your financial situation. The amount you request for the car loan can also affect the interest rate. Larger loan amounts may result in higher interest rates, as they represent a higher level of risk for the lender. It's essential to carefully consider the loan amount and opt for a realistic amount that fits within your budget. Providing a larger down payment can positively influence your interest rate. A substantial down payment reduces the amount you need to borrow, which can make you a more attractive borrower and potentially lead to lower interest rates. Central banks set national interest rates, and these rates can impact various lending rates, including car loan rates. In times of economic growth, interest rates may rise, leading to higher car loan rates. Conversely, during economic downturns, interest rates may be lowered to stimulate borrowing and spending, which could lead to more favorable car loan rates. The type of loan you choose (e.g., new car loan, used car loan, lease, etc.) and the term length can also play a role in the interest rate offered. Different lenders may have varying rates and terms for different types of car loans, so it's essential to compare options thoroughly. Car loan interest rates can fluctuate based on market conditions and competitive pressures among lenders. Shopping around and comparing offers from multiple lenders can help you find the most favorable interest rate available to you. Buying a car with a poor credit score can be challenging, but it's not impossible. Here's a guide on how to buy a car with a poor credit score: Before you start the car-buying process, check your credit score and obtain a copy of your credit report. Understanding your credit situation will help you plan and set realistic expectations for the car-buying process. Determine how much you can afford to spend on a car and calculate a monthly payment that fits within your budget. It's essential to consider not only the car's price but also the ongoing costs like insurance, maintenance, and fuel. A larger down payment can help you secure better loan terms and reduce the amount you need to finance. Save as much as you can for a down payment to improve your chances of getting approved for a car loan. Look for lenders that specialize in providing auto loans to individuals with poor credit. These lenders may be more willing to work with you, even if you have a lower credit score. If possible, find a co-signer with a higher credit score to increase your chances of getting approved for a car loan and potentially get better interest rates. For car buyers with lower credit scores, there are several alternative financing options available that can help them secure a car loan: These dealerships offer in-house financing, specifically targeting individuals with poor credit. The dealerships handle both the car sale and financing, making it convenient for those struggling to get approved elsewhere. However, buyers should approach these dealerships cautiously as they often come with higher interest rates and more stringent terms. It's essential to carefully review the terms and conditions of the loan before committing to ensure it fits within your budget. In this type of loan, the car itself serves as collateral for the loan. By offering the vehicle as security, the lender reduces the risk associated with lending to someone with poor credit. Secured car loans may come with more reasonable interest rates and terms compared to unsecured loans. This involves applying for a car loan with a lender to get an estimate of the terms and interest rates you might receive without a hard inquiry on your credit report. This way, you can shop around and compare offers without potentially damaging your credit score through multiple loan applications. Credit unions often offer more personalized service and may be more willing to work with individuals with lower credit scores. They may have more lenient lending criteria and offer competitive interest rates, making them a viable alternative for car financing. Subprime lenders specialize in providing loans to individuals with less-than-perfect credit. While the interest rates may be higher compared to prime lenders, subprime lenders can be more accommodating to those with lower credit scores. Your credit score significantly influences your car loan terms, impacting the interest rate, monthly payments, and overall cost of the loan. A higher credit score leads to more favorable loan terms, such as lower interest rates and longer loan term options, resulting in potential savings over time. On the other hand, a lower credit score might limit your options, leading to higher interest rates and shorter loan durations. It's essential to consider other factors that lenders take into account when evaluating loan applications, such as income, loan term, loan amount, and economic conditions. Regardless of your credit score, being informed and proactive in the car-buying process will help you make the best financial decisions and find a suitable vehicle within your budget.What Is the Ideal Credit Score to Buy a Car?

How Credit Scores Impact Car Loan Terms

Longer loan terms can result in lower monthly payments, but keep in mind that it also means paying more in interest over time.

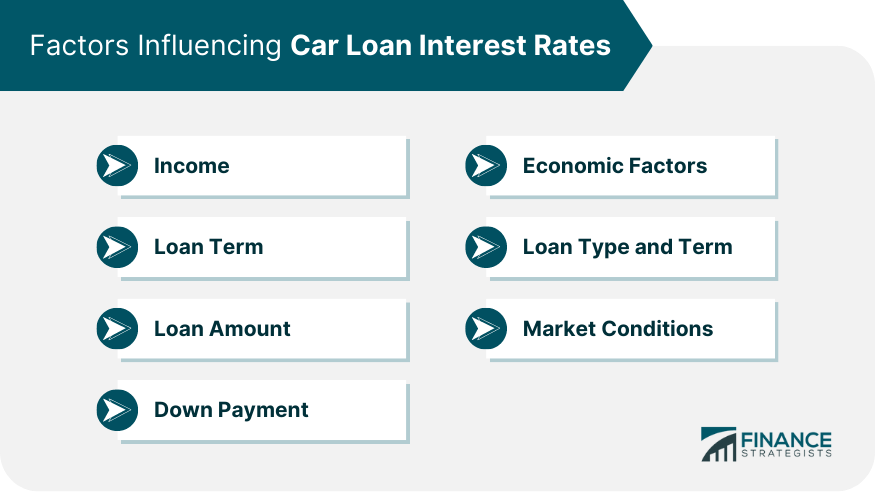

Factors That Influence Car Loan Interest Rates

Income

Loan Term

Loan Amount

Down Payment

Economic Factors

Loan Type and Term

Market Conditions

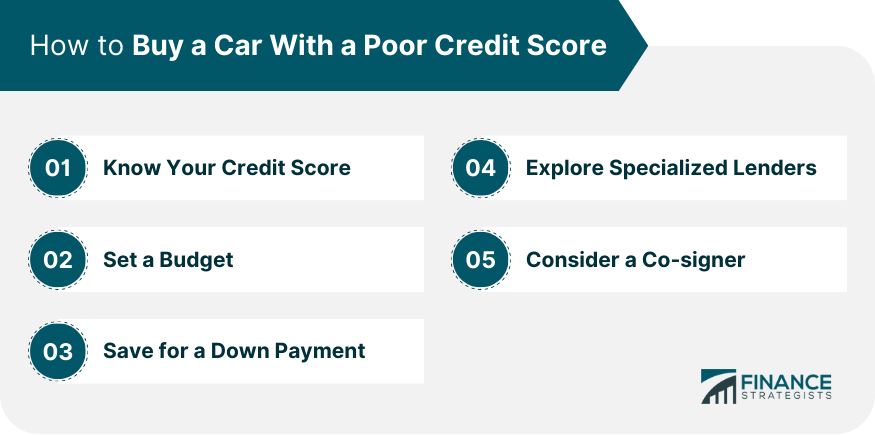

How to Buy a Car With a Poor Credit Score

Know Your Credit Score

Set a Budget

Save for a Down Payment

Explore Specialized Lenders

Consider a Co-signer

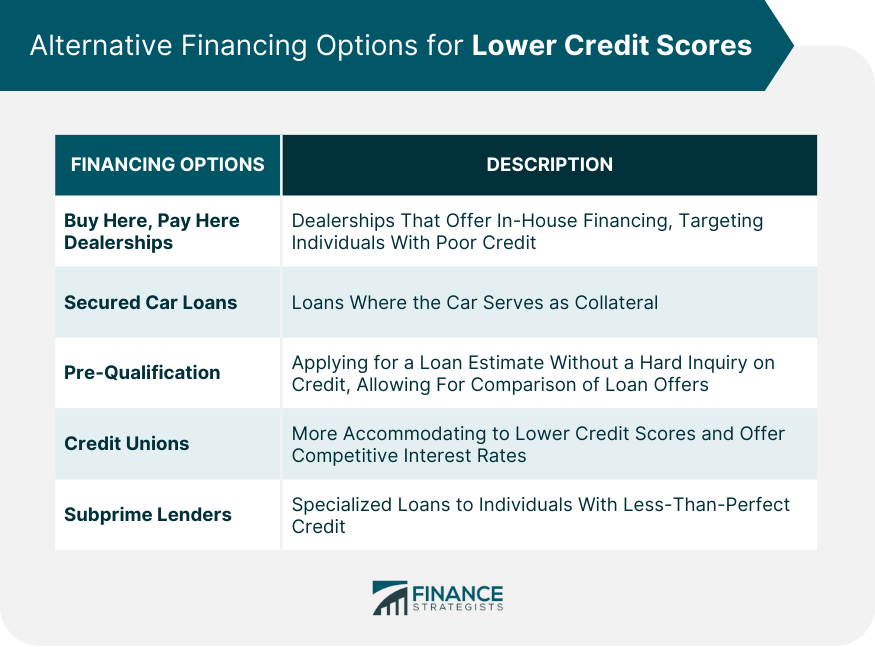

Alternative Financing Options for Those With Lower Credit Scores

Buy Here, Pay Here Dealerships

Secured Car Loans

Pre-qualification

Credit Unions

Subprime Lenders

Conclusion

Ideal Credit Score to Buy a Car FAQs

The ideal credit score to buy a car is generally considered to be at least 600 to qualify for a traditional auto loan.

Yes, you can still buy a car with a credit score below 600, but you may face challenges and may need to explore specialized bad credit car loans.

A higher credit score can lead to lower interest rates, more favorable loan terms, and lower monthly payments.

In addition to credit score, factors like income, loan term, loan amount, and market conditions can influence car loan interest rates.

Yes, alternative financing options for lower credit scores include "Buy Here, Pay Here" dealerships, secured car loans, co-signers, and pre-qualification.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.