Credit Unions are non-profit financial cooperatives that offer a full range of financial services. They offer services such as checking and savings accounts to more substantial commitments like home and auto loans. Unlike traditional banks, which prioritize profit for shareholders, credit unions are owned by their members, prioritizing high-quality service and fair rates. The benefits of joining a credit union are numerous. They often offer higher interest rates on savings and lower rates on loans than traditional banks. Additionally, customer service is often superior at credit unions, as the primary goal is to serve members, not shareholders. Due to their smaller size and localized operations, they're often able to provide more personalized service. Eligibility is the first step to joining a credit union. Most have a common bond requirement, meaning their members share a certain characteristic, like living in a particular geographic area or working in the same industry. However, some credit unions have more flexible membership requirements, allowing more people to join and benefit from their services. A common bond might be employment-based, family-based, or geographically-based. For instance, some credit unions serve specific industries, like education or the military. However, many credit unions define their common bond more broadly, such as serving anyone who lives, works, or worships in a certain area. The eligibility criteria will vary between credit unions. Usually, this information can be found on the credit union's website or by contacting them directly. If it's not immediately apparent, don't hesitate to reach out to the credit union's customer service for clarity. Deciding between a local or a national credit union depends on your preferences and banking needs. Local credit unions often offer a more personalized service, while national credit unions typically provide more extensive branch and ATM networks. This can be crucial if you travel often or if you prefer to bank in person. Just like with any financial decision, it's important to shop around. Look at what products and services each credit union offers, their loan and savings rates, and their fee structures. Consider what financial products you're most likely to use and ensure that the credit union excels in these areas. When applying, you'll usually need to provide your Social Security Number, driver's license or other government-issued ID, and proof of eligibility (such as proof of residence or employment). You might also need your current bank account information for funding your new account. The online application form will guide you through the process of entering this information. Make sure you double-check all information before submission to avoid any issues or delays. After you've filled out the form, you can submit it directly on the credit union's website. After your application is approved, you'll need to fund your account. This initial deposit signifies your share in the credit union, officially making you a member. You can typically fund your new account via an ACH transfer, wire transfer, or check. Some credit unions may also allow you to fund your account with a debit or credit card, but there may be additional fees associated with these methods. The minimum deposit required to open an account can vary significantly between credit unions, so be sure to check this before applying. Some credit unions have low minimum deposit requirements, making it easy for people of all income levels to join. As a member, you can take advantage of all the services and benefits your credit union offers. This includes savings and checking accounts, loans, credit cards, and possibly even investment and insurance services. Beyond this, credit unions often emphasize community involvement and personal growth, with opportunities like financial education resources and counseling. Most credit unions today provide a comprehensive suite of online and mobile banking features. These digital tools allow you to manage your finances from anywhere, anytime. You can check your balance, transfer funds, deposit checks, apply for loans, and more. Plus, mobile banking apps often include additional tools to help manage your finances, such as budgeting tools and alerts. Maintaining your membership usually involves keeping at least a minimum balance in your account. Plus, some credit unions require that you maintain your common bond status, such as staying within a geographic area or maintaining employment with a certain company. Therefore, it's important to keep these requirements in mind and ensure you're able to meet them in the long term. The online application process for joining a credit union often requires several documents for verification purposes, such as your Social Security Number, a government-issued ID, and proof of eligibility (like proof of residence or employment). If you do not have all these documents ready at the time of application, the process can be slowed down, delaying your membership. Therefore, it's important to gather all necessary documents before beginning the application process to ensure a smooth and timely experience. Although many credit unions have modernized their application processes to be fully online, some still might require a part of the process to be completed offline. This could involve a visit to a physical branch to finalize the application. This can pose a challenge, especially for those who chose the credit union for the convenience of online banking or for those who live far from any physical branches. Before starting the application, it can be beneficial to understand the full application process of the credit union and prepare for any necessary in-person interactions. Regular account monitoring is essential for keeping track of your finances. It can help you notice any unusual or fraudulent activity on your account and take immediate action. It also helps you understand your spending habits, enabling better financial decisions. Most credit unions provide online and mobile access to your account, making it convenient to regularly check your account status. Automatic payments can be a great way to manage your bills and ensure payments are made on time. This not only helps avoid late fees and penalties but also can improve your credit score by ensuring timely payment of credit cards or loans. Most online banking platforms, including those of credit unions, offer the ability to set up automatic payments. Many credit unions offer online tools to help manage your budget. These tools can provide a visual representation of your spending, allow you to set spending limits on various categories, and help you track progress toward financial goals. Utilizing these tools can provide valuable insights and make budgeting easier and more effective. Keeping your online banking login information secure is crucial to protect your account from unauthorized access. This involves keeping your usernames and passwords confidential, changing your passwords periodically, and avoiding obvious choices for passwords. Additionally, take advantage of any additional security measures offered by your credit union, such as two-factor authentication. Credit unions are known to offer better rates on savings accounts and loans compared to traditional banks. This is because credit unions are not-for-profit organizations that aim to pass savings on to their members. As a result, if you have a savings account, you could earn more interest over time. Similarly, if you have a loan, you might pay less interest, allowing you to reduce your debt faster. Many credit unions offer financial education resources to their members. These resources might include seminars, workshops, online articles, and more on various financial topics. By taking advantage of these resources, members can improve their financial literacy, gaining knowledge that helps them make informed financial decisions. In addition to educational resources, some credit unions also offer financial counseling services. These services can be especially beneficial for members who are struggling financially or who simply want personalized advice to improve their financial situation. Financial counselors can help members create budgets, develop debt management plans, and more. Joining a credit union online brings an array of benefits, such as member-centric service, competitive rates, and comprehensive online and mobile banking tools. The process requires the determination of eligibility based on common bonds and careful account funding. Potential challenges may include document readiness and some credit unions' limited online application capabilities. However, the advantages generally surpass these challenges. Credit unions enable effective financial management with services such as automatic payments, budgeting tools, and secure account management. They also prioritize members' financial health, offering advantageous rates on savings and loans, valuable financial education, and counseling services. Membership in a credit union represents a strategic move towards improved financial health and literacy. Staying informed and proactive is key to fully leveraging these benefits.Understanding Credit Unions

Joining a Credit Union Online

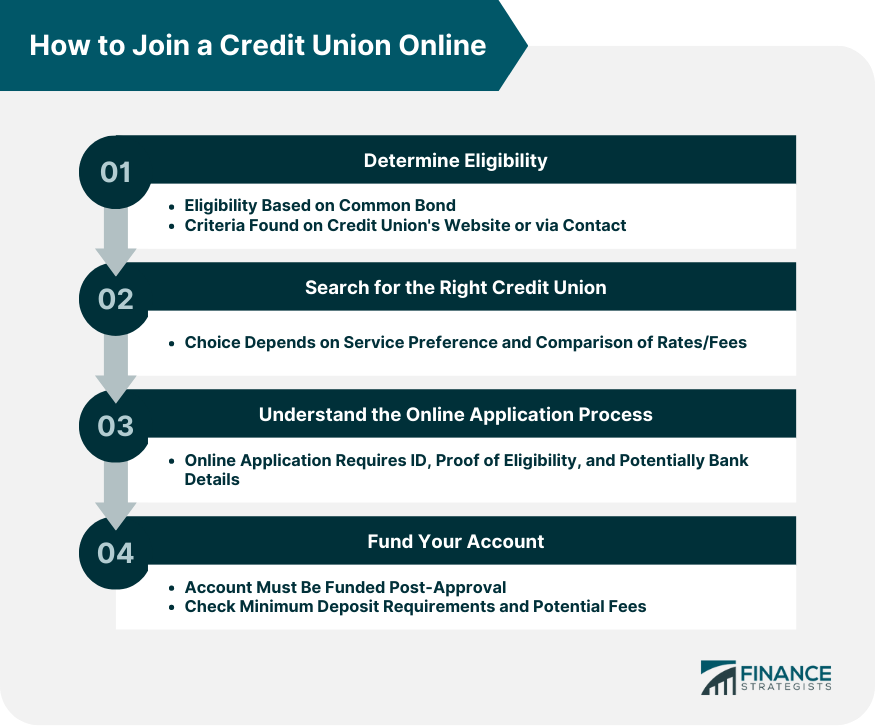

Step 1: Determine Eligibility

Common Bond Requirement

Specific Credit Unions and Their Eligibility Criteria

Step 2: Search for the Right Credit Union

Local vs National Credit Unions

Comparing Services, Rates, and Fees

Step 3: Understand the Online Application Process

Required Information and Documents

Completing and Submitting the Application

Step 4: Fund Your Account

Transfer Methods

Minimum Deposit Requirements

After Joining a Credit Union Online

Member Services and Benefits

Online and Mobile Banking Features

Ongoing Eligibility and Membership Maintenance

Potential Challenges When Joining a Credit Union Online

Document Availability

Limited Online Application Capabilities

Tips on Managing a Credit Union Account Online

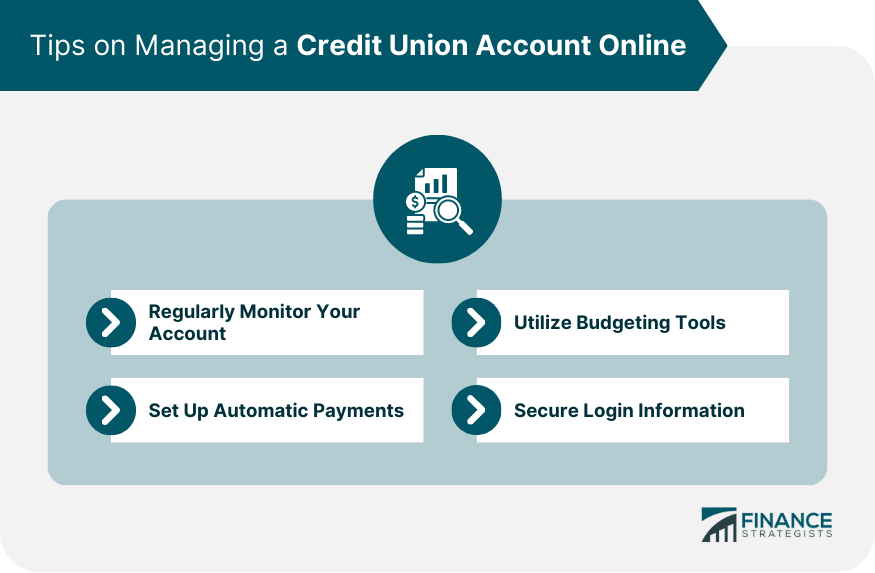

Regularly Monitor Your Account

Set Up Automatic Payments

Utilize Budgeting Tools

Secure Login Information

Role of Credit Unions in Improving Financial Health

Better Rates on Savings and Loans

Financial Education

Counseling Services

Bottom Line

How to Join a Credit Union Online FAQs

Joining a credit union online allows access to better loan and savings rates, personalized services, and improved financial health resources.

You'll need your Social Security Number, a government-issued ID, proof of eligibility (like residence or employment proof), and current bank account information.

You can manage your account through the credit union's online and mobile banking services. These usually allow you to check balances, transfer funds, pay bills, and more.

Challenges can include not having all necessary documents ready or the credit union not having a fully online application process.

Credit unions often offer better savings and loan rates, along with financial education resources, that can help improve your financial literacy and health.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.