Opening a Credit Union Business Account requires a few critical steps. Initially, you need to identify your business needs, including transaction volume, cash flow management, access to credit, and other banking services. Once you've assessed your requirements, research and evaluate different credit unions based on services, fees, interest rates, and member reviews. Keep in mind that credit unions often serve specific communities, so check the membership requirements to ensure your business qualifies. After selecting a suitable credit union, you can apply for an account, which requires providing your business's legal name, address, Employer Identification Number (EIN), and legal documents like articles of incorporation. Post approval, an initial deposit is typically needed to officially open the account. Remember to review the account's terms and conditions, and set up online banking and mobile access for easy management. Before opening a business account with a credit union, it's crucial to clearly define your business needs. These might include transaction volume, cash flow management, access to credit, and other banking services. Consider your business's size, industry, and projected growth to help define these needs. Make a checklist of your requirements to guide you in choosing the right credit union. Once you've defined your business needs, the next step is to evaluate different credit unions. Research the services, fees, interest rates, and member reviews of various credit unions to compare them effectively. Take note of any membership requirements each credit union may have, as credit unions often serve specific communities or affiliations. Unlike banks, credit unions require membership to access their services. Eligibility requirements vary from one credit union to another. Some credit unions serve specific geographic areas, professions, or communities. Before applying, ensure that your business qualifies for membership in the credit union you've chosen. Business savings accounts at credit unions operate similarly to personal savings accounts, providing a platform for businesses to safely store their surplus funds while earning interest. These accounts typically require a low minimum balance and offer higher interest rates compared to traditional banks. While they don't facilitate frequent transactions, they are a great tool for growing your business savings over time. A business checking account is designed to handle daily business transactions such as deposits, withdrawals, and transfers. These accounts often come with features like a high number of free monthly transactions, online banking services, and the issuance of debit cards. Some credit unions also offer tiered business checking accounts, where the benefits increase with the level of account activity or the balance maintained in the account. Business money market accounts combine the benefits of savings and checking accounts. They usually offer higher interest rates than savings accounts while providing more flexibility for transactions. They often come with checks and a debit card, allowing easier access to funds. These accounts are ideal for businesses that have larger balances and want to earn a good return while retaining liquidity. Business CDs are time-bound deposit accounts that offer higher interest rates than savings accounts. Businesses can deposit a lump sum of money for a fixed period, ranging from a few months to several years. The longer the term, the higher the interest rate usually is. However, withdrawal before the maturity date often incurs penalties. This type of account is suitable for businesses that don't need immediate access to their funds and want to earn a high return. While not a deposit account, business credit cards are a common offering from credit unions. They can provide businesses with easy access to credit, rewards programs, and detailed expense tracking. Terms and benefits vary, so businesses should review each card's features to find the best fit. Business checking accounts are designed for daily transactions, such as receiving payments, paying bills, and transferring funds. These accounts often come with a certain number of free transactions per month, with fees incurred for exceeding the limit. High Transaction Limits Overdraft Protection Options Access to Online Banking for Easy Management Debit Cards and Check-Writing Capabilities Easy Access to Funds for Daily Operations Ability to Accept a Range of Payment Types Management of Cash Flow in Real-Time Business savings accounts offer a safe place for businesses to store and grow surplus funds. They typically offer higher interest rates than checking accounts, which can help businesses build their savings over time. Interest Accrual on Deposited Funds Lower Transaction Limits Compared to Checking Accounts Online and Mobile Banking Access Potential to Earn Interest and Increase Business Funds Excellent Option for Setting Aside Emergency Funds or Saving for Future Investments Money market accounts, or MMAs, combine features of both checking and savings accounts. They typically offer higher interest rates than checking accounts and provide more accessibility than savings accounts. Higher Interest Rates Than Most Checking Accounts Check-Writing Capabilities and Debit Card Access Tiered Interest Rates That Increase With the Balance Increased Earnings From Higher Interest Rates Flexibility for Both Saving and Transacting Ideal for Businesses With a Substantial Amount of Liquid Funds Certificates of deposit are time-bound savings accounts that offer higher interest rates in return for leaving a set amount of money untouched for a pre-determined period. Fixed term lengths ranging from a few months to several years Higher Interest Rates Than Most Savings or Money Market Accounts Early Withdrawal Penalties Guaranteed Returns From Fixed Interest Rates Encourages Savings by Penalizing Early Withdrawals Ideal for Long-Term Savings Goals With Minimal Risk To open a business account, you'll need several documents and pieces of information. These usually include your business's legal name and address, your Employer Identification Number (EIN), and legal documents proving the existence of your business, such as articles of incorporation. You may also need personal identification for the account signatories. Most credit unions offer both online and in-person applications for business accounts. Online applications can often be more convenient, allowing you to apply at any time and from anywhere. However, an in-person application allows for more personalized assistance and can be beneficial if you have complex business needs or specific questions. Whether applying online or in person, you'll need to complete the credit union's application form. This form typically asks for details about your business, the account signatories, and your desired account type. After completing the form, you'll need to submit it along with the required documents. The credit union will then review your application and, if approved, open your business account. Once your application has been approved, you'll usually need to make an initial deposit to open the account. The amount required for this initial deposit varies among credit unions, so check with your chosen institution for specific details. After making this deposit, your account will be officially open and ready for use. After opening your account, make sure to thoroughly review the account's terms and conditions. These will cover important information such as fees, transaction limits, and account maintenance requirements. Understanding these details will help you avoid unexpected charges and make the most of your business account. Most credit unions offer online banking and mobile access for their business accounts. This allows you to manage your account from anywhere, at any time. After setting up your account, take the time to set up these online services. These platforms typically allow you to view your balance, transfer funds, pay bills, deposit checks remotely, and more. Online banking provides a variety of features for managing your business account. These often include viewing account balances and transaction history, transferring funds between accounts, paying bills, and setting up recurring payments. Some credit unions also offer budgeting tools and financial management software integration. Mobile banking can provide on-the-go account management. With a mobile banking app, you can check your balance, deposit checks, transfer funds, and even approve wire transactions right from your phone. Spend time familiarizing yourself with your credit union's app to take full advantage of these features. To keep your account in good standing, you'll need to regularly monitor and manage it. This includes keeping track of transactions to ensure accuracy, maintaining the required minimum balance, if any, and reviewing monthly statements. Regular account management can help you avoid fees, catch and report any fraudulent activity early, and stay on top of your business's financial health. Many credit unions offer a variety of loans and financing options for businesses. These might include business lines of credit, commercial real estate loans, equipment financing, and SBA loans. If your business needs additional funding, discuss your options with your credit union. Some credit unions also offer investment services. These can range from simple term certificates (similar to bank certificates of deposit) to more complex services like commercial real estate investment. If you're interested in growing your business funds, talk to your credit union about the investment opportunities they provide. Credit unions often provide various insurance products for businesses. This can include business liability insurance, commercial property insurance, and workers' compensation insurance. These products can help protect your business from potential risks and losses. Credit union business accounts offer businesses an alternative to traditional banking with notable benefits like lower fees, higher interest rates, and personalized customer service. These accounts, including checking, savings, money market accounts, and CDs, each offer unique features to suit different business needs. The application process is straightforward, with both online and in-person options. Once opened, these accounts can be conveniently managed through online and mobile banking. Additionally, credit unions provide other financial services like loans, investments, and insurance products. Businesses should consider their specific needs and circumstances when choosing to open a credit union business account. By doing so, they can leverage the advantages of credit unions and make the most of their financial management.Opening a Credit Union Business Account: Overview

Preparatory Steps for Opening a Credit Union Business Account

Identify Business Needs

Evaluate Different Credit Unions

Determine Eligibility for Membership

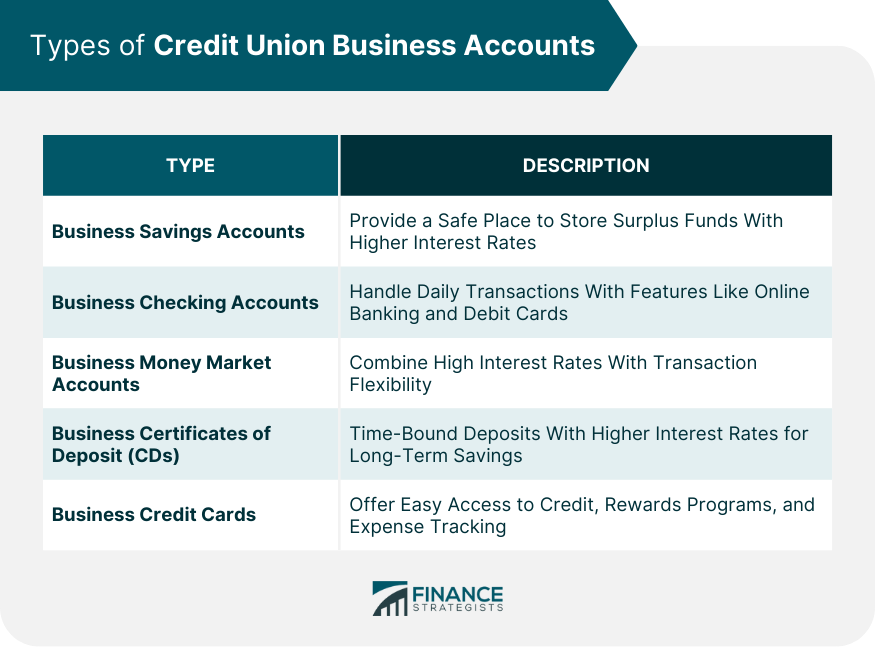

Types of Credit Union Business Accounts

Business Savings Accounts

Business Checking Accounts

Business Money Market Accounts

Business Certificates of Deposit (CDs)

Business Credit Cards

Features and Benefits of Each Type of Account

Business Checking Accounts

Features of Business Checking Accounts

Benefits of Business Checking Accounts

Business Savings Accounts

Features of Business Savings Accounts

Benefits of Business Savings Accounts

Money Market Accounts

Features of Money Market Accounts

Benefits of Money Market Accounts

Certificates of Deposit (CDs)

Features of Certificates of Deposit

Benefits of Certificates of Deposit

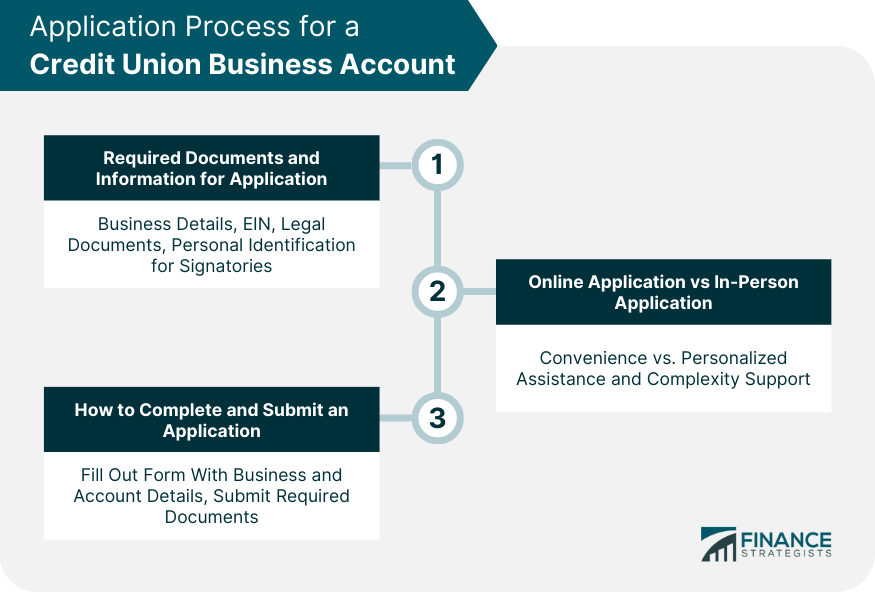

Application Process for a Credit Union Business Account

Required Documents and Information for Application

Online Application vs In-Person Application

How to Complete and Submit an Application

Opening the Credit Union Business Account

Initial Deposit Requirements

Understanding the Terms and Conditions

Setting up Online Banking and Mobile Access

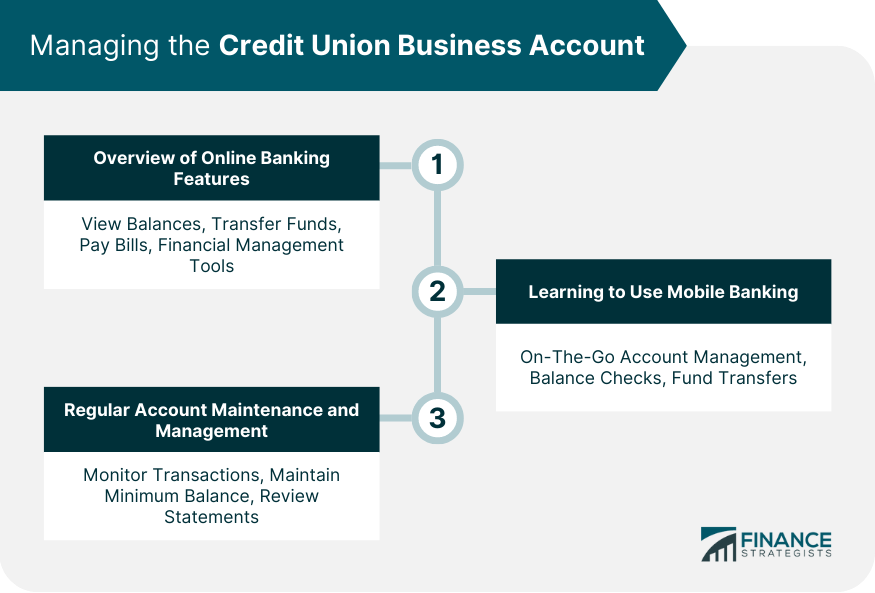

Managing the Credit Union Business Account

Overview of Online Banking Features

Learning to Use Mobile Banking

Regular Account Maintenance and Management

Navigating Services and Products Related to Credit Union Business Account

Loans and Financing Options

Investment Services

Insurance Products

Conclusion

How to Open a Credit Union Business Account FAQs

A credit union business account is a financial account that businesses can open with a credit union. This account facilitates various business transactions like depositing revenues, writing checks, and making online payments. It is an alternative to business accounts offered by traditional banks.

A credit union business account differs from a traditional bank account in terms of the structure of the institutions. Credit unions are not-for-profit, member-owned cooperatives, which often leads to lower fees and higher interest rates. In contrast, traditional banks are for-profit organizations.

The types of business accounts offered by credit unions typically include business checking accounts, business savings accounts, business money market accounts, business certificates of deposit (CDs), and business credit cards. Each type of account serves a specific purpose, catering to different business needs.

To open a credit union business account, a business must first identify its needs and evaluate different credit unions. Once a suitable credit union is selected, the business must verify its eligibility for membership. The actual application involves filling out a form with details about the business and submitting the required documents. After approval, an initial deposit is usually required to open the account.

Besides the basic business account, credit unions often offer additional services and products. These can include loans and financing options, investment services, and insurance products. The specifics of these offerings vary among different credit unions.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.