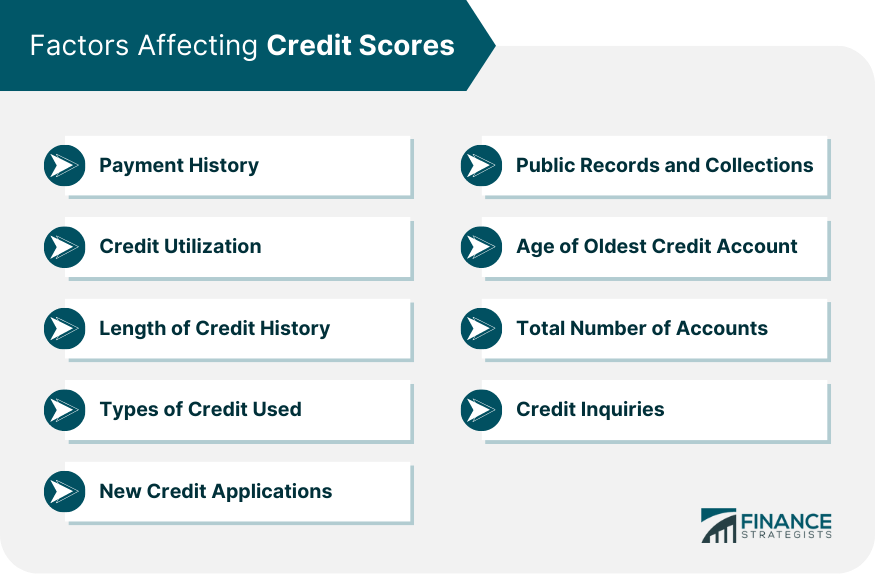

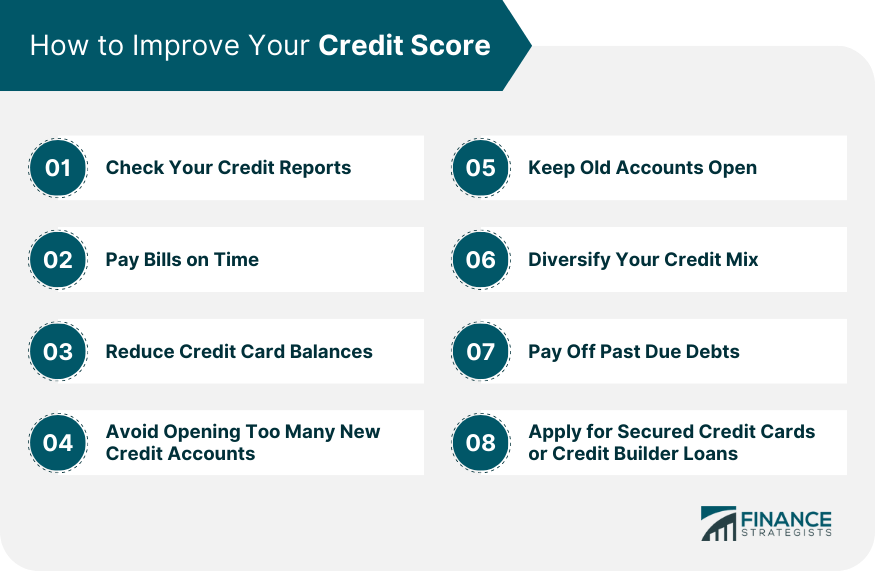

A bad credit score is a low numerical representation of an individual's creditworthiness, based on their credit history and financial behavior. This three-digit number indicates a higher credit risk, with lower scores being associated with increased risk. Lenders, financial institutions, landlords, and other entities use credit scores to assess the likelihood of a person repaying their debts responsibly. It plays a crucial role in determining the terms and conditions offered for loans, credit cards, and other forms of credit. The specific numerical value that qualifies as "bad" can vary depending on the credit scoring model used. Generally, FICO scores consider scores between 300 and 579 as indicative of a bad credit score. A bad credit score suggests that the individual may have a history of missed or late payments, high credit card balances, defaults, bankruptcies, or other negative financial actions that can impact their creditworthiness. By taking proactive measures to address negative financial habits, individuals can work towards enhancing their creditworthiness and gaining access to more favorable credit options. Various factors can affect an individual's credit score, impacting their ability to access credit and financial opportunities. Understanding these factors is essential for managing credit responsibly and improving creditworthiness. Payment History: Timely payments on credit accounts positively contribute to a higher credit score, while late payments or defaults can significantly lower the score. Credit Utilization: A lower credit utilization rate demonstrates responsible credit management and positively influences the credit score. Length of Credit History: A longer credit history tends to improve the credit score, as it provides a more comprehensive track record of financial behavior. Types of Credit Used: Having a diverse portfolio of credit, including credit cards, installment loans, and mortgages, can have a positive effect on creditworthiness. New Credit Applications: Each credit application results in a hard inquiry on the credit report, which can lower the credit score slightly. Multiple inquiries within a short period can be seen as a sign of increased credit risk. Public Records and Collections: Negative items such as bankruptcies, tax liens, and collections can significantly harm credit scores, making it challenging to access credit or financial products on favorable terms. Age of Oldest Credit Account: The age of the oldest credit account impacts the credit score, with a longer credit history generally resulting in a higher score. Total Number of Accounts: The total number of credit accounts, including both open and closed accounts, can influence the credit score. However, it's important to note that opening too many new accounts within a short time frame can negatively affect creditworthiness. Credit Inquiries: Soft inquiries, such as those made for promotional offers or personal credit checks, do not impact credit scores. However, hard inquiries from credit applications can affect the credit score temporarily. Maintaining your credit score offers numerous benefits that can positively impact an individual's financial life and overall well-being. Some of the key benefits include: With a high credit score, individuals are more likely to qualify for loans, mortgages, and credit cards at lower interest rates. This translates to significant cost savings over time, as lower interest rates result in reduced monthly payments and less overall interest paid on loans. Lenders are more willing to extend higher credit limits to individuals with high credit scores. This provides borrowers with greater financial flexibility, allowing them to manage unexpected expenses and take advantage of financial opportunities as they arise. Landlords often reviews credit scores when assessing potential tenants. A high credit score can improve one's chances of securing rental accommodations, as it indicates financial responsibility and reliability in meeting rental obligations. Some employers consider credit scores during the hiring process, especially for roles involving financial responsibility or access to sensitive information. A positive credit score can enhance an individual's employability, reflecting their trustworthiness and financial prudence. Insurance companies use credit scores as a factor in determining insurance premiums. Individuals with high credit scores may qualify for lower premiums, potentially leading to cost savings on auto, home, or other types of insurance. A high credit score increases the likelihood of approval for various financial products, such as personal loans, credit cards, and lines of credit. It also opens doors to specialized financial products and premium credit cards with attractive rewards and benefits. With a high credit score, individuals may have the opportunity to refinance existing debts at more favorable terms, saving money on interest payments and potentially reducing the loan repayment period. Having a low credit score can lead to several significant drawbacks and challenges in managing one's financial life. Some of the key drawbacks of a low credit score include: Lenders view individuals with low credit scores as having higher credit risks, making them less likely to approve loan applications. Even if loans are approved, they often come with higher interest rates and less favorable terms, making borrowing more expensive. A low credit score may result in unpaid debts being sent to collections agencies. Frequent collection calls and debt collection efforts can cause significant stress and strain on an individual's financial and emotional well-being. Rebuilding a low credit score can be a challenging and time-consuming process. Negative marks on the credit report, such as late payments or defaults, can stay on the report for several years, making it difficult to improve credit quickly. Entrepreneurs with low credit scores may encounter challenges in securing financing to start or expand a business. Business loans, lines of credit, or supplier credit terms may be limited or come with unfavorable conditions. Landlords and property managers often check credit scores when screening potential tenants. A low credit score can be a barrier to renting accommodations, as it may raise concerns about the tenant's ability to pay rent on time. Improving your credit scores requires a proactive approach and responsible credit management. While it may take time, dedication, and discipline, the following strategies can help you boost your creditworthiness and achieve better credit scores: Check Your Credit Reports: Start by obtaining free credit reports from the three major credit bureaus – Equifax, Experian, and TransUnion. Review the reports carefully for errors, inaccuracies, or fraudulent accounts. Dispute any incorrect information to have it rectified and potentially improve your credit score. Pay Bills on Time: Set up payment reminders or automatic payments to ensure you never miss due dates. Consistently making on-time payments demonstrates financial responsibility and positively impacts your credit score. Reduce Credit Card Balances: High credit card balances relative to your credit limits (high credit utilization) can lower your credit score. Aim to keep your credit card balances below 30% of the credit limit or even lower if possible. Avoid Opening Too Many New Credit Accounts: Each credit application results in a hard inquiry on your credit report, which can slightly lower your credit score. Limit the number of new credit accounts you apply for and avoid opening unnecessary accounts. Keep Old Accounts Open: The length of your credit history matters, so try to keep old credit accounts open, even if you no longer use them regularly. Closing old accounts can shorten your credit history and potentially lower your credit score. Diversify Your Credit Mix: Having a diverse mix of credit accounts, such as credit cards, installment loans, and mortgages, can positively influence your credit score. If you only have credit cards, consider adding other types of credit to demonstrate responsible credit management. Pay Off Past Due Debts: Address any past due debts or collections accounts promptly. Paying off or settling these accounts can help improve your credit score, although the negative marks may still remain on your credit report for some time. Apply for Secured Credit Cards or Credit Builder Loans: If you're struggling to qualify for traditional credit cards or loans, consider obtaining a secured credit card or a credit builder loan. These options can help you establish or rebuild credit by making regular, on-time payments. A bad credit score is a low numerical representation of an individual's creditworthiness, indicating a higher credit risk. Credit scores play a vital role in financial decisions, impacting access to loans, credit cards, rental housing, and even employment opportunities. A bad credit score can result from missed payments, high credit card balances, defaults, or bankruptcies, affecting an individual's ability to secure credit on favorable terms. To improve a bad credit score, individuals should focus on responsible credit management, timely payments, and reducing debt. Checking credit reports for errors, diversifying credit types, and avoiding excessive new credit applications, can also contribute to credit score improvement. By understanding the factors that affect credit scores and implementing effective strategies to enhance creditworthiness, individuals can pave the way towards a more secure and financially stable future.What Is a Bad Credit Score?

Factors Affecting Credit Scores

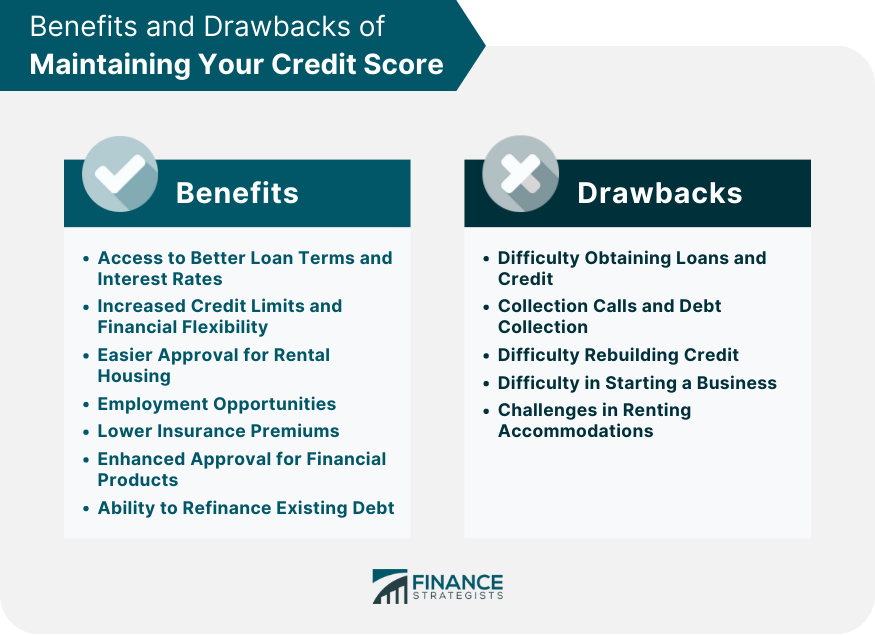

Benefits of Maintaining Your Credit Score

Access to Better Loan Terms and Interest Rates

Increased Credit Limits and Financial Flexibility

Easier Approval for Rental Housing

Employment Opportunities

Lower Insurance Premiums

Enhanced Approval for Financial Products

Ability to Refinance Existing Debt

Drawbacks of a Low Credit Score

Difficulty Obtaining Loans and Credit

Collection Calls and Debt Collection

Difficulty Rebuilding Credit

Difficulty in Starting a Business

Challenges in Renting Accommodations

How to Improve Your Credit Score

Conclusion

Bad Credit Score FAQs

A bad credit score is a low numerical representation of an individual's creditworthiness, indicating higher credit risk based on their credit history and financial behavior.

Generally, credit scores between 300 and 579, as per FICO scores, are considered indicative of a bad credit score.

A bad credit score can make it challenging to obtain loans and credit cards, and even if approved, borrowers may face higher interest rates and less favorable terms.

In some cases, yes. Certain employers may consider credit history when hiring for roles involving financial responsibility or access to sensitive information.

Improving a bad credit score involves responsible credit management, making timely payments, reducing debt, and addressing any negative items on your credit report.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.