A credit union is a type of financial cooperative that provides traditional banking services. These institutions are member-owned, which means they prioritize the financial well-being of their members above earning profits for shareholders. This ethos helps create a sense of community among members while also providing a more personalized banking experience. The appeal of credit unions stems from this focus, offering potential advantages over traditional banks in terms of rates, fees, and community commitment. Unlike traditional banks, credit unions are typically local or regional, enabling them to have a more intimate understanding of their members' financial needs and the economic climate of the area. Most credit unions offer services like savings and checking accounts, loans, and credit cards, often with better rates and lower fees than other financial institutions. These credit unions serve a specific geographic area. If you live, work, or go to school within this area, you may be eligible to join. It's important to check the specific geographical boundaries of the credit union as these can vary greatly. Some credit unions are established by large employers for their employees. Check with your HR department to see if your workplace has a relationship with a credit union, as these often offer great benefits such as convenient payroll deductions. These credit unions are formed around a specific group, association, or organization. Being a member of the group is often the only eligibility requirement, which can make these credit unions an excellent choice for individuals with common interests or affiliations. Start by looking for credit unions in your local area. An online search or a credit union locator tool can help you identify potential institutions. Remember to consider the size, services, and reputation of each credit union. Each credit union offers a unique range of products and services. Look into each institution's offerings to see which one best meets your needs. Consider aspects like loan rates, account types, and additional services like financial education. Credit unions typically require proof of eligibility, like an ID, proof of address, or documentation of your association with a qualifying organization or employer. Be prepared with these documents to ensure a smooth application process. Most credit unions allow applications to be completed online or in person. Choose the method that is most convenient for you, keeping in mind that in-person applications may offer the opportunity for immediate questions and assistance. Most credit unions typically offer both savings and checking accounts. These accounts form the backbone of your financial activities, providing a safe place to store money and a means of carrying out daily transactions. For members interested in better interest rates, credit unions may offer money market accounts and certificates of deposit (CDs). These investment options often come with higher yields than traditional savings accounts, although they may have more specific requirements and limitations. Depending on the credit union, you may also have the option to open retirement accounts. These could include Individual Retirement Accounts (IRAs) or even 401(k) accounts, which are specifically designed for long-term savings and can offer tax advantages. Upon opening your account, you should consider setting up direct deposit if your employer offers it. This allows your paycheck to be automatically deposited into your account, saving you time and providing a more secure way to receive your income. Most credit unions offer online banking platforms. With these digital tools, you can check your account balances, transfer money between accounts, pay bills, and even deposit checks from anywhere you have an internet connection. This convenience can greatly simplify your financial management. Joining a credit union also grants access to various loan products, often at competitive rates. These could include auto loans for vehicle purchases, personal loans for various purposes, and mortgages for home buyers. Many credit unions provide financial counseling services to their members. These services can help guide you in making informed decisions about borrowing, retirement planning, and other financial situations. This benefit can be invaluable in helping you navigate your financial journey and achieve your monetary goals. Credit unions are not-for-profit institutions, which often allows them to offer lower fees for services and better interest rates on savings and loan products than traditional banks. These financial benefits can add up significantly over time, leading to more money in your pocket. Credit unions are owned by their members and are rooted in the communities they serve. This often translates to exceptional customer service and a strong focus on community development initiatives. The personalized service provided by credit unions can make your banking experience more enjoyable and less stressful. Being member-owned institutions, credit unions usually operate on a one-member, one-vote system, regardless of the amount of money a member has on deposit. This democratic structure allows for an equal say in the credit union's decisions, policies, and future directions, unlike traditional banks, where shareholders with more stocks have more voting power. Some credit unions return profits back to their members in the form of dividends or improved services. This can lead to a more rewarding banking experience as members can directly benefit from the success of the credit union. Credit unions may not offer as wide a range of services as traditional banks. For instance, they may lack in diverse investment products, international banking services, or specialized business services, which can be a downside for members seeking a one-stop banking solution. Credit unions typically have fewer branches and ATMs than traditional banks, which may not be as convenient for people who prefer in-person banking or need frequent ATM access. Although many credit unions have improved their digital platforms, they may still lag behind traditional banks in terms of technological innovations, mobile banking options, and online services. Credit unions may be slower in processing transactions compared to traditional banks due to their smaller size and lesser resources. This can lead to delays in check clearances, fund transfers, or loan approvals. Like any financial institution, credit unions offer a variety of financial products and services. These might include savings and checking accounts, auto loans, home mortgages, and even financial education resources. It's important to ensure that the credit union you're considering provides the specific products or services that you require. Keep in mind that these offerings can vary significantly from one credit union to another. Consider how you prefer to handle your banking. If you enjoy in-person service, you'll want to see how many branches the credit union has and where they're located. The convenience of having a branch close to your home or work can make a significant difference in your banking experience. If you prefer digital banking, check that the credit union offers a robust online platform or a user-friendly mobile app. Digital features like mobile deposit, bill pay, and account alerts can make managing your finances much easier. Additionally, verify the size and reach of the credit union's ATM network, as some smaller credit unions might have more limited options. A broad ATM network means you can access cash conveniently without incurring unnecessary fees. As with any financial institution, it's wise to check the financial health of the credit union you're considering. Look for key indicators such as capital adequacy, asset quality, and earnings. You can often find this information on the credit union's website or through online financial resources. Most credit unions are federally insured by the National Credit Union Administration (NCUA), which protects your deposits up to $250,000. This provides an added layer of security for your money. Joining a credit union entails understanding membership requirements, which can be based on community, employer, or association affiliations. After identifying potential credit unions, compare their services, offerings, and reputations to find the right fit. Once decided, prepare the necessary documents for the application process, which can be done online or in person. Upon membership, explore various account options for savings, investments, and retirement. Credit unions offer benefits such as better rates, lower fees, and personalized service due to their member-owned and community-focused nature. However, they may lack in service diversity, ATM locations, technological advancements, and transaction speed compared to traditional banks. Consider the credit union's product offerings, accessibility, and financial health before joining. This holistic view ensures a rewarding financial journey that aligns with personal needs and goals.Overview of Credit Unions

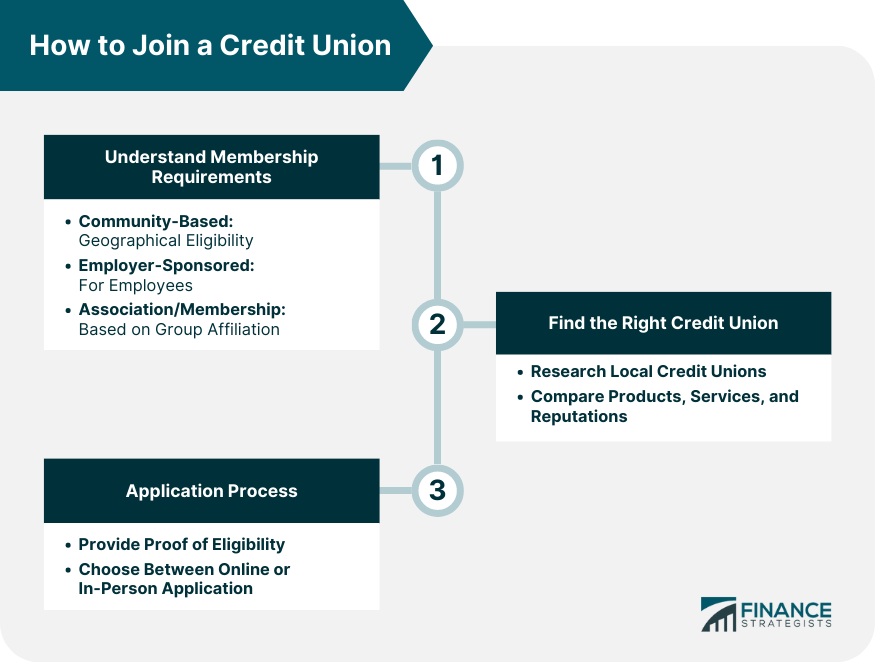

How to Join a Credit Union

Understand Credit Union Membership Requirements

Community-Based Credit Unions

Employer-Sponsored Credit Unions

Association and Membership Group Credit Unions

Find the Right Credit Union for You

Research Credit Unions in Your Area

Compare Credit Union Offerings and Services

Initiate the Application Process

Necessary Documentation for Application

Online vs In-Person Applications

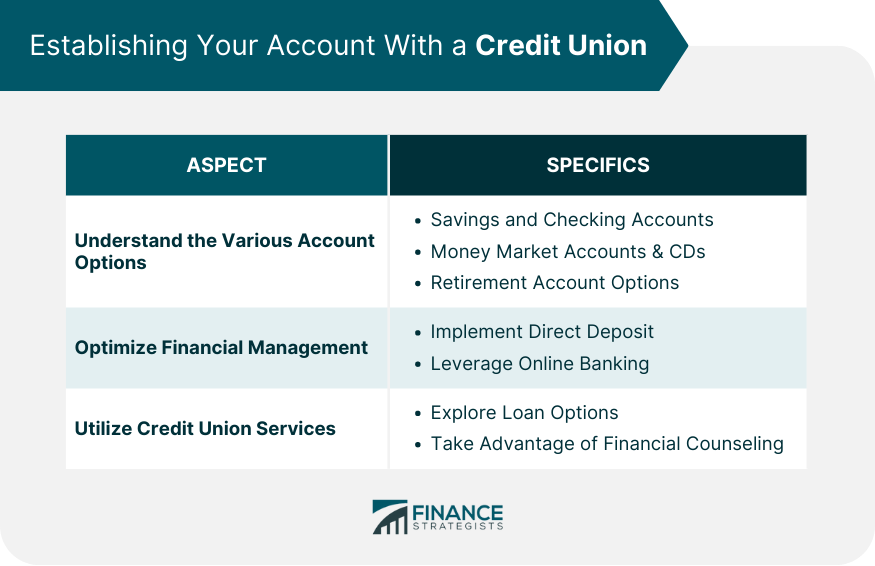

Establishing Your Account With a Credit Union

Understand the Various Account Options

Explore Savings and Checking Accounts

Consider Money Market Accounts and Certificates of Deposit

Investigate Retirement Account Options

Optimize Financial Management

Implement Direct Deposit

Leverage Online Banking

Utilize Credit Union Services

Explore Loan Options

Take Advantage of Financial Counseling

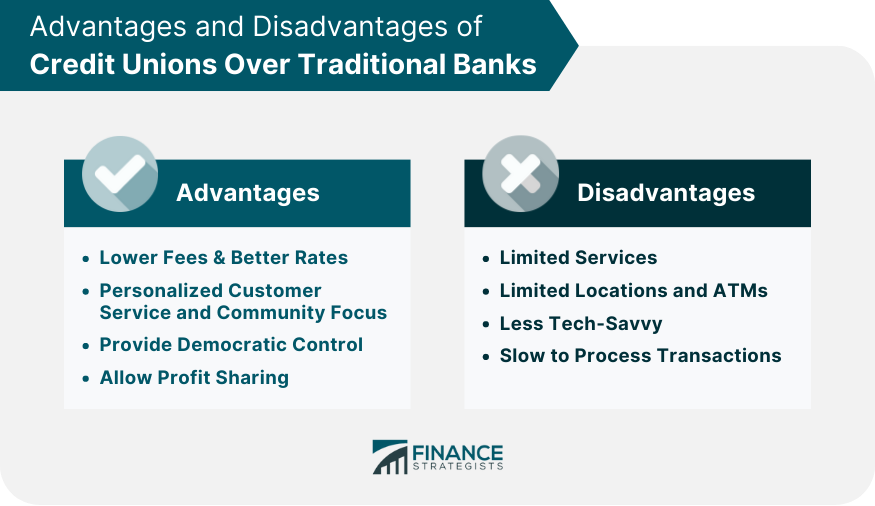

Advantages of Credit Unions Over Traditional Banks

Lower Fees and Better Interest Rates

Personalized Customer Service and Community Focus

Provide Democratic Control

Allow Profit Sharing

Disadvantages of Credit Unions Over Traditional Banks

Limited Services

Limited Locations and ATMs

Less Tech-Savvy

Slow to Process Transactions

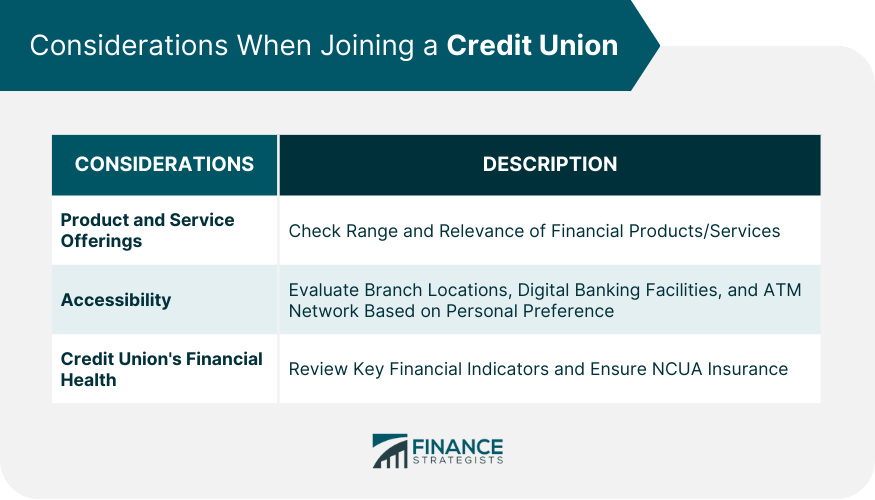

Considerations When Joining a Credit Union

Understand Product and Service Offerings

Assess the Accessibility

Check the Credit Union's Financial Health

Bottom Line

How to Join a Credit Union FAQs

Determine your eligibility, research credit unions in your area, compare their services and complete the application process.

Credit unions typically offer a range of services, including savings and checking accounts, auto loans, home mortgages, and financial education resources.

Consider the credit union's product and service offerings, their accessibility in terms of online access, ATM network, branch availability, and their overall financial health.

Credit unions often offer lower fees, better interest rates, exceptional customer service, and a strong focus on community development initiatives.

After joining a credit union, you can establish your account by understanding the account options available, setting up a direct deposit and online banking, and utilizing their various services.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.