A savings account is a financial tool offered by banks, credit unions, and online institutions, allowing individuals to store their money while earning interest on the balance. It serves as a safe place to keep funds for various purposes, such as building an emergency fund, saving for future goals, or securing money for specific expenses. One of its primary features is its accessibility and the ability to accrue interest over time, providing a secure and convenient way to grow savings. The interest-earning aspect sets a savings account apart from a regular checking account, as it rewards individuals for saving money and encourages financial discipline. This makes it an ideal vessel for both short-term and long-term financial planning, as individuals can set specific goals and steadily contribute to their savings over time. Moreover, a savings account offers liquidity, allowing easy access to funds whenever needed, making it a reliable option for handling unexpected expenses and providing peace of mind. Setting up a savings account is a simple and user-friendly process designed to accommodate various preferences. Individuals have the option to open an account in person at a local bank branch or opt for the convenience of online account setup through the institution's website. To comply with regulatory requirements and ensure the security of the account, applicants will be asked to provide personal information, such as their full name, current address, and Social Security number. This information is vital for identity verification and to establish a legitimate account. Additionally, some financial institutions may request an initial deposit to activate the savings account. The initial deposit amount varies among banks, and some may even offer the flexibility of no-minimum-balance accounts, allowing individuals to start saving without an upfront deposit requirement. By offering this option, banks aim to encourage a broader audience to engage in responsible saving habits and enjoy the benefits of a savings account. One of the primary attractions of a savings account is the opportunity to earn interest on the deposited funds. Interest rates, however, are not standardized and can differ between banks and account types. Understanding interest rates is crucial for individuals to make informed decisions about where to open their savings account, as higher interest rates translate into more substantial earnings over time. To accurately compare the potential returns from different accounts, individuals need to familiarize themselves with the concept of Annual Percentage Yield. APY represents the total amount of interest earned in one year, expressed as a percentage of the account balance. Unlike the nominal interest rate, which only considers the interest earned on the principal amount, APY takes into account the effects of compounding. APY offers a more accurate assessment of the account's growth potential since it considers how often interest is compounded. Compounding refers to the process of earning interest on both the initial deposit and the accumulated interest over time. The more frequently interest is compounded, such as monthly or quarterly, the more significant the impact on the account balance. As a result, accounts with higher APYs and more frequent compounding tend to grow faster, providing account holders with greater returns on their savings. Financial institutions may compound interest daily, monthly, quarterly, or annually, depending on the account type and the bank's policies. Daily compounding is the most advantageous, as it maximizes the growth potential of the savings by adding interest to the account balance every day. On the other hand, less frequent compounding, such as annual compounding, may lead to slower growth. It's important for individuals to inquire about the compounding frequency when selecting a savings account. A higher interest rate enables account holders to earn more from their savings, accelerating the growth of the account balance over time. This means that individuals can reach their financial objectives faster with a savings account that offers a competitive interest rate. Conversely, lower interest rates may hinder the pace of savings growth, potentially affecting the account holder's ability to achieve their financial targets. Savings accounts come in various types, each designed to cater to specific financial needs and objectives. These are commonly offered by banks and credit unions. While they may have lower interest rates compared to other types of accounts, they often have lower minimum balance requirements, making them accessible to a broader audience. These accounts are ideal for individuals who are just starting to save or those with short-term financial goals. Tailored for individuals seeking more significant returns on their savings. With higher interest rates than regular savings accounts, these accounts offer the potential for greater earnings. However, they may require higher minimum balances to access the enhanced interest rates. High-yield savings accounts are well-suited for long-term savings and building emergency funds. Combine features of both savings and checking accounts. They provide higher interest rates compared to regular savings accounts and offer increased liquidity and accessibility to funds. Some money market accounts come with limited check-writing abilities and debit card options, making them a favorable option for those seeking a balance between higher returns and liquidity. Another type of savings account that requires individuals to deposit a fixed amount of money for a specific period is known as the term. While they offer higher interest rates compared to regular savings accounts, early withdrawals may incur penalties, and funds are locked in until the CD matures. These accounts are suitable for individuals who want to save for a specific future goal and are willing to commit their funds for the specified term. A specialized savings account that provides tax advantages for retirement savings. They offer various investment options, such as stocks, bonds, and mutual funds, within the account. Different types of IRAs, including Traditional IRAs, Roth IRAs, and SEP IRAs, have specific eligibility and tax implications. IRAs are suitable for long-term retirement savings and tax planning, helping individuals prepare for their financial future. These are linked to high-deductible health insurance plans. These accounts allow individuals to set aside pre-tax money to pay for qualified medical expenses. Earnings in HSAs grow tax-free, and withdrawals for medical expenses are also tax-free. Additionally, unused funds can be carried over from year to year, making HSAs a valuable tool for managing healthcare expenses and saving for future medical needs. Savings accounts are essential for safeguarding and growing our money, providing a secure space to save for emergencies, future goals, and dreams. Understanding deposits and withdrawals is vital to maximizing the benefits of these accounts and achieving our financial objectives. In-Person Convenience: This method allows account holders to interact with bank personnel directly, providing a personal touch and the opportunity to ask questions or seek assistance if needed. Accessible ATM Deposits: Users can insert cash or checks into the ATM, and the funds are promptly credited to their savings accounts. Many modern ATMs also offer envelope-free cash deposits for added ease. Mobile Banking: With mobile deposit capabilities, users can snap a photo of a check using their smartphones and securely deposit it into their savings account within minutes. Direct Deposit: Offers a hassle-free way to deposit funds directly from one's paycheck or other income sources into the savings account. It eliminates the need for manual deposits and ensures a steady influx of funds with every payment. ATM Withdrawals: ATMs serve as convenient outlets to withdraw cash quickly and easily. They are available at various locations, allowing account holders to access their funds whenever necessary. In-Person Withdrawals: For those who prefer a face-to-face experience, visiting a bank branch for an in-person withdrawal allows for personalized assistance and the opportunity to discuss specific financial needs with a bank representative. Online Transfers: With online banking, transferring money from a savings account to a linked checking account or another external account is a seamless and swift process, accessible from the comfort of one's home. When it comes to managing our savings, it is essential to be aware of the various fees and charges that may apply to our savings accounts. These fees can vary between different financial institutions and may impact our account balance significantly. These are charges imposed by some financial institutions for the upkeep of a savings account. These fees can vary in amount and may be applied regardless of the account's balance. However, some accounts offer fee waivers based on specific factors, such as maintaining a minimum account balance or having other linked services with the bank. By understanding the terms and conditions related to monthly maintenance fees, account holders can take steps to manage these costs effectively. Certain savings accounts require account holders to maintain a minimum balance to avoid fees. If the account balance falls below the specified minimum, the bank may apply additional charges. Minimum balance fees aim to encourage account holders to keep a certain amount of funds in their accounts, ensuring that the bank can invest these funds and generate returns. For individuals considering a savings account with a minimum balance requirement, it is crucial to be aware of the specified amount and plan their finances accordingly to avoid unnecessary fees. Regulation D is a federal rule set by the Federal Reserve that limits the number of certain withdrawals and transfers from savings accounts to six per month. If an account holder exceeds this limit, the bank may charge an excess withdrawal fee for each additional transaction. This regulation is in place to encourage saving habits and maintain the distinction between savings and checking accounts. To prevent excess withdrawal fees, account holders must track their transactions carefully and be mindful of the number of withdrawals made in a given month. Certain transactions, such as in-person withdrawals at the bank branch or ATM, are exempt from Regulation D limitations, allowing account holders to access their funds without incurring additional fees. Savings accounts are essential for keeping our money secure, and the Federal Deposit Insurance Corporation (FDIC) and the National Credit Union Administration (NCUA) play a critical role in safeguarding our funds. The FDIC protects deposits in banks, while the NCUA safeguards funds in credit unions, providing insurance coverage for up to a specific limit in case of a bank or credit union failure. Understanding the insurance coverage offered by these agencies provides peace of mind, assuring account holders that even during uncertain times, their savings remain protected. The convenience of managing finances through online savings accounts is undeniable, but it also comes with the responsibility of ensuring robust security measures. One of the first lines of defense is creating strong and unique passwords for online banking accounts. Combining uppercase and lowercase letters, numbers, and special characters enhances the security of passwords and reduces the risk of unauthorized access. Additionally, enabling Two-Factor Authentication (2FA) adds an extra layer of protection to online savings accounts. With 2FA, account holders need to provide an additional authentication method, such as a verification code sent to their mobile device, when logging in. This prevents unauthorized individuals from accessing the account, even if they manage to obtain the account holder's password. Being vigilant against phishing attempts is equally crucial. Phishing scams use deceptive emails or messages to trick individuals into revealing their personal information or login credentials. Account holders should never share sensitive information or click on suspicious links, as reputable banks and credit unions will never request such information through email. Savings accounts represent secure and accessible tools for safeguarding and growing money, serving as invaluable assets for both short-term and long-term financial planning. Understanding the dynamics of deposits, withdrawals, and interest rates maximizes the benefits of such accounts. It is also essential to remain aware of common fees associated with savings accounts, such as monthly maintenance fees, minimum balance fees, and excess withdrawal fees, to effectively manage finances. Furthermore, the FDIC and NCUA insurance coverage offers reassurance for the safety of deposits, especially during uncertain times. Robust online security measures protect online savings accounts from unauthorized access and phishing attempts. By adopting a proactive and informed approach, individuals can confidently navigate the realm of savings, ensuring the protection and growth of their finances to establish a sturdy financial foundation for the future.What Is a Savings Account?

How Savings Accounts Work

Initial Account Setup and Requirements

Interest Rates and Compounding

Annual Percentage Yield (APY)

Frequency of Interest Compounding

Impact of Interest Rates on Savings Growth

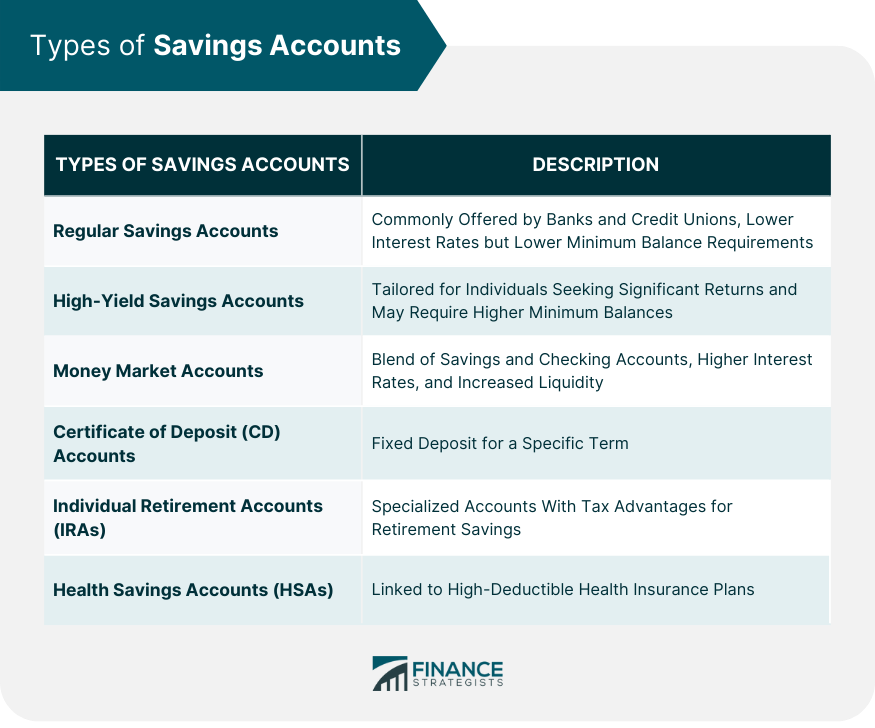

Types of Savings Accounts

Regular Savings Accounts

High-Yield Savings Accounts

Money Market Accounts

Certificate of Deposit (CD) Accounts

Individual Retirement Accounts (IRAs)

Health Savings Accounts (HSAs)

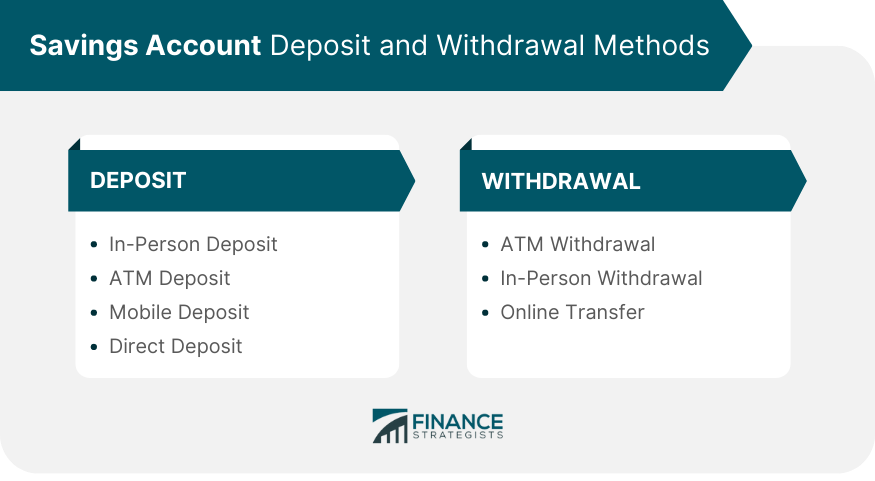

Deposits and Withdrawals

Methods of Depositing

Withdrawal Methods

Fees and Charges

Monthly Maintenance Fees

Minimum Balance Fees

Excess Withdrawal Fees

Safety and Security

FDIC and NCUA Insurance Coverage

Online Security Measures for Online Savings Accounts

Conclusion

How Savings Accounts Work FAQs

A savings account is a financial tool offered by banks, credit unions, and online institutions that allows individuals to store their money while earning interest on the balance. It serves as a safe place to keep funds for various purposes, such as building an emergency fund, saving for future goals, or securing money for specific expenses.

Savings accounts work by depositing money into the account, which then earns interest over time. The interest rate can vary between different banks and account types, affecting the growth of the savings. Account holders can make deposits and withdrawals as needed, with some limitations on the number of withdrawals allowed per month.

Savings accounts offer several benefits, including a safe place to keep money, the potential to earn interest on the balance, and liquidity, allowing easy access to funds when needed. They are ideal for short-term and long-term financial goals and can provide peace of mind during emergencies.

You can deposit money into a savings account through various methods, including in-person at a bank branch, using an ATM, mobile banking with check deposits, or setting up direct deposit from your paycheck or other income sources.

Yes, some savings accounts may have fees, such as monthly maintenance fees, minimum balance fees, or excess withdrawal fees. However, fee structures vary between banks and account types, and some institutions offer fee waivers based on specific criteria, like maintaining a minimum balance or having linked services.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.