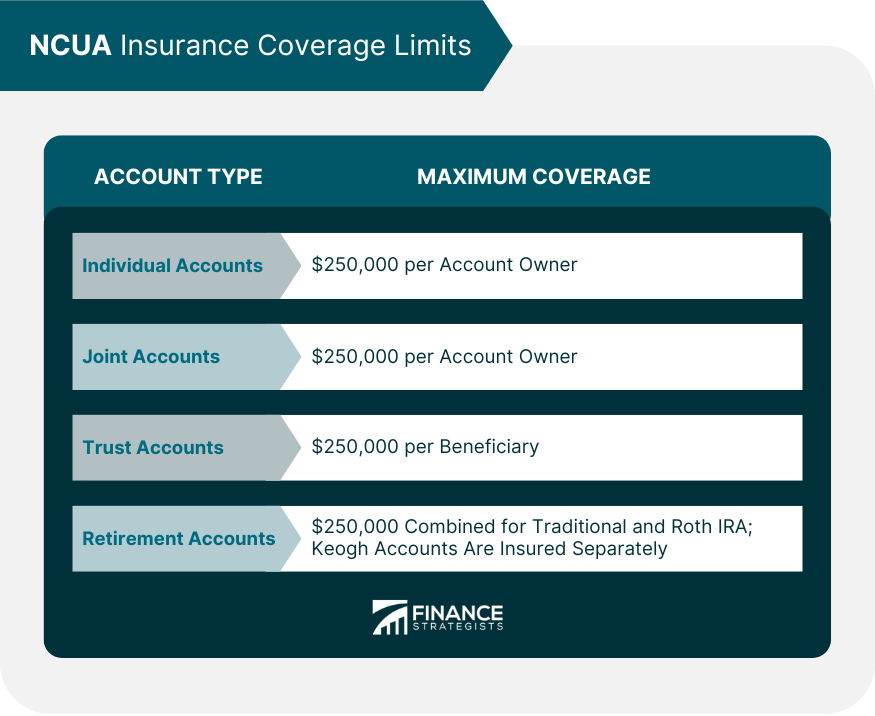

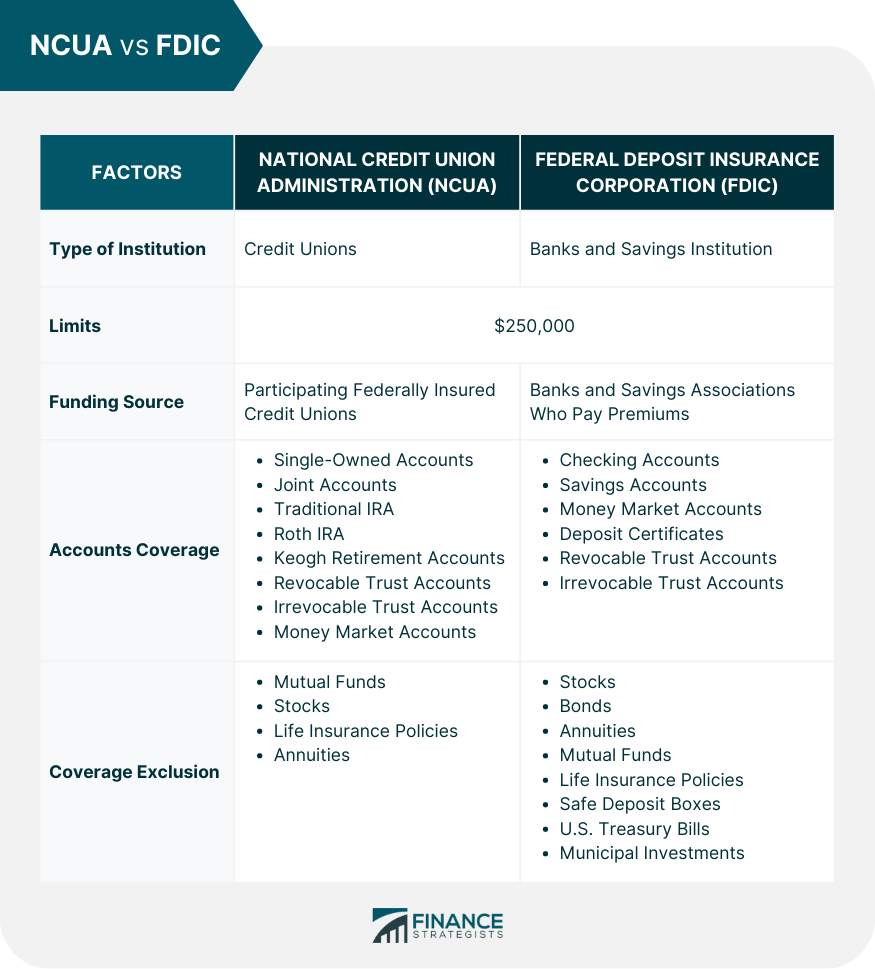

The United States Congress established the National Credit Union Administration (NCUA) in 1970 to oversee and regulate credit unions. It operates as an independent agency of the federal government. The primary objective of the NCUA is to promote credit unions' safety and protect their members' interests. The agency was created in response to the rapid expansion of credit unions in the United States, which led to concerns about their financial stability and solvency. Before the creation of the NCUA, credit unions were regulated by the individual states in which they operated. However, this fragmented regulatory system made ensuring consistent standards across the industry difficult, and the need for a national regulatory body became evident. The NCUA is managed by a three-member Board of Directors who set policy, approve budgets, and adopt regulations. Each Board member is nominated by the President and confirmed by the Senate. The President also designates the Chairman of the Board. The agency has headquarters in Alexandria, Virginia. It has an asset Management and Assistance Center in Austin, Texas, which liquidates credit unions and recovers assets. Three regional offices administer the agency's supervision and examination programs. NCUA conducts regular examinations of federally-insured credit unions to assess their financial health and adherence to regulatory requirements. It also offers guidance and training to credit union management and staff to help them understand and comply with regulatory requirements. NCUA's supervisory authority includes: Examining credit union operations Approving field of membership expansions Granting charters for new credit unions Beyond its supervisory functions, NCUA also works to promote credit union growth. Additionally, it advocates access to affordable financial services. It offers grant and loan programs to assist credit unions in serving low-income communities. It also works to improve financial literacy among credit union members and the public at large. The NCUA's role is to ensure the stability and integrity of the credit union system by identifying, monitoring, and mitigating risks to the National Credit Union Share Insurance Fund. NCUA insurance is a deposit insurance designed to protect members of federally-insured credit unions in the United States. The program is administered to safeguard deposits and ensure the stability and soundness of the credit union industry. The insurance covers members if their credit union fails and they cannot return their deposits. The NCUA provides insurance coverage up to $250,000 per individual depositor per credit union. Credit unions fund NCUA insurance through regular premiums paid into the National Credit Union Share Insurance Fund (NCUSIF). The NCUSIF is a federal insurance fund, much like the FDIC, and the full faith and credit of the U.S. government backs that. The insurance reduces the risk of deposit loss. If a credit union collapses, the NCUA ensures that the NCUSIF provides prompt payment of insured deposits to members while also managing the liquidation or reorganization of the failed credit union. The NCUA will often arrange for another credit union to assume the failed credit union's assets and liabilities, preserving members' access to their funds and services. Many types of accounts are covered by federal share insurance. The NCUSIF covers savings, checking, money market, share certificates, traditional and Roth IRAs, Keogh retirement accounts, and revocable and irrevocable trust accounts. A credit union must inform its members whether a specific product is federally insured. This ensures that their members are well-informed about the safety and security of their deposits. The NCUA sets specific limits on the amount of coverage members can receive in case of a credit union failure. Federally insured credit unions offer up to $250,000 protection per individual account. Similarly, it provides $250,000 coverage for each joint account holder's aggregate interests at each federally insured credit union. It is possible to have more than $250,000 insured at one credit union. This can be done by placing the funds in different ownership categories. These categories include individual owner accounts, joint accounts, traditional IRAs, Roth IRAs, Keogh accounts, revocable trust accounts, and irrevocable trust accounts. For instance, if someone has $250,000 in an individual account and $150,000 in a joint account, the entire $400,000 will still be federally insured if their credit union goes bankrupt. The NCUA provides a useful tool on its website, the Share Insurance Estimator. This allows individuals to calculate insurance coverage based on their account holdings and ownership structure. Below is a table summarizing the NCUA insurance coverage limits: The NCUA and the Federal Deposit Insurance Corporation (FDIC) are both government agencies that offer deposit insurance for their respective financial institutions. The NCUA insures deposits at federally insured credit unions, while the FDIC insures deposits at banks. Both agencies were created to provide stability in the financial system by insuring deposits, and they share similar goals, such as promoting financial literacy and preventing bank failures. Both provide a maximum deposit insurance amount of $250,000 per account holder. Participating federally insured credit unions fully fund the National Credit Union Share Insurance Fund. The FDIC is funded by banks and savings associations who pay premiums for deposit insurance coverage. The coverage provided by the NCUA extends to individual accounts, such as those owned by a single individual, joint accounts and retirement accounts like traditional IRA or Keogh accounts and it also protects trust accounts. NCUA and FDIC insurance covers money market accounts that provide interest rates based on the prevailing rates in the money market as well as revocable and irrevocable trust accounts. The FDIC provides insurance coverage for checking and savings accounts. There are some accounts that are not eligible for NCUA coverage, such as mutual funds that are used to collect money from investing entities to purchase bonds. The list includes stocks, which allow individuals to own a portion of an entity through investment. Life insurance policies, and annuities that are offered by affiliated entities are also not covered by the NCUA. On the other hand, the accounts that are not covered by the FDIC include stocks, bonds, annuities, mutual funds, life insurance policies, safe deposit boxes, U.S. Treasury bills, and municipal investments. The National Credit Union Administration is a regulatory agency established by the United States to oversee and regulate credit unions. Its primary objective is to promote the safety of credit unions and protect the interests of their members. Its functions and responsibilities include supervising and regulating federally-insured credit unions, administering the NCUSIF, providing guidance and training to credit unions, and promoting growth and access to affordable financial services. The insurance offered by the NCUA is funded by the regular premiums paid into the National Credit Union Share Insurance Fund. The standard maximum amount of coverage is $250,000 per account holder and includes individual, joint and retirement accounts. The NCUA and the FDIC differ in the institutions they provide financial insurance for. The FDIC covers banks and savings associations, whereas the NCUA covers credit unions. By supervising federally insured credit unions and managing the National Credit Union Share Insurance Fund, the NCUA helps to safeguard the financial interests of credit union members across the country.What Is the National Credit Union Administration (NCUA)?

How NCUA Works

What Is NCUA Insurance?

NCUA Insurance Coverage Limits

NCUA vs Federal Deposit Insurance Corporation (FDIC)

Final Thoughts

National Credit Union Administration (NCUA) FAQs

If you are a member of a credit union, you can check if it is NCUA-insured by looking for the official NCUA insurance sign, which should be prominently displayed in the credit union's branch offices and on their website. You can also verify the credit union's insurance status by visiting the NCUA's website and using their tool.

The National Credit Union Administration (NCUA) is run by a three-member board appointed by the President of the United States and confirmed by the Senate. The members of the board serve staggered six-year terms, and one member is designated as the Chairman by the President.

The main difference between the FDIC and the NCUA is the type of financial institutions they insure. FDIC insures deposits at banks and savings associations, while NCUA insures deposits at credit unions. There are also some differences in the accounts they cover and the source of their funds.

The National Credit Union Administration regulates, charters, and supervises federal credit unions and insures savings in federal and most state-chartered credit unions across the United States. The purpose of the NCUA is to ensure the safety of credit unions, promote confidence in the credit union system, and protect the interests of credit union members.

The NCUA protects your money by providing insurance coverage for your deposits at federally insured credit unions. It insures up to $250,000 per individual depositor, for each ownership category. In the event that a federally insured credit union fails, the NCUA steps in to protect depositors by covering the insured deposits up to the limit.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.