Precedent Transaction Analysis is a valuation method used in finance and investment banking to determine the value of a company by looking at the prices paid for similar companies in the past. The analysis is based on the assumption that the value of a company is influenced by the prices paid for other companies in the same industry, with similar size, growth, and profitability. In Precedent Transaction Analysis, a set of comparable transactions, also known as "precedents," are identified and analyzed. These transactions typically involve mergers, acquisitions, or sales of similar companies in the same industry. The analysis includes factors such as the purchase price, the financial metrics of the company being acquired (such as revenue, EBITDA, and net income), the terms of the deal, and any other relevant information. The methodology used in PTA involves identifying similar companies and transactions, gathering appropriate data, selecting valuation metrics, analyzing the data, and interpreting the results. The key steps involved in PTA are: The first step in PTA is to identify similar companies and transactions that can be used as a benchmark for valuation. These companies and transactions should have similar characteristics to the target company, such as industry, size, and market capitalization. The next step is to gather data on the selected transactions, such as transaction price, purchase price allocation, and financial metrics of the companies involved in the transaction. This data can be obtained from public sources such as SEC filings, company announcements, and industry reports. Once the data is gathered, the next step is to select the appropriate valuation metrics. The most commonly used valuation metrics in PTA are Enterprise Value (EV) to Revenue, EV to EBITDA, and Price to Earnings (P/E) ratio. These metrics are used to compare the valuation of the target company to the valuation of similar companies in previous transactions. The data is analyzed to determine the range of values for the target company. This involves comparing the valuation metrics of the target company to the valuation metrics of similar companies in previous transactions. The range of values for the target company is determined based on the median or average of the valuation metrics of the similar companies. The final step in PTA is to interpret the results and use them to determine the value of the target company. The range of values for the target company is used as a benchmark for valuation, and adjustments are made based on the specific characteristics of the target company. The data gathering process in PTA involves identifying similar companies and transactions, selecting appropriate data, screening transactions, and organizing the data. The following steps are involved in the data gathering process: The first step in data gathering is to identify similar companies and transactions. This can be done by analyzing the industry, size, and market capitalization of the target company. Once the similar companies and transactions are identified, the next step is to select the appropriate data. This includes transaction price, purchase price allocation, and financial metrics of the companies involved in the transaction. The data is screened to ensure that it is relevant and appropriate for the target company. Transactions that are not similar to the target company or that do not provide relevant data are excluded from the analysis. The data is gathered from public sources such as SEC filings, company announcements, and industry reports. Once the data is gathered, it is organized in a spreadsheet for analysis. The most commonly used valuation metrics in PTA are Enterprise Value (EV) to Revenue, EV to EBITDA, and Price to Earnings (P/E) ratio. These metrics are used to compare the valuation of the target company to the valuation of similar companies in previous transactions. EV to Revenue is used to compare the valuation of the target company to the valuation of similar companies based on their revenue. The formula for EV to Revenue is: EV/Revenue = Enterprise Value / Revenue EV to EBITDA is used to compare the valuation of the target company to the valuation of similar companies based on their EBITDA. EBITDA stands for earnings before interest, taxes, depreciation, and amortization. The formula for EV to EBITDA is: EV/EBITDA = Enterprise Value / EBITDA The P/E ratio is used to compare the valuation of the target company to the valuation of similar companies based on their earnings. The formula for P/E ratio is: P/E Ratio = Price per Share / Earnings per Share The analysis process in PTA involves examining the data gathered, comparing the transactions analyzed, determining the range of values for the target company, and interpreting the results. The following steps are involved in the analysis process: The data gathered is examined to ensure that it is accurate and relevant to the target company. The transactions analyzed are compared to determine the similarities and differences between the target company and the similar companies in previous transactions. The range of values for the target company is determined based on the median or average of the valuation metrics of the similar companies. The results of the analysis are interpreted and used to determine the value of the target company. Adjustments may be made based on the specific characteristics of the target company. PTA provides a benchmark for valuation by analyzing previous transactions of similar companies. This enables investment bankers to determine the range of values for a target company and to make adjustments based on the specific characteristics of the target company. PTA uses real-world data from previous transactions, which is more reliable than using theoretical models or assumptions. The data used in PTA provides a more accurate representation of the market value of a company. PTA takes into account current market conditions, which may affect the valuation of a company. The valuation metrics used in PTA reflect the current market conditions, providing a more accurate representation of the value of a company. PTA analyzes market trends by looking at previous transactions in the industry. This enables investment bankers to identify trends and make informed decisions about the valuation of a company. PTA provides investment bankers with a range of values for a target company, which is used in negotiating merger and acquisition (M&A) transactions. The range of values enables investment bankers to negotiate a fair price for the target company and to make informed decisions about the transaction. PTA provides a comprehensive analysis of the value of a target company by considering multiple valuation metrics. This enables investment bankers to have a more complete picture of the value of a company, allowing them to make more informed decisions. The data available for PTA is limited to public transactions, which may not be representative of the entire market. This can lead to an incomplete picture of the market value of a company. The transactions analyzed may not be transparent, and the information available may be incomplete or inaccurate. This can lead to an inaccurate valuation of a company. PTA may not be applicable to all industries, and the methodology may need to be adjusted based on the specific industry being analyzed. This can make the valuation process more complex and time-consuming. PTA is time-sensitive, and the data analyzed may not reflect current market conditions. This can lead to an inaccurate valuation of a company if the market conditions have changed significantly since the transaction was completed. PTA relies heavily on historical data, which may not be a reliable indicator of future performance. This can lead to an inaccurate valuation of a company if the market conditions have changed significantly since the previous transaction. PTA only considers previous transactions of similar companies and does not take into account the unique characteristics of the target company. This can lead to an inaccurate valuation of a company if the target company has unique characteristics that are not reflected in the previous transactions. Precedent Transaction Analysis is an important valuation method used in investment banking to determine the value of a target company. The methodology used in PTA involves gathering data from previous transactions of similar companies, selecting appropriate valuation metrics, analyzing the data, and interpreting the results. he most commonly used valuation metrics in PTA are Enterprise Value (EV) to Revenue, EV to EBITDA, and Price to Earnings (P/E) ratio. While PTA has some limitations, such as limited data availability, lack of transparency, and industry-specificity, it is a widely used valuation method that provides a benchmark for valuation. Investment bankers use PTA to determine the range of values for a target company and to make adjustments based on the specific characteristics of the target company. PTA is an important tool in the investment banking industry and plays a critical role in the valuation of companies for merger and acquisition transactions.What Is Precedent Transaction Analysis?

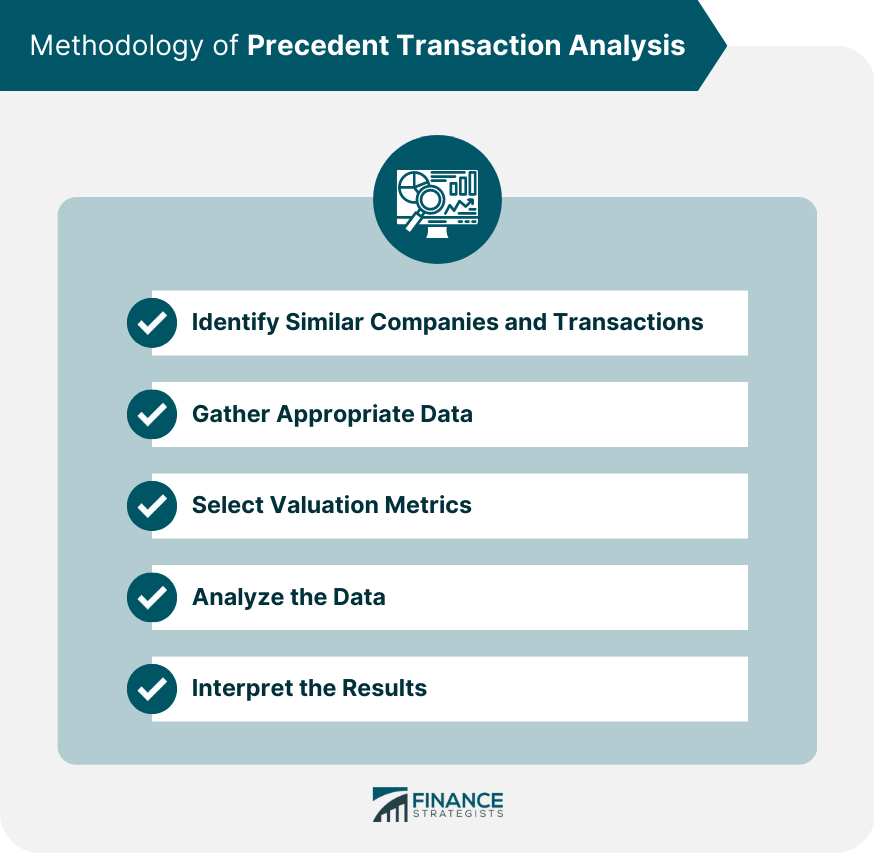

Methodology of Precedent Transaction Analysis

Identify Similar Companies and Transactions

Gather Appropriate Data

Select Valuation Metrics

Analyze the Data

Interpret the Results

Data Gathering for Precedent Transaction Analysis

Identification of Similar Companies and Transactions

Selection of Appropriate Data

Screening Process for Transactions

Gathering and Organizing Transaction Data

Valuation Metrics in Precedent Transaction Analysis

Enterprise Value (EV) to Revenue

Enterprise Value (EV) to EBITDA

Price to Earnings (P/E) Ratio

Analysis

Examination of the Data Gathered

Comparison of the Transactions Analyzed

Determination of the Range of Values for the Target Company

Interpretation of Results

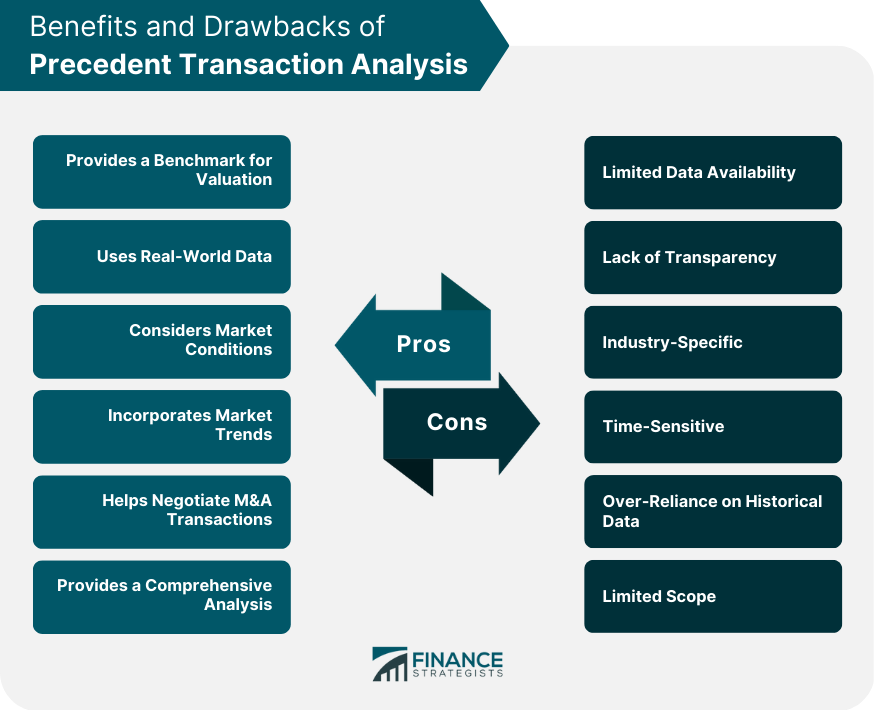

Advantages of Precedent Transaction Analysis

Provides a Benchmark for Valuation

Uses Real-World Data

Considers Market Conditions

Incorporates Market Trends

Helps Negotiate M&A Transactions

Provides a Comprehensive Analysis

Disadvantages of Precedent Transaction Analysis

Limited Data Availability

Lack of Transparency

Industry-Specific

Time-Sensitive

Over-Reliance on Historical Data

Limited Scope

Final Thoughts

Precedent Transaction Analysis FAQs

Precedent Transaction Analysis (PTA) is a valuation method used in investment banking to determine the value of a target company by analyzing previous transactions of similar companies. The methodology involves gathering data from previous transactions, selecting appropriate valuation metrics, analyzing the data, and interpreting the results.

The advantages of Precedent Transaction Analysis include providing a benchmark for valuation, using real-world data, considering market conditions and trends, helping negotiate M&A transactions, and providing a comprehensive analysis of the value of a company.

The limitations of Precedent Transaction Analysis include limited data availability, lack of transparency, industry-specificity, time-sensitivity, over-reliance on historical data, and limited scope.

Precedent Transaction Analysis is used in M&A transactions to provide a range of values for a target company, which is used in negotiating a fair price for the target company. The analysis of previous transactions provides investment bankers with a benchmark for valuation and helps them make informed decisions about the transaction.

Other valuation methods used in conjunction with Precedent Transaction Analysis include Discounted Cash Flow (DCF) analysis, Comparable Company Analysis (CCA), and Asset-Based Valuation. These methods provide a more complete picture of the value of a company and help investment bankers make informed decisions.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.