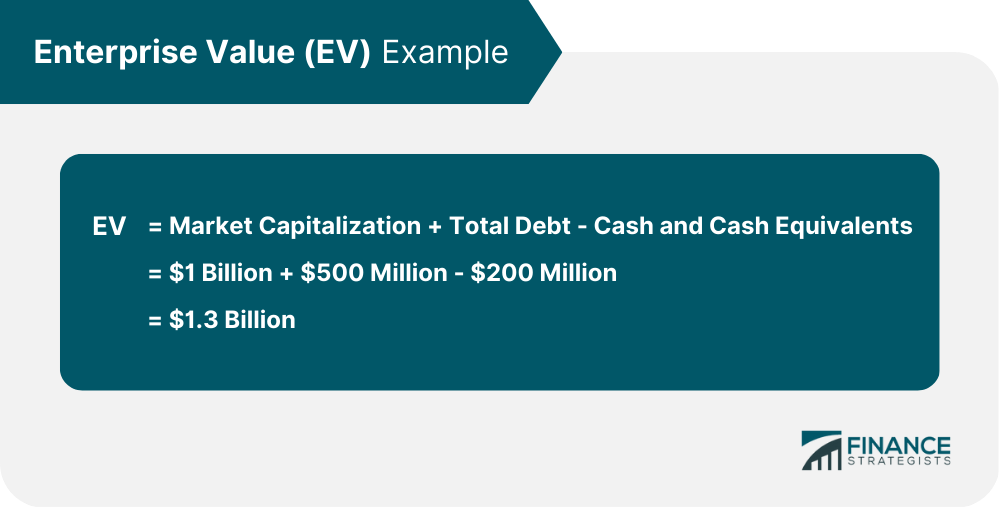

Enterprise value is a financial metric used to determine the total value of a company's operating assets. EV is an important metric used in finance, accounting, and investing because it provides an accurate picture of a company's overall value rather than market capitalization alone. Calculating EV involves taking into account all of the factors that contribute to a company's value, including its cash holdings, equity, and debt. By considering these factors, investors and analysts can get a more accurate sense of a company's true worth and its ability to generate profits over the long term. EV is a complex financial metric that requires a deep understanding of finance and accounting principles to fully grasp. However, at a high level, EV is calculated by adding a company's market capitalization to its total debt and then subtracting its cash and cash equivalents. This provides a more accurate picture of a company's true worth than market capitalization alone, which only takes into account the value of a company's outstanding shares. To illustrate how EV works, consider a company with a market capitalization of $1 billion, total debt of $500 million, and cash and cash equivalents of $200 million. Its EV would be calculated as follows: This calculation takes into account both the value of a company's equity and the amount of debt it owes, as well as the cash and cash equivalents it has on hand. The components of EV include market capitalization, total debt, and cash and cash equivalents. Each of these components plays a significant role in determining a company's overall value and its ability to generate profits over the long term. Market capitalization is a measure of a company's equity value or the total value of its outstanding shares. It is calculated by multiplying the number of outstanding shares by the current market price of the stock. Market capitalization is significant because it represents the value of a company's equity. However, it does not provide a complete picture of a company's overall value, which is why it is combined with other components, such as total debt and cash and cash equivalents, to calculate EV. Interpreting EV can be complex. Generally, a higher EV indicates that a company is worth more, while a lower EV indicates that it is worth less. Total debt refers to the amount of money a company owes to creditors, including both short-term and long-term debt. It includes items such as bonds, loans, and other forms of debt. Total debt is a significant component of EV because it reflects the amount of money a company owes to creditors. This can impact a company's overall value, as it can impact its ability to generate profits and its financial stability. A company with a high amount of debt may be less attractive to investors because it may have less financial flexibility and be at greater risk of defaulting on its debt obligations. On the other hand, a company with low debt may be more attractive to investors because it may have more financial flexibility and be at a lower risk of defaulting on its debt. Generally, a higher EV may indicate that a company is worth more, but if the company has a significant amount of debt, this may impact its overall financial stability and ability to generate profits. Cash and cash equivalents refer to the amount of cash a company has on hand, as well as any short-term investments that can be easily converted into cash. Cash and cash equivalents are significant components of EV because they reflect a company's ability to generate cash and its financial stability. A company with a significant amount of cash and cash equivalents may be more attractive to investors because it has more financial flexibility and may be at lower risk of running into financial difficulties. EV is a widely used financial metric that has a number of applications in investing, accounting, and finance. Some of the most common applications of EV include mergers and acquisitions, investment analysis, and business valuation. EV is frequently used in mergers and acquisitions (M&A) to determine the total cost of acquiring a company's operating assets. In M&A transactions, EV is often compared to Earnings Before Interest, Taxes, Depreciation, and Amortization (EBITDA) to determine whether a deal is financially feasible. This is because EBITDA reflects a company's earnings before accounting for certain expenses, such as interest, taxes, depreciation, and amortization. By comparing EV to EBITDA, investors and analysts can get a more accurate sense of a company's overall value and its ability to generate profits over the long term. EV is also frequently used in investment analysis to evaluate a company's overall value. This is because EV takes into account all of the factors that contribute to a company's overall value, including its equity, debt, and cash holdings. In investment analysis, EV is often compared to other financial metrics, such as earnings per share (EPS) and price to earnings (P/E) ratios, to determine whether a company is undervalued or overvalued. EV is also commonly used in business valuation to determine the value of a business. In business valuation, EV is often compared to other financial metrics, such as book value and equity value, to determine the total value of a business. By comparing EV to these other metrics, investors and analysts can get a more accurate sense of a company's overall value and its potential for long-term growth. While EV is a useful financial metric, it is not without its limitations. Some of the most significant limitations of EV include its failure to consider off-balance sheet items, its sensitivity to changes in interest rates, and its comparability to other financial metrics. One of the biggest limitations of EV is its failure to consider off-balance sheet items, such as leases or contingent liabilities. This means that EV may not provide a complete picture of a company's overall financial health and may underestimate the total value of a company's assets. Another limitation of EV is its sensitivity to changes in interest rates. This is because changes in interest rates can impact a company's debt obligations, which can impact its overall value. As a result, EV may not provide a reliable indicator of a company's overall value during periods of significant interest rate volatility. Finally, EV may not be directly comparable to other financial metrics, such as Book Value or Equity Value. This is because EV takes into account all of the factors that contribute to a company's overall value, while these other metrics focus on specific components, such as a company's assets or its equity. As a result, it can be difficult to make direct comparisons between EV and other financial metrics. Enterprise value (EV) is a widely used financial metric that is used to determine the total value of a company's operating assets. It is calculated by adding a company's market capitalization to its total debt and then subtracting its cash and cash equivalents. EV is an important metric used in finance, accounting, and investing because it provides a more accurate picture of a company's overall value than market capitalization alone. While EV is a useful financial metric, it is not without its limitations. These include its failure to consider off-balance sheet items, its sensitivity to changes in interest rates, and its comparability to other financial metrics. As a result, investors and analysts should use caution when interpreting EV and should consider other factors when making investment decisions.What Is Enterprise Value (EV)?

How Enterprise Value Works

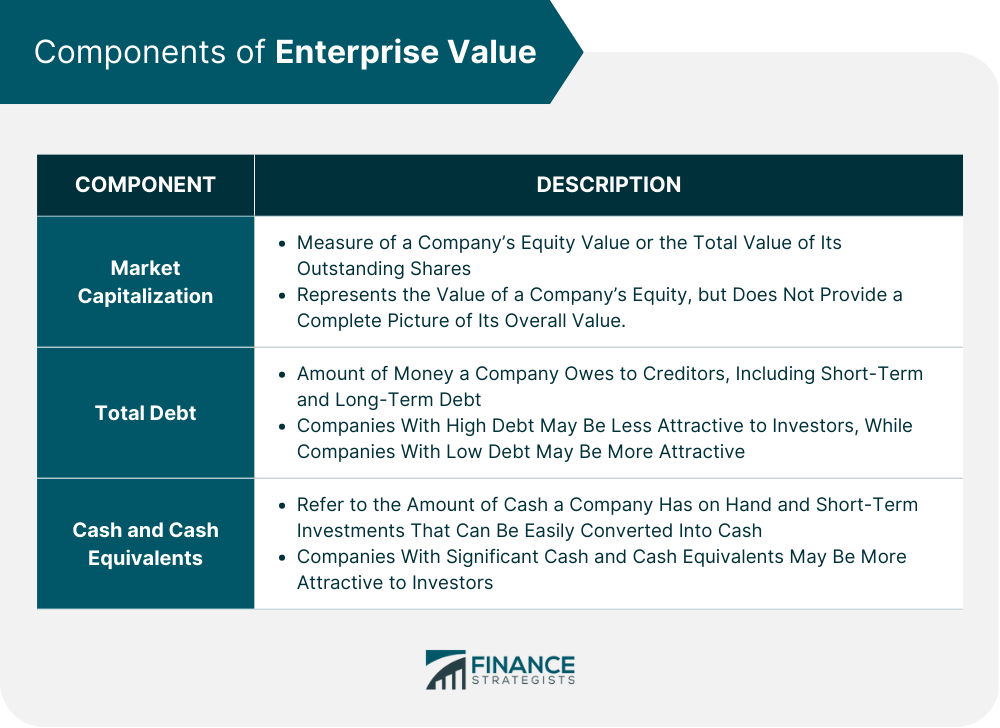

Components of Enterprise Value

Market Capitalization

Total Debt

Cash and Cash Equivalents

Applications of Enterprise Value

Mergers and Acquisitions

Investment Analysis

Business Valuation

Limitations of Enterprise Value

Final Thoughts

It is recommended to seek the advice of financial professionals covering the calculation of EV and business valuation. The U.S. Securities and Exchange Commission (SEC) also offers a comprehensive overview of EV and its importance in finance and investing.

Enterprise Value (EV) FAQs

Enterprise Value (EV) is a financial metric that provides a more accurate picture of a company's overall value by taking into account its equity, debt, and cash holdings. It is crucial in finance and investing because it provides a comprehensive view of a company's operating assets and its ability to generate profits over the long term.

EV is calculated by adding a company's market capitalization to its total debt and then subtracting its cash and cash equivalents. Its components include market capitalization, total debt, and cash and cash equivalents.

The limitations of EV include its failure to consider off-balance sheet items, its sensitivity to changes in interest rates, and its comparability to other financial metrics.

EV is used in M&A transactions to determine the total cost of acquiring a company's operating assets. It is often compared to Earnings Before Interest, Taxes, Depreciation, and Amortization (EBITDA) to determine whether a deal is financially feasible.

EV is used in business valuation to determine the total value of a business. It is often compared to other financial metrics, such as Book Value and Equity Value, to provide a comprehensive view of a company's overall value.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.