Extrinsic value refers to the portion of an option's price that is not attributable to its intrinsic value, which represents the difference between the option's strike price and the underlying asset's market price. Extrinsic value captures the additional premium that the option buyer is willing to pay for the time and potential price movement that the option contract provides. Understanding extrinsic value is crucial for option traders, as it plays a significant role in determining the price of an option contract. Extrinsic value is comprised of two main components: time value and implied volatility value. Time value reflects the remaining time until the option's expiration, while implied volatility value captures the expected future price fluctuations of the underlying asset. As the time to expiration decreases, the extrinsic value of an option tends to decrease as well. This is because there is less time for the underlying asset's price to move in favor of the option holder, reducing the probability of the option becoming profitable. Implied volatility is a measure of the expected future price fluctuations of the underlying asset. Higher implied volatility increases the extrinsic value of an option, as it suggests a greater likelihood of the option becoming profitable due to larger price movements. Higher interest rates can increase the extrinsic value of call options and decrease the extrinsic value of put options. This is because an increase in interest rates makes holding the underlying asset more expensive, increasing the cost of carry and, consequently, the value of call options. Conversely, higher interest rates make put options less valuable, as the cost of holding the underlying asset decreases. Upcoming dividend payments can decrease the extrinsic value of call options and increase the extrinsic value of put options. When an underlying asset pays a dividend, its price typically decreases by the amount of the dividend, making call options less valuable and put options more valuable. The Black-Scholes model is a widely used option pricing model that considers various factors, including extrinsic value, to determine the fair price of an option contract. The model calculates extrinsic value based on factors such as time to expiration, implied volatility, interest rates, and dividends. The binomial option pricing model is another popular method for pricing options that takes extrinsic value into account. This model uses a binomial tree to model the potential price movements of the underlying asset over time and calculates the option's value based on the probabilities of different price paths. There are numerous other option pricing models available, such as the Monte Carlo simulation and finite difference methods, which also incorporate extrinsic value in their calculations. Each model has its own strengths and limitations, and option traders should choose the model that best suits their needs and preferences. While intrinsic value represents the immediate, tangible value of an option based on the difference between the underlying asset's market price and the option's strike price, extrinsic value captures the additional premium associated with the option's remaining time and potential price movement. Intrinsic value can be zero or positive, while extrinsic value is always positive. Both intrinsic and extrinsic values play a crucial role in determining an option's price. Option traders should consider both components when making trading decisions, as they can provide valuable insights into the potential risks and rewards associated with an option contract. Various factors can affect the intrinsic and extrinsic values of an option, such as the underlying asset's price, option's strike price, time to expiration, implied volatility, interest rates, and dividends. Option traders should monitor these factors to better understand the changing values of their option contracts and adjust their trading strategies accordingly. Time decay, also known as theta, refers to the decrease in an option's extrinsic value as it approaches its expiration date. As time passes, the option's time value component diminishes, reducing the overall extrinsic value. Time decay has a negative impact on extrinsic value, causing it to decline as the option nears expiration. This can affect option trading strategies, as options with less time remaining have a lower probability of becoming profitable and, therefore, a lower extrinsic value. Option traders can manage the impact of time decay on extrinsic value by employing various strategies, such as: Trading options with longer time to expiration, which have higher extrinsic values due to their greater time value component. Selling options to collect premium and benefit from time decay, as the extrinsic value declines in the seller's favor. Utilizing time decay-neutral strategies, such as calendar spreads, which involve buying and selling options with different expiration dates to minimize the impact of time decay on the overall position. The extrinsic value plays a crucial role in buying and selling options. When purchasing options, traders pay for the extrinsic value in addition to the intrinsic value, whereas sellers collect the extrinsic value as part of the premium received. Vertical spreads involve buying and selling options with the same expiration date but different strike prices. By understanding the extrinsic value of each option in the spread, traders can better manage their risk and potential rewards. Calendar spreads involve buying and selling options with different expiration dates but the same strike price. These spreads can help traders manage the impact of time decay on extrinsic value, as the options with longer time to expiration typically have higher extrinsic values. Straddles and strangles are option strategies that involve buying or selling a combination of call and put options with the same strike price (straddle) or different strike prices (strangle). Extrinsic value plays an essential role in these strategies, as it can impact the potential profitability of the position. Understanding extrinsic value is vital for option traders, as it plays a significant role in determining an option's price and potential profitability. By considering the factors that affect extrinsic value, traders can make more informed decisions about their trading strategies and positions. Option traders should consider extrinsic value alongside other factors, such as intrinsic value, time to expiration, and implied volatility, when making trading decisions. Balancing these factors can help traders optimize their risk-reward profile and achieve better investment outcomes. As extrinsic value can change over time due to factors such as time decay and changing market conditions, option traders should continuously monitor and evaluate the extrinsic value of their option contracts. By doing so, they can better manage their positions and adapt their trading strategies to maximize potential profits and minimize risks.What Is Extrinsic Value?

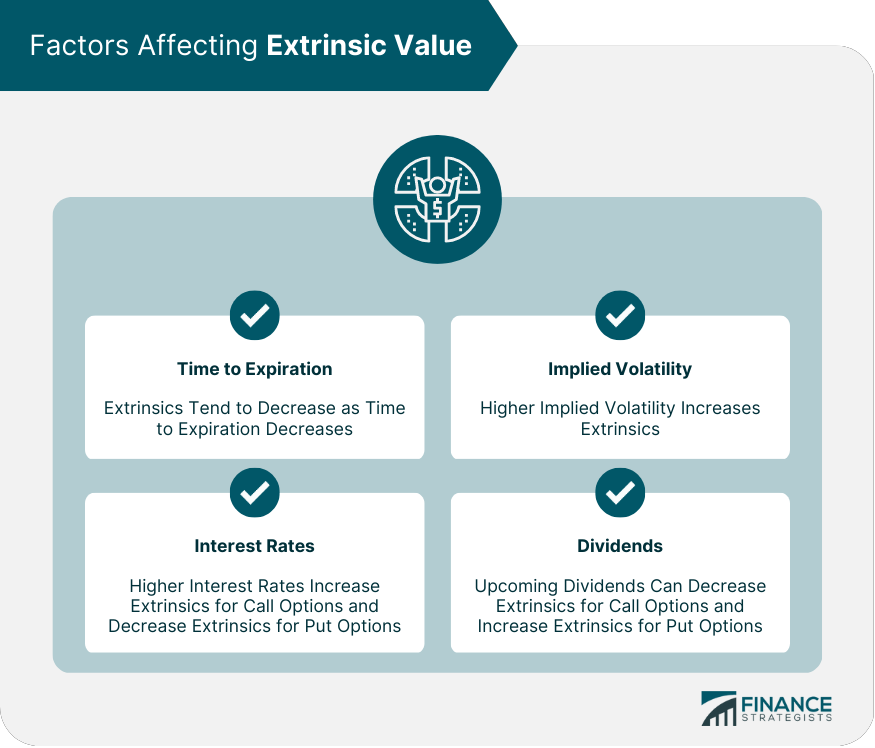

Factors Affecting Extrinsic Value

Time to Expiration

Implied Volatility

Interest Rates

Dividends

Extrinsic Value and Option Pricing Models

Black-Scholes Model

Binomial Option Pricing Model

Other Option Pricing Models

Intrinsic Value vs Extrinsic Value

Definitions and Differences

Importance of Both Components in Option Pricing

Factors Affecting Intrinsic and Extrinsic Value

Time Decay and Extrinsic Value

Definition of Time Decay

Impact of Time Decay on Extrinsic Value

Strategies for Managing Time Decay

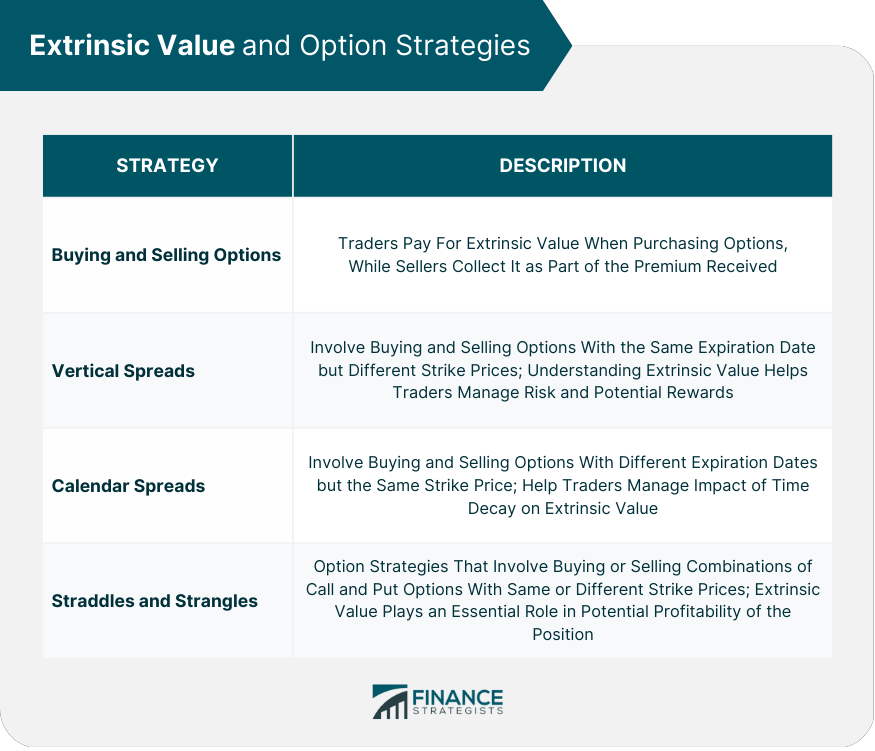

Extrinsic Value and Option Strategies

Buying and Selling Options

Vertical Spreads

Calendar Spreads

Straddles and Strangles

Conclusion

Extrinsic Value FAQs

Extrinsic value, also known as time value, is the portion of an option's premium that is attributed to the time remaining until expiration. It reflects the probability of the option's price moving in the desired direction before it expires.

Extrinsic value is calculated as the difference between an option's total premium and its intrinsic value. Intrinsic value is the amount by which the option is in-the-money, while extrinsic value is the remainder.

The key factors that influence extrinsic value are time to expiration, implied volatility, and the strike price of the option relative to the underlying asset's current price. Additionally, interest rates and dividend payments can also affect extrinsic value.

Extrinsic value is an essential component of an option's price, and it is a crucial consideration when buying or selling options. It represents the market's expectations for the underlying asset's future price movements and can provide traders with valuable information when making trading decisions.

Traders can profit from extrinsic value by buying options with low extrinsic value and selling options with high extrinsic value. This strategy is often used in options trading strategies such as calendar spreads and iron condors, which involve buying options with longer expiration dates and selling options with shorter expiration dates.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.