A zero plus tick, also known as a zero uptick, is a crucial term in the complex world of financial markets. It refers to a security trade executed at the same price as the previous trade but at a higher price than the last trade with a different price. This small distinction carries significant implications for traders and the overall functioning of financial markets. For example, if trades occur at $10.00, $10.01, and then $10.01 again, the latter trade would be labeled a zero plus tick or zero uptick. This concept applies to various traded securities, especially listed equity securities. It plays a vital role in maintaining market stability and preventing stock manipulation by balancing buying and selling pressures. Understanding the concept of a zero plus tick is essential for grasping market dynamics, particularly in the equity market. A zero plus tick occurs when a specific set of trading conditions are met. These conditions are reliant upon the price movements of the security and the sequence of trades made. The first condition is that the trade must occur at the same price as the preceding trade. Secondly, this price must be higher than the price of the last trade, which had a different price. It is the fulfillment of these conditions that gives rise to a zero plus tick. Let's take a practical example to better illustrate this concept. Assume a sequence of trades for a particular stock takes place at the following prices: $20.00, $20.01, $20.01, $20.02, $20.02, and $20.02. Here, the third trade is a zero plus tick because it happened at the same price as the second trade ($20.01) but at a higher price than the first trade ($20.00), which had a different price. The fifth and sixth trades are also zero plus ticks for similar reasons. Each happened at the same price as the immediately preceding trade but at a higher price than the last trade of a different price. To fully appreciate the idea of a zero plus tick, it's vital to understand its converse: the zero minus tick. A zero minus tick, or a zero downtick, represents a trade executed at the same price as the preceding trade but at a lower price than the last trade with a different price. Returning to our earlier example, if the trades occurred at $20.02, $20.01, $20.01, $20.00, $20.00, and $20.00, the third and fifth trades would be considered zero minus ticks. Both occurred at the same price as the immediately preceding trade but at a lower price than the last trade with a different price. Understanding both zero plus tick and zero minus tick helps traders track the micro-movements of a security's price, enabling more informed trading decisions. The concept of a zero plus tick also ties into the principle of the national best bid. The national best bid refers to the highest quoted bid for security among all those offered in a given market. A zero plus tick transaction happens when a security trades above the national best bid (an uptick), and another transaction takes place at that same price. This concept plays a vital role in determining the optimal price for executing trades, thereby maximizing profits and minimizing losses for traders. The concept of a zero plus tick plays a crucial role in maintaining stability in financial markets. By controlling when stocks can be shorted, it prevents excessive selling pressure from driving down stock prices too rapidly, which could lead to market volatility. Zero plus tick also plays a role in preventing potential stock manipulation. Without restrictions like the alternate uptick rule, unscrupulous traders could continuously short-sell a stock, driving down its price and potentially destabilizing the market. In stocks, the zero plus tick concept is often used to track price movements, especially when dealing with short selling. Understanding when a zero plus tick occurs helps traders make informed decisions about when to enter or exit a position. Zero plus tick is also relevant in the bond market. Similar to stocks, it helps track small price changes, which can be crucial in the fast-moving bond market. In the commodities market, zero plus tick provides valuable information about market trends and patterns. It assists in understanding the buying and selling pressure on commodities, allowing traders to make strategic decisions. Understanding the zero plus tick can open a plethora of trading strategies for those engaged in financial markets. For instance, short sellers may use the zero plus tick rule to time their trades, shorting a stock when they perceive a downtrend but waiting for a zero plus tick to comply with trading rules. Similarly, a series of zero plus ticks may indicate positive market sentiment for a particular security, signaling to traders that it might be a good time to enter a long position or exit a short position. The precise application of this information will depend on a trader's overall strategy and risk tolerance. Knowledge of zero plus ticks can benefit traders in several ways. Firstly, it helps them understand the subtle movements in security prices and the dynamics of buy and sell orders. This knowledge can aid in forecasting future price movements and creating effective trading strategies. Secondly, understanding zero plus ticks and the rules surrounding them is crucial for compliance with trading regulations, especially for those involved in short selling. Traders who fail to comply with these rules could face penalties, making this knowledge essential for risk management. Despite its widespread use, the zero plus tick rule has faced criticism and controversy. Some market participants argue that it hampers market efficiency by preventing traders from executing trades when they want to. They contend that in a truly efficient market, price should be the sole determinant of when trades can be executed, not arbitrary rules like the zero plus tick rule. Moreover, critics also suggest that the rule may not be effective in preventing sharp stock price declines as intended. They argue that during times of extreme market stress, selling pressure can still overwhelm buying demand, resulting in a rapid price decline despite the zero plus tick rule. Regulation surrounding the zero plus tick rule has also been a subject of debate. Some feel that the current rules are too restrictive and impede the free functioning of the markets. On the other hand, proponents argue that these rules are necessary to prevent manipulative trading practices and maintain market stability. The SEC's decision in 2010 to implement the alternate uptick rule, replacing the previous uptick rule, was a significant development in this ongoing debate. However, as markets continue to evolve, the debate over the optimal level of regulation and the role of the zero plus tick rule within that framework is likely to persist. The term zero plus tick is essential in the realm of traded securities and plays a significant role in financial market dynamics. It refers to a trade that occurs at the same price as the preceding trade but higher than the last trade of a different price. This concept relies on understanding the subtle nuances of price movements in security trades, enabling informed trading decisions. Zero plus tick is crucial for maintaining market stability, as it helps prevent stock manipulation and excessive downward pressure on stock prices, particularly in relation to short-selling practices. Traders who grasp the concept can employ effective and compliant trading strategies. Regardless of the market being traded, such as stocks, bonds, or commodities, understanding concepts like zero plus tick is vital. To navigate the complexities of financial markets, it's advisable to seek professional wealth management services to optimize trading strategies and adhere to market regulations.What Is Zero Plus Tick?

Mechanism of Zero Plus Tick

How It Occurs

Example to Illustrate

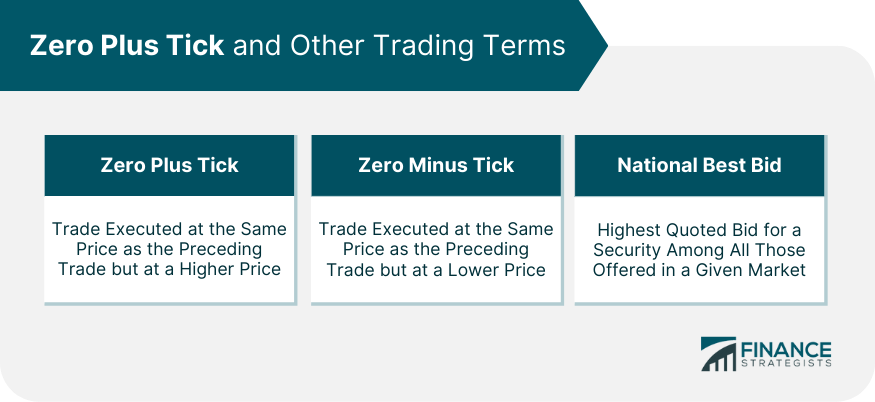

Zero Plus Tick Relationship With Other Trading Terms

Comparison With Zero Minus Tick

Connection With National Best Bid

Importance of Zero Plus Tick in the Financial Market

Impact on Market Stability

Role in Preventing Potential Stock Manipulation

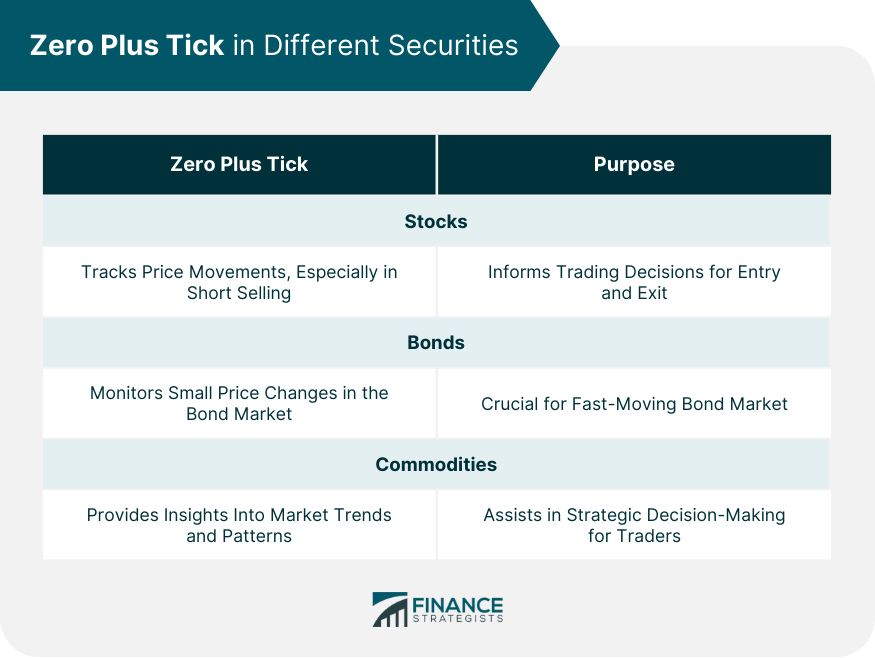

Zero Plus Tick in Different Types of Securities

Stocks

Bonds

Commodities

Theoretical and Practical Implications of Zero Plus Tick

Strategies Involving Zero Plus Tick

How Traders Can Benefit From Understanding This Concept

Criticism and Controversies Surrounding Zero Plus Tick

Opposing Views Regarding Its Effectiveness

Debates Over Its Regulation

Final Thoughts

Zero Plus Tick FAQs

A zero plus tick, or zero uptick, is a security trade that happens at the same price as the preceding trade but higher than the last trade of a different price.

Zero plus tick plays a crucial role in maintaining market stability and preventing potential stock manipulation. It influences when stocks can be shorted, preventing excessive downward pressure on stock prices.

A zero plus tick occurs when specific trading conditions are met. These conditions depend on the price movements of the security and the sequence of trades. The first condition is that the trade must happen at the same price as the preceding trade. Secondly, this price must be higher than the price of the last trade with a different price. Fulfilling these conditions results in a zero plus tick.

A zero minus tick, or a zero downtick, represents a trade executed at the same price as the preceding trade but at a lower price than the last trade with a different price.

Yes, the concept of zero plus tick applies to various traded securities, including stocks, bonds, commodities, and other securities. However, it is predominantly used in listed equity securities.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.