A whisper stock refers to a company's stock that is being discussed or circulated within the investment community as a potential opportunity or investment idea. The term "whisper" suggests that the information is not widely known or publicly available, but rather shared among a select group of investors or market participants. These stocks often generate buzz through informal channels such as word-of-mouth, online forums, or private discussions among traders and investors. The information about whisper stocks may include rumors, insider tips, or speculative insights regarding the company's financial performance, upcoming announcements, or potential catalysts that could impact the stock price. Whisper stocks are known for their speculative nature, as they rely on unverified information and are subject to higher levels of risk. Investors interested in whisper stocks should exercise caution, conduct thorough research, and seek reliable sources before making any investment decisions. Whisper stocks typically operate under low public awareness. These are usually small-cap stocks or those of companies that are not yet well known in the market. As such, they can offer opportunities for significant gains before the wider market catches on. Given their relative obscurity, whisper stocks usually have limited coverage by market analysts. This lack of attention can lead to mispricing, creating potential investment opportunities for those who discover these stocks early. Whisper stocks often have high potential for returns. This stems from their relative obscurity—once the broader market recognizes their potential, their stock price can increase substantially. While whisper stocks can offer high returns, they are also associated with high risk and volatility. The lack of public awareness and limited analyst coverage can lead to drastic price swings, making these stocks a risky investment. Market sentiment—how investors feel about the overall market or a particular stock—can significantly influence whisper stocks. A positive sentiment can cause the price to increase, while a negative sentiment can do the opposite. Since whisper stocks are often known only to a small group of insiders, any information from these insiders can greatly impact the stock's price. The information can be either positive (such as unannounced business deals) or negative (such as undisclosed financial problems). Given their obscurity, whisper stocks are often subject to rumors and speculations. While such hearsay can sometimes lead to profitable investment opportunities, it can also lead to losses if the rumors turn out to be false. News and events related to the company—such as product launches, partnerships, or financial reports—can also influence the price of whisper stocks. Positive news can drive the price up, while negative news can do the opposite. One of the main advantages of investing in whisper stocks is their potential for significant returns. Because these stocks are not yet widely recognized, early investors can see substantial profits as the stocks gain broader market attention. Whisper stocks can offer early access to emerging opportunities. These might be innovative startups, companies developing new technologies, or firms poised to benefit from industry or macroeconomic trends. The limited public awareness and analyst coverage of whisper stocks can lead to market inefficiencies, such as mispricing. Investors who identify these inefficiencies can capitalize on them to earn above-average returns. Investing in whisper stocks often involves dealing with a lack of reliable information. The limited analyst coverage and low public awareness can make it challenging to evaluate these stocks and make informed investment decisions. The obscurity of whisper stocks can make them susceptible to misinformation and manipulation. For instance, unscrupulous parties might spread false rumors to artificially inflate the stock's price. Whisper stocks often have limited liquidity and market depth. This means that there may not be enough buyers or sellers at any given time, making it difficult to buy or sell these stocks without significantly impacting the price. Given the high risks associated with whisper stocks, it's crucial to conduct thorough research before investing. This includes understanding the company's business model, financial health, competitive landscape, and industry trends. Diversification is a key strategy for managing the risks of investing in whisper stocks. By holding a mix of different types of investments, you can spread your risk and potentially improve your overall return. Investing in whisper stocks requires a disciplined approach. This includes setting clear investment goals, establishing risk tolerance levels, and sticking to your investment plan regardless of market fluctuations. Given the complexities and risks of investing in whisper stocks, it can be beneficial to seek professional advice. Financial advisors or wealth managers can provide valuable insights and guidance based on their experience and expertise. The limited public awareness and liquidity of whisper stocks make them susceptible to market manipulation. Unscrupulous parties might engage in practices such as 'pump and dump' schemes, which involve artificially inflating the stock's price before selling it off at a profit. Investing in whisper stocks can also involve regulatory concerns. For instance, there might be limited oversight or disclosure requirements for these stocks, making it harder for investors to make informed decisions. The limited liquidity of whisper stocks can result in limited exit options. If you need to sell your shares quickly, you might have to do so at a lower price than you would like. The high volatility of whisper stocks can lead to emotional decision-making. Investors might panic and sell their shares during a market downturn, or become overly exuberant and invest too much during a market upswing. A whisper stock refers to a company's stock that circulates within the investment community through informal channels, such as word-of-mouth or online forums, based on unverified information or speculative insights. These stocks are characterized by their speculative nature and higher levels of risk, as they rely on rumors, insider tips, or limited availability of information. While whisper stocks can generate excitement and potentially offer lucrative investment opportunities, investors should approach them with caution. The pros of whisper stocks include the potential for high returns and the opportunity to discover undervalued stocks before they become widely known. However, the cons lie in the inherent risks associated with unverified information, the lack of transparency, and the potential for manipulation. It is crucial for investors to conduct thorough research, seek reliable sources, and carefully evaluate the risks before considering investments in whisper stocks.What Is a Whisper Stock?

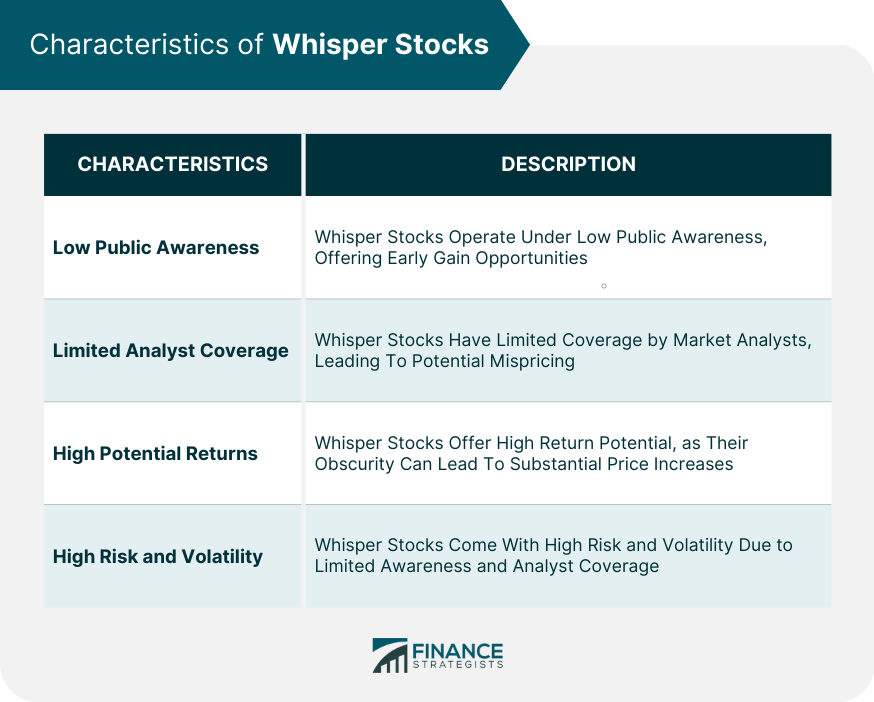

Characteristics of Whisper Stocks

Low Public Awareness

Limited Analyst Coverage

High Potential Returns

High Risk and Volatility

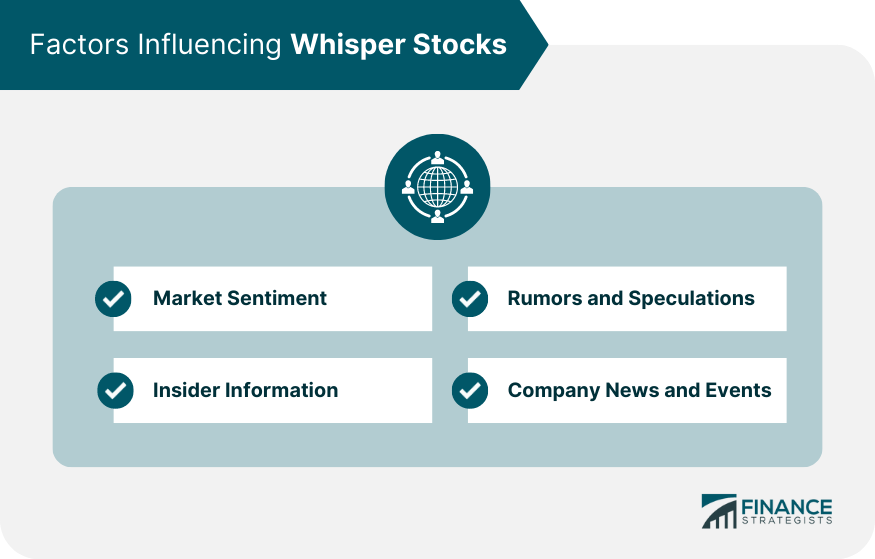

Factors Influencing Whisper Stocks

Market Sentiment

Insider Information

Rumors and Speculations

Company News and Events

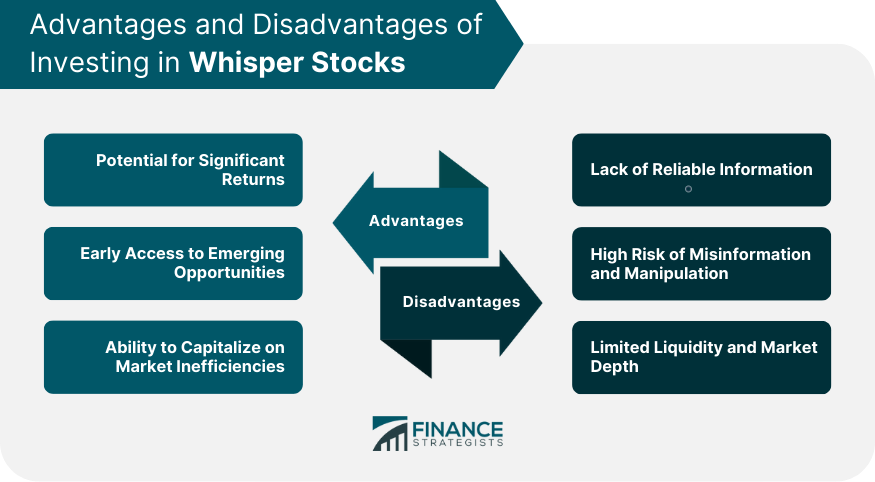

Advantages of Investing in Whisper Stocks

Potential for Significant Returns

Early Access to Emerging Opportunities

Ability to Capitalize on Market Inefficiencies

Disadvantages of Investing in Whisper Stocks

Lack of Reliable Information

High Risk of Misinformation and Manipulation

Limited Liquidity and Market Depth

Strategies for Investing in Whisper Stocks

Conduct Thorough Research

Diversify Your Portfolio

Use a Disciplined Approach

Seek Professional Advice

Risks of Whisper Stocks

Market Manipulation

Regulatory Concerns

Limited Exit Options

Emotional Decision-Making

Conclusion

Whisper Stock FAQs

A whisper stock refers to a relatively unknown or under-followed company that is expected to perform well and provide high returns but is not yet recognized by the broader market.

Investing in whisper stocks can potentially yield high returns, provide early access to emerging opportunities, and allow investors to capitalize on market inefficiencies.

Investing in whisper stocks carries disadvantages such as the lack of reliable information, a high risk of misinformation and manipulation, and limited liquidity.

Investors can manage these risks by conducting thorough research, diversifying their portfolio, using a disciplined investment approach, and seeking professional advice.

Risks include market manipulation, regulatory concerns, limited exit options, and emotional decision-making.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.