The Hollywood Stock Exchange (HSX) is a virtual trading platform that allows users to trade virtual stocks and bonds representing movies, celebrities, and television shows. It operates as a simulated stock market for the entertainment industry, where participants can buy and sell virtual securities using virtual currency. The HSX serves as a platform for entertainment enthusiasts and investors to engage in virtual trading and gain insights into the entertainment industry. It provides a unique opportunity to simulate investment strategies and track the performance of movies, celebrities, and television shows in a risk-free environment. The significance of HSX lies in its ability to offer a bridge between the entertainment industry and financial markets. It allows users to speculate on the success or failure of movies, predict box office performance, and assess the popularity of celebrities. HSX provides valuable information and data that can be utilized for research, analysis, and decision-making in wealth management. The Hollywood Stock Exchange was established in 1996 by Max Keiser and Michael R. Burns as an online game that simulated stock trading for movies. It quickly gained popularity and evolved into a platform where participants could trade virtual securities representing a wide range of entertainment-related assets. Max Keiser and Michael R. Burns were the founders of HSX, envisioning a platform that would allow individuals to experience the excitement and dynamics of the stock market within the context of the entertainment industry. The success and growth of HSX attracted the attention of major stakeholders, including entertainment industry professionals, investors, and financial analysts. Over time, HSX became a subsidiary of Cantor Fitzgerald, a leading global financial services firm, which recognized the value and potential of the platform. The involvement of Cantor Fitzgerald further solidified the credibility and significance of HSX within the financial and entertainment industries. Since its inception, the Hollywood Stock Exchange has continuously evolved and expanded its offerings. Initially focused on movie stocks, it later introduced StarBonds, which represent the value of celebrities and their box office potential. In recent years, HSX has also included television stocks, allowing participants to trade virtual securities based on the success of television shows. The platform has witnessed technological advancements, improved user interfaces, and enhanced features to provide a seamless and engaging trading experience. These developments have contributed to the sustained popularity and relevance of HSX as a unique virtual trading platform for the entertainment industry. The Hollywood Stock Exchange (HSX) operates as a virtual trading platform accessible via its website or mobile application. Users create accounts and receive a virtual currency to trade virtual securities. The platform replicates the functionality of a real stock exchange, allowing users to buy and sell virtual stocks and bonds. Participants can browse the marketplace to view and research various securities, including movie stocks, StarBonds, and TV stocks. They can place orders, set prices, and execute trades based on their investment strategies. The platform provides real-time updates on prices, trading volumes, and other relevant data to enable informed decision-making. The virtual currency used in the Hollywood Stock Exchange is called "Hollywood Dollars" (H$). Each user is allocated a starting balance of H$2 million upon account creation. Participants can use these Hollywood Dollars to purchase virtual securities and build their virtual portfolios. The value of Hollywood Dollars is determined by the supply and demand within the virtual marketplace. As users engage in trading activities, the prices of virtual securities fluctuate, affecting the overall value of Hollywood Dollars held by participants. The virtual currency is not redeemable for real-world currency and serves solely as a means of trading within the HSX platform. HSX follows a set of trading mechanisms and rules similar to those of real-world stock exchanges. Participants can place market orders to buy or sell securities at the prevailing market prices. They can also set limit orders to specify the desired buying or selling price for a security. The platform incorporates trading rules to simulate real-market dynamics. For example, it implements circuit breakers to prevent extreme price volatility and sudden market crashes. These mechanisms ensure a fair and controlled trading environment for participants. HSX also imposes trading fees and transaction costs, such as brokerage fees and market impact fees, which simulate the costs associated with real-world trading activities. These fees add an additional layer of realism to the virtual trading experience within the Hollywood Stock Exchange. Movie stocks represent virtual securities that correspond to specific movies. Each movie stock is assigned a ticker symbol and initial price based on market expectations and industry factors. Participants can buy and sell movie stocks based on their predictions about a film's success at the box office. The prices of movie stocks fluctuate in response to market dynamics, including pre-release buzz, marketing campaigns, critical reviews, and box office performance. Participants aim to buy movie stocks at lower prices and sell them at higher prices, thereby generating virtual profits. The performance of movie stocks on HSX provides insights into market sentiment and predictions about real-world box office performance. StarBonds are virtual securities that represent the value and potential earnings of celebrities. Each StarBond is assigned a ticker symbol and initial price based on the popularity and marketability of the celebrity. Participants can trade StarBonds based on their assessments of a celebrity's box office draw and potential for success in the entertainment industry. The prices of StarBonds are influenced by factors such as the celebrity's recent movie releases, critical acclaim, awards, and public image. Participants can buy StarBonds of celebrities they believe will have successful careers and sell them when the value of the StarBond increases. The trading of StarBonds reflects the market's perception of a celebrity's popularity and potential profitability. HSX also offers virtual securities known as TV stocks, representing television shows. These securities allow participants to speculate on the success or failure of specific TV programs. Participants can trade TV stocks based on their assessments of a show's ratings, audience reception, and overall performance. TV stocks on HSX provide insights into market expectations and predictions about the popularity and longevity of television shows. The prices of TV stocks are influenced by factors such as viewer ratings, critical reception, audience buzz, and the renewal or cancellation decisions made by television networks. Participants can aim to profit from virtual trades by accurately predicting the success or failure of TV shows. The box office performance of movies is a crucial factor influencing the prices of movie stocks on the Hollywood Stock Exchange (HSX). The success or failure of a movie at the box office significantly impacts the virtual trading activity and prices of related movie stocks. Pre-release buzz, marketing campaigns, critical reviews, and audience anticipation all contribute to market expectations about a film's box office potential. Positive reception and strong ticket sales can drive up the prices of movie stocks, indicating market optimism and confidence in a film's success. Conversely, disappointing box office performance can lead to a decline in prices, reflecting market skepticism or disappointment. Critical acclaim and recognition through awards play a significant role in shaping the prices of movie stocks and StarBonds on HSX. Positive reviews from film critics and nominations for prestigious awards can generate market enthusiasm and impact the perceived value of related securities. A movie receiving favorable reviews or earning nominations for major awards such as the Academy Awards can lead to increased demand and higher prices for its associated movie stocks. Similarly, StarBonds of celebrities who receive critical acclaim or win awards may experience price appreciation due to heightened market interest in their work. The popularity and public image of celebrities influence the prices of StarBonds on HSX. Factors such as a celebrity's recent movie releases, public appearances, media coverage, and personal life events can impact their perceived value and trading activity. Positive news, successful projects, and positive public sentiment surrounding a celebrity can lead to increased demand and higher prices for their StarBonds. Conversely, negative news, scandals, or controversies may result in a decline in prices, reflecting market concerns or diminished market appeal. Participants in HSX closely monitor celebrity-related news and events to gauge the potential impact on the prices of StarBonds. Participants in the Hollywood Stock Exchange (HSX) can employ various trading strategies to maximize returns within the virtual marketplace. Here are a few common strategies: Participants can analyze market trends, pre-release buzz, and critical reviews to make informed predictions about a movie's box office performance. By buying movie stocks of films they believe will be successful and selling them when the prices rise, participants aim to generate virtual profits. Participants can evaluate the market value of celebrities by considering factors such as recent movie releases, critical acclaim, awards, and public image. By buying StarBonds of celebrities they believe will have successful careers and selling them when the prices appreciate, participants aim to capitalize on the market's perception of a celebrity's value. Certain events, such as award nominations, wins, or high-profile movie releases, can significantly impact stock prices on HSX. Participants can take advantage of these events by closely monitoring the news and executing timely trades based on the expected market response. This strategy involves taking positions opposite to the prevailing market sentiment. Participants may identify undervalued movie stocks or StarBonds that they believe the market has underestimated. Participants can generate virtual profits by buying these securities at lower prices and selling them when the market recognizes their value. Just like in real-world investing, diversification is important in HSX. Participants can build portfolios with a mix of movie stocks, StarBonds, and TV stocks to spread risk and potentially benefit from different sectors of the entertainment industry. It is important for participants to conduct thorough research, stay updated with industry trends, and consider their risk tolerance and investment goals when implementing trading strategies on HSX. By tracking the performance of virtual movie stocks, StarBonds, and TV stocks, wealth managers can gain a deeper understanding of market sentiment, audience preferences, and the potential success or failure of entertainment-related projects. This information can inform investment decisions and strategies in the real-world entertainment sector. HSX offers a risk-free virtual trading experience, allowing wealth managers and investors to practice and test their investment strategies without risking real capital. The virtual nature of HSX provides a controlled environment to learn, experiment, and refine investment approaches before implementing them in real-world markets. This can help build confidence and expertise in entertainment industry investments. While trading on HSX does not involve real money, participants can still experience the thrill of generating virtual profits through successful trades. The performance of movie stocks, StarBonds, and TV stocks on HSX can reflect market sentiment and provide insights into potential investment opportunities in the real entertainment industry. Box office success, critical reception, and audience demand can be influenced by numerous factors, making it challenging to accurately predict the performance of movies and celebrities. This inherent unpredictability introduces risks when using HSX as a basis for investment decisions. HSX relies on market participants' assessments and predictions about the performance of movies, celebrities, and TV shows. However, these assessments are subjective and can be influenced by misinformation or speculative biases. False rumors, exaggerated expectations, or inaccurate predictions can impact the prices of virtual securities on HSX, leading to potential misjudgments and losses. Participants should exercise caution and conduct thorough research to validate information and avoid making investment decisions solely based on speculative or unverified claims. A critical and discerning approach is necessary to mitigate the risks associated with misinformation and speculation within the HSX platform. It is important to recognize that trading on the Hollywood Stock Exchange (HSX) is a virtual and simulated experience. The prices of virtual securities on HSX do not have direct financial implications or impact real-world markets. While the platform can provide insights into market sentiment and industry trends, it does not offer the same level of financial consequences as real investments. Participants should be mindful of the distinction between virtual trading and real-world investing. The strategies and decisions made within HSX may not necessarily translate to success in real financial markets. It is essential for wealth managers and investors to apply the lessons learned from HSX to real-world investment analysis, taking into account the complexities and risks associated with actual financial transactions. The Hollywood Stock Exchange (HSX) is a virtual trading platform where participants engage in simulated trading of movie-related securities. HSX offers Movie Stocks, StarBonds, and TV Stocks, allowing traders to speculate on the success of movies, celebrities, and television shows. The benefits of HSX include the opportunity to engage in virtual trading, gain industry knowledge, and develop analytical skills. Participants can learn about market dynamics, analyze sentiment, and predict box office performance or celebrity popularity. HSX offers a learning experience without the financial risks associated with real investments. However, it's important to recognize the limitations of HSX. Simulated results may not reflect real market outcomes, and participants should not solely rely on its predictions for actual investments. By leveraging the virtual trading experience and incorporating real-world financial analysis, participants can enhance their understanding of the entertainment industry and make more informed investment decisions in the real marketplace.What Is the Hollywood Stock Exchange (HSX)?

Background of HSX

Establishment and History

Founders and Key Stakeholders

Evolution of HSX Over Time

Function and Mechanics of HSX

Virtual Trading Platform

Virtual Currency Used in HSX

Trading Mechanisms and Rules Within HSX

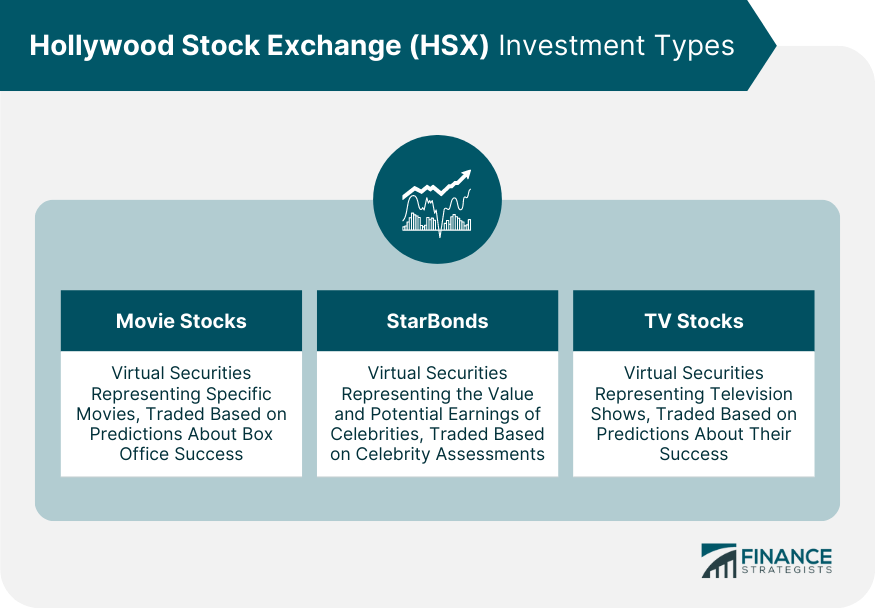

Types of Investments Available on HSX

Movie Stocks

StarBonds

TV Stocks

Factors Influencing Stock Prices

Box Office Performance

Critical Acclaim and Awards

Celebrity Popularity and News

Trading Strategies for Maximizing Returns on HSX

Box Office Predictions

Celebrity Assessment

Event-Based Trading

Contrarian Strategy

Portfolio Diversification

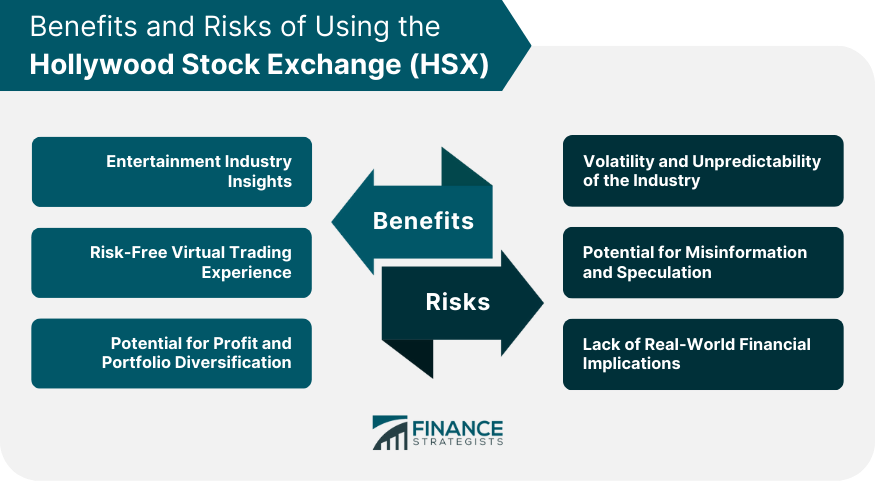

Benefits of Using HSX

Entertainment Industry Insights

Risk-Free Virtual Trading Experience

Potential for Profit and Portfolio Diversification

Risks Associated With HSX

Volatility and Unpredictability of the Entertainment Industry

Potential for Misinformation and Speculation

Lack of Real-World Financial Implications

Conclusion

Hollywood Stock Exchange (HSX) FAQs

The Hollywood Stock Exchange (HSX) is a virtual trading platform that allows users to buy and sell virtual stocks based on movies, stars, and TV shows.

HSX operates as a prediction market for the entertainment industry. Users trade virtual currency to invest in movie stocks, starbonds, and TV stocks, influenced by box office performance, critical acclaim, and celebrity popularity.

Participating in HSX provides insights into the entertainment industry, a risk-free trading experience, and the potential for profit and portfolio diversification.

Risks of HSX include the volatility and unpredictability of the entertainment industry, potential for misinformation and speculation, and the lack of real-world financial implications.

Yes, HSX serves as a valuable tool for learning about stock market dynamics, analyzing market trends and behaviors, and gaining a deeper understanding of the entertainment industry.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.