Escrowed shares are a specific type of financial instrument in which a third party, often a financial institution, holds shares on behalf of the primary parties involved in a transaction. This arrangement is usually temporary and serves to protect the interests of both parties until certain predetermined conditions are met. In the context of initial public offerings (IPOs), escrowed shares may be shares that are held in trust by a financial institution on behalf of the company's founders, executives, or early investors. This arrangement ensures that these stakeholders remain committed to the company's success, as they cannot sell or transfer their shares until certain conditions have been satisfied. The primary purpose of escrowed shares is to provide an additional layer of protection and assurance for parties involved in a financial transaction. By placing the shares in escrow, the parties can ensure that their respective interests are safeguarded and that the agreed-upon terms and conditions of the transaction are met before the shares are released. Additionally, escrowed shares can serve as a mechanism to encourage commitment from key stakeholders in a company. By placing a portion of their shares in escrow, company founders and executives signal their dedication to the long-term success of the business, which can help to attract investors and build trust with shareholders. Escrowed shares play a critical role in financial transactions by providing an added layer of security and confidence for all parties involved. They can help to prevent fraud, reduce the risk of disputes, and ensure that both parties meet their respective obligations. In the context of mergers and acquisitions, for example, escrowed shares can be used to hold a portion of the purchase price in trust, providing assurance to the seller that the buyer will fulfill their payment obligations. In this way, escrowed shares facilitate smoother, more secure transactions and can help to foster a stable and transparent financial market. Voluntary escrow refers to an escrow arrangement that is entered into willingly by both parties involved in a transaction. This type of escrow is often used when the parties want to demonstrate their commitment to the transaction or when they wish to protect themselves from potential risks. For example, in the case of an IPO, company founders and executives may voluntarily place a portion of their shares in escrow to demonstrate their long-term commitment to the business. This can help to build investor confidence and support a higher valuation for the company. Involuntary escrow, also known as mandatory escrow, is an arrangement that is imposed on one or both parties involved in a transaction by a regulatory authority or other governing body. This type of escrow is typically used to ensure compliance with regulations or to protect the interests of third parties, such as minority shareholders. In the context of a company restructuring, for example, a regulatory authority might require that certain shares be placed in escrow to protect the interests of minority shareholders. This can help to ensure that these shareholders are treated fairly and that their rights are respected throughout the restructuring process. Conditional escrow is an arrangement in which the release of escrowed shares is contingent upon the fulfillment of specific conditions. These conditions may be related to the performance of the company, regulatory compliance, or other factors that are relevant to the transaction. For instance, in an IPO, the release of escrowed shares might be contingent upon the company achieving certain revenue or profitability milestones. This can help to align the interests of key stakeholders with the long-term success of the business and provide an incentive for them to work towards these goals. One of the primary benefits of escrowed shares is the risk mitigation they provide for investors. By placing shares in escrow, both parties involved in a transaction can be assured that their interests are protected and that any potential disputes or uncertainties can be resolved before the shares are released. This can help to prevent fraud, reduce the likelihood of disputes, and promote transparency in financial transactions. For example, in an IPO, placing a portion of the shares in escrow can help to ensure that company founders and executives remain committed to the business's success. This can give investors greater confidence in the company's long-term prospects and reduce the risk of insider selling or other adverse events that could negatively impact the share price. Another significant benefit of escrowed shares is their ability to help ensure compliance with relevant regulations and laws. In some cases, regulatory authorities may require that shares be placed in escrow to protect the interests of minority shareholders or to ensure that certain conditions are met before the shares are released. By placing shares in escrow, companies can demonstrate their commitment to regulatory compliance and provide assurance to investors that they are adhering to the rules and regulations governing their industry. This can help to foster trust and confidence in the company and its management, which can ultimately contribute to its long-term success. Escrowed shares can also serve to encourage investor confidence by signaling the commitment of key stakeholders to the company's success. When shares are placed in escrow, it indicates that the parties involved are willing to place their own interests on hold until certain conditions are met, demonstrating their dedication to the transaction and the company's long-term prospects. This can be particularly important in situations where investor trust may be uncertain or where the company's future performance is uncertain. By placing shares in escrow, key stakeholders can help to build investor confidence and support a higher valuation for the company. One of the primary risks associated with escrowed shares is illiquidity. Because escrowed shares cannot be sold or transferred until certain conditions are met, they may be difficult or impossible to liquidate in the event that an investor needs to access their funds quickly. This can be particularly problematic in situations where the conditions for the release of the escrowed shares are not met or where the timeline for their release is uncertain. In such cases, investors may be forced to wait an extended period before they can access their funds, which can create financial strain and limit their ability to make other investments. Escrowed shares are also subject to market risk, as the value of the shares may fluctuate due to changes in market conditions or the company's performance. While the escrow arrangement can help to protect the interests of both parties, it cannot shield them from the inherent risks associated with investing in the stock market. This means that, even if the conditions for the release of the escrowed shares are met, investors may still face losses if the share price declines during the escrow period. In such cases, investors may need to carefully weigh the potential benefits of the escrow arrangement against the potential risks associated with market fluctuations. Another risk associated with escrowed shares is counterparty risk, which refers to the risk that one party in the transaction will fail to fulfill their obligations. While the escrow arrangement is designed to mitigate this risk by holding the shares in trust until the agreed-upon conditions are met, there is still the potential for one party to default on their obligations, leading to disputes or other issues. In order to minimize counterparty risk, it is important for both parties to carefully vet their counterparties and to ensure that the terms of the escrow agreement are clearly defined and understood by all involved. Additionally, working with a reputable and experienced escrow agent can help to further reduce counterparty risk and ensure that the escrow process runs smoothly. An escrow agreement is a legal document that outlines the terms and conditions under which the escrowed shares will be held and released. The parties involved in an escrow agreement typically include the buyer, the seller, and the escrow agent, who acts as the neutral third party responsible for holding and releasing the shares according to the agreed-upon terms. In some cases, other parties, such as legal or financial advisors, may also be involved in the escrow process to provide additional support and guidance to the primary parties. The terms and conditions of an escrow agreement are essential in determining the rights and obligations of each party involved in the transaction. These terms may include, among other things, the specific conditions under which the escrowed shares will be released, any applicable fees or expenses associated with the escrow arrangement, and the process for resolving disputes or other issues that may arise during the escrow period. It is crucial for all parties to carefully review and understand the terms of the escrow agreement before entering into it, as these terms will govern their rights and obligations throughout the escrow process. The termination of an escrow agreement typically occurs when the conditions for the release of the escrowed shares have been met, or when the parties mutually agree to terminate the agreement. In some cases, the escrow agreement may also be terminated if one party defaults on their obligations or if a dispute arises that cannot be resolved through the terms of the agreement. When an escrow agreement is terminated, the escrow agent is responsible for releasing the escrowed shares according to the terms of the agreement or, if necessary, taking appropriate legal action to enforce the terms of the agreement and protect the interests of the parties involved. Escrowed shares are a financial instrument used to protect the interests of parties involved in various transactions. They are held in trust by a neutral third party, usually a financial institution, until specific predetermined conditions are met. By understanding the definition and purpose of escrowed shares, investors and companies can make more informed decisions about their use in financial transactions. There are several types of escrowed shares, including voluntary, involuntary, and conditional escrow. Each type serves a different purpose and is used in different scenarios to help protect the interests of the parties involved. Recognizing the different types of escrowed shares and their respective applications can help investors and companies navigate the complexities of various financial transactions while ensuring that their interests are safeguarded.What Are Escrowed Shares?

Purpose of Escrowed Shares

Importance of Escrowed Shares in Financial Transactions

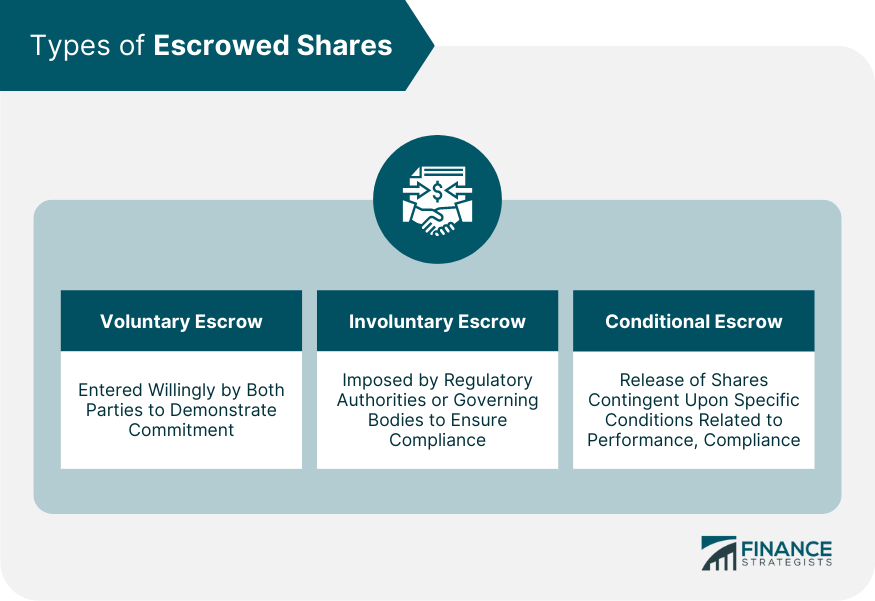

Types of Escrowed Shares

Voluntary Escrow

Involuntary Escrow

Conditional Escrow

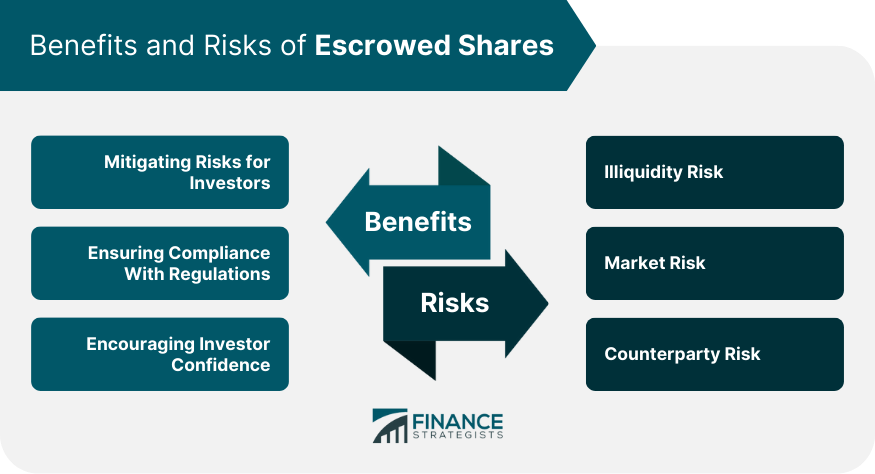

Benefits of Escrowed Shares

Mitigating Risks for Investors

Ensuring Compliance With Regulations

Encouraging Investor Confidence

Risks of Escrowed Shares

Illiquidity Risk

Market Risk

Counterparty Risk

Escrow Agreement

Parties Involved

Terms and Conditions

Termination of Agreement

Bottom Line

Escrowed Shares FAQs

Escrowed Shares are stocks that are held in an escrow account, which is a financial account held by a neutral third party on behalf of two parties in a transaction, until certain conditions are met, such as regulatory approval or the completion of a merger.

Escrowed Shares can mitigate risks for investors, ensure compliance with regulations, and encourage investor confidence in financial transactions.

The potential risks of Escrowed Shares include illiquidity risk, market risk, and counterparty risk.

Escrowed Shares are held in an escrow account until certain conditions are met, after which they are released and transferred to the intended recipient.

The three main types of Escrowed Shares are voluntary escrow, involuntary escrow, and conditional escrow. Each type has specific conditions that must be met for the shares to be released.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.