Decoupling refers to a phenomenon where a stock or a group of stocks diverges from the movement of a broader index or another related security. Essentially, it means that a stock's price movement is independent of the general market trends. This can occur due to various factors, such as specific news or events related to a company, industry-specific developments, or a shift in market sentiment. Historically, decoupling has often been observed during periods of market volatility and economic shifts. For instance, during the Global Financial Crisis of 2008, some stocks and sectors, notably in technology and alternative energy, decoupled from the overall downward trend. Likewise, in the recent COVID-19 pandemic, tech giants like Amazon and Apple saw their stock prices soar while the rest of the market suffered. Several factors can drive decoupling. Company-specific news or events such as earnings reports, product launches, and leadership changes can cause a stock to decouple. Similarly, industry-specific trends, regulatory changes, or technological breakthroughs can lead to decoupling of a sector's stocks from the broader market. Additionally, changes in macroeconomic conditions, including shifts in economic policy, can also result in stock decoupling. Market sentiment plays a significant role in decoupling. If the market sentiment towards a particular company or sector is significantly different from that of the broader market, decoupling can occur. For instance, strong positive sentiment towards the tech sector, driven by expectations of future growth, often leads tech stocks to decouple from the rest of the market. When prices are generally rising, decoupling can occur if certain stocks or sectors do not participate in the broader upswing. This could be due to company-specific issues or negative sentiment towards a particular sector. Conversely, some stocks may outperform the broader market due to exceptional performance or positive market sentiment. Decoupling can occur during bear markets when certain stocks or sectors defy the overall downward trend in prices. This phenomenon is commonly observed in defensive stocks or sectors that exhibit lower sensitivity to economic cycles. Utility and consumer staple stocks, for example, often demonstrate decoupling behavior from the broader market during bearish conditions. Decoupling has important implications for risk management. If a stock decouples from the broader market or its sector, it can increase the overall volatility of an investment portfolio. On the other hand, if a stock decouples in a way that is inversely correlated with the market, it can serve as a hedge and reduce portfolio volatility. Decoupling also impacts asset allocation decisions. If certain stocks or sectors are expected to decouple from the market, investors may choose to over- or under-allocate to these securities to take advantage of potential diversification benefits. However, predicting decoupling can be challenging, and misjudgments can lead to increased portfolio risk. In domestic markets, decoupling can occur due to factors unique to a particular country's economy. For instance, in the U.S., tech stocks have frequently decoupled from the broader market due to the sector's strong growth prospects. Similarly, in China, stocks related to state-owned enterprises have sometimes decoupled from the broader market due to government policies. Internationally, decoupling can occur when a country's stock market diverges from global markets. This is often driven by country-specific economic factors, geopolitical events, or variations in monetary policy. For instance, during the European debt crisis, Greek stocks decoupled from global markets due to the country's unique economic challenges. Changes in economic indicators like GDP, inflation, and unemployment can affect investor sentiment and cause stocks or sectors to decouple from the market. For example, a sudden rise in unemployment can cause consumer discretionary stocks to decouple from the market due to expected declines in consumer spending. Changes in interest rates or money supply can create divergences between sectors. For instance, an increase in interest rates can lead to decoupling of interest-sensitive sectors like real estate and utilities from the broader market. For example, within the tech sector, software stocks might decouple from hardware stocks due to differing growth prospects. Similarly, within the energy sector, renewable energy stocks might decouple from traditional energy stocks due to regulatory changes or technological breakthroughs. Disruptive technologies, changes in consumer behavior, and shifts in competitive dynamics can cause certain stocks to decouple from their sectors. For instance, electric vehicle stocks have decoupled from traditional auto stocks due to the rapid growth of the electric vehicle market. Fundamental analysis involves evaluating a company's financials, industry position, and macroeconomic factors to determine its intrinsic value. If this value differs significantly from the stock's market price, decoupling might be expected. Technical analysis involves studying price trends and patterns to predict future price movements. If a stock's price pattern diverges from that of the market or its sector, it could indicate potential decoupling. These include momentum trading, contrarian investing, and pair trading. Momentum trading involves buying stocks that are outperforming the market (decoupling to the upside) and selling those that are underperforming (decoupling to the downside). Contrarian investing involves doing the opposite, based on the belief that decoupling is temporary. Pair trading involves buying one stock and short selling another within the same sector, aiming to profit from their price convergence or divergence. Perhaps one of the most significant benefits of decoupling is the diversification potential it provides to an investment portfolio. Diversification is a key strategy in finance, employed to manage risk by spreading investments across different types of assets. When a stock or a group of stocks decouples from broader market trends, it often indicates that these securities are responding to different drivers compared to the rest of the market. This makes them less correlated with the overall market, thereby reducing the impact of market-wide swings on the investor's portfolio. In other words, decoupled stocks can provide a buffer against market volatility, helping to protect the investment portfolio during market downturns. Often, stocks decouple from the broader market due to unique strengths or growth prospects. For example, a company that announces innovative new products, enters lucrative markets, or significantly improves its profitability may see its stock price rise even if the overall market is declining. Investors who identify these decoupling stocks early can potentially reap substantial returns by investing in them before the rest of the market catches on. Traders can use a range of strategies to exploit decoupling patterns. For example, momentum trading strategies involve buying stocks that outperform the market and selling those that are underperforming. By identifying stocks that are decoupling from the broader market, traders can profit from their distinct price movements. Moreover, pair trading, a strategy that involves taking a long position in one stock and a short position in another, can be highly effective in cases of decoupling. If two stocks in the same sector start to decouple, a trader can short the underperforming stock and go long on the outperforming one, making a profit as the price gap between the two stocks widens. Typically, stocks begin to decouple due to emerging trends or shifts that are not yet fully recognized by the broader market. For instance, if tech stocks begin to decouple from the rest of the market, it may indicate that digital transformation trends are accelerating. Investors who spot such decoupling early on can position their portfolios to benefit from these broader shifts, making strategic investments that will likely pay off in the future. While decoupling can offer diversification benefits, if a stock decouples from the market in a manner that isn't inversely correlated with the market, it can raise the overall risk level of a portfolio. This means that while some decoupled stocks can help insulate a portfolio during market downturns, others might exacerbate losses. Even experienced investors and financial analysts often struggle to forecast market movements accurately. Misjudging decoupling can lead to poor investment decisions, potentially resulting in significant losses. Notably, it can be particularly difficult to determine whether a stock is genuinely decoupling or merely experiencing temporary volatility. If investors expect particular stocks to decouple positively from the market, they might overinvest in these stocks. Overconcentration can lead to a lack of diversification, exposing the investor to heightened risk if those particular stocks or sectors underperform. Decoupling can lead to market inefficiencies, particularly if it results from irrational investor behavior. For instance, if investors pile into a specific stock due to a temporary trend or fad, causing it to decouple from the market, it can lead to a price bubble. When the bubble bursts, it can result in substantial losses for investors who bought at the peak. These inefficiencies are not just detrimental to individual investors but can also have broader implications for market stability and efficiency. Decoupling, the phenomenon where stocks diverge from broader market trends, has significant implications for investors. It can occur due to specific company news, industry trends, or shifts in market sentiment. Decoupling can provide diversification benefits and serve as a hedge against market volatility, but it can also increase portfolio volatility if decoupled stocks are not inversely correlated with the market. Investors can use fundamental and technical analysis to predict and profit from decoupling, employing strategies such as momentum trading, contrarian investing, and pair trading. However, there are drawbacks to consider, including the difficulty of prediction, the risk of overconcentration, and potential market inefficiencies resulting from irrational behavior. Decoupling can occur in both domestic and international stocks, driven by country-specific factors, economic indicators, and industry trends. It has important implications for risk management and asset allocation decisions. While decoupling offers benefits such as diversification and investment opportunities in stocks with unique strengths, it also carries risks, including increased portfolio volatility and potential market inefficiencies. To make informed investment decisions, investors must carefully analyze decoupling situations, considering fundamental and technical factors, and managing their portfolios effectively. By understanding the dynamics of decoupling, investors can navigate market shifts and potentially capitalize on profitable trading strategies.What Is Decoupling?

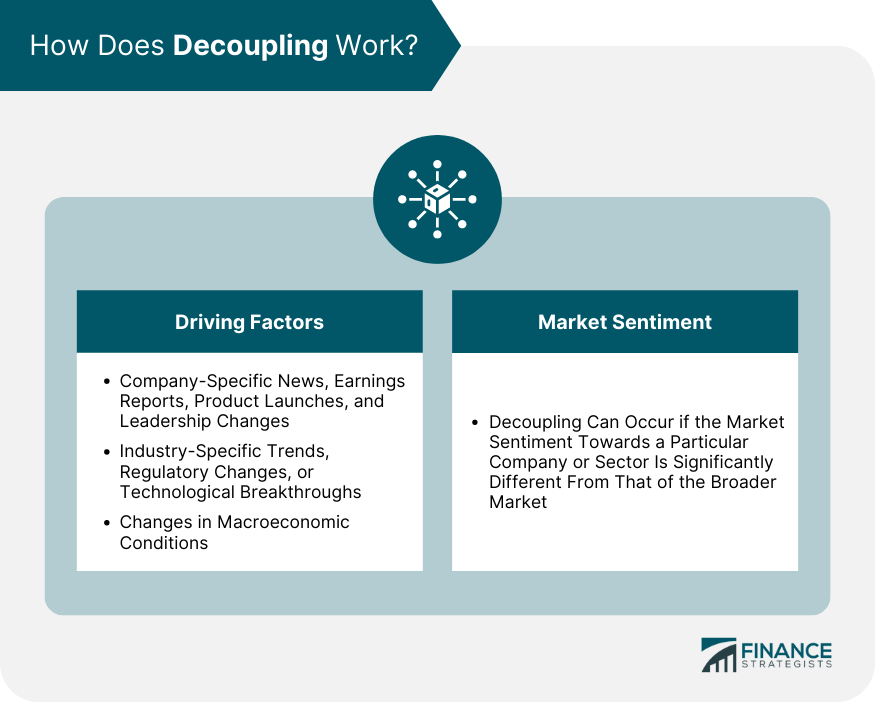

How Decoupling Works

Driving Factors

Market Sentiment Role

Decoupling in Different Market Conditions

Bull Markets

Bear Markets

Impact of Decoupling on Investment Portfolios

Risk Management Implications

Asset Allocation Considerations

Decoupling in Domestic and International Stocks

Domestic Stocks

International Stocks

Economic Factors and Decoupling

Macroeconomic Conditions

Monetary Policy

Decoupling and Sector Performance

Decoupling Within Specific Sectors

Industry Trends and Disruptions

Predicting and Profiting From Decoupling

Fundamental and Technical Analysis

Strategies for Profitable Trading and Investing

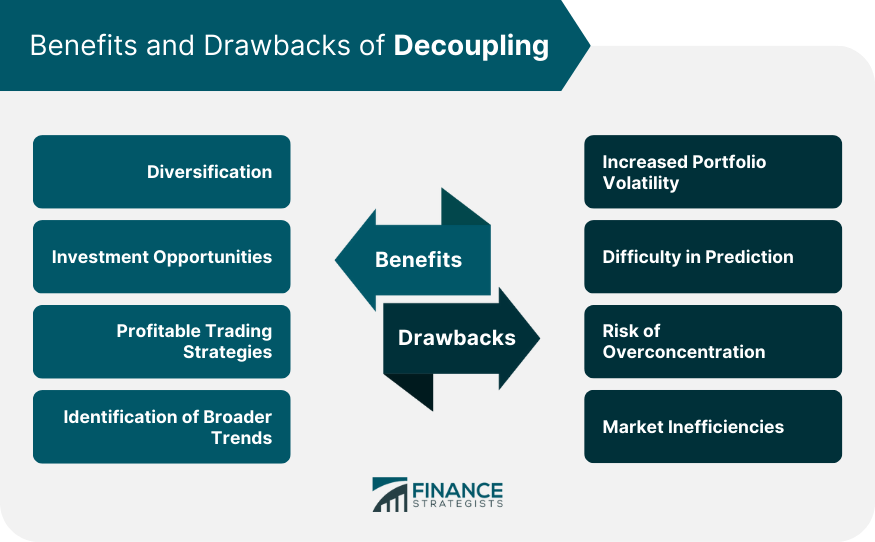

Benefits of Decoupling

Diversification

Investment Opportunities

Profitable Trading Strategies

Identification of Broader Trends

Drawbacks of Decoupling

Increased Portfolio Volatility

Difficulty in Prediction

Risk of Overconcentration

Market Inefficiencies

Final Thoughts

Decoupling FAQs

Stock decoupling refers to a phenomenon where a stock or a group of stocks diverges from the movement of a broader index or another related security.

Several factors can drive stock decoupling, including company-specific news or events, industry-specific trends, changes in macroeconomic conditions, and shifts in market sentiment.

Investors can use fundamental and technical analysis to attempt to predict stock decoupling. However, predicting decoupling can be challenging and misjudgments can lead to increased portfolio risk.

Stock decoupling can provide diversification benefits, create investment opportunities, enable profitable trading strategies, and serve as a signal of broader economic or industry shifts.

Drawbacks of stock decoupling include increased portfolio volatility, the difficulty of predicting decoupling, the risk of overconcentration in certain stocks or sectors, and the potential for market inefficiencies.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.