Real estate income planning involves assessing your current financial situation, determining your investment goals, and developing a strategy to acquire and manage properties that will generate consistent and reliable income. This may involve choosing the right type of property to invest in, such as rental properties or commercial properties, and developing a plan for property management, including finding tenants, collecting rent, and handling maintenance and repairs. It also involves considering the potential risks and challenges involved in real estate investing, such as market volatility, unexpected expenses, and tax and legal issues, and having contingency plans in place to manage these risks. Real estate offers a range of income-generating opportunities, including rental income, real estate investment trusts (REITs), flipping properties, and real estate partnerships. Rental income is one of the most common sources of real estate income. Rental properties can provide a steady stream of passive income, particularly if the property is well-maintained and in a desirable location. It's important to consider the expenses associated with rental properties, such as property management fees, repairs, and vacancies, when developing a real estate income plan. REITs are investment vehicles that allow investors to pool their money to invest in a portfolio of properties. REITs offer several advantages over owning physical properties, including diversification and professional management. There are several types of REITs to choose from, including equity REITs, mortgage REITs, and hybrid REITs. Flipping properties involves buying a property, renovating it, and selling it for a profit. This can be a lucrative way to generate income, particularly if the market is strong and the property is located in a desirable area. However, flipping properties can also be risky, particularly if the renovation costs exceed the anticipated profit. Real estate partnerships involve two or more investors pooling their money to invest in a property. Partnerships can provide several advantages, including shared expenses, shared risk, and access to a wider range of investment opportunities. It's important to establish clear roles and responsibilities, as well as a legal agreement, when entering into a real estate partnership. Developing a successful real estate income plan requires considering several factors, including cash flow needs, tax implications, investment goals, risk tolerance, and market conditions. When developing a real estate income plan, it's essential to consider your cash flow needs. This includes evaluating your current expenses, debt, and other financial obligations to determine how much income you need to generate from your real estate investments. Real estate investments can have significant tax implications, particularly when it comes to rental income and property sales. It's important to understand the tax laws in your area and work with a qualified accountant or tax professional to develop a tax-efficient real estate income plan. Your investment goals will also play a role in your real estate income plan. Understanding your investment goals can help you make informed decisions about your real estate investments. Real estate investing involves risk, and it's important to understand your risk tolerance when developing a real estate income plan. Consider how much risk you're willing to take on and how much you're willing to lose before entering into a real estate investment. Finally, it's important to consider market conditions when developing a real estate income plan. This includes evaluating the local real estate market, as well as broader economic trends. Understanding market conditions can help you make informed decisions about your real estate investments. There are several strategies you can use to generate income from your real estate investments, such as: When investing in rental properties, you can choose between long-term and short-term rentals. Long-term rentals involve renting a property to tenants for an extended period, such as several months or years. Short-term rentals involve renting a property for a shorter period, such as a week or a month. Managing a rental property can be time-consuming and stressful. Consider hiring a property management company to handle the day-to-day responsibilities, such as finding tenants, collecting rent, and handling repairs and maintenance. REITs offer investors the opportunity to diversify their real estate portfolios without the hassle of owning physical properties. This can help reduce risk and provide a more stable source of income. To be successful in property flipping, it's essential to identify properties with potential for profit. Look for properties in desirable locations with strong resale potential. Timing is critical when it comes to property flipping. It's important to buy low and sell high, which means being able to accurately predict market trends and demand. Real estate syndication involves pooling money from multiple investors to purchase a property. This can provide access to larger and more profitable investments. Real estate joint ventures involve two or more investors sharing ownership and responsibility for a property. This can provide access to a wider range of investment opportunities and shared expenses. Real estate can be a valuable source of retirement income, particularly if you plan ahead and make informed investment decisions. Real estate can provide a stable source of passive income during retirement, particularly if you invest in rental properties or REITs. A reverse mortgage allows homeowners to convert the equity in their home into cash, which can be used to supplement retirement income. Reverse mortgages can be a valuable source of income for retirees, but they also come with significant risks and drawbacks. REITs can be an attractive investment option for retirees, particularly those who are looking for a more passive and low-risk investment strategy. Real estate investing can be complex and risky, and there are several challenges to consider when developing a real estate income plan. Managing rental properties can be time-consuming and stressful, particularly if you have multiple properties. Consider hiring a property management company to handle the day-to-day responsibilities, such as finding tenants, collecting rent, and handling repairs and maintenance. Real estate markets can be volatile, and it's important to be prepared for changes in market conditions. This includes understanding market trends, being able to accurately predict demand, and being flexible enough to adjust your investment strategy as needed. Real estate investments can come with unexpected expenses, such as repairs and maintenance, vacancies, and legal fees. It's important to have a contingency plan in place to cover these expenses and ensure that they don't disrupt your cash flow. Real estate investing can have significant tax and legal implications, particularly when it comes to rental income and property sales. It's important to work with a qualified accountant and attorney to ensure that you're compliant with all tax and legal requirements. Real estate income planning is an important process that involves assessing one's financial situation, identifying investment goals, and developing a strategy to acquire and manage properties that generate consistent and reliable income. The process requires considering several factors such as cash flow needs, tax implications, investment goals, risk tolerance, and market conditions. There are several strategies for generating income from real estate investments, including rental property investment, REIT investment, property flipping investment, and real estate partnership investment. Real estate can also be a valuable source of retirement income if planned ahead, but risks and challenges such as property management issues, market volatility, unexpected expenses, and tax and legal issues should be taken into account. Overall, it's important to make informed decisions and work with qualified professionals to ensure successful real estate income planning. What Is Real Estate Income Planning?

Real Estate Income Sources

Rental Income

Real Estate Investment Trusts (REITs)

Flipping Properties

Real Estate Partnerships

Factors to Consider in Real Estate Income Planning

Cash Flow Needs

Tax Implications

Investment Goals

Risk Tolerance

Market Conditions

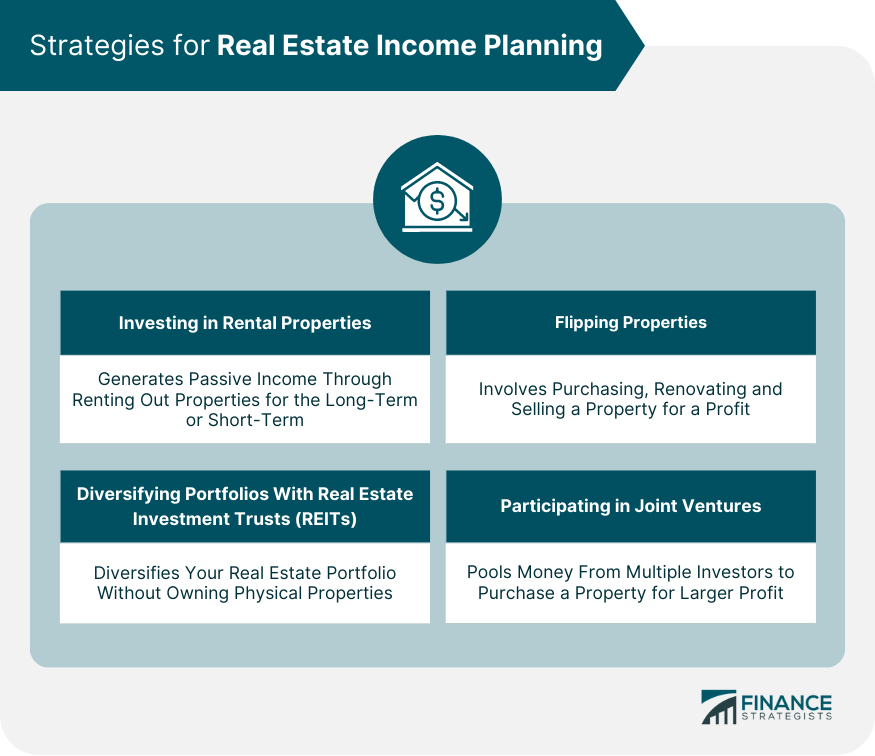

Strategies for Real Estate Income Planning

Investing in Rental Properties

Diversifying Portfolios With REITs

Flipping Properties

Pooling Money From Multiple Investors

Participating in Joint Ventures

Real Estate Income Planning and Retirement

Real Estate as a Retirement Income Source

Reverse Mortgages

Real Estate Investment Trusts (REITs) and Retirement

Risks and Challenges in Real Estate Income Planning

Property Management Issues

Market Volatility

Unexpected Expenses

Tax and Legal Issues

Bottom Line

Real Estate Income Planning FAQs

Real estate income planning involves creating a plan to generate income through real estate investments, such as rental properties or REITs.

Real estate income planning is important because it helps individuals develop a strategy for generating income from their real estate investments. By creating a comprehensive real estate income plan, individuals can make informed decisions about their real estate investments, maximize their returns, and achieve their financial goals.

Cash flow needs, tax implications, investment goals, risk tolerance, and market conditions should be considered in real estate income planning.

Strategies include rental property investment, REIT investment, property flipping investment, and real estate partnership investment.

Real estate investing can be complex and risky, and challenges to consider in Real Estate Income Planning include property management issues, market volatility, unexpected expenses, and tax and legal issues.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.