Fix-and-flip investing is a strategy in the real estate industry where investors purchase properties in need of repair or renovation, make the necessary improvements, and then sell the properties at a higher price. This type of investing aims to generate a profit by adding value to the property through renovations and repairs, capitalizing on market demand for turnkey, move-in-ready homes. Fix-and-flip investing has been around for decades, but it gained popularity in the early 2000s during the housing boom. With the rise of home improvement television shows and an increasing interest in do-it-yourself (DIY) projects, fix-and-flip investing became a popular way for investors to generate profits in a relatively short amount of time. The housing market crash in 2008 led to a temporary decline in fix-and-flip investments, but the strategy has since regained momentum, thanks in part to a recovering housing market and continued interest in property renovation. Fix-and-flip investing plays a significant role in the real estate industry by providing investors with opportunities to generate profits and contribute to the revitalization of neighborhoods and communities. Additionally, this investment strategy can help increase property values, improve the housing stock, and stimulate local economies through job creation and increased spending on construction materials and services. One of the main advantages of fix-and-flip investing is the potential for high returns on investment. By purchasing properties at a lower cost, making value-added improvements, and selling at a higher price, investors can potentially generate significant profits in a relatively short period of time. Fix-and-flip investing is typically a short-term investment strategy, as investors aim to complete the renovation and sale of a property within a few months to a year. This shorter investment horizon can be appealing to those looking for quicker returns and who prefer not to hold onto properties for extended periods of time. Fix-and-flip investing offers investors the opportunity to express their creativity and be directly involved in the process of transforming a property. This hands-on approach can be both rewarding and enjoyable, allowing investors to take pride in their work and see the tangible results of their efforts. Fix-and-flip investing can contribute to the revitalization of neighborhoods and communities by improving the quality of housing stock, increasing property values, and attracting new residents. By renovating and updating properties, investors can help breathe new life into distressed areas and stimulate local economic growth. One of the main risks associated with fix-and-flip investing is acquiring properties at the right price. Overpaying for a property can significantly reduce potential profits and make it difficult to recoup the investment. Investors need to conduct thorough research, understand local market trends, and be skilled at negotiating to mitigate acquisition risks. Renovating a property can be unpredictable, and investors may encounter unexpected issues such as structural problems, permit delays, or cost overruns. These risks can lead to increased expenses and a longer renovation timeline, potentially reducing the overall return on investment. To manage renovation risks, investors should work with experienced contractors, develop a realistic renovation plan, and maintain a contingency budget for unforeseen expenses. Fix-and-flip investing is subject to market risks, as property values and buyer demand can fluctuate due to changes in local economic conditions, interest rates, and other factors. Investors need to monitor market trends, anticipate potential changes, and be prepared to adjust their strategies accordingly to minimize the impact of market risks on their investments. Securing financing for fix-and-flip investments can be challenging, as traditional lenders may be hesitant to provide loans for properties in need of significant repairs or renovations. Investors may need to explore alternative financing options, such as hard money loans or private lenders, which can come with higher interest rates and fees. To mitigate financing risks, investors should maintain a strong credit profile, build relationships with multiple lenders, and explore various financing options. The first step in fix-and-flip investing is identifying potential properties to purchase. Investors should research local markets, attend auctions, and network with real estate agents to find properties in need of renovation that can be acquired at a favorable price. Before purchasing a property, investors need to conduct thorough due diligence to evaluate the property's condition, estimate renovation costs, and determine the potential return on investment. This process may involve obtaining property inspections, researching comparable sales, and consulting with contractors and other real estate professionals. Once a suitable property has been identified, investors need to secure financing for the purchase and renovation. This may involve obtaining a mortgage, leveraging personal savings, or seeking alternative financing options such as hard money loans or private lenders. After acquiring the property, investors should begin the renovation process by developing a detailed renovation plan, obtaining necessary permits, and hiring a reliable contractor. Renovations should be completed in a timely and cost-effective manner to maximize potential returns. Once the property has been renovated, investors should focus on marketing and selling the property to generate a profit. This may involve staging the property, hiring a real estate agent, and utilizing various marketing strategies to attract potential buyers. Successful fix-and-flip investing requires a well-defined business plan that outlines investment goals, target markets, financing strategies, and other key aspects of the investment process. Developing a comprehensive business plan can help investors stay organized, manage risks, and make more informed decisions throughout the investment process. Assembling a reliable team of professionals, such as contractors, real estate agents, attorneys, and accountants, is essential for successful fix-and-flip investing. A strong team can provide valuable expertise, resources, and support, helping investors navigate the complexities of the real estate market and maximize their investment returns. Understanding the local real estate market is crucial for fix-and-flip investing. Investors should research market trends, neighborhood characteristics, and property values to identify potential investment opportunities and make more informed decisions about property acquisitions and renovations. Effective budget management is essential for successful fix-and-flip investing, as cost overruns and unexpected expenses can significantly impact investment returns. Investors should develop a realistic budget, track expenses closely, and maintain a contingency fund to cover unforeseen costs. Flexibility and adaptability are key attributes for successful fix-and-flip investors. Market conditions, property conditions, and other factors can change rapidly, and investors need to be prepared to adjust their strategies and make quick decisions in response to these changes. Fix-and-flip investing is a popular real estate investment strategy that involves purchasing properties in need of renovation, making improvements, and selling the properties at a higher price to generate a profit. This approach offers several advantages, including the potential for high returns and the opportunity for creativity and hands-on involvement. However, fix-and-flip investing also comes with risks and challenges, such as acquisition risks, renovation risks, market risks, and financing risks. To be successful in fix-and-flip investing, investors should follow a well-defined process that includes identifying potential properties, conducting due diligence, securing financing, renovating the property, and marketing and selling the property. By developing a comprehensive business plan, building a reliable team, understanding the local market, managing budgets effectively, and staying flexible and adaptable, investors can increase their chances of success in fix-and-flip investing. With proper planning, research, and execution, this investment strategy can generate significant returns and contribute to the revitalization of communities.What Is Fix-and-Flip Investing?

Importance of Fix-and-Flip Investing in the Real Estate Industry

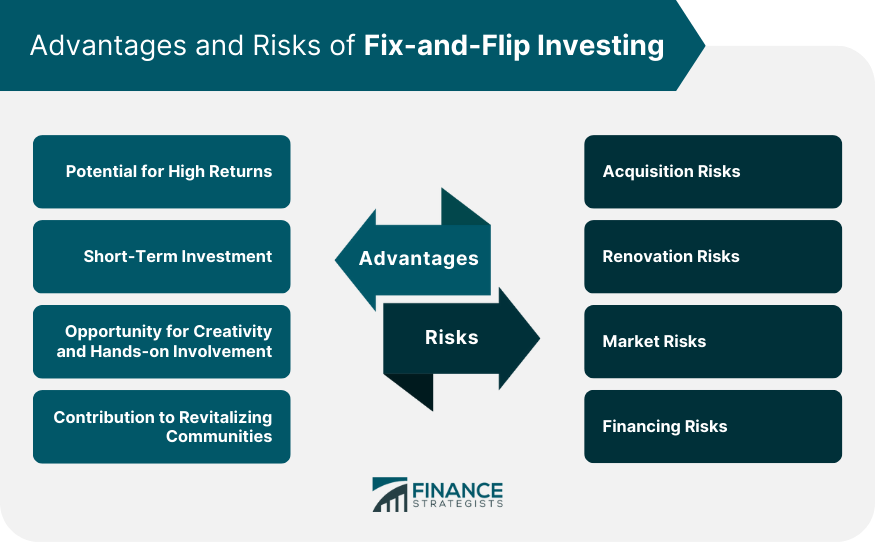

Advantages of Fix-and-Flip Investing

Potential for High Returns

Short-Term Investment

Opportunity for Creativity and Hands-on Involvement

Contribution to Revitalizing Communities

Risks and Challenges of Fix-and-Flip Investing

Acquisition Risks

Renovation Risks

Market Risks

Financing Risks

Steps in Fix-and-Flip Investing

Identify Potential Properties

Conduct Due Diligence

Secure Financing

Renovate the Property

Market and Sell the Property

Tips for Successful Fix-and-Flip Investing

Develop a Business Plan

Build a Reliable Team

Know Your Market

Manage Your Budget Effectively

Stay Flexible and Adaptable

Final Thoughts

Fix-and-Flip Investing FAQs

Fix-and-flip investing is a strategy in which an investor purchases a property with the intention of renovating and selling it for a profit.

The potential for high returns, short-term investment, opportunity for creativity and hands-on involvement, and contribution to revitalizing communities.

Acquisition risks, renovation risks, market risks, and financing risks.

Identifying potential properties, conducting due diligence, securing financing, renovating the property, and marketing and selling the property.

Developing a business plan, building a reliable team, knowing your market, managing your budget effectively, and staying flexible and adaptable.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.