Encumbrance refers to any legal claim, restriction, or liability that affects the ownership or use of a property. It is a broad term that encompasses various rights and interests that can limit the property's title and impede its transfer or free enjoyment. Encumbrances can take different forms, such as mortgages, liens, easements, restrictive covenants, and judgments. These encumbrances are typically created and recorded in public records, ensuring that they are legally binding and visible to potential buyers and lenders. The presence of an encumbrance on a property can have implications for its value, marketability, and potential uses. It is essential for buyers, sellers, and lenders to conduct thorough due diligence to identify and understand any encumbrances associated with a property before entering into a transaction. Encumbrances work by placing certain restrictions or burdens on the property owner's rights. They can affect the property's title, use, and transferability. Encumbrances can take various forms, including mortgages, liens, easements, restrictions, and judgments. When a property has an encumbrance, it means that there are limitations or obligations tied to the property that may affect its value or use. For example, a mortgage encumbrance gives the lender the right to seize the property if the borrower fails to repay the loan. Easement encumbrances grant certain rights to third parties, such as the right to access a portion of the property. It is crucial for buyers and sellers to identify and assess encumbrances before entering into a real estate transaction, as they can impact the property's marketability and value. Buyers may need to assume or address the encumbrances, while sellers must disclose them to potential buyers. Additionally, lenders typically conduct thorough title searches to identify any encumbrances before approving a mortgage. Easements are one of the most common types of encumbrances. They grant specific rights or privileges to individuals or entities to use a portion of another person's property for a particular purpose. Easements can be either appurtenant (attached to the property) or in gross (attached to an individual or entity). Liens are legal claims against a property that serve as security for a debt or obligation. Common types of liens include mortgage liens, tax liens, mechanic's liens, and judgment liens. Liens give the lienholder the right to foreclose on the property or take legal action to recover the owed debt. Covenants and restrictions are contractual obligations or limitations imposed on the property by a previous owner, developer, or governing entity. They can include conditions regarding land use, building restrictions, architectural guidelines, and homeowner association rules. Encroachments occur when a structure, fence, or other improvement on one property extends onto or overlaps with another property. Encroachments can cause disputes between neighboring property owners and may need to be resolved before a property can be sold or transferred. Encumbrances, such as liens or restrictive covenants, can diminish the attractiveness of a property to potential buyers. These encumbrances may restrict property use or impose certain obligations, which can deter buyers seeking flexibility or freedom in their property ownership. Encumbrances can limit the marketability of a property by narrowing the pool of potential buyers. Some buyers may be unwilling to navigate the complexities associated with encumbrances or may find them too burdensome, leading to a smaller target market for the property. The presence of encumbrances can result in decreased demand for a property. Buyers may be cautious about investing in properties with encumbrances due to perceived risks or limitations. Reduced demand can impact the property's market value, potentially leading to a lower selling price. Certain encumbrances, such as outstanding liens, can make it challenging for buyers to secure financing for the property. Lenders may be reluctant to provide loans for properties with significant encumbrances, which can further limit the buyer pool and impact the market value. Appraisers consider encumbrances when determining the value of a property. Encumbrances that impose restrictions or negatively impact property use may lead to downward adjustments in the appraised value. These adjustments reflect the perceived limitations imposed by the encumbrances, potentially reducing the market value. Sellers may need to make concessions, such as lowering the selling price or offering incentives, to compensate for the encumbrances and attract potential buyers. These concessions can impact the final sale price and, consequently, the market value of the property. Sellers have an obligation to disclose any known encumbrances to potential buyers. This includes providing accurate and complete information about existing easements, liens, covenants, restrictions, and encroachments that affect the property. Buyers should conduct a thorough title search and obtain title insurance to identify and address any encumbrances before completing a real estate transaction. Title insurance protects the buyer against losses resulting from undiscovered encumbrances or defects in the property's title. When faced with encumbrances in a real estate transaction, one effective strategy is to engage in open communication and negotiation with the parties involved. By discussing the nature of the encumbrances and their impact, it may be possible to reach mutually acceptable agreements. This could involve establishing specific conditions or restrictions to address the encumbrances and ensure a satisfactory outcome for all parties. Drafting and executing legally binding agreements can provide clarity and protection throughout the transaction process. Obtaining comprehensive title insurance is a crucial strategy for dealing with encumbrances. Title insurance provides protection against potential losses resulting from undiscovered or undisclosed encumbrances. Conducting thorough due diligence is equally important. This involves conducting a detailed examination of property records, surveys, and other relevant documents to identify any existing encumbrances. By performing diligent research and obtaining title insurance, buyers can make informed decisions and mitigate the risks associated with encumbrances. In some cases, legal remedies may be necessary to address encumbrances effectively. Seeking advice from a real estate attorney experienced in encumbrance matters can provide valuable guidance. Legal remedies may involve pursuing actions such as quiet title actions, which aim to establish clear ownership rights and eliminate conflicting encumbrances. Injunctions can also be sought to halt encroachment or other violations of property rights. By understanding the legal options available and taking appropriate action, parties can work towards resolving encumbrance issues and protecting their interests. Encumbrance is a legal term that refers to any claim, lien, restriction, or liability that affects the ownership rights and transferability of a property. There are several types of encumbrances that can affect a property. Easements are rights granted to others to use a portion of a property, while liens are legal claims against a property that secure a debt or obligation. Understanding encumbrances is crucial in real estate transactions as they can have significant implications for both buyers and sellers. Sellers have an obligation to disclose known encumbrances, while buyers should conduct thorough due diligence, including title searches and obtaining title insurance, to identify and address any encumbrances before completing the transaction. By identifying and addressing encumbrances, parties can ensure a smooth and successful transaction.What Is Encumbrance?

How an Encumbrance Works

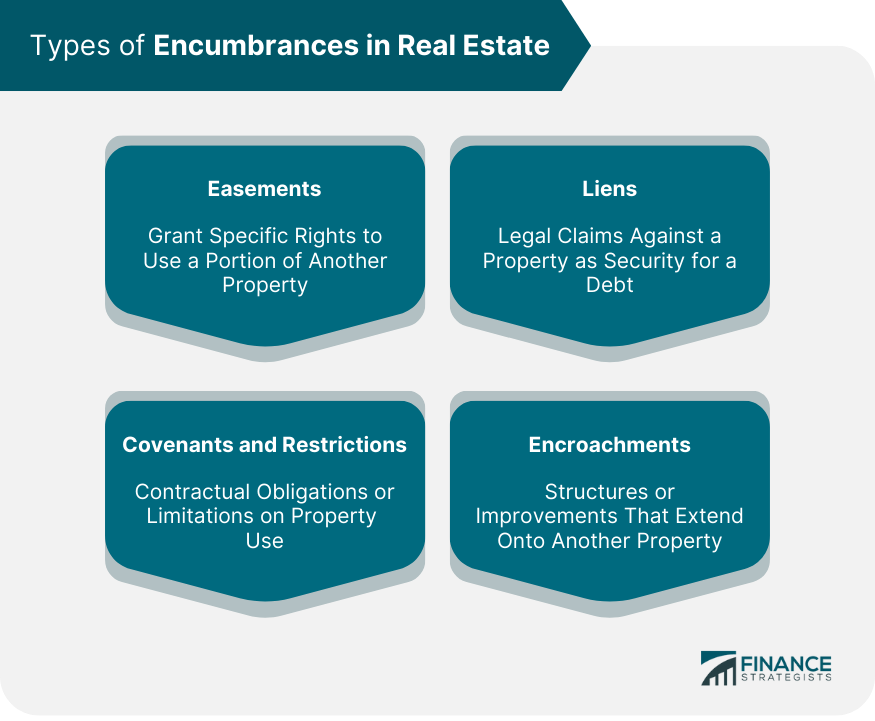

Types of Encumbrances

Easements

Liens

Covenants and Restrictions

Encroachments

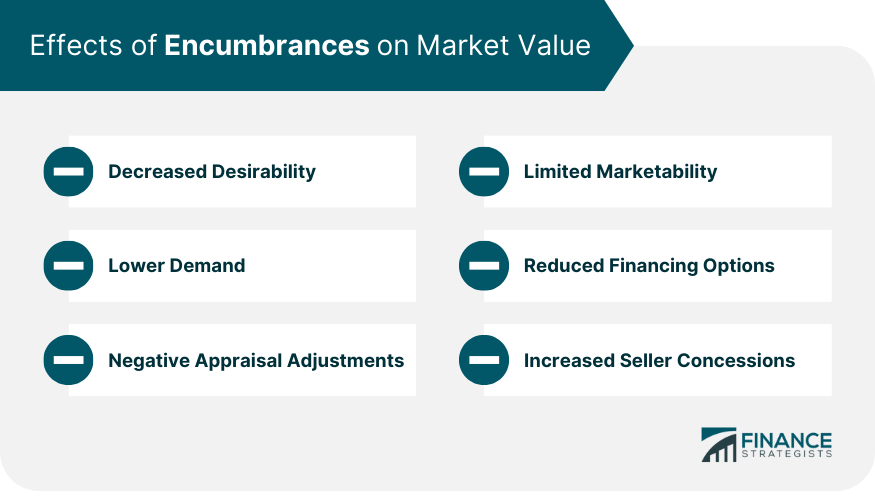

Effects of Encumbrances on Market Value

Decreased Desirability

Limited Marketability

Lower Demand

Reduced Financing Options

Negative Appraisal Adjustments

Increased Seller Concessions

Disclosure and Due Diligence

Seller's Disclosure Obligations Regarding Encumbrances

Importance of Conducting a Title Search and Obtaining Title Insurance

Strategies for Dealing With Encumbrances

Negotiation and Agreement

Title Insurance and Due Diligence

Legal Remedies and Resolution

Final Thoughts

Encumbrance FAQs

Buyers should carefully review the encumbrances and consult with legal professionals to understand the implications. They can negotiate with the seller to resolve or address the encumbrances before proceeding with the purchase.

Yes, some encumbrances can be removed from a property's title through various legal processes, such as obtaining releases, satisfying debts, or going through court proceedings. The specific method depends on the type of encumbrance and applicable laws.

Not all encumbrances are negative or undesirable. Some easements, such as utility easements, can provide necessary services to a property and be beneficial. However, it is essential to understand the extent and implications of any encumbrance on the property.

Title companies conduct thorough title searches to identify encumbrances and provide title insurance. They play a crucial role in uncovering any existing encumbrances and helping buyers and lenders assess the associated risks.

In most cases, encumbrances remain with the property and are transferred to the new owner upon sale. However, it is important for buyers to be aware of any existing encumbrances and address them before completing the transaction.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.