Planned giving is a strategic approach to philanthropy that enables individuals to make significant donations to non-profit organizations, either during their lifetime or as part of their estate plan. Planned giving can provide numerous benefits to both the donor and the receiving organization, such as tax advantages and the satisfaction of leaving a lasting legacy. A simple bequest is a provision in a will or living trust that designates a specific sum of money, a percentage of the estate, or particular assets to be donated to a non-profit organization upon the donor's death. A residuary bequest allocates the remainder of an estate after all other bequests, expenses, and taxes have been paid, to one or more non-profit organizations. Contingent bequests take effect only if certain conditions are met, such as the death of a primary beneficiary before the donor. A charitable gift annuity is a contract between a donor and a non-profit organization in which the donor makes a gift of cash or securities, and the organization agrees to pay the donor a fixed income for life. An immediate gift annuity begins making payments to the donor shortly after the initial gift is made. A deferred gift annuity delays the start of income payments until a future date chosen by the donor, typically at retirement. A CRAT is a type of trust that provides a fixed income to the donor or other beneficiaries for a specified period of their lifetime, with the remaining assets going to a non-profit organization upon the trust's termination. A CRUT is similar to a CRAT, but the income payments are based on a fixed percentage of the trust's assets, revalued annually. A CLAT provides a fixed income to a non-profit organization for a specified period, with the remaining assets passing to the donor's heirs upon the trust's termination. A CLUT is similar to a CLAT but provides a variable income to the non-profit organization based on a fixed percentage of the trust's assets revalued annually. A donor-advised fund (DAF) is an account established with a sponsoring organization, typically a public charity or community foundation, that allows donors to make charitable contributions, receive an immediate tax deduction, and recommend grants to non-profit organizations over time. Donors can designate a non-profit organization as the beneficiary of their life insurance policy or retirement plan, such as an IRA or 401(k). A donor can transfer ownership of an existing life insurance policy to a non-profit organization, which becomes both the owner and beneficiary of the policy. A donor can purchase a new life insurance policy with a non-profit organization as the owner and beneficiary and make tax-deductible premium payments. Donors can make outright gifts of real estate, artwork, or other tangible assets to non-profit organizations, which can then use or sell the assets to support their mission. A donor can gift a personal residence or farm to a non-profit organization while retaining the right to live on the property for their lifetime or a specified term. Upon the donor's death or the end of the term, the organization assumes full ownership of the property. A donor can sell a property or other tangible assets to a non-profit organization at a price below fair market value, creating a charitable gift equal to the difference between the sale price and the asset's fair market value. Consider your personal values, interests, and the causes or organizations you wish to support through your planned giving strategy. Explore the tax benefits of various planned giving strategies to maximize your tax savings and the impact of your gifts. Evaluate how planned giving strategies can complement your retirement income and financial security. Determine how you want to be remembered and the lasting impact you hope to create through your philanthropic efforts. Review your assets and liabilities to understand your overall financial position and the resources available for planned giving. Identify your current and future sources of income to ensure that your planned giving strategy aligns with your financial needs. Examine your existing estate plan to determine how planned giving can be integrated or updated to meet your philanthropic goals. Choose the planned giving strategies that best align with your personal and financial goals, as well as the needs of your chosen non-profit organization(s). Consult with a financial planner to review your overall financial plan and explore planned giving strategies that fit your needs and objectives. Seek legal advice to draft or revise your will, trust, or other estate planning documents to include your planned giving intentions. Work with a tax professional to understand the tax implications and benefits of your planned giving strategy. Inform your chosen non-profit organization(s) of your planned giving intentions, so they can plan for the future and recognize your generosity. Set up the legal and financial structures necessary to implement your chosen planned giving strategy, such as creating a trust or donor-advised fund. Ensure that your gifts are properly managed and funded according to your planned giving strategy, including making regular contributions or premium payments, if applicable. Reevaluate your planned giving strategy in light of major life events, such as marriage, divorce, retirement, or the birth of a child. Review your planned giving strategy if your financial situation changes significantly, such as receiving an inheritance or experiencing a significant change in income. Stay informed of changes in tax laws that may affect your planned giving strategy and consult with your tax advisor as needed. Monitor the status of your chosen non-profit organization(s) to ensure they continue to align with your philanthropic goals and maintain their tax-exempt status. Planned giving is a strategic approach to philanthropy that allows individuals to make meaningful contributions to non-profit organizations while benefiting from potential tax savings and other financial advantages. A well-designed planned giving strategy involves understanding various types of planned giving vehicles, such as bequests, charitable gift annuities, and charitable trusts, and selecting the most suitable option based on personal and financial goals. Regularly reviewing and updating your strategy in response to life events, financial changes, and evolving tax laws is crucial to ensure its ongoing effectiveness. Engaging professional advisors, such as financial planners, attorneys, and tax advisors, can help in implementing and maintaining a successful planned giving strategy that not only maximizes your philanthropic impact but also creates a lasting legacy for future generations.Planned Giving Strategies Overview

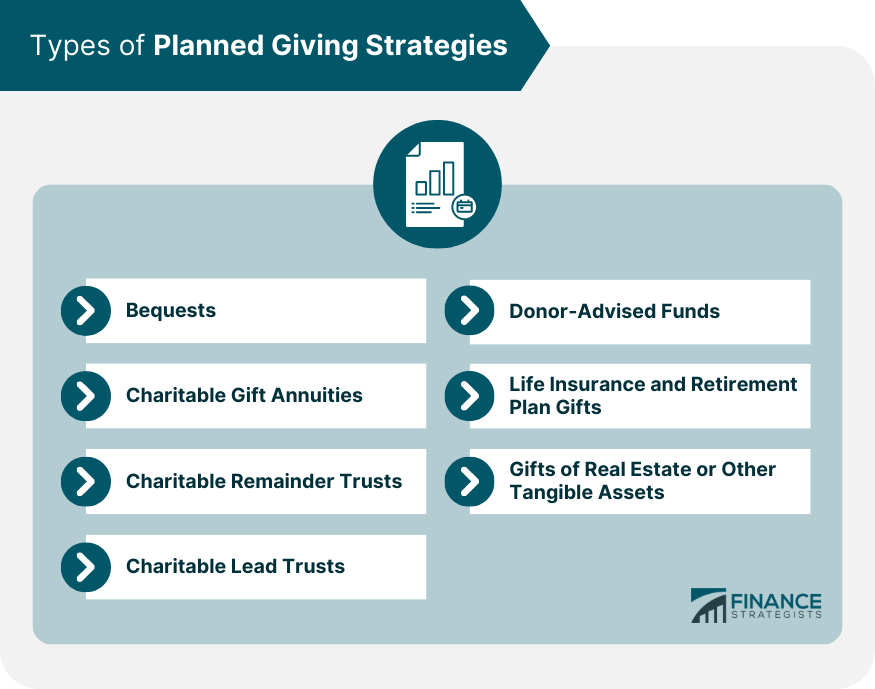

Types of Planned Giving Strategies

Bequests

Simple Bequests

Residuary Bequests

Contingent Bequests

Charitable Gift Annuities

Immediate Gift Annuities

Deferred Gift Annuities

Charitable Remainder Trusts

Charitable Remainder Annuity Trusts (CRATs)

Charitable Remainder Unitrusts (CRUTs)

Charitable Lead Trusts

Charitable Lead Annuity Trusts (CLATs)

Charitable Lead Unitrusts (CLUTs)

Donor-Advised Funds

Life Insurance and Retirement Plan Gifts

Naming a Charity as a Beneficiary

Gifting an Existing Policy

Gifting a New Policy

Gifts of Real Estate or Other Tangible Assets

Outright Gifts

Retained Life Estate Gifts

Bargain Sale Gifts

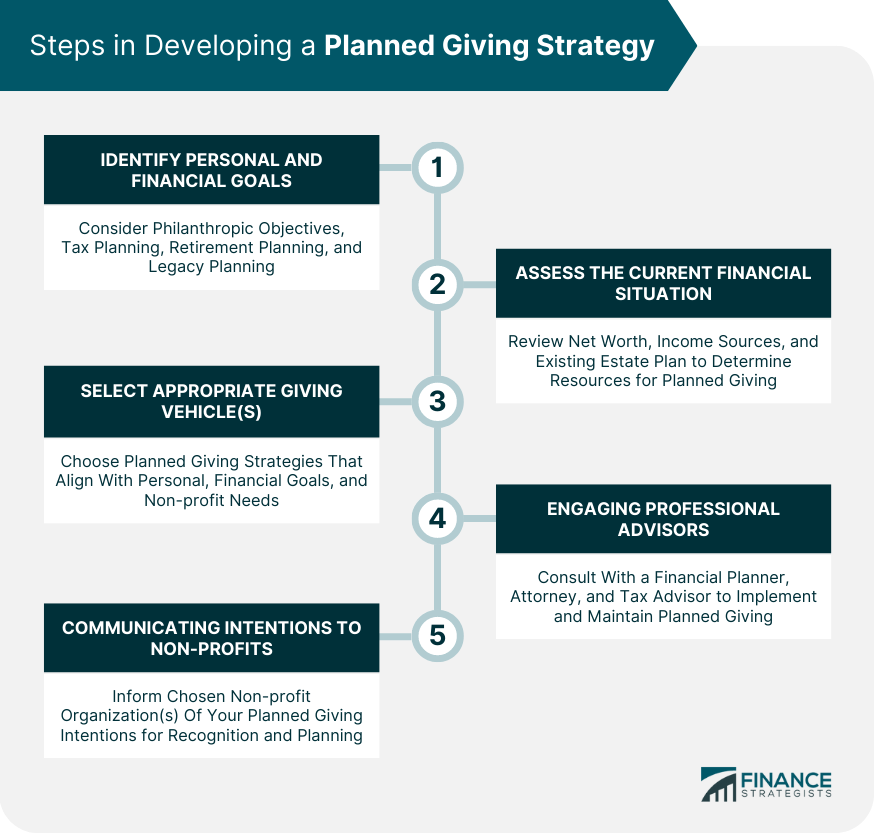

Developing a Planned Giving Strategy

Identifying Personal and Financial Goals

Philanthropic Objectives

Tax Planning

Retirement Planning

Legacy Planning

Assessing the Current Financial Situation

Net Worth

Income Sources

Existing Estate Plan

Selecting the Appropriate Planned Giving Vehicle(s)

Engaging Professional Advisors

Financial Planner

Attorney

Tax Advisor

Communicating Intentions to Chosen Non-Profit Organization(s)

Implementing and Monitoring the Planned Giving Strategy

Establishing the Chosen Planned Giving Vehicle(s)

Managing and Funding the Gifts

Regularly Reviewing and Updating the Strategy

Life Events

Changes in Financial Situation

Changes in Tax Laws

Changes in Non-profit Organization Status

Conclusion

Planned Giving Strategies FAQs

The primary types of planned giving strategies include bequests, charitable gift annuities, charitable remainder trusts, charitable lead trusts, donor-advised funds, life insurance and retirement plan gifts, and gifts of real estate or other tangible assets. Each strategy offers different benefits and tax implications, making it essential to choose the one that aligns with your philanthropic and financial goals.

Planned giving strategies offer benefits to both donors and non-profit organizations. Donors can potentially receive tax advantages, an additional source of retirement income, and the satisfaction of creating a lasting legacy. Non-profit organizations benefit from the financial support that helps them achieve their mission and sustain their programs over the long term.

Yes, planned giving strategies can be integrated into an existing estate plan. By working with professional advisors, such as an attorney and financial planner, you can revise your will, trust, or other estate planning documents to include your planned giving intentions and ensure that your philanthropic goals are achieved.

It is essential to regularly review and update your planned giving strategies, especially in response to significant life events, changes in your financial situation, tax law updates, or changes in the status of your chosen non-profit organization(s). Regular reviews help ensure that your planned giving strategy remains aligned with your financial needs and philanthropic objectives.

Professional advisors, such as financial planners, attorneys, and tax advisors, play a crucial role in implementing planned giving strategies. They can help you assess your current financial situation, identify your philanthropic and financial goals, select the appropriate planned giving vehicle(s), and establish the legal and financial structures necessary for your planned giving strategy. Additionally, they can provide ongoing advice and support to ensure that your strategy remains effective over time.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.