Multi-family offices (MFOs) are specialized organizations that provide comprehensive wealth management and advisory services to multiple high-net-worth (HNW) and ultra-high-net-worth (UHNW) families. These offices pool the resources of several affluent families to access a wide range of expertise, investment opportunities, and customized services at a lower cost compared to single-family offices. Multi-family offices have evolved from single-family offices, which were established by wealthy families to manage their wealth and personal affairs. The growth of multi-family offices in wealth management can be attributed to the rising number of HNW and UHNW individuals and the increasing complexity of managing significant wealth. The primary purpose of multi-family offices is to address the unique financial, personal, and intergenerational needs of affluent clients. Benefits of multi-family offices include: 1. Economies of scale 2. Access to a wide range of expertise and services 3. Customized solutions and personal attention 4. Confidentiality and privacy

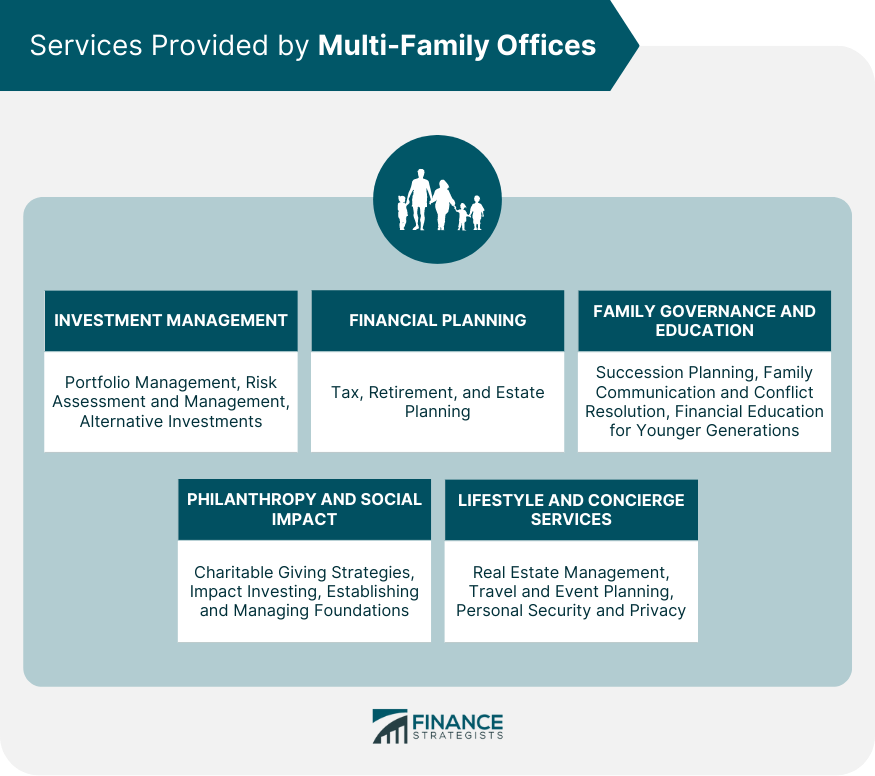

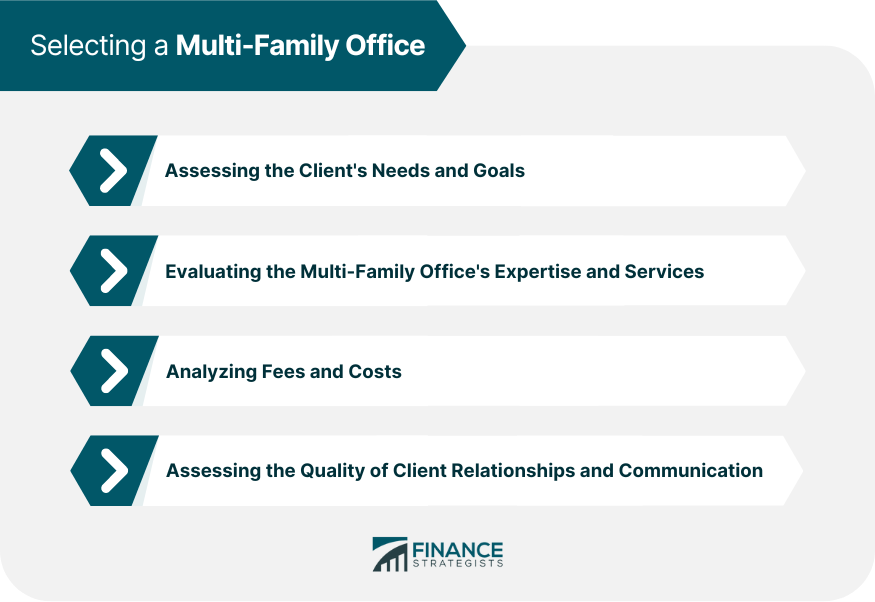

Multi-family offices provide comprehensive portfolio management services, including asset allocation, investment selection, and performance monitoring to help clients achieve their financial goals. Risk assessment and management services help clients identify, evaluate, and mitigate potential risks associated with their investment portfolios. Multi-family offices often provide access to alternative investments, such as private equity, hedge funds, real estate, and collectibles, to diversify clients' portfolios and enhance returns. Tax planning services assist clients in minimizing their tax liabilities and maximizing tax-efficient strategies. Retirement planning services help clients prepare for their post-work lives by developing income generation strategies and managing retirement accounts. Estate planning services address clients' wealth transfer needs, including the creation of wills, trusts, and charitable giving strategies. Succession planning services help clients ensure the smooth transfer of family businesses or wealth management responsibilities to the next generation. Multi-family offices may provide guidance on family communication and conflict resolution to maintain harmony and preserve family values. Financial education services help younger family members understand wealth management principles and prepare them for future financial responsibilities. Multi-family offices assist clients in developing and implementing charitable giving strategies, including the establishment of foundations and donor-advised funds. Impact investing services help clients align their investments with their social and environmental values. Multi-family offices may provide guidance on establishing and managing foundations to support clients' philanthropic endeavors. Real estate management services help clients manage and maintain their residential, commercial, and investment properties. Travel and event planning services assist clients in organizing personal and family events, vacations, and other lifestyle experiences. Personal security and privacy services ensure the safety and confidentiality of clients and their families. This type of MFO provides comprehensive wealth management services to high net worth families. They typically have a team of professionals who work closely with each family to understand their unique financial goals and needs. They offer a range of services, including investment management, financial planning, tax advice, estate planning, and more. This type of MFO specializes in a particular area of wealth management, such as investment management or estate planning. They may offer fewer services than a traditional MFO, but they are often more focused and specialized in their expertise. This type of MFO has a global presence and provides services to high net worth families around the world. They have teams in different regions and may offer specialized expertise in international tax planning, cross-border investments, and other global wealth management issues. This type of MFO uses technology to provide wealth management services to clients remotely. They typically have a team of professionals who work virtually and offer services such as investment management, financial planning, and more. This type of MFO is often more affordable than traditional MFOs, as they have lower overhead costs. This type of MFO combines the services of a traditional MFO with those of a single-family office (SFO). They typically offer a range of services to multiple families, but they may also provide more customized services to individual families when needed. Clients should begin by evaluating their specific needs and goals, such as investment management, estate planning, philanthropy, and lifestyle services, to identify the most suitable multi-family office. It is essential to assess the multi-family office's expertise, experience, and range of services offered to ensure they align with the client's needs and objectives. Clients should analyze the fees and costs associated with the multi-family office's services, including management fees, performance fees, and other expenses, to ensure transparency and value for money. The quality of client relationships and communication is crucial in selecting a multi-family office, as clients require trust, confidentiality, and a personalized approach to their wealth management needs. Multi-family offices play a vital role in wealth management for high-net-worth clients by providing a wide range of expertise and services tailored to their unique financial, personal, and intergenerational needs. These firms offer the benefits of economies of scale, access to specialized knowledge, and a customized approach, making them an attractive option for affluent families seeking comprehensive wealth management solutions. Choosing the right multi-family office is essential for clients to ensure their financial objectives are met, and their wealth is managed efficiently and effectively. By carefully assessing their needs and goals, evaluating the multi-family office's expertise and services, and analyzing fees and costs, clients can select a multi-family office that aligns with their unique requirements. It can help clients achieve financial success and preserve their wealth for generations to come.What Are Multi-Family Offices?

Services Provided by Multi-Family Offices

Investment Management

Portfolio Management

Risk Assessment and Management

Alternative Investments

Financial Planning

Tax Planning

Retirement Planning

Estate Planning

Family Governance and Education

Succession Planning

Family Communication and Conflict Resolution

Financial Education for Younger Generations

Philanthropy and Social Impact

Charitable Giving Strategies

Impact Investing

Establishing and Managing Foundations

Lifestyle and Concierge Services

Real Estate Management

Travel and Event Planning

Personal Security and Privacy

Types of Multi-Family Offices

Traditional Multi-Family Office

Boutique Multi-Family Office

Global Multi-Family Office

Virtual Multi-Family Office

Hybrid Multi-Family Office

Selecting a Multi-Family Office

Assessing the Client's Needs and Goals

Evaluating the Multi-Family Office's Expertise and Services

Analyzing Fees and Costs

Assessing the Quality of Client Relationships and Communication

Conclusion

Multi-Family Offices FAQs

A multi-family office (MFO) is a professional organization that offers personalized financial and investment services to high-net-worth families and individuals. MFOs aim to provide comprehensive wealth management services to multiple families, typically with investable assets in excess of $100 million.

MFOs offer a wide range of financial services, including investment management, tax planning, estate planning, philanthropic planning, risk management, and family governance. The services provided are customized to meet the specific needs of each family or individual.

Unlike other wealth management firms that offer services to a broad range of clients, MFOs focus exclusively on serving a limited number of high-net-worth families and individuals. Additionally, MFOs typically offer a higher level of customization and personalization in their services.

MFOs offer several benefits to high-net-worth families, including customized wealth management solutions, access to top-tier investment managers, reduced administrative burdens, and greater control and flexibility over their financial affairs.

Choosing the right MFO requires careful consideration of several factors, including the firm's reputation, investment philosophy, client service model, and cost structure. It is important to conduct due diligence and seek recommendations from trusted advisors before selecting an MFO to manage your wealth.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.