Securities lending is the provision of collateralized loans to eligible borrowers by securities lenders. Collateral may be cash, a bank letter of credit, a certificate of deposit (CD), or securities as agreed in advance. At the end of every securities lending transaction, both parties involved must return the same amount of securities and collateral to each other. In a securities loan, the borrower pays the lender an agreed fee, an annualized percentage of the current market value of the securities loaned. This is typically processed monthly. If the lender recalls security during the life of the loan, the borrower must return the security to the lender. This does not affect the agreed fee for the loan. Lenders review their portfolios regularly and may recall securities that are in high demand. If this happens, they can negotiate a higher cost with the borrower for the remainder of the loan. On securities loans that are collateralized by cash, the lender pays the borrower a percentage of the interest gained on the cash investment. This percentage is likely below the market rate to enable the lender to reinvest the money at a higher rate in the market to make a profit. Due to a lack of immediately available certificates for US railway bonds (sold by certain clients), brokers/dealers borrow certificates from other investors in order to complete the transactions. At the current time Borrowing among brokers/dealers has expanded to include large institutional investors around the world lending and borrowing equities. Most governments here and abroad have given their blessing to such lending, which was suggested by the Group of Thirty (G30) as a tool for industry liquidity. Borrowing among brokers/dealers has expanded to include large institutional investors around the world lending and borrowing equities. Most governments here and abroad have given their blessing to such lending, which was suggested by the Group of Thirty (G30) as a tool for industry liquidity. The reasons for securities lending are as follows: The following are examples of functional participants: Some middlemen coordinate access between lenders and borrowers in the securities lending industry. Amongst other services, intermediaries provide the following: A tri-party agreement exists between lenders and borrowers who wish to formalize their participation through intermediaries. In these arrangements, it is typical for the borrower to pay custodian fees. The significance of this is that most custodians can serve as agents by indemnifying borrowers against the complete return of loaned securities to lenders or the collection and payment of monetary compensation equal to the value of any protection at the time a default can occur. Lendable domestic securities include: Lendable international issues include: The simultaneous exchange of securities and collateral is known as domestic processing. International processing requires that the collateral be received FIRST (usually 24 hours in advance) BEFORE the securities to be loaned are delivered. Processing Securities Delivery Domestic loans can be delivered in several ways: DTCC, Federal Reserve Bank, NSCC, other clearing corporations or securities depositories, and physical. Euroclear, Clearstream (CEDEL), other national clearing companies or securities depositories, and physical are the main ways that Eurobonds are distributed. Failure to establish securities lending services per schedule, content, quality of performance, financial outcomes, and other criteria may result in the loss of money invested in developing the business and related securities. The following are a few examples of monetary damage: through a clerical error, failure to execute precisely, and other unforeseen circumstances. The potential for a borrower not repaying their debt could lead to the loss of financial assets by the lending party. This risk is managed through: Several risks are associated with collateral, including the risk of loss. This refers to the loss of financial assets caused by the failure to access and use related collateral to sufficiently replace the value of the securities, which are not returned in part or full when required. Central banks manage such risks through various methods, including setting minimum reserve requirements and cuts and monitoring and managing collateral availability. The risk of agent default refers to the loss of financial assets that could occur if an agent fails to perform their duties. This type of risk can be managed through measures such as: The risks of employee fraud or error happening are referred to as "loss of financial assets." This could be caused by something like an employee making a mistake, not doing their job properly, or trying to defraud the company. There are measures in place to help reduce these types of risks, which include: Each security has its own rules, processes, related dangers, and financial gains. Long-term investors, such as pension funds, endowments, foundations, insurance companies, and mutual fund management firms, typically act as lenders in the securities market. These entities are motivated to supply securities by fee income generation and the potential for limited downside risk. A corporate or individual client who is seeking to borrow stocks, bonds, precious metals, other commodities, or any combination of items. The borrower might be a broker/dealer in need of securities for an investment strategy (such as covering a short position) or operational reasons (such as avoiding a fail-to-deliver). The agent, typically a commercial bank with expansive custodial abilities, provides two vital services: The agent may also help the lender by financially covering certain losses if the borrower does not return the securities they borrowed. Since the Federal Reserve implemented the "Risk-Based Capital Guidelines" in January 1991, banks providing indemnifications to securities lending clients must set aside a portion of capital against such indemnifications. The automatic stay of proceedings against a person's assets, including the assets in possession of the person’s creditors, is an important issue in terms of securities loans. “Negotiation” refers to the discussion and arrangement of viable securities loans. The following are elements of the negotiation procedure: In addition, the collateral investment must be under pre-determined standards. Collateral of superior quality should be invested, such as: A “mark to the market” is a mathematical calculation performed by the lender to see whether collateral currently has enough value to repay borrowed assets (if the borrower does not return them.) To protect against any unforeseen declines in the collateral's market value, a margin of 2% to 5% is generally kept on top. If the collateral's value falls below acceptable levels, the lender instructs the borrower to make up the difference immediately by providing extra collateral as needed. The present market value is constantly tracked, including currency fluctuations for international loans. For domestic loans, 102 percent margins must be maintained on the collateral (2% above current market value to cover the potential decrease in the market value of underlying collateral). For loans outside of your home country, you must have collateral worth 105% more than the loan in order to cover any potential losses from market value changes. Securities loans are loaned securities and underlying collateral that are exchanged simultaneously, while they are not in the case of foreign equities. The borrower's securities are returned first, typically 24 hours ahead of time, before the lender gets access to the collateral. Revenue-sharing in securities lending is calculated utilizing the following information from the securities loan: Customers may be asked to pay a flat percentage of net income or, in some cases, give their whole earnings. The borrower's specific rebate is calculated by each of the securities loans related to them. The securities lending agent subtracts all expenses from total profits together in both a detailed and summarized way. In order to make a securities loan, you must have an understanding of the market, the securities being loaned, and the collateral being posted. You should also be aware of the various risks associated with securities lending. Revenue sharing is an important aspect of securities lending, and you should be familiar with how it works before entering into any agreements. Securities lending is the act of loaning out securities in exchange for collateral. The practice enables investors to generate income from idle securities, while also providing borrowers with the ability to use securities without having to purchase them outright. Introduction

Fees and Profitability

The History of Securities Lending

Past - the late 1800's

Present

Common Reasons to Borrow Securities

Some arbitrage strategies include convertible bond arbitrage, index arbitrage, relative value arbitrage, and tax arbitrage.

In simple language, a barrier reduces any substantial losses or gains suffered by an individual or an organization. A variety of complex financial instruments and strategies are used as hedges, including but not limited to futures contracts, options, and swaps.

Common Reasons to Lend Securities

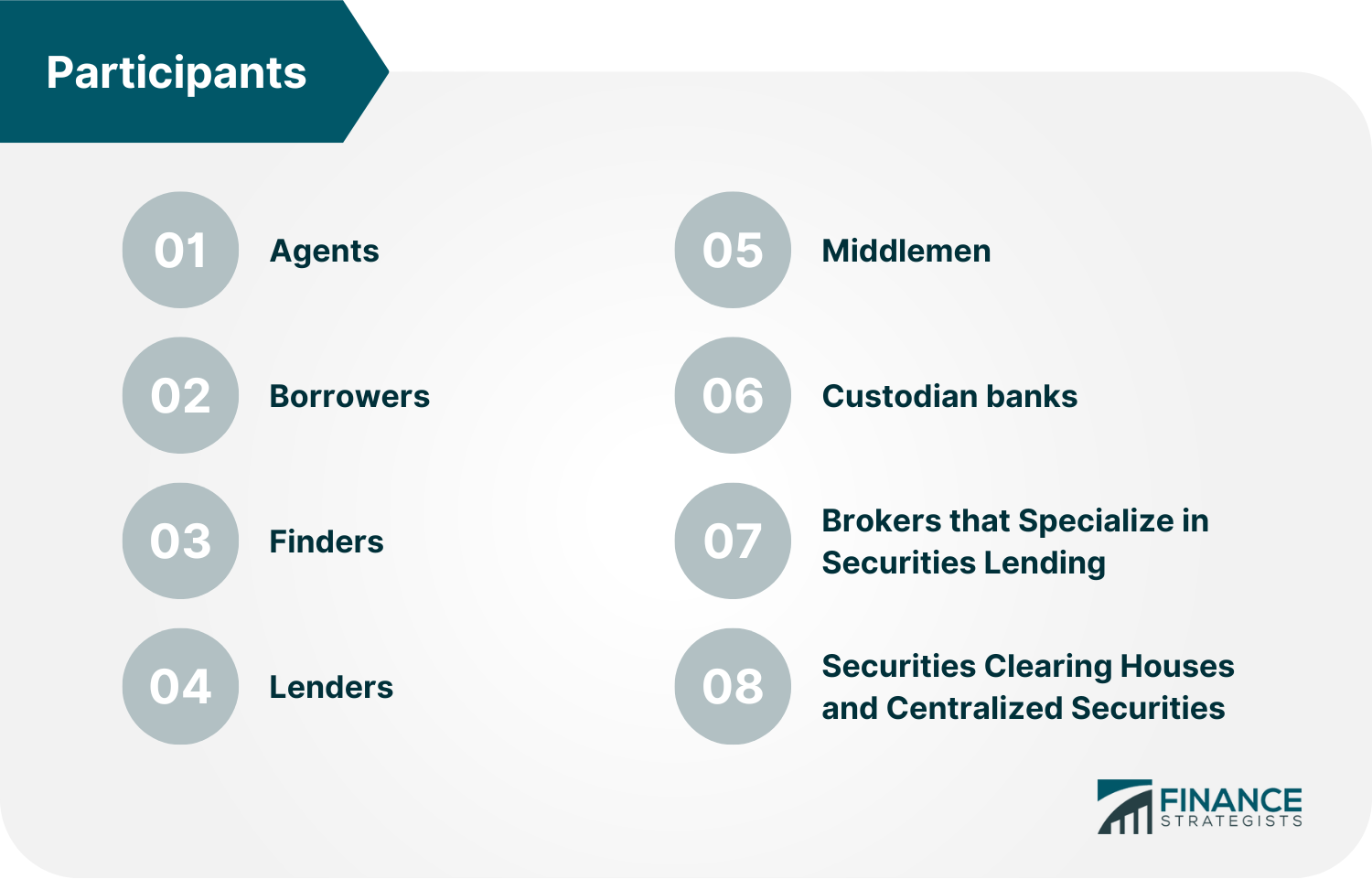

Participants in Securities Lending

These organizations usually settle securities lending transactions through one of the large central depositories.

Lendable Securities

Different Types of Collateral

Processing of Collateral Receipt

Risks of Joining

Risks

Risk Management

Borrower Default Risk

Loss Risk Associated With Collateral

Agent Default Risk

Employee Fraud Risk

Critical Issues

Negotiation

Guidelines for Investing in Collateral

Marks to the Market

Daily Pricing

Canceling Securities Loans

Revenue Sharing

Conclusion

Securities Lending FAQs

Securities lending is the act of loaning out securities in exchange for collateral. The practice enables investors to generate income from idle securities, while also providing borrowers with the ability to use securities without having to purchase them outright.

There are a number of risks associated with securities lending, including the risk of market value changes, the risk of counterparty default, and the risk of collateral value changes.

Securities lending fees refer to the compensation that lenders receive for loaning out their securities. Securities lending fees are typically calculated by taking the difference between the return rate of the loaned security and an agreed-upon interest rate.

For domestic loans, 102 percent margins must be maintained on the collateral (2% above current market value to cover the potential decrease in the market value of underlying collateral). For loans outside of your home country, you must have collateral worth 105% more than the loan in order to cover any potential losses from market value changes.

Revenue sharing for securities loans is calculated utilizing both total profits and expenses. Customers may be asked to pay a flat percentage of net income or, in some cases, give their whole earnings. The borrower's specific rebate is calculated by each of the securities loans related to them.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.