Rent vs buy analysis is a method of evaluating the financial and personal aspects of renting and buying a home to determine which option is more suitable for an individual or a family. The analysis considers various factors, including market conditions, individual financial circumstances, and personal preferences, in order to make an informed decision about whether to rent or buy a property. The decision to rent or buy a home is one of the most significant financial choices a person can make. A thorough rent vs buy analysis helps individuals weigh the pros and cons of each option, taking into account their unique circumstances and long-term goals. By comparing the costs and benefits of renting and buying, individuals can make informed choices that align with their financial and personal objectives. One of the key advantages of renting is the flexibility it offers. Renters can easily relocate without the burden of selling a property, making it an ideal option for those who anticipate frequent moves or are uncertain about their long-term plans. Renting a property requires a lower level of commitment compared to buying. Renters can change their living situation with relative ease, while homeowners are typically tied to their properties until they sell or refinance. Renting a property generally involves lower upfront costs compared to buying. Renters are not required to make a down payment, which can be a significant barrier to homeownership. As a renter, maintenance costs are typically covered by the landlord, which can result in significant savings over time compared to owning a home. Renters do not face the risk of property value depreciation, as they are not exposed to housing market fluctuations. This allows renters to diversify their financial risks and avoid potential losses associated with homeownership. Renters do not bear the risk of property depreciation, which can occur due to various factors such as changes in the local economy or housing market trends. This makes renting a safer option for those concerned about potential losses. Buying a home allows individuals to build equity over time as they gradually pay off their mortgage and increase their ownership stake in the property. This can provide a sense of financial security and serve as a long-term investment. If property values increase over time, homeowners may benefit from appreciation, which can result in significant gains when they eventually sell their property. Owning a home with a fixed-rate mortgage provides stability in terms of monthly housing expenses. Unlike renting, where rent can increase over time, fixed mortgage payments remain constant, making it easier to budget and plan for the future. Homeownership allows individuals greater control over their living environment, as they can customize their property to suit their preferences and needs without needing approval from a landlord. Homeowners may be eligible for tax deductions on the interest paid on their mortgage, which can result in significant savings over time. Property taxes paid by homeowners may also be tax-deductible, providing additional financial benefits to owning a home. One of the primary factors in deciding whether to rent or buy is affordability. Prospective homeowners should assess their financial situation, considering factors such as income, expenses, and savings, to determine whether they can comfortably afford the costs associated with buying a home. Mortgage rates play a significant role in the rent vs buy decision. Lower mortgage rates make buying a home more attractive, as monthly payments will be more manageable. Conversely, higher mortgage rates can make renting a more appealing option. The rent-to-price ratio is a metric that compares the cost of renting a property to the cost of purchasing it. A high rent-to-price ratio indicates that renting may be more financially advantageous, while a low ratio suggests that buying might be a better option. Understanding local housing market trends is essential for making an informed rent vs buy decision. Factors such as property appreciation rates, vacancy rates, and inventory levels can impact the relative attractiveness of renting or buying a home. Rent control laws, which limit the amount that landlords can increase rent, can make renting more attractive in certain areas. Prospective renters and buyers should be aware of any rent control regulations in their desired location. The availability of properties for sale or rent in a given area can influence the rent vs buy decision. A limited supply of rental properties may result in higher rents, making buying a more attractive option. Conversely, a surplus of homes for sale may lead to lower property prices, making homeownership more accessible. Job stability is an important consideration when deciding whether to rent or buy. Individuals with stable employment may feel more confident in their ability to afford homeownership, while those with uncertain job prospects may prefer the flexibility of renting. Individuals should consider their lifestyle preferences when deciding whether to rent or buy. Some people may prefer the freedom and flexibility that renting offers, while others may value the stability and control associated with homeownership. Considering long-term goals is crucial for making an informed rent vs buy decision. Individuals who plan to settle down in a specific area for an extended period may find buying a home more appealing, while those with more transient lifestyles may prefer to rent. Rent vs buy calculators are online tools that help individuals compare the costs of renting and buying a property based on various inputs such as property price, rent, down payment, mortgage rate, and property appreciation rate. Some of the key inputs for rent vs buy calculators include property price, down payment, mortgage term, mortgage rate, rent, annual rent increase, property appreciation rate, and property tax rate. The break-even point in rent vs buy analysis is the point at which the total costs of renting a property become equal to the total costs of buying and owning a property. Several factors can impact the break-even point, including property appreciation rates, rent increases, mortgage rates, and maintenance costs. By evaluating these factors, individuals can determine the length of time it would take for buying a home to become more financially advantageous than renting. Sensitivity analysis is a method of assessing the impact of uncertainties and potential changes in key factors on the rent vs buy decision. This can help individuals understand the potential risks and rewards associated with each option. By conducting sensitivity analysis, individuals can explore various scenarios and assess how changes in factors such as mortgage rates, property appreciation rates, and rent increases may impact their rent vs buy decision. This allows for a more informed and comprehensive understanding of the potential outcomes associated with each option. The decision to rent or buy a home is highly dependent on individual circumstances, financial situation, and personal preferences. There is no one-size-fits-all answer, and the most suitable option will vary from person to person. Conducting a comprehensive rent vs buy analysis is crucial for making an informed decision about housing. By evaluating the financial, market, and personal factors that influence the rent vs buy decision, individuals can choose the option that best aligns with their unique needs and goals. As personal and market factors change over time, it is essential to regularly reassess the rent vs buy decision. Individuals should periodically review their financial situation, housing market trends, and personal preferences to ensure they continue to make the best housing choice for their circumstances.Rent vs Buy Analysis Overview

Importance of Rent vs Buy Analysis in Decision-Making for Housing

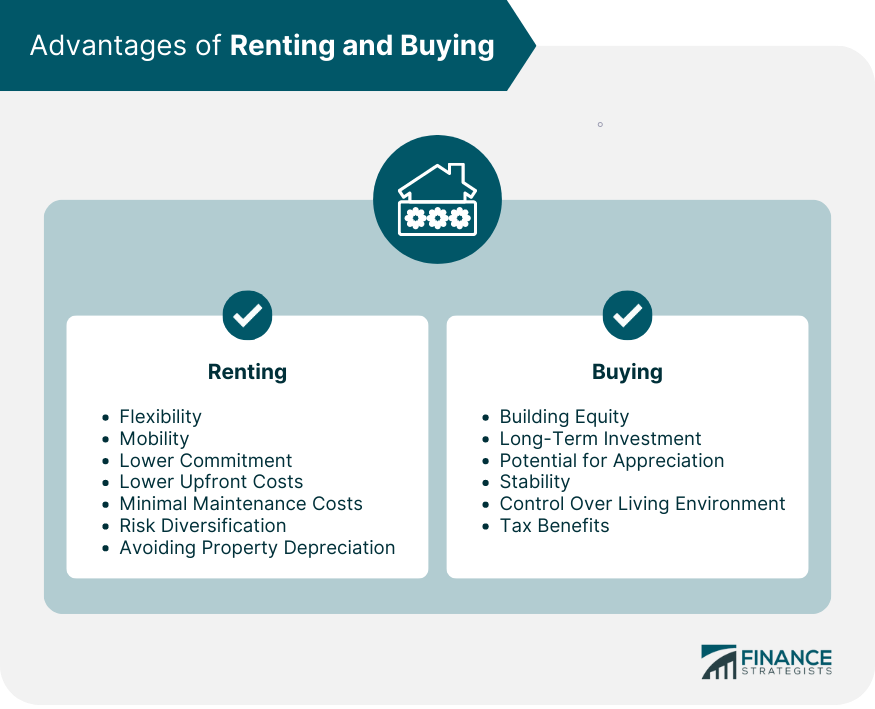

Advantages of Renting

Flexibility

Easier Relocation

Lower Commitment

Lower Upfront Costs

No Down Payment

Minimal Maintenance Costs

Risk Diversification

No Exposure to Housing Market Fluctuations

Avoiding Property Depreciation

Advantages of Buying

Building Equity

Homeownership as a Long-Term Investment

Potential for Appreciation

Stability

Fixed Mortgage Payments

Control Over Living Environment

Tax Benefits

Mortgage Interest Deduction

Property Tax Deduction

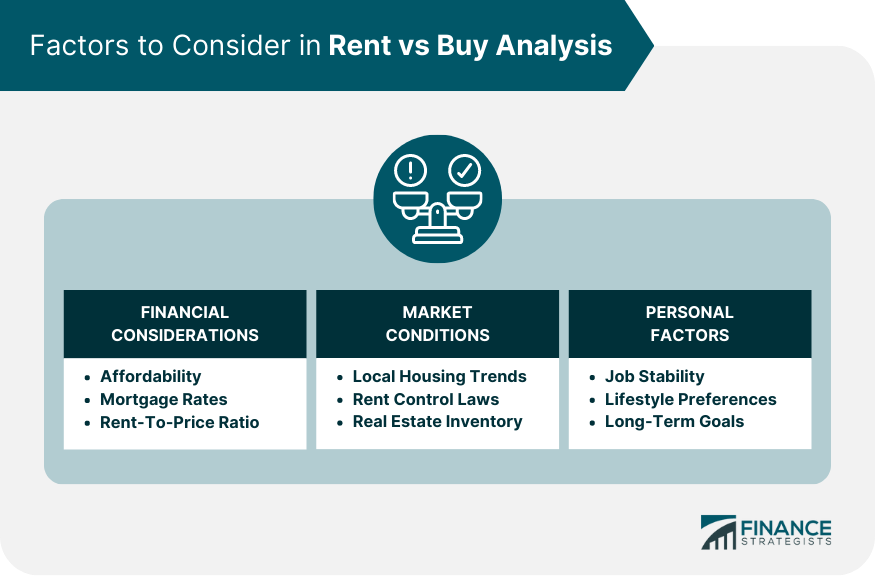

Factors to Consider in Rent vs Buy Analysis

Financial Considerations

Affordability

Mortgage Rates

Rent-to-Price Ratio

Market Conditions

Local Housing Market Trends

Rent Control Laws

Real Estate Inventory

Personal Factors

Job Stability

Lifestyle Preferences

Long-Term Goals

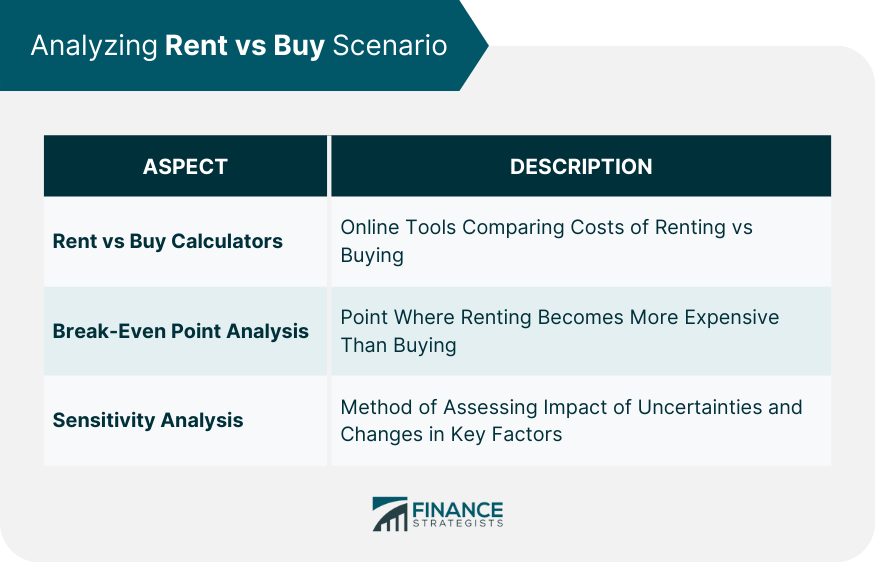

Analyzing Rent vs Buy Scenarios

Rent vs Buy Calculators

How They Work

Key Inputs

Break-Even Point Analysis

Definition

Factors Affecting the Break-Even Point

Sensitivity Analysis

Understanding Uncertainties

Exploring Different Scenarios

Conclusion

Rent vs Buy Analysis FAQs

Rent vs buy analysis helps individuals evaluate the financial and personal aspects of renting and buying a home, considering various factors such as market conditions, individual financial circumstances, and personal preferences. This analysis assists in making an informed decision about whether to rent or buy a property based on their unique situation and long-term goals.

By comparing the costs and benefits of renting and buying, rent vs buy analysis allows you to assess the impact of various factors such as affordability, mortgage rates, local housing market trends, and personal preferences. This helps you make an informed decision that aligns with your financial and personal objectives.

When conducting a rent vs buy analysis, you should consider financial factors such as affordability, mortgage rates, and rent-to-price ratio; market conditions such as local housing market trends, rent control laws, and real estate inventory; and personal factors such as job stability, lifestyle preferences, and long-term goals.

The rent vs buy calculator is an online tool that compares the costs of renting and buying a property based on various inputs such as property price, rent, down payment, mortgage rate, and property appreciation rate. By using a rent vs buy calculator, you can obtain a clearer understanding of the financial implications of renting versus buying a home in your specific situation.

Sensitivity analysis allows you to assess the impact of uncertainties and potential changes in key factors on the rent vs buy decision. By conducting sensitivity analysis, you can explore various scenarios and assess how changes in factors such as mortgage rates, property appreciation rates, and rent increases may impact your decision to rent or buy a home. This provides a more informed and comprehensive understanding of the potential outcomes associated with each option.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.